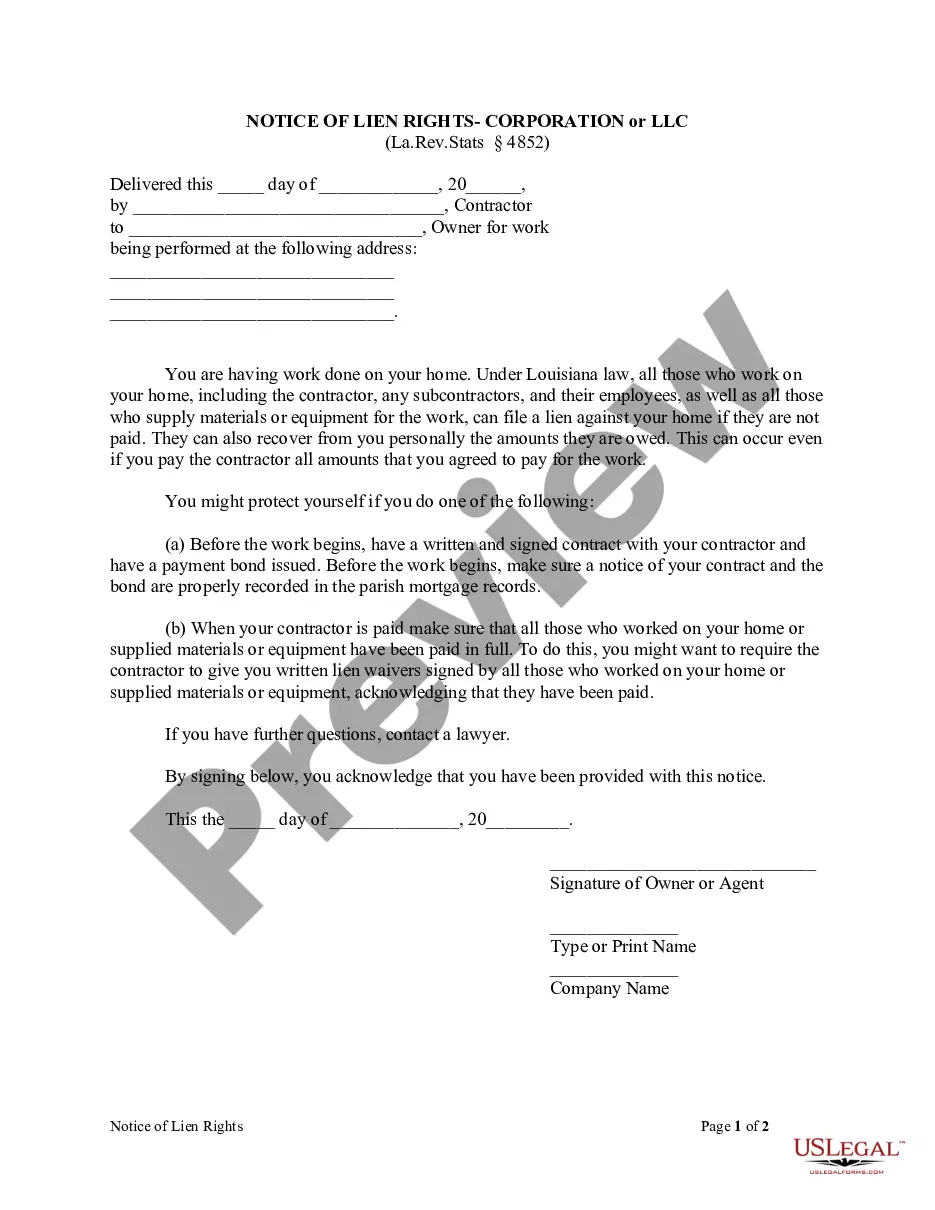

This Notice of Lien Rights form is for use by a corporation to provide notice to an owner of residential property that the contractor is about to begin improving the owner's residential property according to the terms and conditions of a contract, and that a right to file a lien against the owner's property and improvements is granted to every contractor, subcontractor, architect, engineer, surveyor, mechanic, cart-man, truckman,workman, laborer, or furnisher of material, machinery or fixtures, who performs work or furnishes material for the improvement or repair of the owner's property, for the payment in principal and interest of such work or labor performed, or the materials, machinery or fixtures furnished, and for the cost of recording such privilege. Further, the notice provides that the owner shall be liable to subcontractors, materialmen, suppliers or laborers for any unpaid amounts due them pursuant to their timely filed claims to the same extent as is the designated contractor when a contract is unwritten and/or unrecorded, or a bond is not required or is insufficient or unrecorded, or the surety is not proper or solvent. The lien rights granted in the notice can be enforced against the owner's property even though the contractor has been paid in full if the contractor has not paid the persons who furnished the labor or materials for the improvement. The owner may require a written contract, to be recorded, and a bond with sufficient surety to be furnished and recorded by the contractor in an amount sufficient to cover the cost of improvements, thereby relieving the owner, and his or her property, of liability for any unpaid sums remaining due and owing after completion to subcontractors, journeymen, cartmen, workmen, laborers, mechanics, furnishers of material or any other persons furnishing labor, skill, or material on the work who record and serve their claims in accordance with the requirements of law.

Louisiana Notice of Lien Rights - Corporation or LLC

Description

How to fill out Louisiana Notice Of Lien Rights - Corporation Or LLC?

Searching for Louisiana Notice of Lien Rights - Corporation or LLC templates and filling out them might be a problem. To save time, costs and energy, use US Legal Forms and choose the right example specially for your state within a few clicks. Our lawyers draw up every document, so you just need to fill them out. It truly is that simple.

Log in to your account and come back to the form's web page and download the document. All of your downloaded samples are saved in My Forms and therefore are accessible all the time for further use later. If you haven’t subscribed yet, you have to sign up.

Look at our thorough instructions concerning how to get your Louisiana Notice of Lien Rights - Corporation or LLC sample in a couple of minutes:

- To get an qualified sample, check its applicability for your state.

- Take a look at the form utilizing the Preview function (if it’s offered).

- If there's a description, read it to learn the details.

- Click on Buy Now button if you found what you're trying to find.

- Choose your plan on the pricing page and make an account.

- Select you wish to pay out by a card or by PayPal.

- Save the file in the preferred file format.

Now you can print out the Louisiana Notice of Lien Rights - Corporation or LLC template or fill it out utilizing any web-based editor. No need to concern yourself with making typos because your template can be utilized and sent away, and published as many times as you wish. Try out US Legal Forms and get access to more than 85,000 state-specific legal and tax files.

Form popularity

FAQ

Complete the Louisiana Statement of Claim and Privilege form. Record the claim form with the recorder of mortgages office in the parish where the property is located. Serve notice of the lien claim to the property owner.

When your efforts to collect a bill from a business that owes you money have been unsuccessful, you can place a lien on the assets of the business. As a lienholder, you gain legal rights to the company's property and the authority to sell the property and use the proceeds to repay what is owed to you.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

A judgment lien in Louisiana will remain attached to the debtor's property (even if the property changes hands) for ten years.

A judgment lien in Louisiana will remain attached to the debtor's property (even if the property changes hands) for ten years.

Avoid harassing the people that owe you money. Keep phone calls short. Write letters. Get a collection agency to write demand letters. Offer to settle for less than is due. Hire a collection agency. Small claims court. File a lawsuit.

If the Notice of Contract is filed, a contractor has 60 days from the filing of a Notice of Acceptance to file a Louisiana mechanics lien. If no Notice of Contract has been filed, a contractor has 60 days from completion on the project to file a Louisiana mechanics lien if the contract amount is less than $25,000.

2. States where the lien law doesn't require a written contract. In these states, contractors and suppliers are generally allowed to file a lien even if they don't have a written contract.These states typically permit parties with verbal, oral, or even implied contracts to claim lien rights.

A federal tax lien is the government's legal claim against your business assets. The IRS will file a lien, and this happens as a result of tax debt not being paid.By filing a lien, the IRS is marking your business assets bank accounts, building, land, etc.