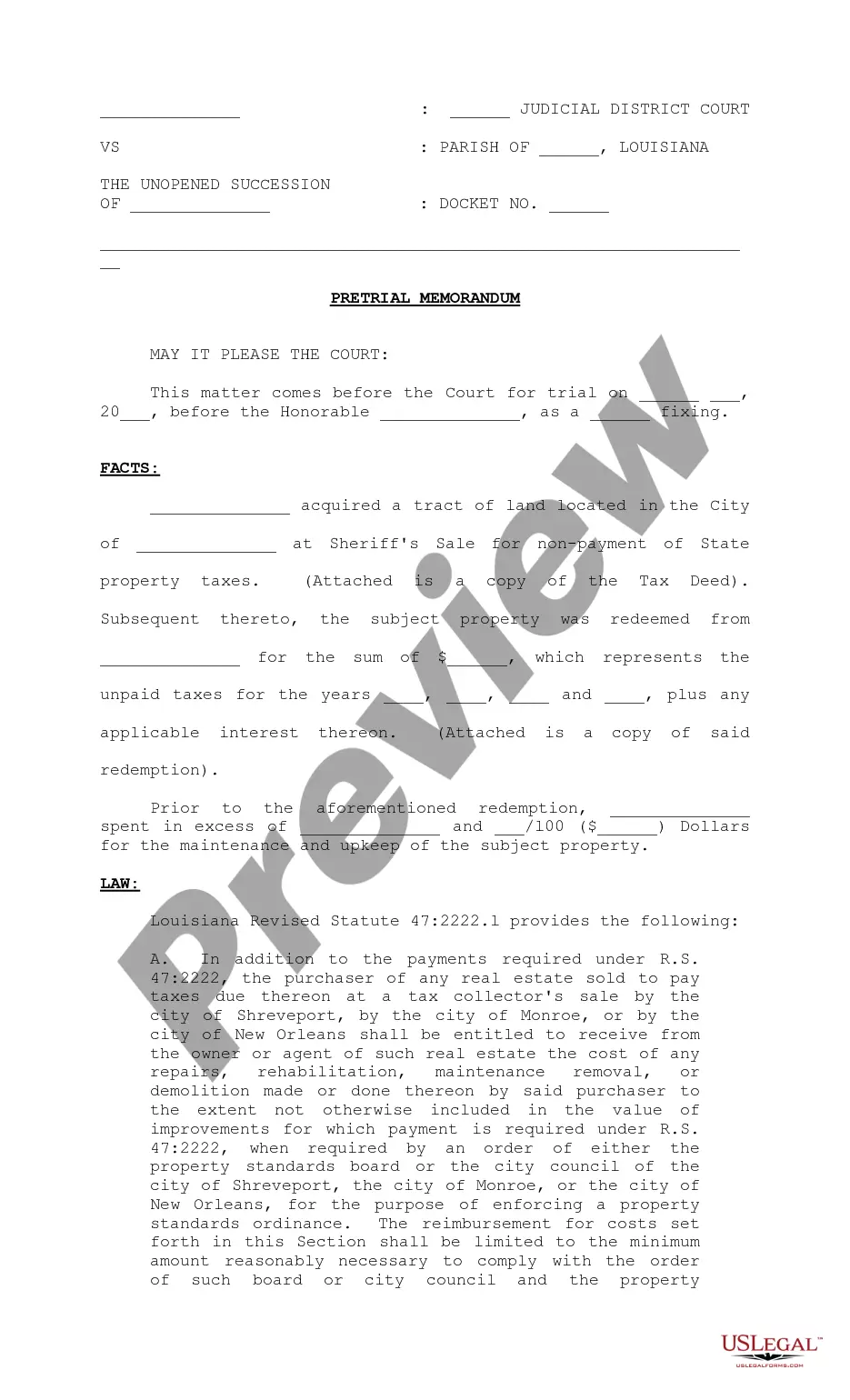

Louisiana Pretrial Memorandum requesting reimbursement of real estate upkeep costs for redeemed property

Description

How to fill out Louisiana Pretrial Memorandum Requesting Reimbursement Of Real Estate Upkeep Costs For Redeemed Property?

Searching for the Louisiana Pretrial Memorandum requesting reimbursement for property maintenance expenses for reclaimed assets forms and completing them can be a hurdle.

To conserve time, money, and effort, utilize US Legal Forms and locate the appropriate template specifically for your state in just a few clicks.

Our legal experts prepare each document, so you only need to complete them. It really is that simple.

Click Buy Now if you found what you’re looking for. Choose your plan on the pricing page and create an account. Select your payment method via credit card or PayPal. Download the document in the desired file format. You can print the Louisiana Pretrial Memorandum requesting reimbursement of real estate upkeep costs for redeemed property form or fill it out using any online editor. Don’t worry about typographical errors because your sample can be utilized and submitted, and printed as many times as you like. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to download the example.

- Your saved templates are stored in My documents and can be accessed at any time for future use.

- If you haven’t registered yet, you need to sign up.

- Review our detailed instructions on how to obtain the Louisiana Pretrial Memorandum requesting reimbursement for property maintenance expenses for reclaimed assets form in a few minutes.

- To obtain a valid form, verify its relevance for your state.

- Examine the form using the Preview feature (if it’s available).

- If there's a description, read it to understand the specifics.

Form popularity

FAQ

Five U.S. states (New Hampshire, Oregon, Montana, Alaska and Delaware) do not impose any general, statewide sales tax on goods or services. Of the 45 states remaining, four (Hawaii, South Dakota, New Mexico and West Virginia) tax services by default, with exceptions only for services specifically exempted in the law.

In the case of service transactions, only the particular transactions enumerated in the law are taxable. What is the sales tax rate in Louisiana? Sales and use taxes levied by political subdivisions of the state are in addition to the sales and use taxes levied by the state.

In Louisiana, failing to pay your property taxes will lead to a tax sale.But you'll eventually lose ownership of the property permanently if you don't pay off the debt during what's called a redemption period after the sale.

Louisiana is classified as a Redemption Deed State. The municipal or parish tax collector oversees the sale which is an oral public auction. Tax deeds are sold with a 3 year right of redemption. Investors receive a rate of return of 1% per month, or 12% annually.

The statewide tax rate is 7.25%. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Those district tax rates range from 0.10% to 1.00%. Some areas may have more than one district tax in effect.

A tax sale gives the original property owner three years to redeem their property. To redeem the property, the owner has to pay the purchaser of the tax title the price paid at the tax sale; all taxes paid on the property since the tax sale; a 5% penalty; and 1% interest per month.

Louisiana is classified as a Redemption Deed State. The municipal or parish tax collector oversees the sale which is an oral public auction. Tax deeds are sold with a 3 year right of redemption.The state also mandates a flat penalty rate of 5% due to the deed holder upon property redemption.

Labor Only for Repairs Charges for repairs of tangible personal property needing only labor or service are not subject to sales tax or surtax. The dealer must keep documentation to prove no tangible personal property was joined with, or attached to, the repaired item.

Louisiana sales tax details The Louisiana (LA) state sales tax rate is currently 4.45%. Depending on local municipalities, the total tax rate can be as high as 11.45%.