Louisiana Revocable Trust for Estate Planning

Description

How to fill out Revocable Trust For Estate Planning?

If you wish to complete, acquire, or print legal document templates, utilize US Legal Forms, the premier selection of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal needs are organized by categories and states or keywords. Use US Legal Forms to locate the Louisiana Revocable Trust for Estate Planning in just a few clicks.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal form and save it to your system. Step 7. Complete, modify, and print or sign the Louisiana Revocable Trust for Estate Planning. Every legal document template you download is yours forever. You have access to each form you saved in your account. Click the My documents section and select a form to print or download again. Complete and obtain, and print the Louisiana Revocable Trust for Estate Planning with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are presently a US Legal Forms user, Log In to your account and click on the Download option to obtain the Louisiana Revocable Trust for Estate Planning.

- You can also access forms you previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/region.

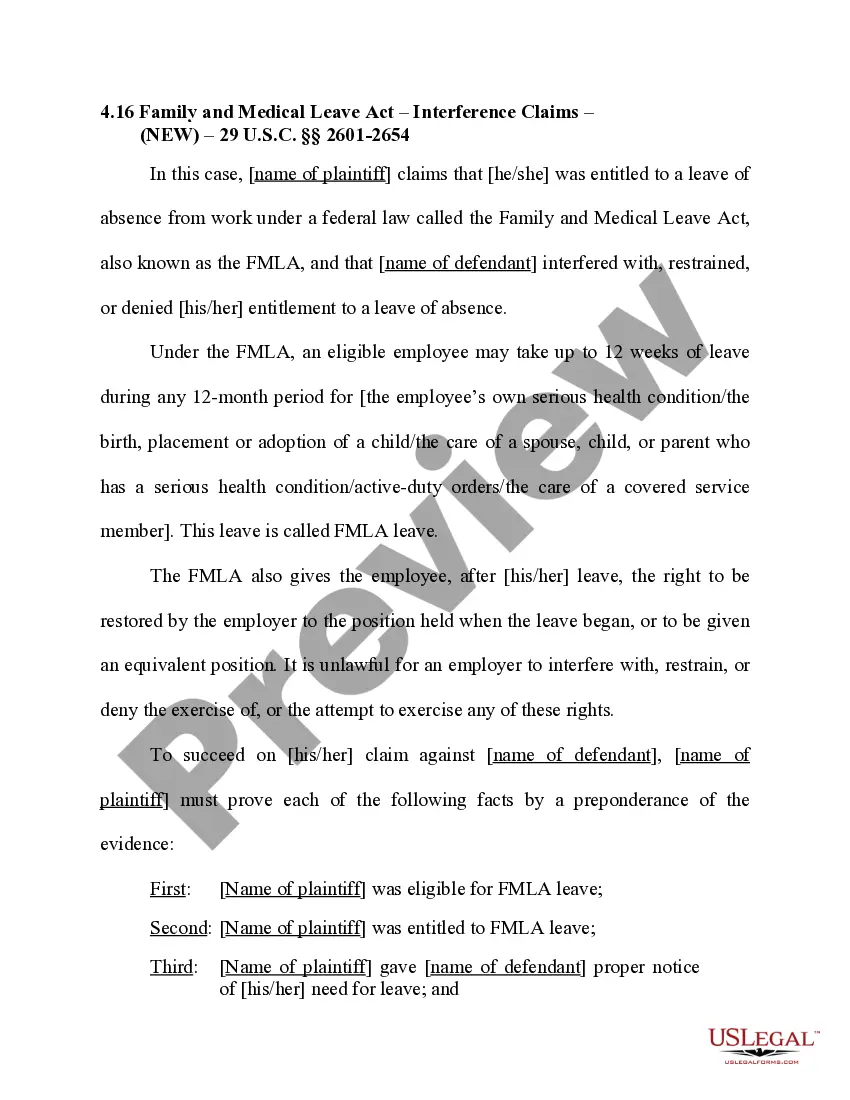

- Step 2. Utilize the Review feature to examine the form's content. Don't forget to check the details.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative forms in the legal form template.

- Step 4. Once you have found the form you need, click the Get now option. Select the pricing plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

Setting up a trust, including a Louisiana Revocable Trust for Estate Planning, can present several pitfalls if not approached carefully. Common issues include failing to fund the trust properly, which renders it ineffective, and overlooking tax obligations tied to the trust. Moreover, not clearly stating the distribution terms can lead to disputes among beneficiaries. Seeking assistance from professionals can provide guidance and help you navigate these challenges.

A revocable trust in Louisiana is a legal arrangement allowing you to manage your assets while retaining control over them during your lifetime. With a Louisiana Revocable Trust for Estate Planning, you can change or revoke the trust at any time, ensuring your assets are handled according to your wishes. This type of trust can help you avoid probate and manage your estate more efficiently. It provides flexibility and peace of mind for you and your family.

The biggest mistake parents make when setting up a trust fund in the UK is often neglecting to consider tax implications and legal obligations. Although this question focuses on the UK, similar errors can occur with a Louisiana Revocable Trust for Estate Planning if you fail to understand local regulations. Proper planning and seeking advice can help avoid unexpected tax liabilities. Understanding these requirements ensures that your plans align with your financial goals.

The biggest mistake parents often make when establishing a trust fund is neglecting to clearly define the terms and objectives. A Louisiana Revocable Trust for Estate Planning should explicitly state how and when funds are distributed to beneficiaries, ensuring the wishes are clear and enforceable. Lack of communication can create confusion and potentially lead to disputes among heirs. Regular discussions with your family can help alleviate these issues.

To place your house in a Louisiana Revocable Trust for Estate Planning, start by reviewing your current mortgage and title documents. You will need to prepare a deed that transfers the property to the trust, ensuring all parties are informed. Additionally, consider consulting a legal professional to ensure the transfer aligns with state regulations. This process can help safeguard your property for future generations.

One disadvantage of a family trust, particularly a Louisiana Revocable Trust for Estate Planning, is that it requires ongoing management. You must ensure assets are properly transferred into the trust and that trustees follow the trust's guidelines. Additionally, if trust documents are not updated to reflect changes in your family or financial situation, issues can arise. Regular reviews can help you avoid complications.

Choosing between a will and a Louisiana Revocable Trust for Estate Planning depends on your individual needs. A revocable trust can help you avoid probate, ensuring your assets are distributed quickly and privately. In contrast, a will generally points out who gets your assets but may require probate, which can delay distribution. Assessing your circumstances can clarify which option serves you best.

To set up a Louisiana Revocable Trust for Estate Planning, start by choosing a trustee, who will manage the trust assets. Next, draft a trust agreement detailing the terms and conditions of the trust, including how assets will be distributed upon your death. You will then transfer your assets into the trust, ensuring they are properly titled in the name of the trust. Consider using online platforms like US Legal Forms to access customizable templates and ensure compliance with Louisiana laws.

The primary difference lies in control and flexibility. A revocable trust allows you to change or revoke the trust during your lifetime, providing a higher level of adaptability for estate planning needs. Conversely, an irrevocable trust typically cannot be changed once established, securing its assets from estate taxes and creditors. Understanding these differences helps you choose the right Louisiana Revocable Trust for Estate Planning according to your specific situation.

In Louisiana, a revocable trust does not need to be recorded to be valid. However, it is recommended to keep the trust document in a safe place, as it outlines your wishes for estate planning. This document serves as a guide for your trustees and beneficiaries when the time comes. Utilizing a Louisiana Revocable Trust for Estate Planning can simplify the management of your assets without the need for court involvement.