Louisiana Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

Are you presently in a position where you need to have files for either company or specific reasons just about every day? There are a variety of legal file web templates available on the Internet, but discovering versions you can rely on isn`t easy. US Legal Forms provides a huge number of type web templates, like the Louisiana Unrestricted Charitable Contribution of Cash, that happen to be composed in order to meet state and federal requirements.

When you are already familiar with US Legal Forms site and possess a free account, merely log in. Following that, it is possible to acquire the Louisiana Unrestricted Charitable Contribution of Cash template.

Should you not have an profile and want to begin to use US Legal Forms, adopt these measures:

- Discover the type you need and ensure it is for the right metropolis/area.

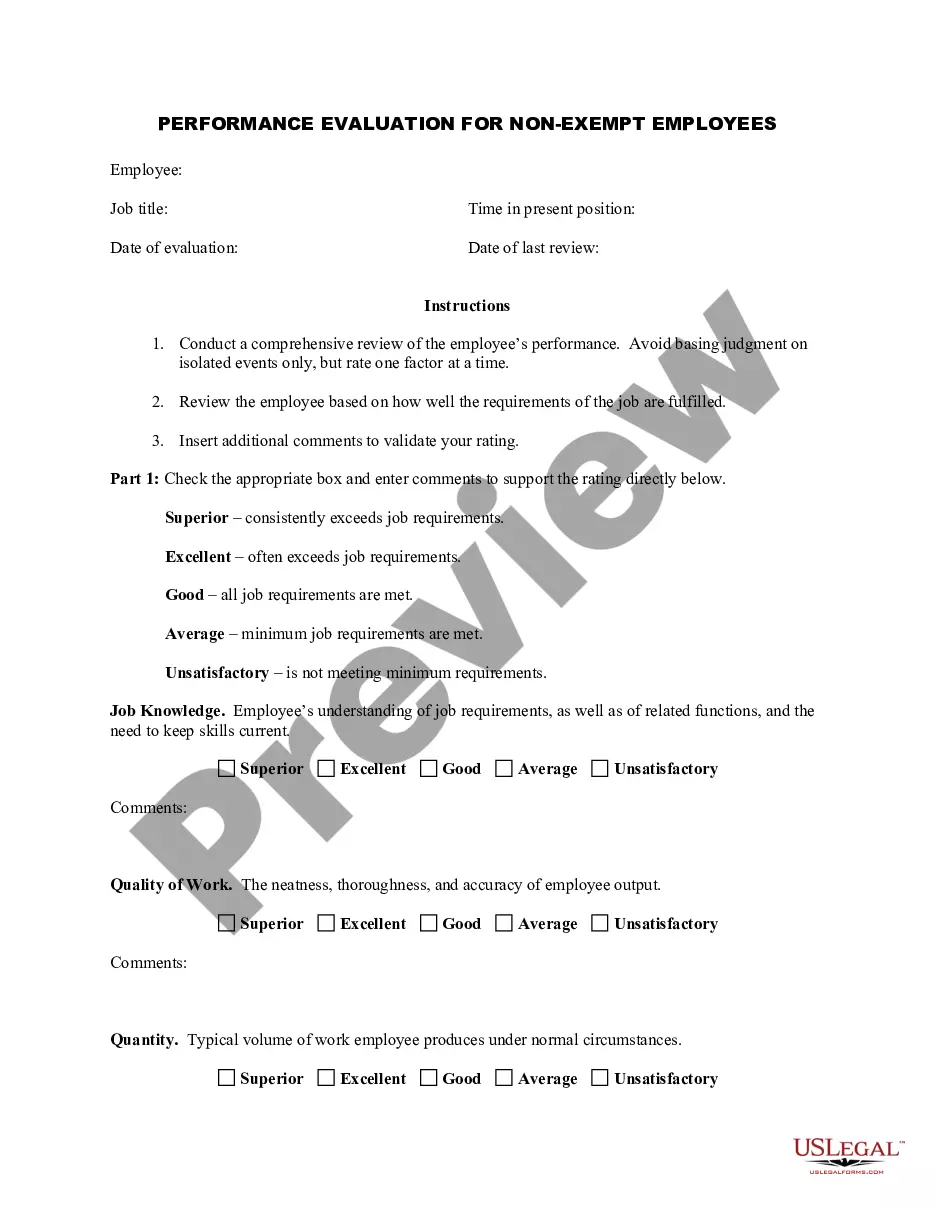

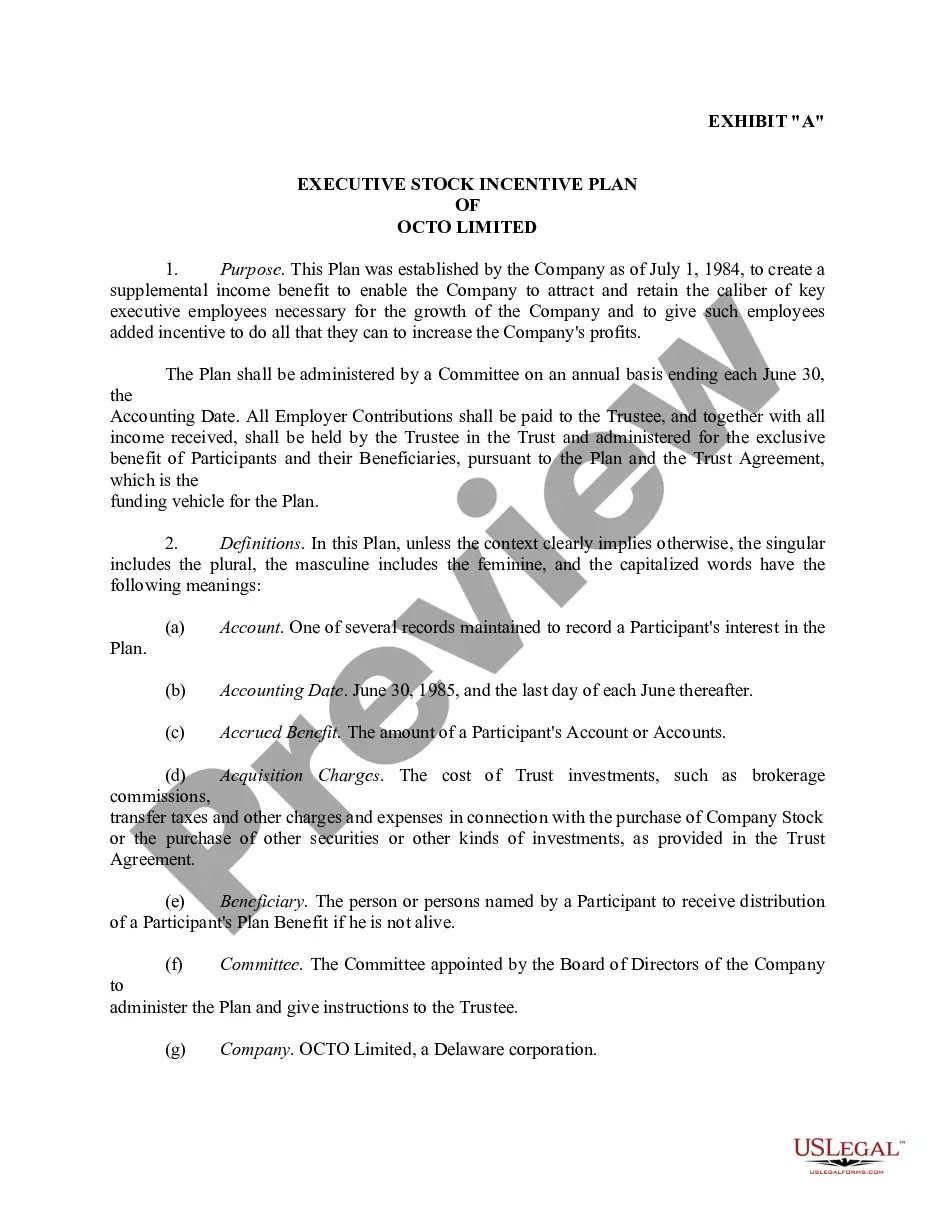

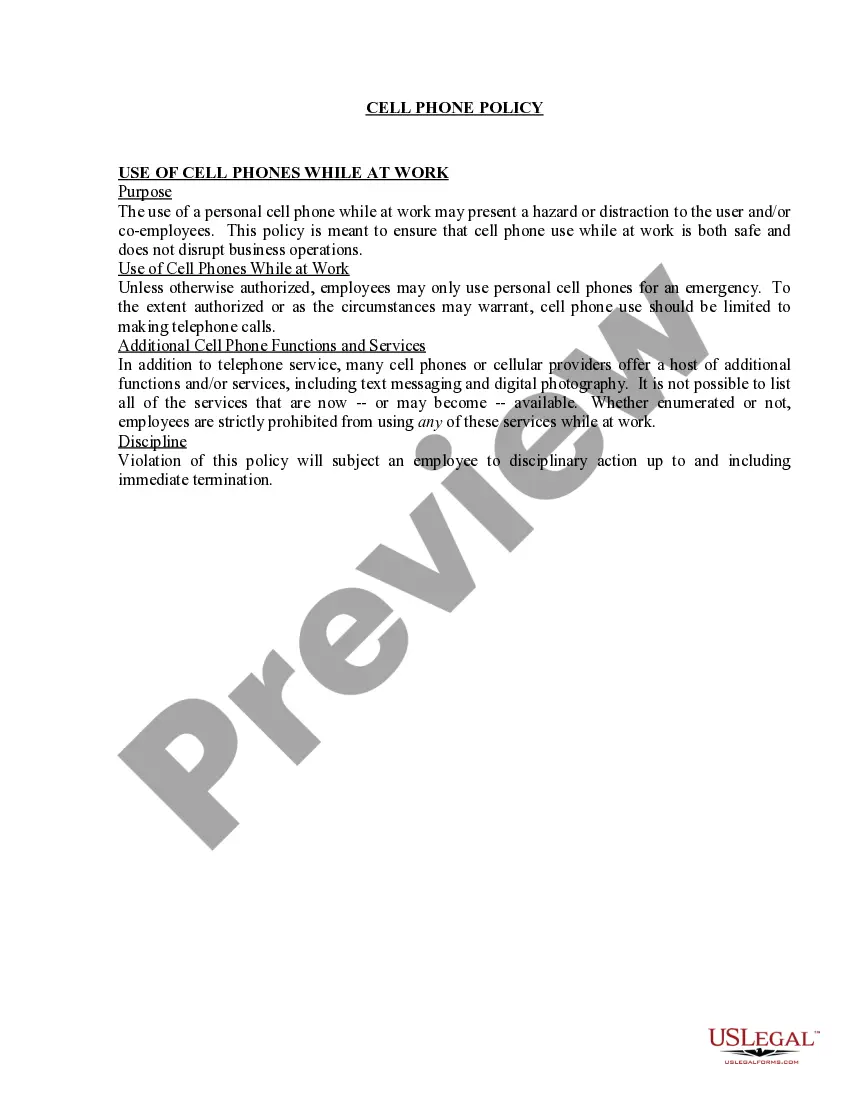

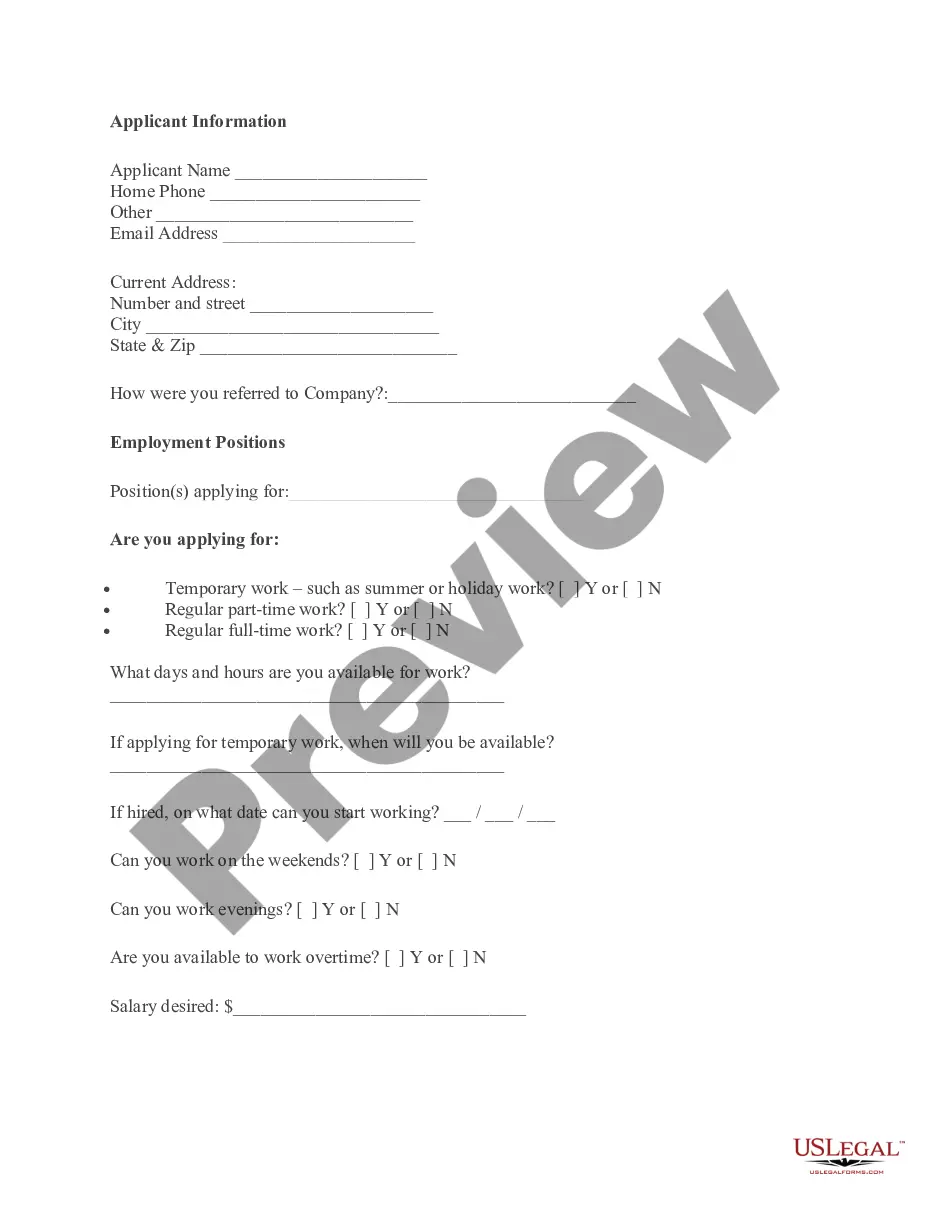

- Take advantage of the Preview switch to review the form.

- Look at the information to ensure that you have selected the right type.

- When the type isn`t what you`re searching for, take advantage of the Search discipline to discover the type that suits you and requirements.

- When you find the right type, click Get now.

- Pick the rates prepare you would like, complete the desired details to make your bank account, and pay money for your order utilizing your PayPal or bank card.

- Select a practical data file file format and acquire your backup.

Get every one of the file web templates you have purchased in the My Forms menus. You can obtain a more backup of Louisiana Unrestricted Charitable Contribution of Cash at any time, if possible. Just go through the necessary type to acquire or print the file template.

Use US Legal Forms, probably the most comprehensive selection of legal forms, to save time as well as steer clear of mistakes. The services provides skillfully made legal file web templates which can be used for a variety of reasons. Produce a free account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

A donor can deduct a charitable contribution of $250 or more only if the donor has a written acknowledgment from the charitable organization. The donor must get the acknowledgement by the earlier of: The date the donor files the original return for the year the contribution is made, or.

For contributions of cash, check, or other monetary gift (regardless of amount), you must maintain a record of the contribution: a bank record or a written communication from the qualified organization containing the name of the organization, the amount, and the date of the contribution.

How To Document Cash Donations. Your nonprofit treasurer should record cash donations in your statement of activities, which is a component of your complete financial statement that provides a net change in assets over the course of the year. In other words, it is a picture of how "profitable" your nonprofit agency is.

Federal law limits cash contributions to 60 percent of your federal adjusted gross income (AGI). California limits cash contributions to 50 percent of your federal AGI.

Your clients must keep adequate records to prove the amount taken. Contributions of $250 or more to any single charity require written acknowledgment of the contribution by the charity (done) before claiming a charitable contribution.

Always keep proof of your gift, such as a bank or credit card statement, canceled check, or written acknowledgement from the charity showing the date and value of the donation (if greater than $250).

Cash or property donations worth more than $250: The IRS requires you to get a written letter of acknowledgment from the charity. It must include the amount of cash you donated, whether you received anything from the charity in exchange for your donation, and an estimate of the value of those goods and services.

Overall deductions for donations to public charities, including donor-advised funds, are generally limited to 50% of adjusted gross income (AGI). The limit increases to 60% of AGI for cash gifts, while the limit on donating appreciated non-cash assets held more than one year is 30% of AGI.