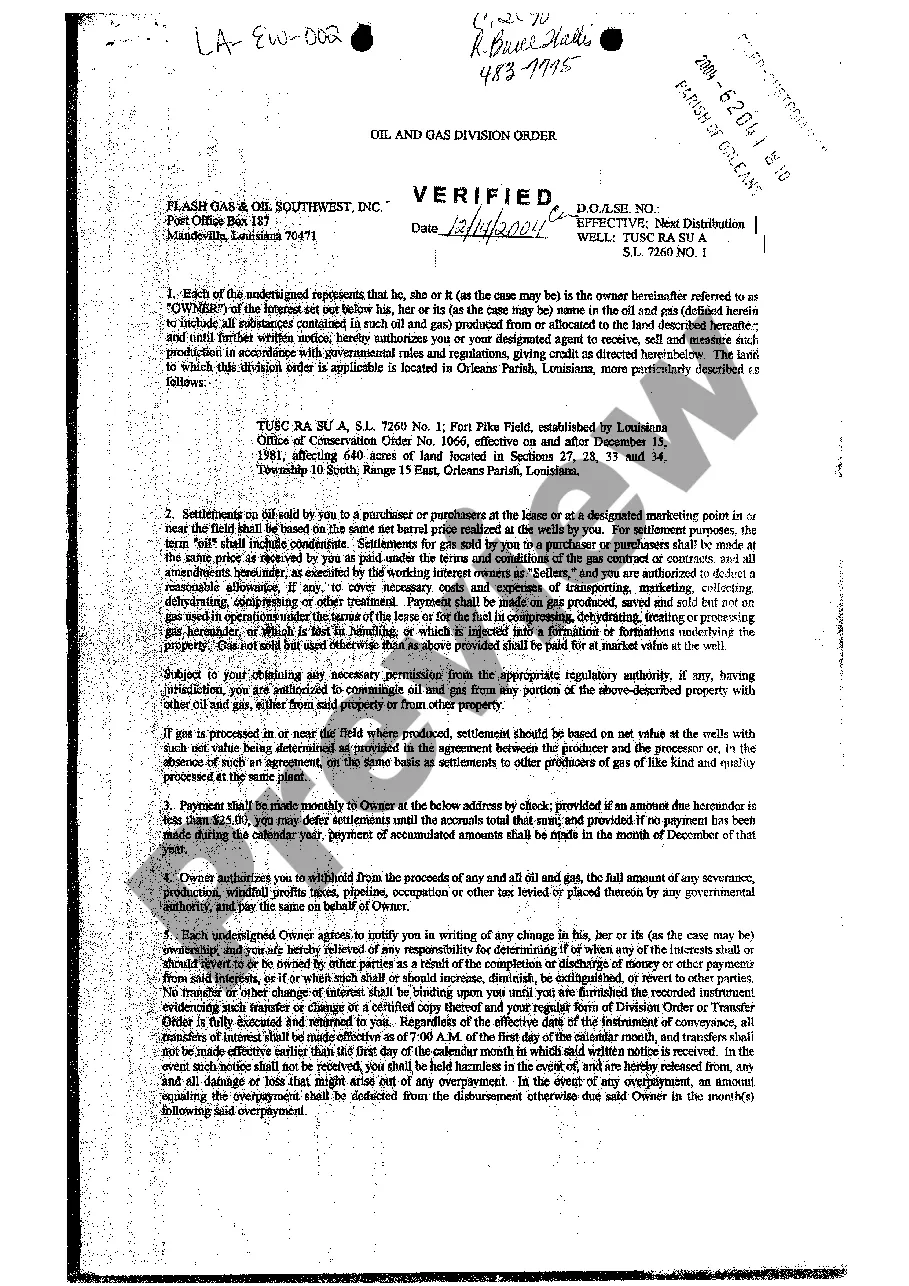

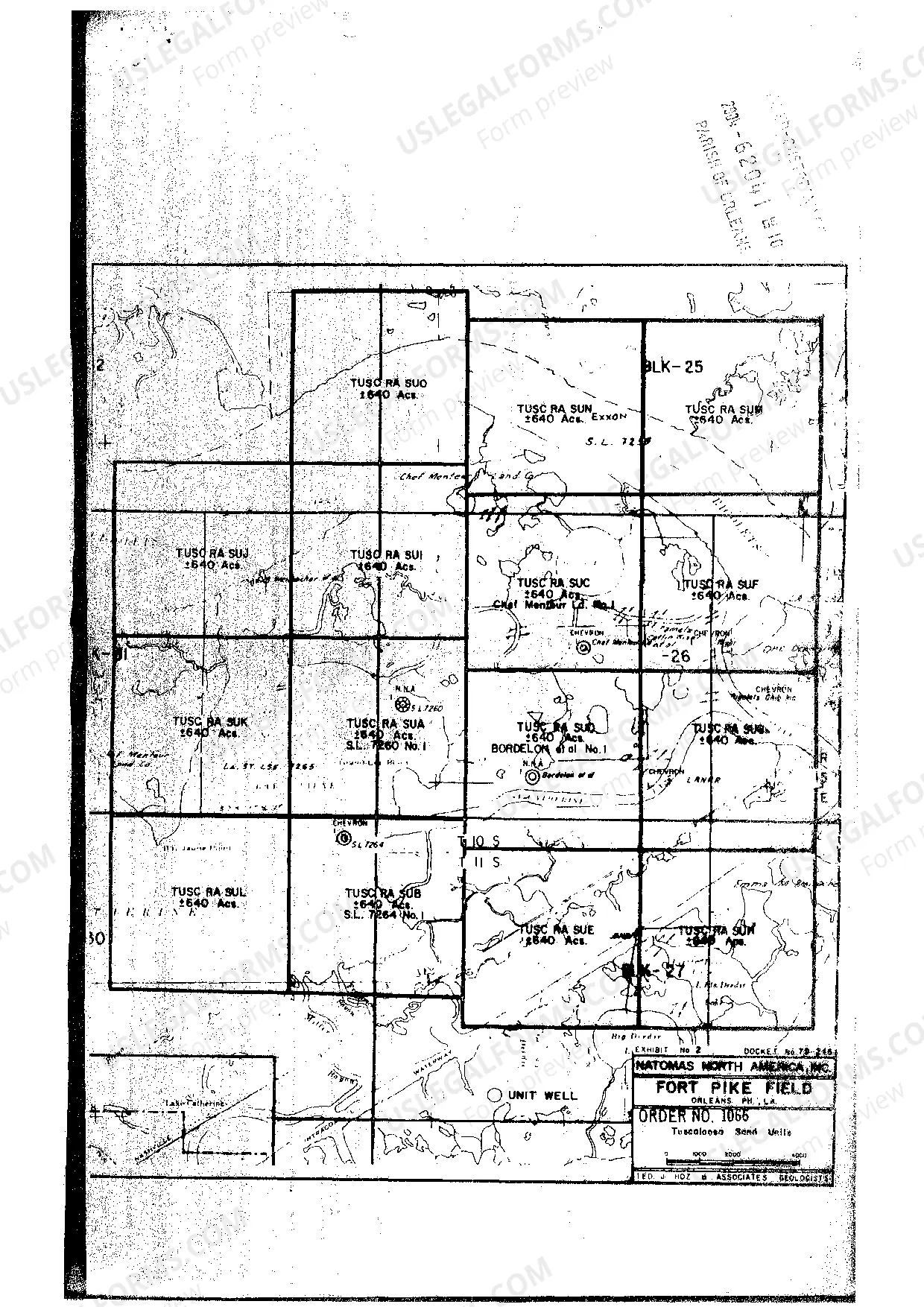

Louisiana Oil and Gas Division Order

Description

Key Concepts & Definitions

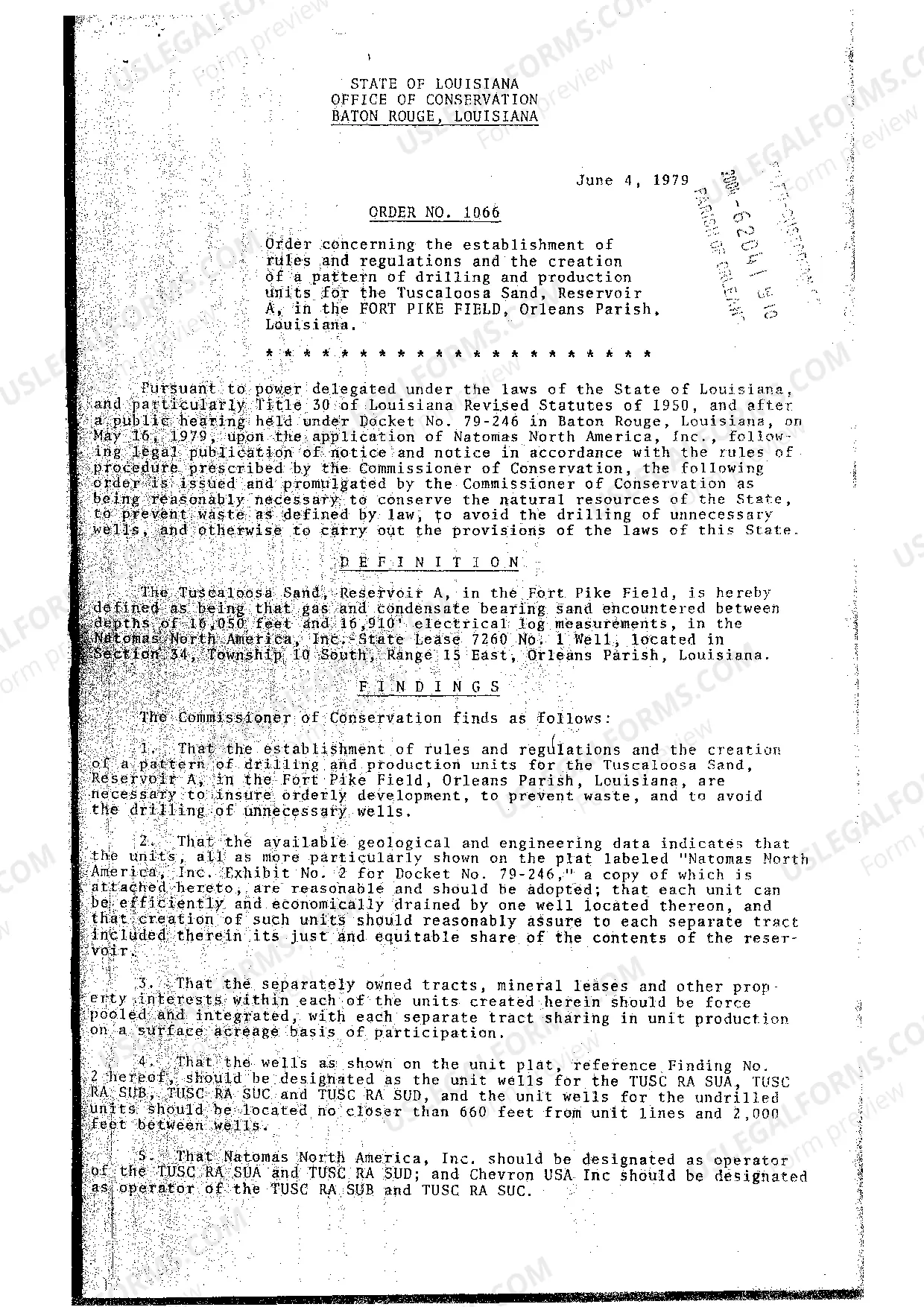

Oil and Gas Division Order: A legally binding document which clarifies the proportion of production revenue owed to each party from a well. It includes essential details such as royalty owner information, mineral rights planning, and division orders processing.

- Royalty Owner Information: Details about individuals or entities who own royalties on oil and gas production.

- Mineral Rights Planning: Planning and management involving mineral estates and their extraction rights.

- Oil Gas Lease: A contractual agreement between a mineral owner and a producer to explore, drill, and produce oil or gas.

Step-by-Step Guide: How to Sign a Division Order

- Contact Management Company: Reach out to the company managing the oil and gas leases to procure a division order.

- Review Royalty Payments: Ensure the order accurately reflects your interests and the agreed percentage of royalty payments.

- Sign Division Order: Sign the order to confirm acceptance of terms and start receiving your royalties.

Risk Analysis of Division Orders

- Inaccuracies in Documentation: Errors in the division order can lead to incorrect royalty payments.

- Legal Disputes: Ambiguities in mineral rights or lease terms can result in legal challenges.

- Probate Representation Service Needs: In cases of inheritance, appropriate legal representation is crucial to manage transfers effectively.

Best Practices for Managing Oil and Gas Royalties

- Regular Review of Documents: Regularly review lease agreements, division orders, and royalty statements to ensure accuracy.

- Understanding Legal Terms: Have a clear understanding of terms like 'mineral acres ownership' and 'texas property royalties' and how they impact your rights and revenues.

- Professional Consultation: Consult with professionals for mineral rights planning and negotiation of lease terms.

FAQ: Common Questions about Division Orders

- What happens if I don't sign a division order? Not signing can delay your royalty payments.

- How do I verify the accuracy of a division order? Cross-reference the document with your lease agreement and seek professional advice if needed.

- Can I renegotiate the terms in a division order? Terms are generally set based on the lease agreement but discussing adjustments with a legal advisor or the management company could be possible.

How to fill out Louisiana Oil And Gas Division Order?

You are invited to the biggest collection of legal documents, US Legal Forms. Here you can obtain any template such as Louisiana Oil and Gas Division Order forms and download them (as many copies as you desire). Create official documents in a matter of hours, rather than days or even weeks, without having to pay a fortune for a lawyer. Acquire your state-specific template in just a few clicks and feel confident knowing it was crafted by our state-certified legal experts.

If you’re already a subscribed member, simply Log In to your account and then click Download next to the Louisiana Oil and Gas Division Order you need. Since US Legal Forms is an online service, you’ll consistently have access to your downloaded forms, no matter the device you’re using. Find them under the My documents section.

If you don't yet have an account, what are you waiting for? Follow our instructions below to get going.

After you’ve completed the Louisiana Oil and Gas Division Order, present it to your lawyer for validation. It’s an additional step but a crucial one to ensure you’re fully protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- If this is a state-specific template, verify its applicability in your state.

- Examine the description (if available) to see if it’s the appropriate template.

- Explore additional information with the Preview feature.

- If the template meets your requirements, just click Buy Now.

- To create an account, select a pricing plan.

- Use a credit card or PayPal account to register.

- Download the document in the format you need (Word or PDF).

- Print the document and fill it with your or your company’s information.

Form popularity

FAQ

Use this formula to calculate your decimal share of royalties from the producing well: (Mineral Interest Share) times (Royalty Rate) = (Royalty Share Decimal). Example 1: (1/3 x 100% mineral interest) times (1/8 Royalty Rate) = 1/3 x 1/8 = 1/24 = 0.04166667 RI.

A division order is a record of your interest in a specific well. It contains your decimal interest, interest type, well number and well name. Division orders are issued to all that own an interest in a specific well after that well has achieved first sales of either oil or gas.

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.

There are multiple ways to buy minerals, the most common being at auction, from brokers, by negotiated sale, tax sales, and directly from mineral owners. The process of buying minerals varies depending on where you buy them.

Mineral rights have sold for as high as $40,000 per acre, and usually, the average price can be between $250 and $9,000. If mineral rights buyers and sellers conduct proper due diligence, both parties can negotiate the best mining rights deal and avoid future legal quagmires.

A Division Order (DO's), also known as a Division of Interest (DOI), is the instrument which details the proportional ownership of produced minerals, including oil, liquids, natural gas, etc., in a well or unitized area of production.

Net revenue is the amount that is shared among the property owners. To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.