Louisiana Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate

Description

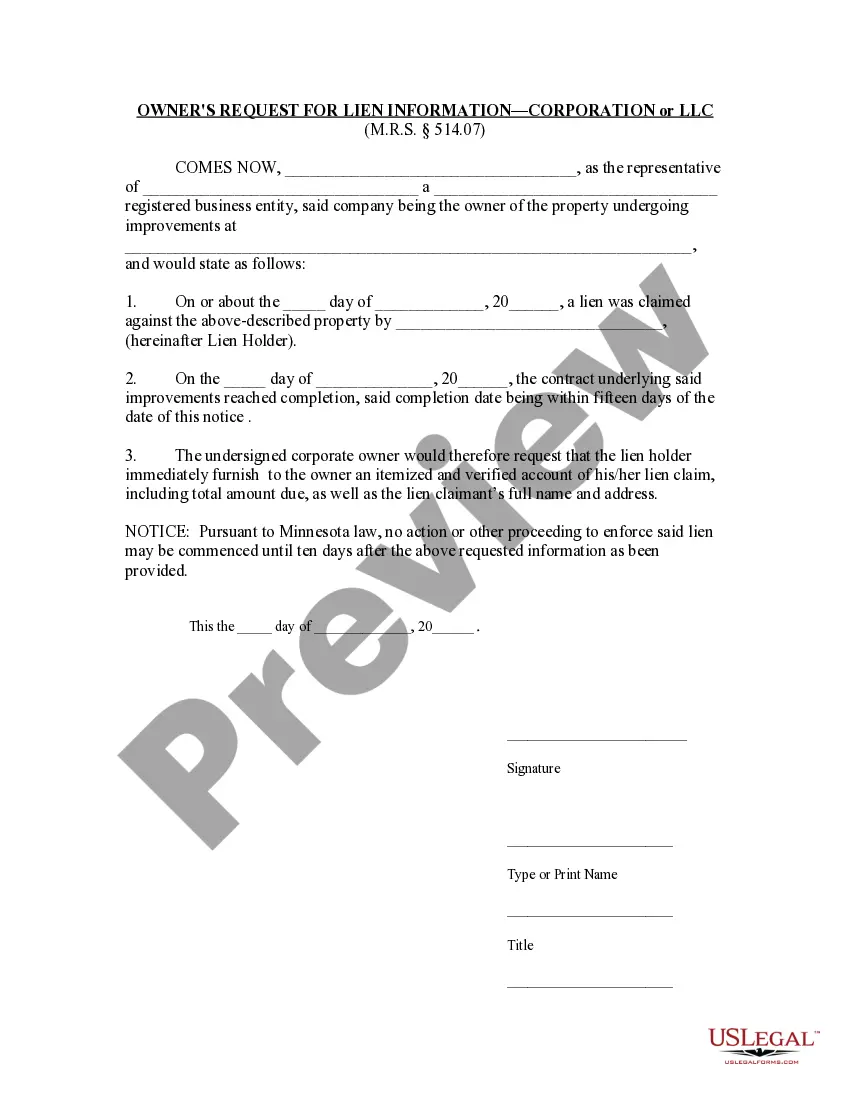

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Executor Of An Estate?

If you wish to be thorough, acquire, or reproduce legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site’s straightforward and convenient search to find the documents you require. A range of templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to obtain the Louisiana Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate with just a few clicks.

Step 5. Complete the transaction. You may use your credit card or PayPal account to process the payment.

Step 6. Retrieve the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Louisiana Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate. Each legal document template you acquire is yours indefinitely. You have access to every form you obtained within your account. Select the My documents section and choose a form to print or download again. Engage and download, and print the Louisiana Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are currently a US Legal Forms user, sign in to your account and click on the Obtain button to retrieve the Louisiana Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate.

- You can also access forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Preview option to review the form’s content. Do not forget to read the details.

- Step 3. If you are dissatisfied with the document, use the Search section at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Select the pricing plan you prefer and enter your credentials to register for the account.

Form popularity

FAQ

If you have a trust and funded it with most of your assets during your lifetime, your successor Trustee will have comparatively more power than your Executor. ?Attorney-in-Fact,? ?Executor? and ?Trustee? are designations for distinct roles in the estate planning process, each with specific powers and limitations.

Often, executors take 8-12 months to settle an estate; however, the process can take two or more years. Executors are given an executor year, referring to a granted period where they are expected to fulfill their fiduciary duties.

Can An Executor Sell Estate Property Without Getting Approval From All Beneficiaries? The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

While there is no time limit on opening a succession after a person's death, you will want to start the process as soon as possible. Because the deceased's assets will be frozen until the completion of the succession process, debts cannot be paid and could continue to grow.

The Estate Settlement Timeline: There is no specific deadline for this in Louisiana law, but it is generally best to do so within a month to ensure a smooth start to the probate process. Inventorying the Estate: Once the will has been submitted, the executor must compile a thorough inventory of the deceased's assets.

After a Louisiana resident passes away, their executor is tasked with protecting the estate until any outstanding debts and taxes have been paid.

At the end of the Succession, the Executor will still have to provide all heirs with an accounting of the assets on hand at your death plus all monies collected, less all payments made, unless the heirs waive the formality of such an accounting.