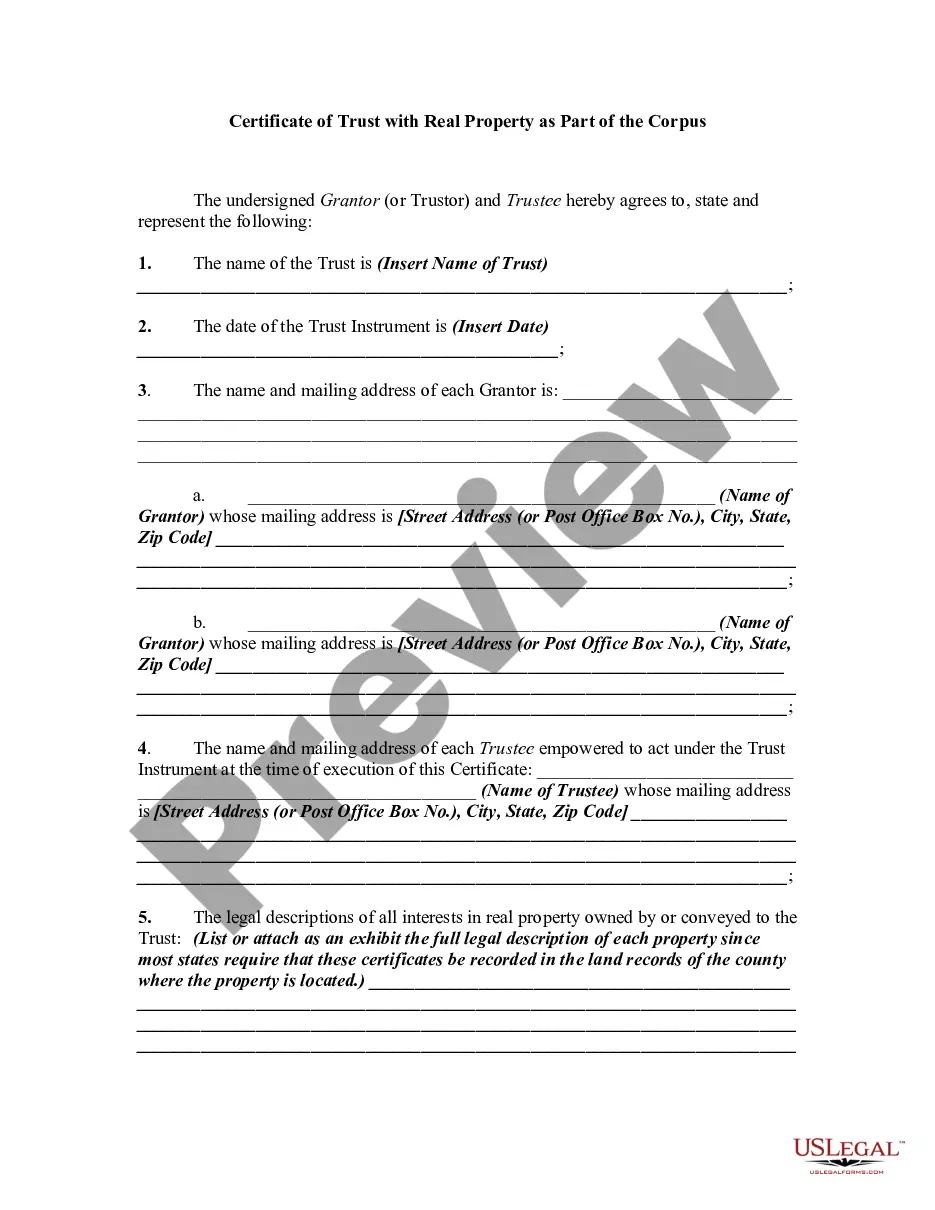

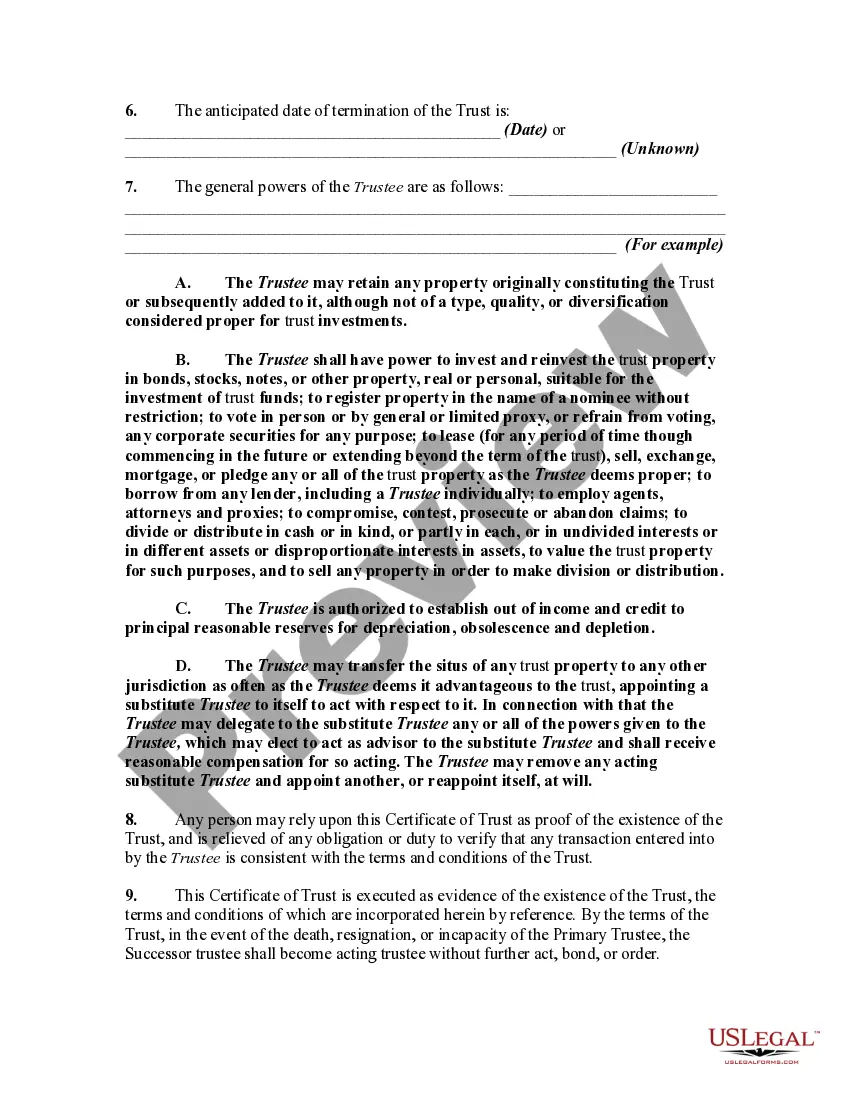

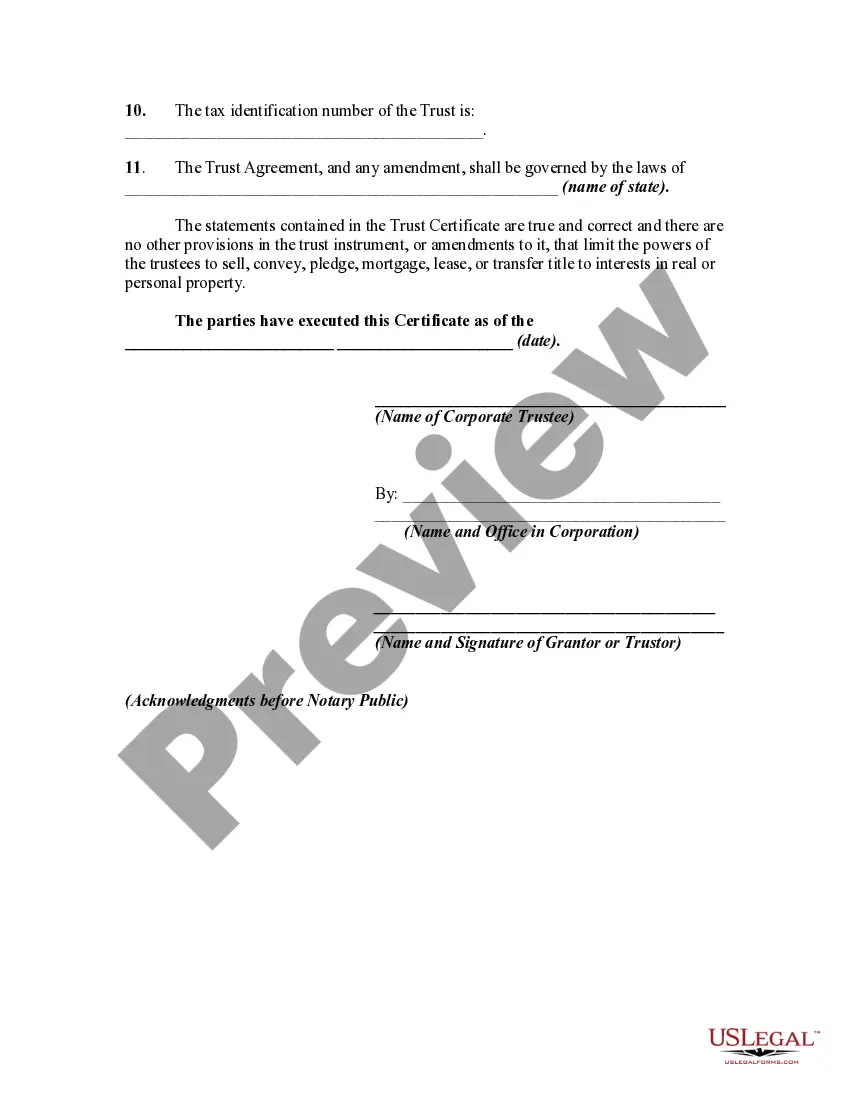

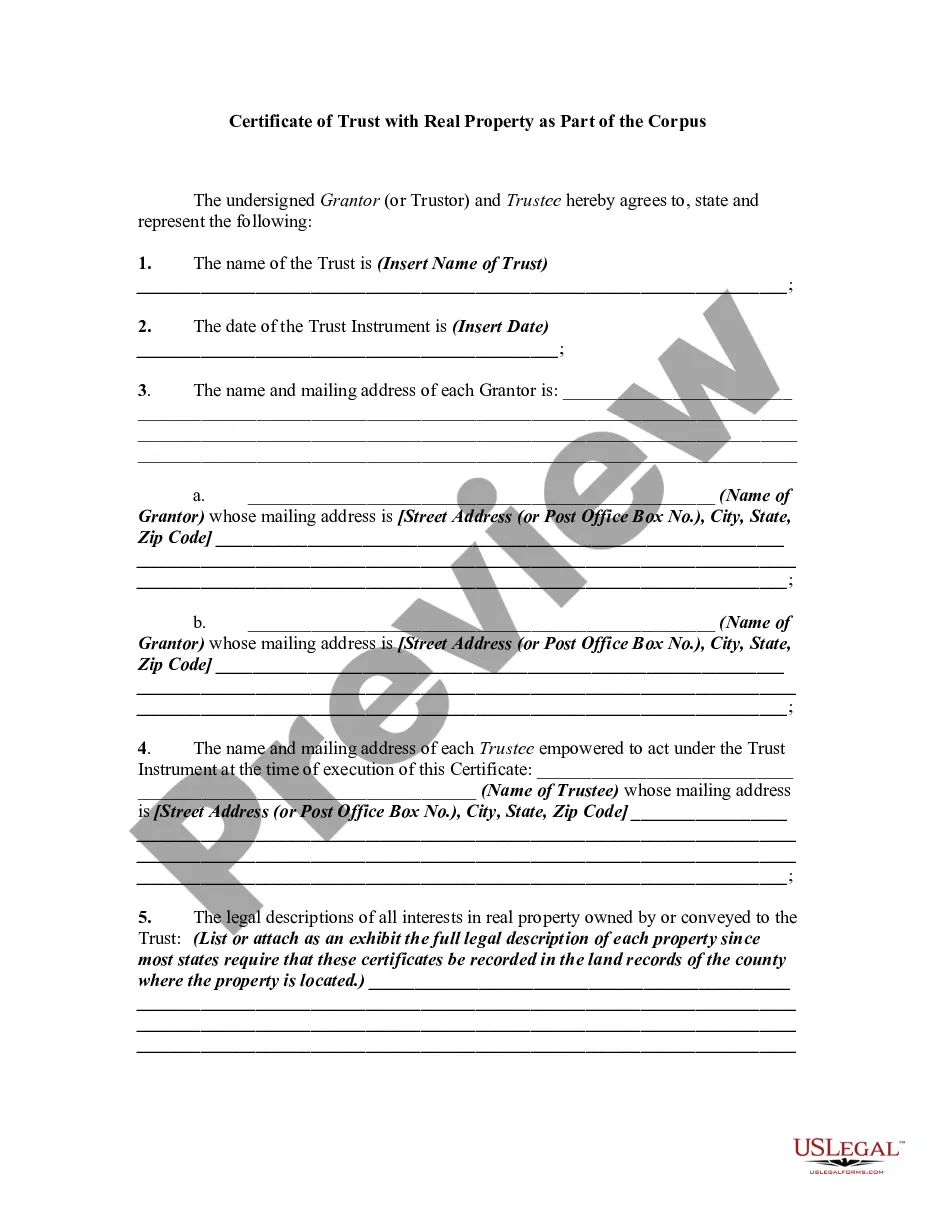

A certificate of trust is a shortened version of a trust that verifies the trust's existence, explains the powers given to the trustee, and identifies the successor trustee(s). A certificate of a trust agreement which conveys or contains an interest in real property must generally be recorded in the office of the county clerk where deeds are recorded and the property is located.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.