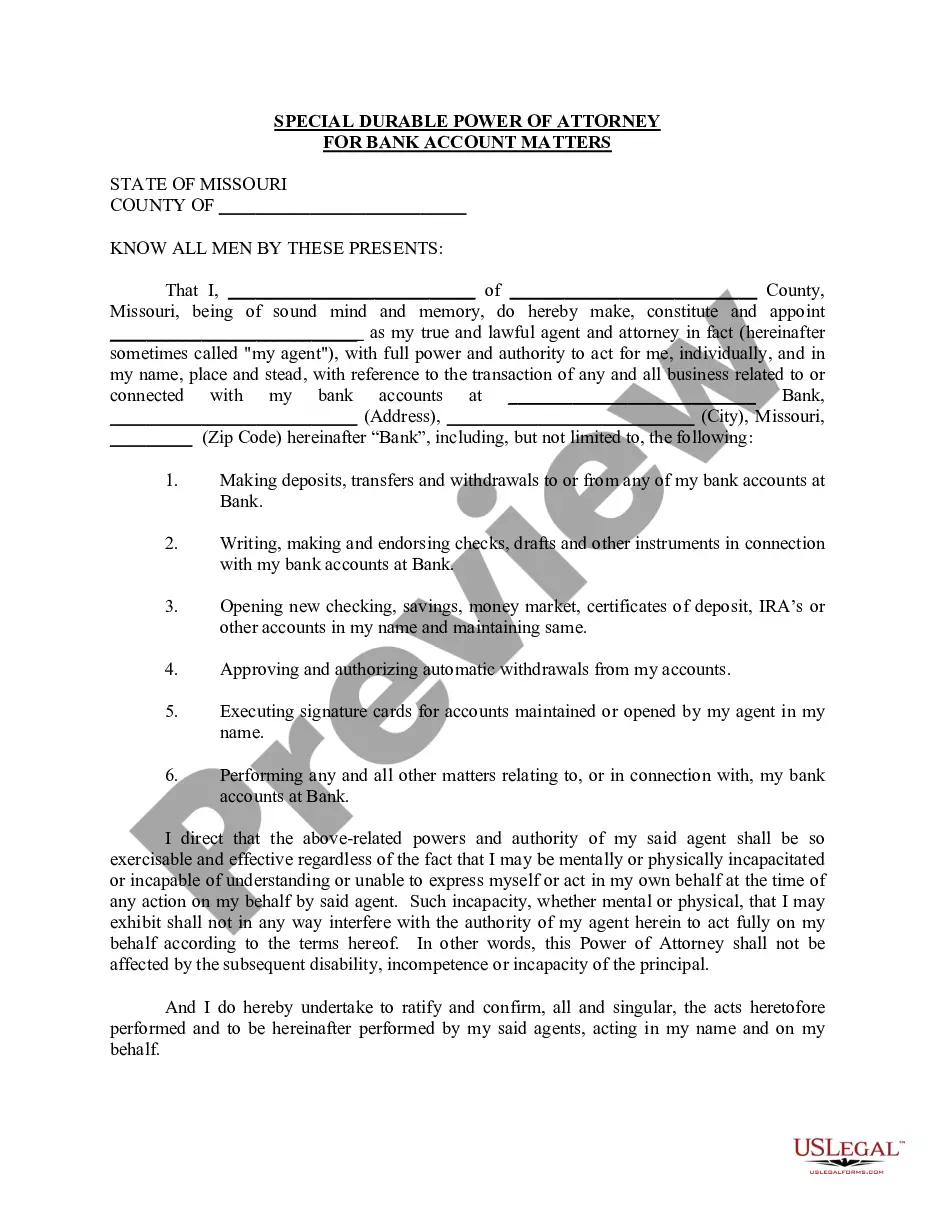

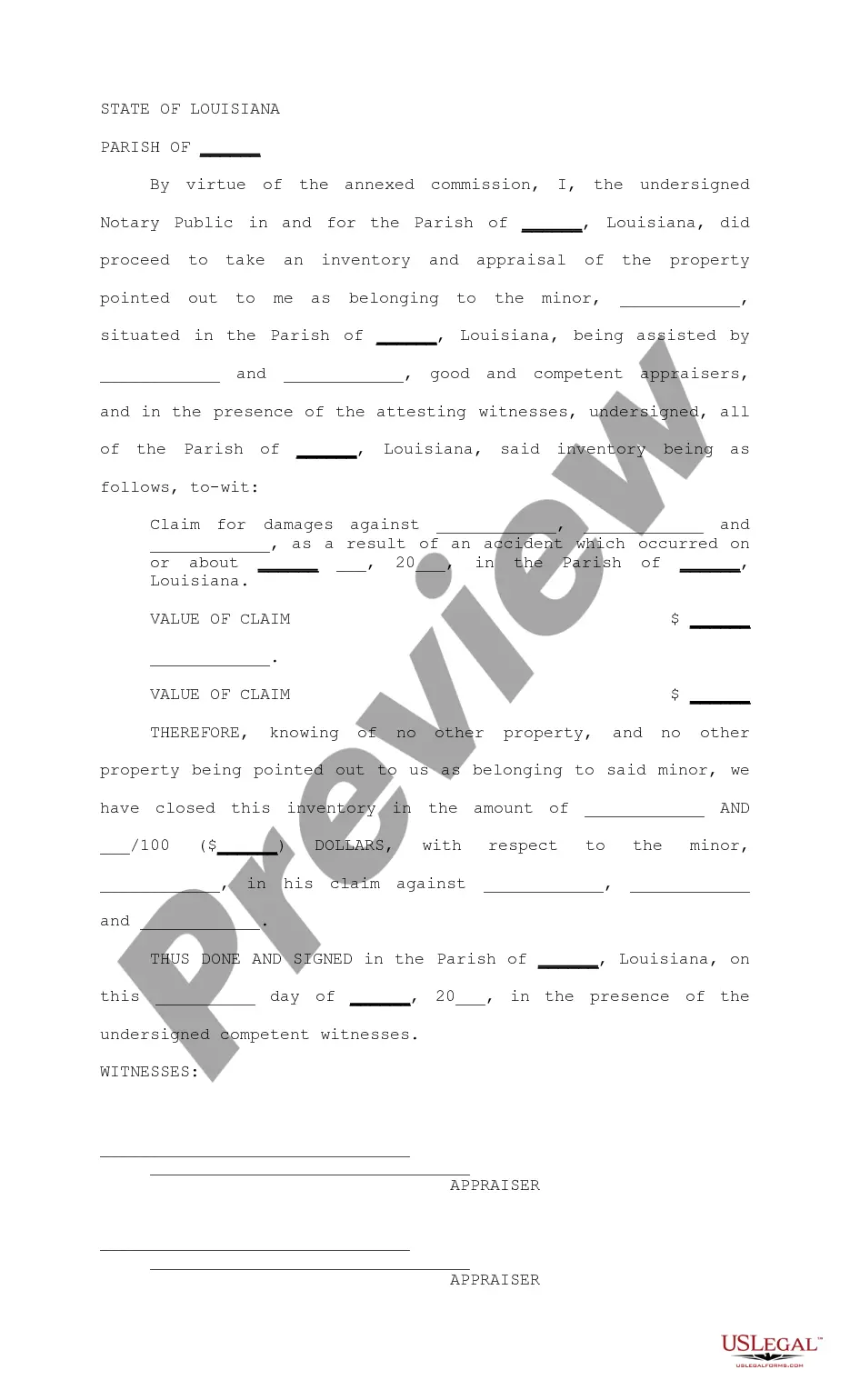

Louisiana Inventory and Appraisal of Property

Description

How to fill out Louisiana Inventory And Appraisal Of Property?

Locating Louisiana Inventory and Appraisal of Property forms and finalizing them may pose a difficulty.

To conserve considerable time, expenses, and effort, utilize US Legal Forms and select the appropriate template tailored for your state with just a few clicks.

Our legal experts prepare every document, so you simply need to complete them.

Select your plan on the pricing page and create an account. Decide whether you prefer to pay by credit card or via PayPal. Save the sample in your chosen format. Now, you can either print the Louisiana Inventory and Appraisal of Property form or fill it out using any online editor. Don’t worry about making mistakes because your sample can be used and submitted, and printed as many times as desired. Experience US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to save the sample.

- All of your stored samples are kept in My documents and are accessible at any time for future use.

- If you haven’t enrolled yet, you will need to register.

- Follow our comprehensive guidelines on how to obtain the Louisiana Inventory and Appraisal of Property template in a few minutes.

- To acquire a qualified form, verify its relevance to your state.

- Examine the sample using the Preview feature (if available).

- If there’s a description, read it to comprehend the details.

- Click Buy Now if you have found what you are looking for.

Form popularity

FAQ

To obtain a judgment of possession in Louisiana, you must file a petition with the appropriate court, demonstrating your right to the property as an heir or legatee. This process also involves submitting a Louisiana Inventory and Appraisal of Property to define the assets and verify ownership. Once approved, you will receive the judgment that formally grants possession of the property.

It includes land and buildings, for example. Personal property typically includes furniture, fixtures, tools, vehicles, and machinery and equipment. All of these items can be moved.

An assessed value is the dollar value assigned to a property to measure applicable taxes. Assessed valuation determines the value of a residence for tax purposes and takes comparable home sales and inspections into consideration.

Every business has furniture, fixtures, equipment, inventory or other components owned by the company that lend themselves to the production of income. This is considered business personal property, and it is taxable in many jurisdictions.

Fixed assets are owned by the business and used to generate revenue, while inventory is a current asset because it is reasonable to expect it can be converted into cash within one business year. From an accounting perspective, fixed assets and inventory stock both represent property that a company owns.

Personal property is a class of property that can include any asset other than real estate. The distinguishing factor between personal property and real estate, or real property, is that personal property is movable; that is, it isn't fixed permanently to one particular location.

The two types you'll most likely encounter are market value and assessed value. Market value is the estimated amount active buyers would currently be willing to pay for your home.Assessed value, on the other hand, takes the market value and puts it in the context of your property taxes.

The Louisiana constitution provides that property shall be valued on the basis of either fair market price or use value.The following types of property are assessed at a percentage of fair market value: residential 10%, commercial 15%, and public service 25%.

Tangible personal property taxes are levied on property that can be moved or touched, such as business equipment, machinery, inventory, and furniture.