Louisiana Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

Are you presently in a circumstance where you will require documents for certain companies or specific tasks almost all the time.

There are numerous legal document templates available online, but finding versions you can depend on is not easy.

US Legal Forms offers thousands of form templates, such as the Louisiana Revocable Trust for Asset Protection, which can be tailored to comply with federal and state requirements.

Once you find the correct form, click on Acquire now.

Choose the pricing option you wish, provide the required information to create your account, and pay for the order using your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can download another copy of the Louisiana Revocable Trust for Asset Protection whenever you need; just follow the necessary steps to obtain or print the document template. Utilize US Legal Forms, one of the most comprehensive collections of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be applied for various purposes. Register on US Legal Forms and begin simplifying your life.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can obtain the Louisiana Revocable Trust for Asset Protection template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for your correct region/state.

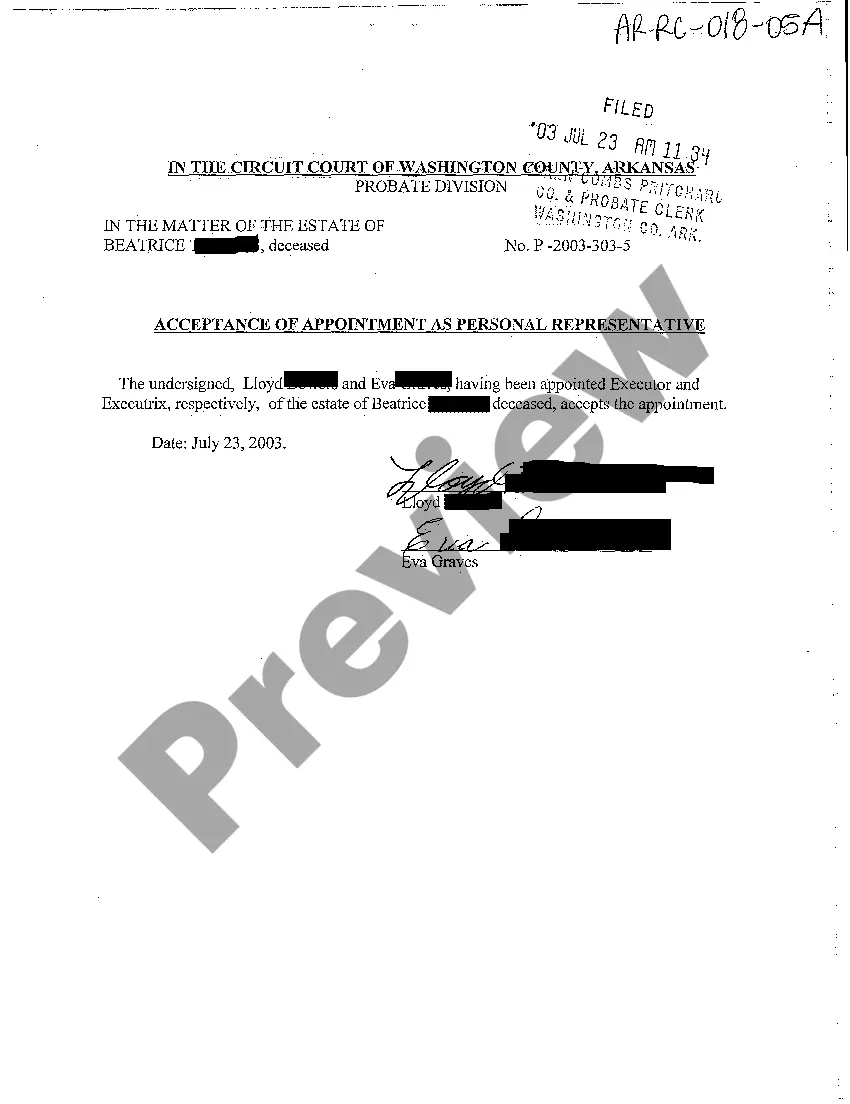

- Utilize the Review button to examine the document.

- Check the overview to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search box to find the form that fits your needs.

Form popularity

FAQ

A Louisiana Revocable Trust for Asset Protection is often regarded as one of the best options for safeguarding assets. This type of trust allows you to retain control over your assets while providing flexibility and protection from certain creditors. It is crucial to evaluate your specific needs and consult with a legal expert who can help you set one up effectively. Additionally, USLegalForms offers valuable resources to assist you in creating the right trust for your unique situation.

To begin a trust for asset protection, first consider a Louisiana Revocable Trust for Asset Protection. You can start by gathering your financial documents and deciding which assets you want to include. Next, consult with a legal professional to guide you through the setup process and ensure all documents comply with Louisiana law. Additionally, using platforms like USLegalForms can simplify this process by providing templates and legal information tailored to your needs.

While a Louisiana Revocable Trust for Asset Protection offers benefits like avoiding probate and ensuring privacy, its primary purpose is not asset protection. The trust allows you to smoothly transfer assets to beneficiaries when you pass away. However, since you retain control over these assets, they remain vulnerable to claims from creditors or legal actions during your lifetime.

For optimal asset protection, a Louisiana Irrevocable Trust is often considered a better choice than a revocable trust. An irrevocable trust removes your assets from your control, thus shielding them from creditors. It is important to evaluate your unique needs and consult a professional to select the right trust for your asset protection strategy.

It is generally advised not to place retirement accounts or life insurance policies in a Louisiana Revocable Trust for Asset Protection, as these may have their own beneficiary designations. Additionally, certain types of business assets may be better managed outside of a revocable trust. Always consult an expert to ensure your assets are protected according to your specific situation.

A Louisiana Revocable Trust for Asset Protection does not provide strong asset protection against creditors. This type of trust allows you to maintain control over your assets, but they can still be accessed in legal judgments. While it can help with estate planning and probate issues, it is vital to seek a different strategy for robust asset protection.

The disadvantage of a family trust often lies in the potential for disputes among family members over the interpretation of the trust's terms. Miscommunication can lead to misunderstandings and conflicts. However, a well-drafted Louisiana Revocable Trust for Asset Protection can include provisions to mitigate these issues, promoting harmony among family members.

To write an asset protection trust, it is essential to start with clear objectives about what you want to achieve. Consulting with a legal professional who specializes in estate planning is highly recommended. They can help construct a comprehensive Louisiana Revocable Trust for Asset Protection that complies with state laws and meets your specific needs.

The major disadvantage of a trust can be the complexity of maintaining it over time. Changes in family dynamics or financial situations may require adjustments that can be cumbersome. A well-structured Louisiana Revocable Trust for Asset Protection can mitigate these issues, but it does require commitment and diligence from the individual overseeing it.

Yes, placing assets in a Louisiana Revocable Trust for Asset Protection can provide financial security and ensure proper distribution of assets. It can help avoid probate, which can be a lengthy and costly process. By using a trust, your parents can manage their assets during their lifetime and protect them for future generations.