Louisiana Sample Letter for Reinstatement of Loan

Description

How to fill out Sample Letter For Reinstatement Of Loan?

It is feasible to invest hours online attempting to locate the legal document template that meets the state and federal requirements you desire. US Legal Forms offers thousands of legal documents that are evaluated by experts.

You can indeed download or print the Louisiana Sample Letter for Loan Reinstatement from my services.

If you already possess a US Legal Forms account, you can Log In and click the Download button. Afterwards, you can complete, modify, print, or sign the Louisiana Sample Letter for Loan Reinstatement. Every legal document template you purchase is yours indefinitely.

Complete the purchase. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the Louisiana Sample Letter for Loan Reinstatement. Download and print thousands of document templates using the US Legal Forms site, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

- To obtain an additional copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, verify that you have selected the correct document template for your area/town of choice. Review the form description to ensure that you have selected the right form.

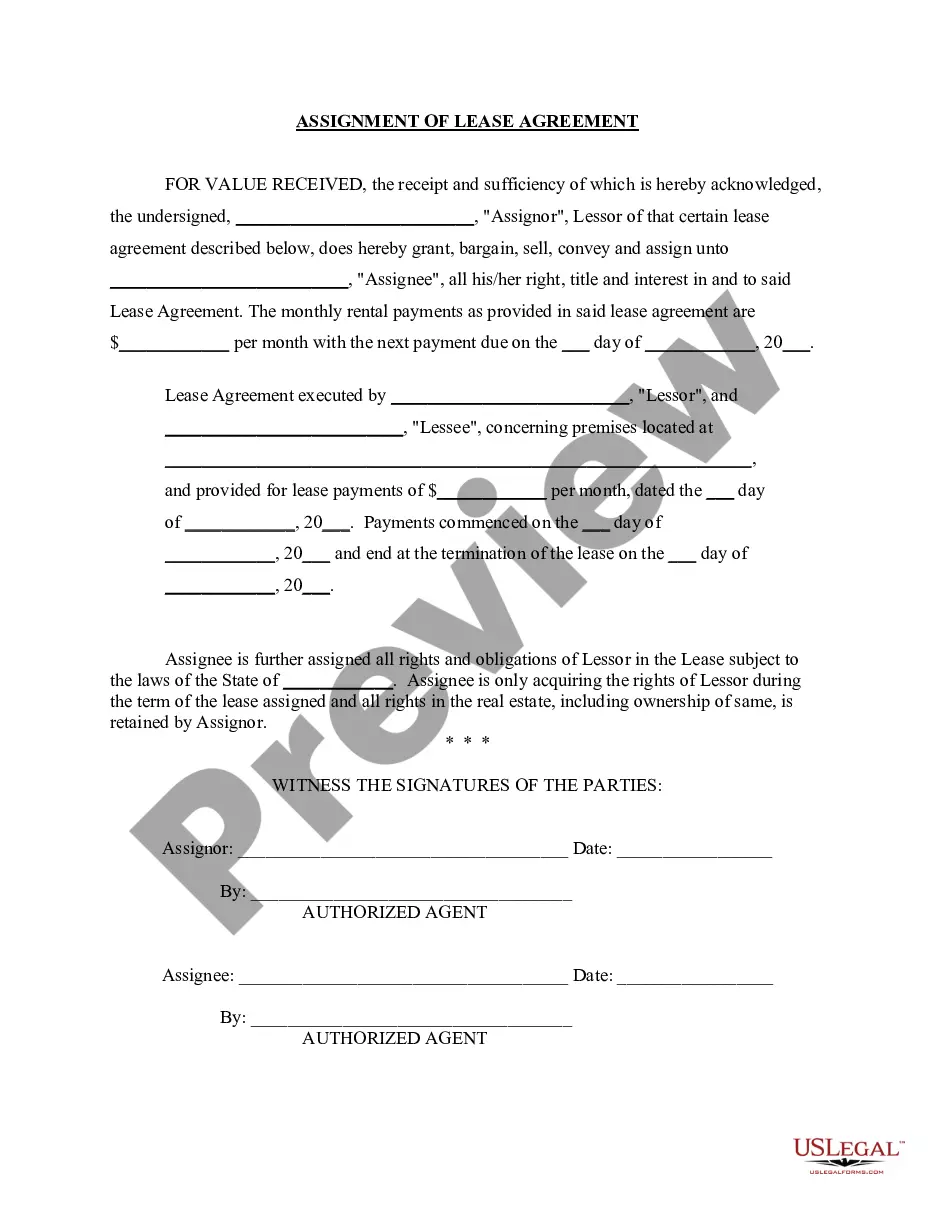

- If available, utilize the Review button to examine the document template as well.

- If you wish to find another version of the form, use the Search field to locate the template that meets your needs and specifications.

- Once you have found the template you desire, click Purchase now to proceed.

- Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

You may be able to reinstate the loan by catching up on payments. However, you will need to repay all past due bills, including late fees and the costs a lender incurs from repossession.

Loan restructuring is a process in which borrowers facing financial distress renegotiate and modify the terms of the loan with the lender to avoid default. It helps to maintain continuity in servicing the debt and gives borrowers a certain degree of flexibility to restore financial stability.

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)

How to write a reinstatement letterKnow who you're writing to.Look at the current job openings.Start with a friendly introduction.State the reason for writing.Explain why they should hire you.Conclude with a call to action.Include your contact information.

How to Write an Effective Hardship LetterPart 1: Explain what happened and why you are applying.Part 2: Specifically illustrate the time and severity of the hardship.Part 3: Back up the reasons traditional remedies won't work.Part 4: Detail why you are stable enough to succeed with a modification.More items...?

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

To reinstate a loan, you must first find out the amount needed to bring the loan current. You can get this information by requesting a "reinstatement quote" or "reinstatement letter" from the loan servicer.

You are in financial hardship if you have difficulty paying your bills and repayments on your loans and debts when they are due. Under credit law you have rights when you are in financial hardship . This page explains your rights and obligations under the law.

I sincerely want to keep regular EMI payments but require restructuring in the terms of the loan. I request that the monthly EMI payments to be reduced so I can pay my EMI on before due date in the future without any failure. I would appreciate if you could restructure the EMI amount of my loan to about Rs.

Dear Lender, I am writing to request financial hardship assistance with my (mortgage/credit card/student loan/auto loan/personal loan/etc.). This letter provides the details of my hardship, the type of assistance I am requesting and the documents that show my hardship.