Louisiana Warranty Deed to Separate Property of one Spouse to both as Joint Tenants or as Community Property with Right of Survivorship

Description

How to fill out Louisiana Warranty Deed To Separate Property Of One Spouse To Both As Joint Tenants Or As Community Property With Right Of Survivorship?

Among countless complimentary and premium templates available on the web, you cannot guarantee their precision.

For instance, who authored them or whether they possess the expertise to fulfill your needs.

Stay composed and make use of US Legal Forms! Obtain Louisiana Warranty Deed to Separate Property of one Spouse to both as Joint Tenants or as Community Property with Right of Survivorship examples crafted by expert attorneys and sidestep the expensive and lengthy process of searching for a lawyer and subsequently compensating them to draft a document for you that you can conveniently locate yourself.

Select a subscription plan and register for an account. Purchase the subscription using your credit/debit card or Paypal. Download the document in your preferred format. After signing up and securing your subscription, you are free to use your Louisiana Warranty Deed to Separate Property of one Spouse to both as Joint Tenants or as Community Property with Right of Survivorship as often as needed or as long as it is valid in your area. Edit it in your chosen online or offline editor, complete it, sign it, and create a physical copy. Achieve more for less with US Legal Forms!

- If you already hold a subscription, sign in to your account and find the Download button adjacent to the form you need.

- You will also have access to all of your previously saved templates in the My documents section.

- If you’re using our platform for the first time, adhere to the instructions below to acquire your Louisiana Warranty Deed to Separate Property of one Spouse to both as Joint Tenants or as Community Property with Right of Survivorship promptly.

- Ensure that the document you find is authorized where you reside.

- Examine the template by reviewing the information using the Preview feature.

- Click Buy Now to initiate the purchasing procedure or search for another example using the Search bar at the top.

Form popularity

FAQ

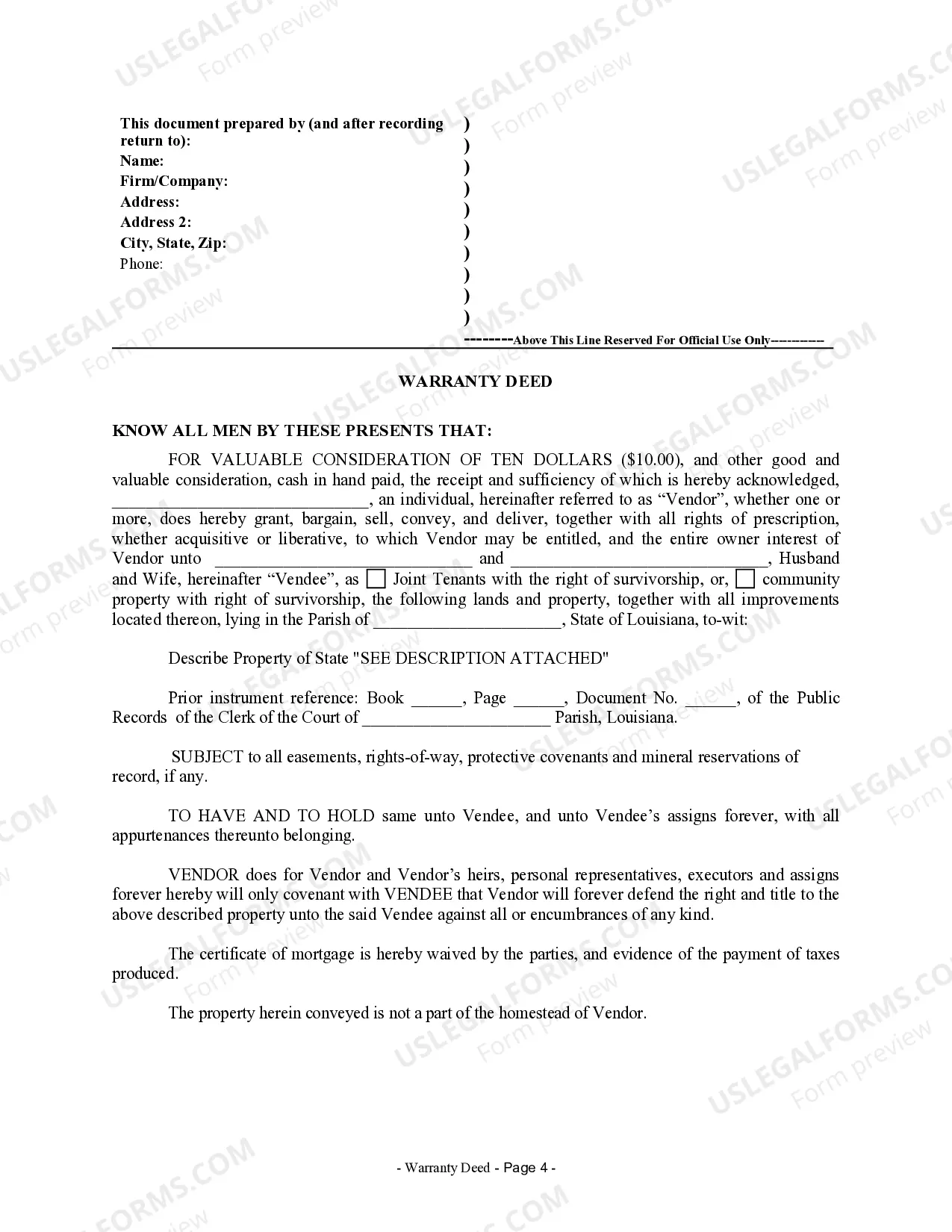

Overview of Joint Tenants For example, joint tenants must all take title simultaneously from the same deed while tenants in common can come into ownership at different times. Another difference is that joint tenants all own equal shares of the property, proportionate to the number of joint tenants involved.

In estate law, joint tenancy is a special form of ownership by two or more persons of the same property. The individuals, who are called joint tenants, share equal ownership of the property and have the equal, undivided right to keep or dispose of the property. Joint tenancy creates a Right of Survivorship.

One of the main differences between the two types of shared ownership is what happens to the property when one of the owners dies. When a property is owned by joint tenants with survivorship, the interest of a deceased owner automatically gets transferred to the remaining surviving owners.

When a property is owned by joint tenants with survivorship, the interest of a deceased owner automatically gets transferred to the remaining surviving owners. For example, if four joint tenants own a house and one of them dies, each of the three remaining joint tenants ends up with a one-third share of the property.

In California, most married couples hold real property (such as land and buildings) as joint tenants with right of survivorship.For instance, many married couples share real property as joint tenants. This way, upon the death of a spouse, the surviving spouse will own 100% share of the property.

When one joint owner (called a joint tenant, though it has nothing to do with renting) dies, the surviving owners automatically get the deceased owner's share of the joint tenancy property.The surviving joint tenant will automatically own the property after your death.

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Joint tenancy often works well when couples (married or not) acquire real estate, vehicles, bank accounts, securities, or other valuable property together.

It is very simple to break a joint tenancy. You simply prepare and excute before a notary public a quitclaim deed to yourself and record the quitclaim deed with the County Recorder in the County in which the real property is located.

While the joint tenant with right of survivorship can't will his share in the property to his heir, he can sell his interest in the property before his death. Once a joint tenant sells his share, this ends the joint tenancy ownership involving the share.