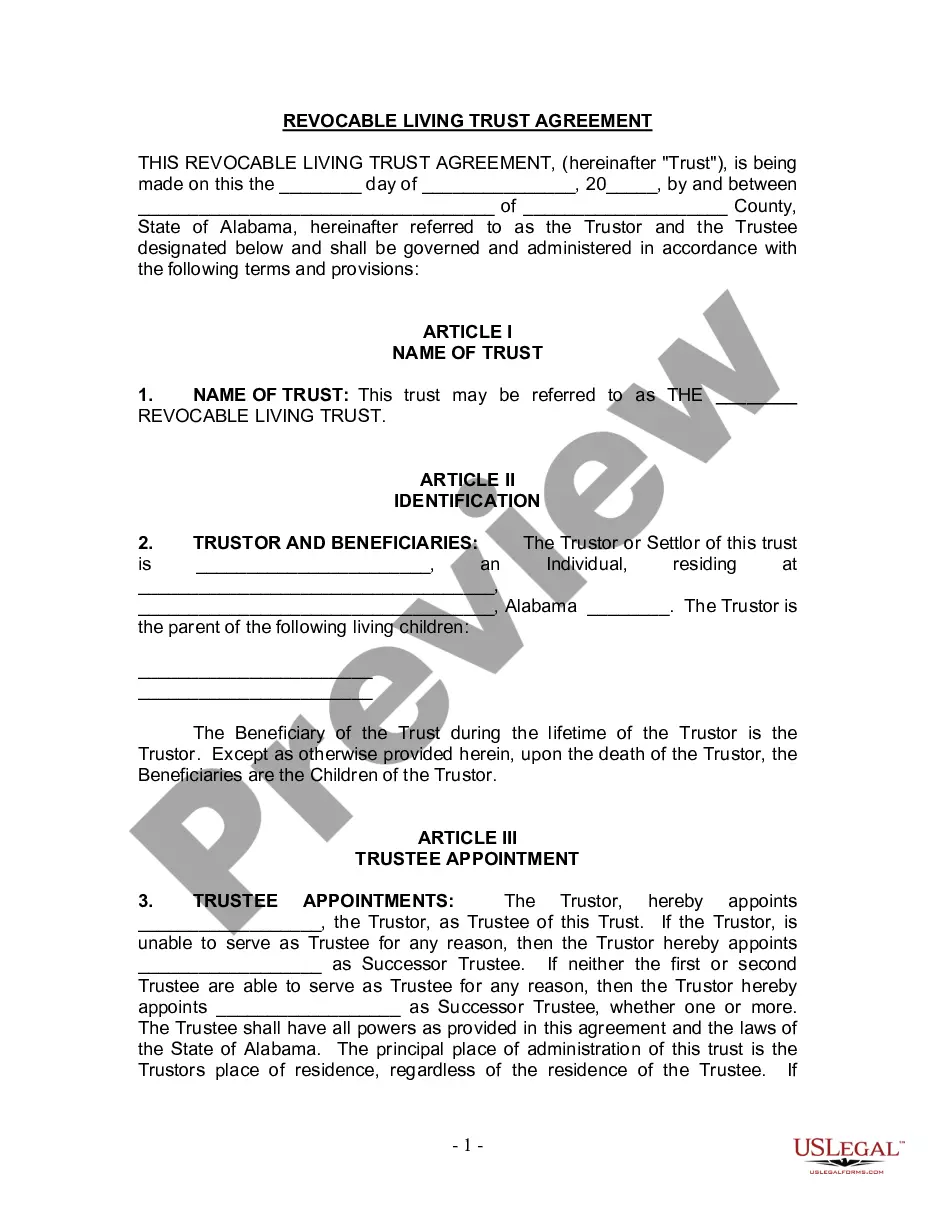

This document is a 53-page Declaration of Trust. It includes definitions of all relevant terms, as well as the constitution, capital accounts, valuations and prices, issue of units, register of unitholders, transmission, redemption of units, and every other necessary clause that constitutes a valid Declaration of Trust.

Kentucky Declaration of Trust

Description

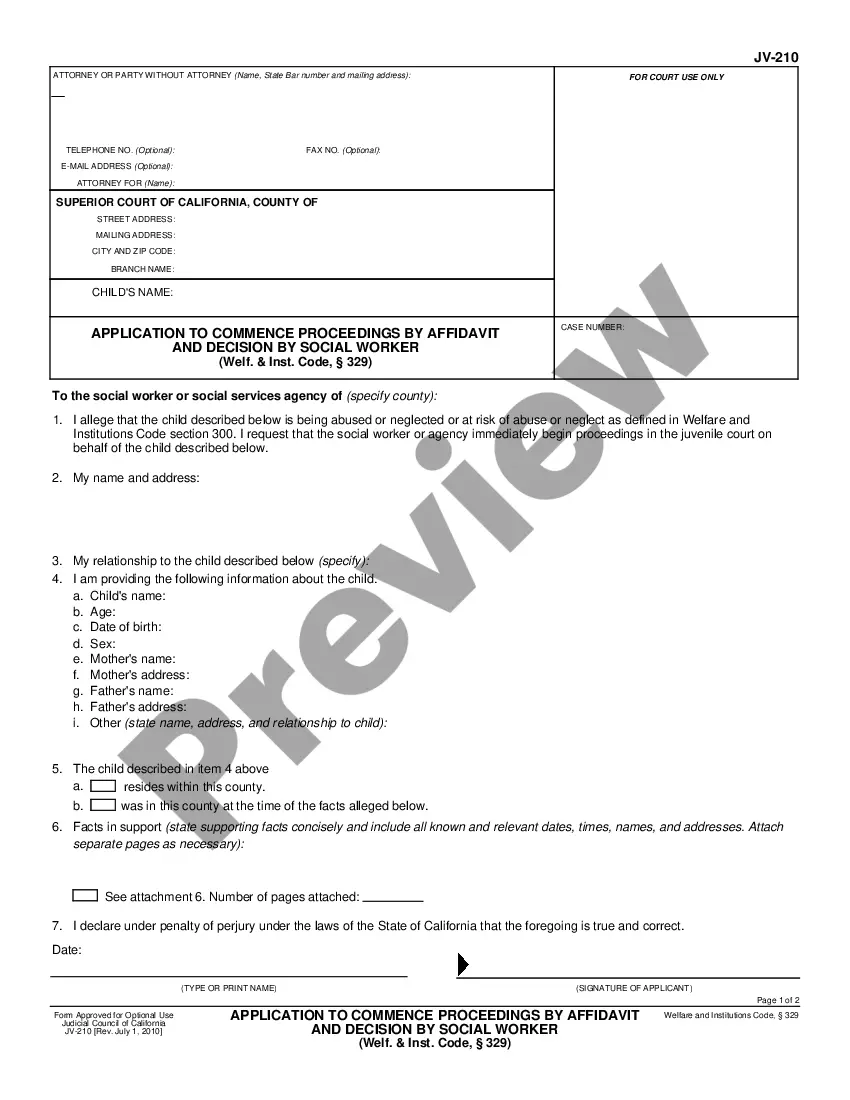

How to fill out Declaration Of Trust?

Discovering the right legal file format could be a have a problem. Of course, there are a lot of web templates accessible on the Internet, but how will you find the legal develop you need? Take advantage of the US Legal Forms internet site. The support delivers thousands of web templates, for example the Kentucky Declaration of Trust, which can be used for organization and personal requires. All of the forms are inspected by professionals and meet state and federal demands.

If you are currently registered, log in to the profile and then click the Download key to obtain the Kentucky Declaration of Trust. Make use of profile to appear through the legal forms you might have ordered previously. Visit the My Forms tab of the profile and have one more duplicate of the file you need.

If you are a brand new user of US Legal Forms, allow me to share straightforward guidelines that you can comply with:

- Initial, ensure you have chosen the right develop for your town/area. It is possible to examine the shape making use of the Review key and read the shape outline to guarantee it is the best for you.

- When the develop will not meet your preferences, take advantage of the Seach industry to discover the proper develop.

- Once you are positive that the shape is proper, click the Buy now key to obtain the develop.

- Select the rates prepare you want and type in the essential information and facts. Design your profile and purchase your order with your PayPal profile or charge card.

- Select the document formatting and obtain the legal file format to the system.

- Total, revise and printing and indicator the obtained Kentucky Declaration of Trust.

US Legal Forms will be the biggest catalogue of legal forms in which you can find various file web templates. Take advantage of the company to obtain expertly-created documents that comply with express demands.

Form popularity

FAQ

A living trust does not protect your assets from a lawsuit. Living trusts are revocable, meaning you remain in control of the assets and you are the legal owner until your death. Because you legally still own these assets, someone who wins a verdict against you can likely gain access to these assets.

The trust is not public record, as a will and probate proceeding are. The terms of the trust, assets in it, and beneficiaries of it are never revealed and remain completely private.

A declaration of trust under U.S. law is a document or an oral statement appointing a trustee to oversee assets being held for the benefit of one or more other individuals. These assets are held in a trust.

Generally, no you cannot sue a trust directly. Again, that's because a trust is a legal entity, not a person. It's possible, however, to sue the trustee of a trust whether that trust is revocable or irrevocable. As mentioned, in the case of a creditor lawsuit the trustee of a revocable living trust could be sued.

Kentucky adopted its version of the UTC in 2014. The UTC ? initially drafted by the National Conference of Commissioners on Uniform State Laws (NCUSL) in 2000 ? exists to provide ?precise, comprehensive, and easily accessible guidance on trust law questions.?

In Kentucky, having a will isn't what determines whether the probate courts must administer an estate. Instead, it's the size of the estate?the amount of assets?and how they're titled that controls the decision.

Sign the trust document in front of a notary public: If it isn't officially notarized by a notary recognized by the state of Kentucky then it may not stand as a legitimate trust.