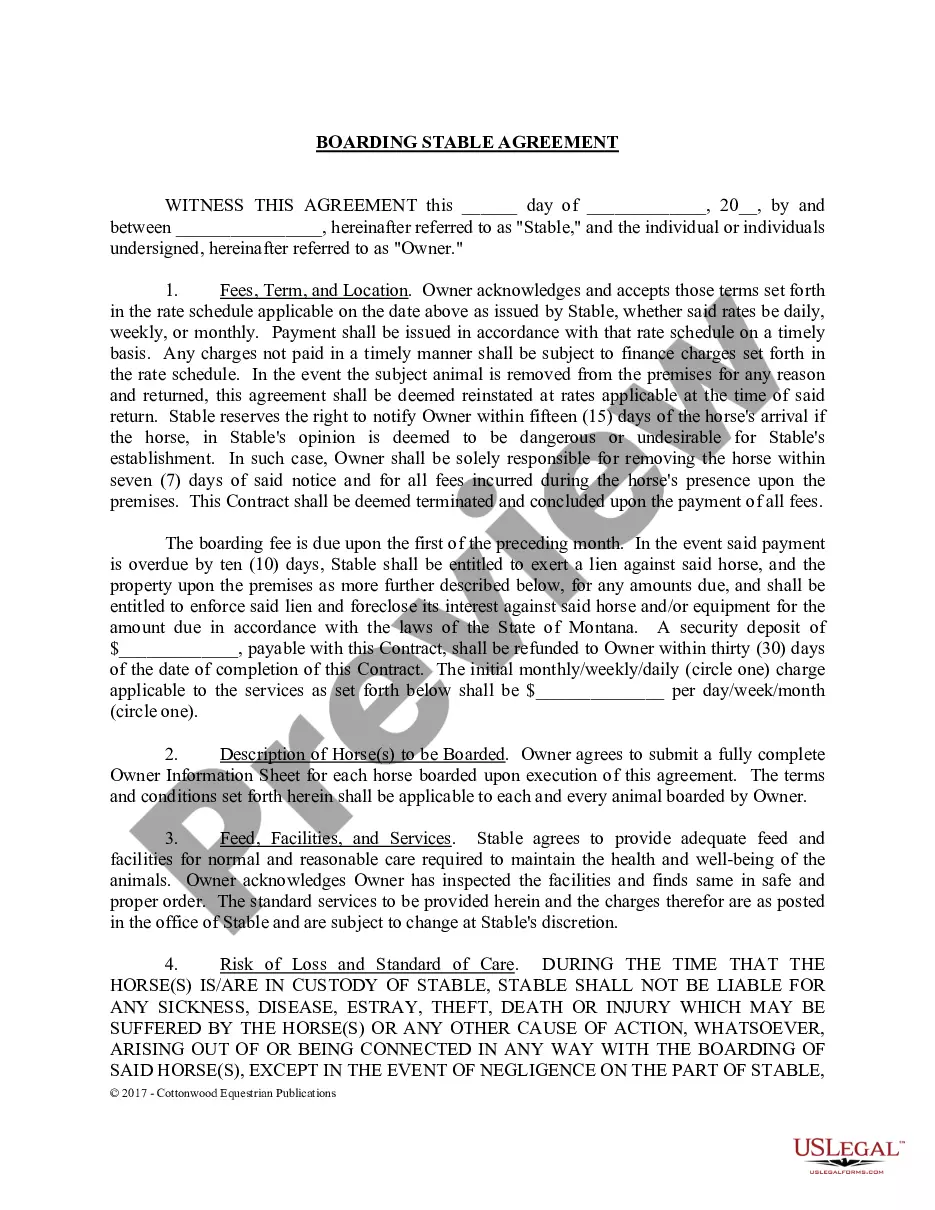

Louisiana Plan Reconciliation with Form 122C is a process used by the Louisiana Department of Revenue to reconcile sales and use taxes. This process involves a detailed comparison of sales and use taxes for a particular period. The reconciliation is done using Form 122C, which is a form that must be completed and submitted to the Department of Revenue along with supporting documents. There are two types of Louisiana Plan Reconciliation with Form 122C. The first type is the Annual Reconciliation, which must be completed annually by the taxpayer. This type of reconciliation requires the taxpayer to submit their Form 122C to the Department of Revenue for review and approval. The second type of Louisiana Plan Reconciliation with Form 122C is the Quarterly Reconciliation. This type of reconciliation must be completed quarterly by the taxpayer and requires the submission of Form 122C along with supporting documents to the Department of Revenue for review and approval.

Louisiana Plan Reconciliation with Form 122C

Category:

State:

Louisiana

Control #:

LA-SKU-0054

Format:

PDF

Instant download

Public form

Description

Plan Reconciliation with Form 122C

How to fill out Louisiana Plan Reconciliation With Form 122C?

US Legal Forms is the simplest and most economical method to find suitable legal templates.

It’s the most comprehensive online collection of business and personal legal documents created and validated by legal experts.

Here, you can discover printable and fillable templates that adhere to national and local regulations - just like your Louisiana Plan Reconciliation with Form 122C.

Examine the form description or preview the document to ensure you’ve identified the one that meets your needs, or discover another using the search bar above.

Click Buy now when you’re confident of its alignment with all the requirements, and select the subscription plan that best suits you.

- Obtaining your template involves just a few straightforward steps.

- Users who already possess an account with an active subscription only need to Log In to the platform and download the document onto their device.

- Subsequently, they can locate it in their profile under the My documents section.

- And here’s how to acquire a professionally crafted Louisiana Plan Reconciliation with Form 122C if you are using US Legal Forms for the first time.