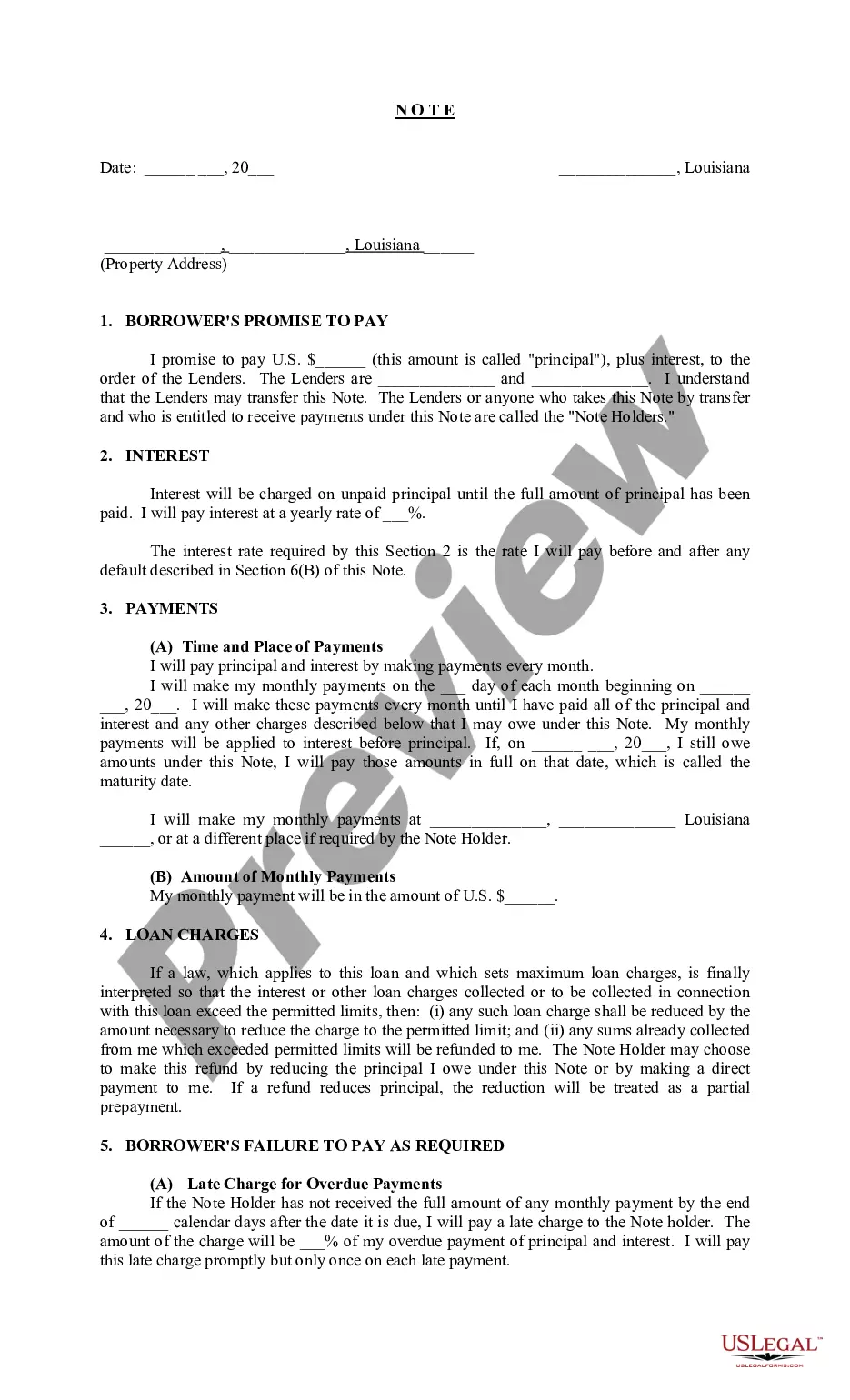

Louisiana Promissory Note

Description

How to fill out Louisiana Promissory Note?

Seeking to locate a Louisiana Promissory Note template and completing it can be challenging.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the appropriate example specifically for your state in just a few clicks.

Our lawyers create every document, so you merely need to fill them out. It is truly that easy.

Select your payment option, either by credit card or PayPal. Save the document in your preferred file format. Now you can print the Louisiana Promissory Note template or complete it using any online editor. Don’t be concerned about making mistakes because your template can be utilized and submitted, and printed as many times as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to save the template.

- All your saved templates are kept in My documents and they are always accessible for future use.

- If you haven't subscribed yet, you need to sign up.

- Review our detailed guidelines on how to obtain the Louisiana Promissory Note template in just a few moments.

- To obtain a valid template, verify its eligibility for your state.

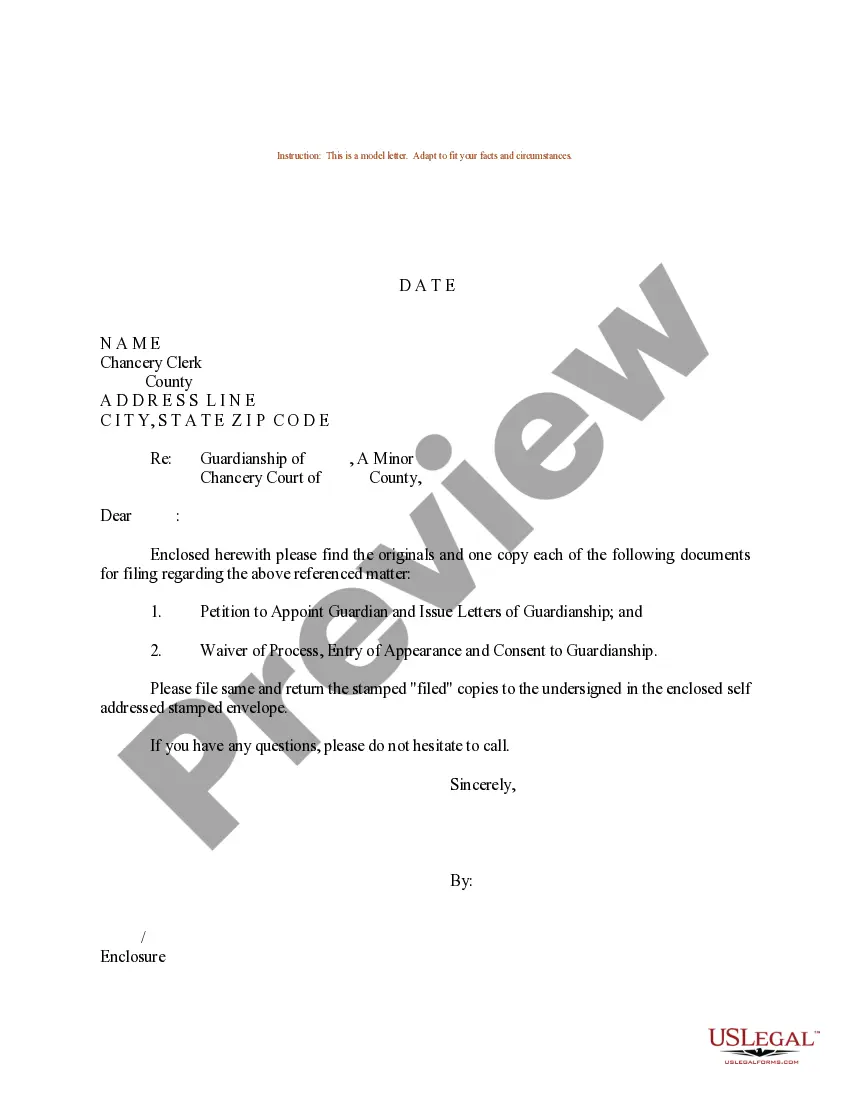

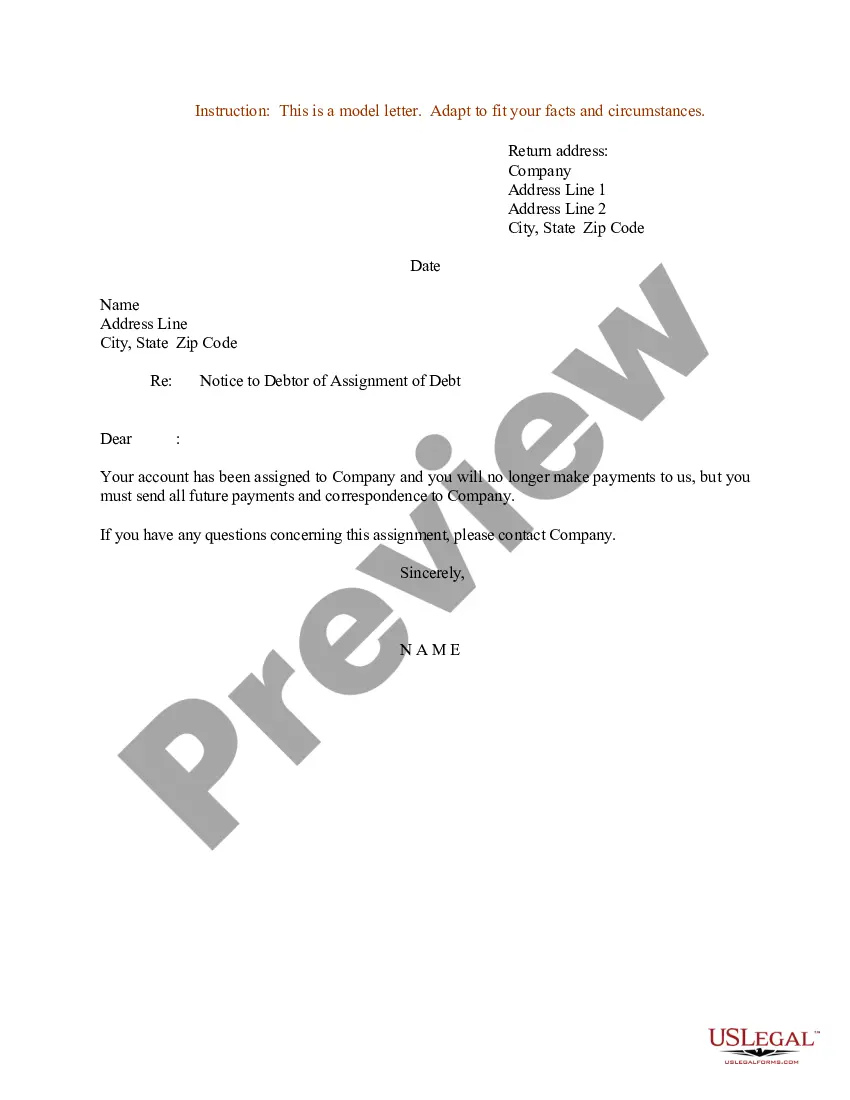

- Examine the template using the Preview option (if available).

- If there is a description, read it to understand the specifics.

- Click on Buy Now button if you found what you're looking for.

Form popularity

FAQ

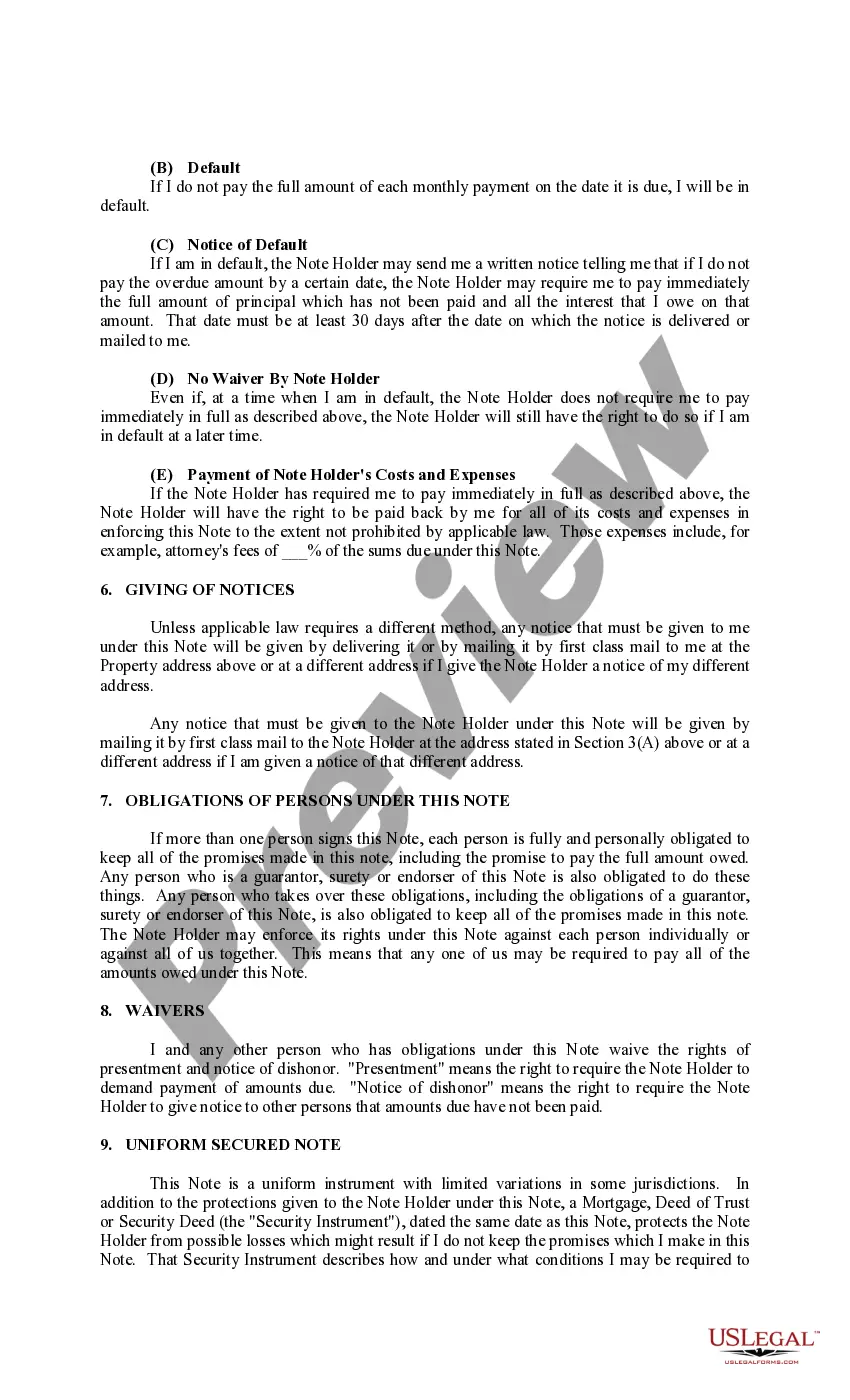

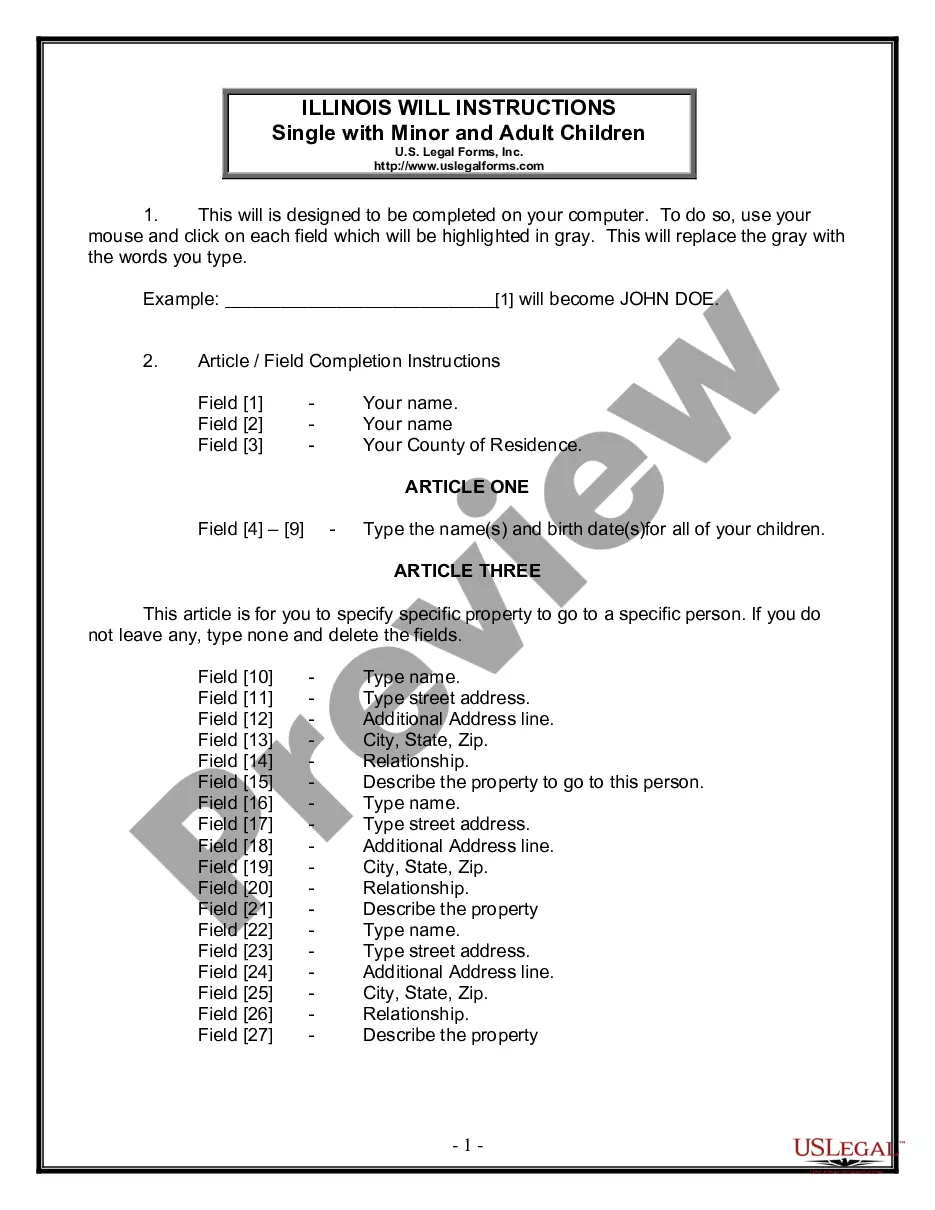

To fill out a Louisiana Promissory Note, start by including the date and the names of both the borrower and the lender. Next, clearly state the amount borrowed, the interest rate, repayment schedule, and any other important terms. You can find user-friendly templates on platforms like US Legal Forms, which simplify the process and ensure you comply with Louisiana regulations.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

1Write the date of the writing of the promissory note at the top of the page.2Write the amount of the note.3Describe the note terms.4Write the interest rate.5State if the note is secured or unsecured.6Include the names of both the lender and the borrower on the note, indicating which person is which.How to Write a Binding Promissory Note - Small Business - Chron.com\nsmallbusiness.chron.com > write-binding-promissory-note-3712

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

There are four significant types of promissory notes in India. A personal note is the kind of promissory note that an individual should seek when lending money to family members or close relatives. A commercial note is the type of promissory note that is signed between a borrower and a financial institution.

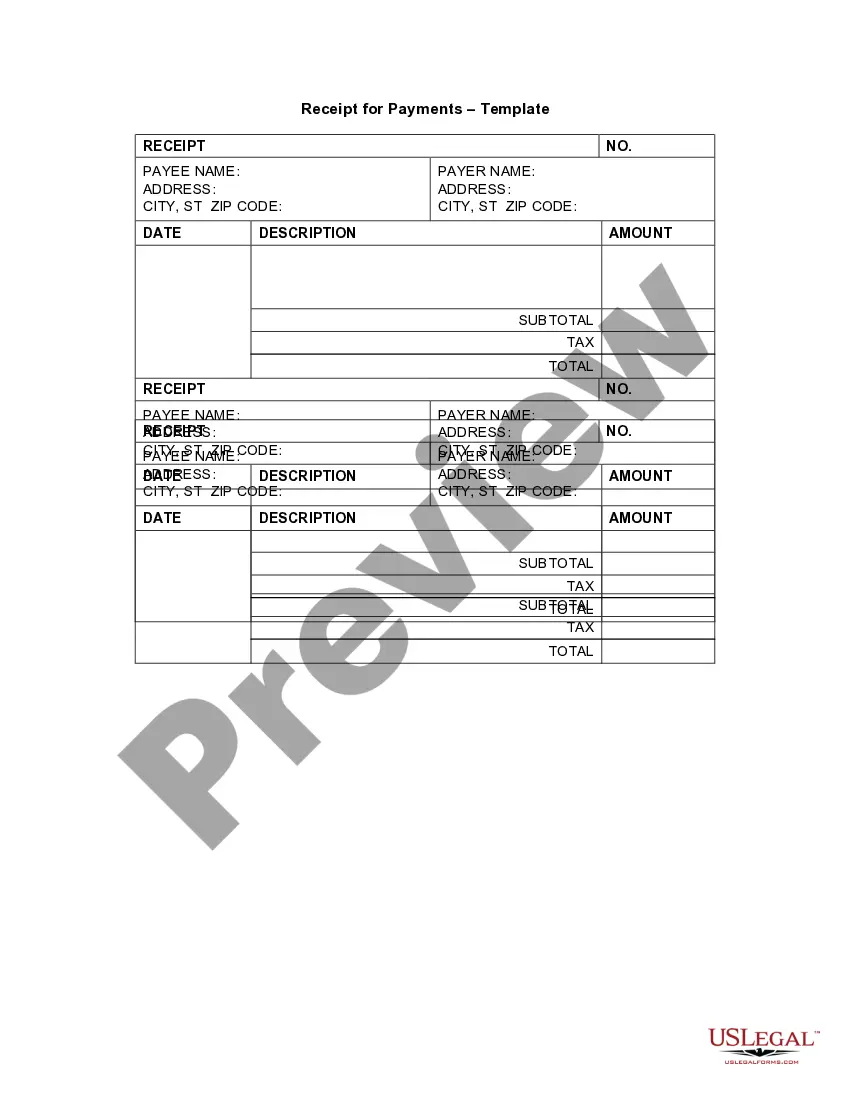

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.