This office lease clause lists a way to provide for variances between the rentable area of a "to be built" demised premises and the actual area after construction.

Kentucky Remeasurement Clause Used When Variances Exist Between the Rentable and Actual Area of a Space to be Built

Description

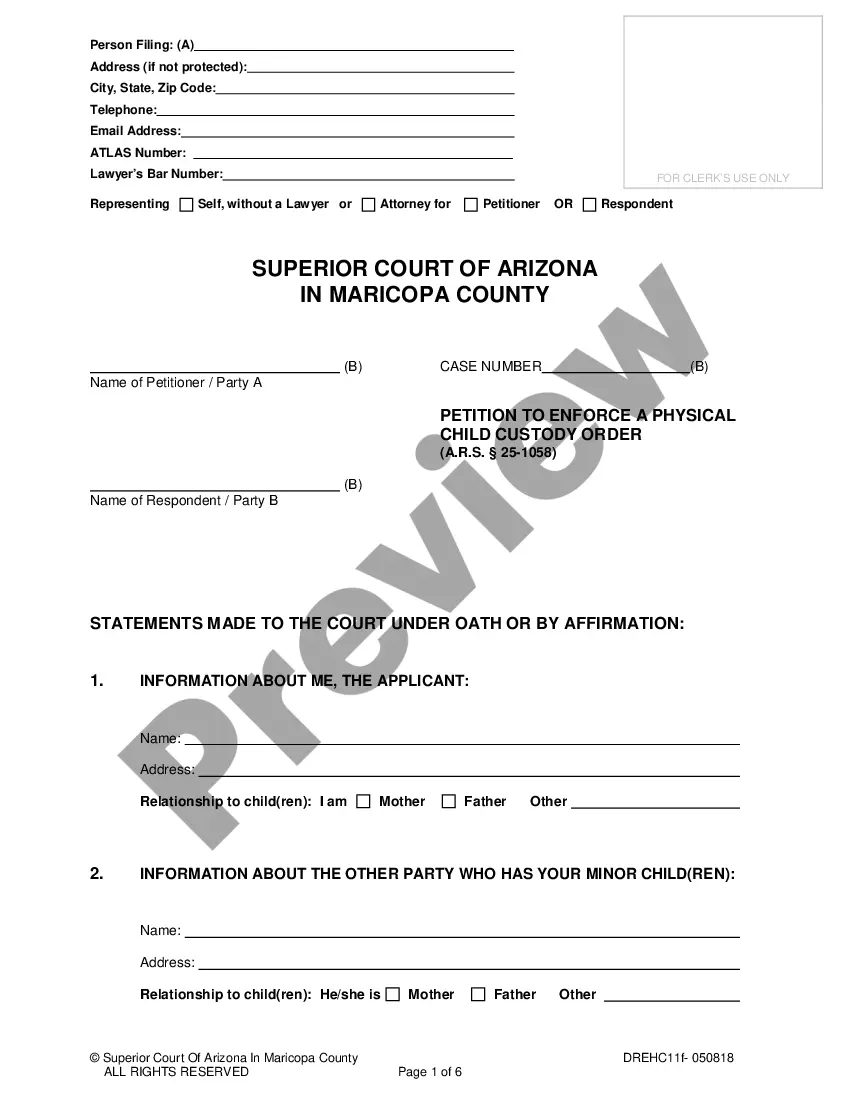

How to fill out Remeasurement Clause Used When Variances Exist Between The Rentable And Actual Area Of A Space To Be Built?

US Legal Forms - one of several biggest libraries of lawful forms in America - offers a wide array of lawful record templates you can down load or print. Utilizing the internet site, you can get a huge number of forms for business and person purposes, sorted by types, states, or search phrases.You will find the most recent versions of forms much like the Kentucky Remeasurement Clause Used When Variances Exist Between the Rentable and Actual Area of a Space to be Built within minutes.

If you have a subscription, log in and down load Kentucky Remeasurement Clause Used When Variances Exist Between the Rentable and Actual Area of a Space to be Built from your US Legal Forms library. The Down load key will appear on every single form you see. You have accessibility to all in the past saved forms inside the My Forms tab of your accounts.

If you want to use US Legal Forms the first time, listed here are easy guidelines to help you get began:

- Ensure you have selected the best form for your personal town/area. Click on the Preview key to check the form`s articles. See the form information to actually have selected the proper form.

- In the event the form does not satisfy your requirements, make use of the Research field towards the top of the display screen to find the one who does.

- Should you be content with the shape, validate your option by simply clicking the Get now key. Then, pick the costs plan you want and give your references to sign up to have an accounts.

- Procedure the deal. Make use of Visa or Mastercard or PayPal accounts to accomplish the deal.

- Choose the structure and down load the shape on the gadget.

- Make changes. Fill out, edit and print and signal the saved Kentucky Remeasurement Clause Used When Variances Exist Between the Rentable and Actual Area of a Space to be Built.

Every single format you included with your bank account does not have an expiration time which is the one you have permanently. So, if you wish to down load or print an additional duplicate, just proceed to the My Forms section and then click in the form you require.

Obtain access to the Kentucky Remeasurement Clause Used When Variances Exist Between the Rentable and Actual Area of a Space to be Built with US Legal Forms, one of the most extensive library of lawful record templates. Use a huge number of professional and status-certain templates that meet up with your organization or person needs and requirements.

Form popularity

FAQ

Triple net leases are one of the most widely used types of commercial real estate leases. In this arrangement, the tenant pays rent, a share of property taxes, a share of insurance, and a fixed fee for common area maintenance and operating expenses.

A Standard Clause defining the leased premises for a commercial real estate lease with language allowing the parties to remeasure the premises. A tenant's right to remeasure is generally a tenant-favorable concept, but this Standard Clause offers a landlord-friendly alternative for remeasurement.

Percentage leases are most commonly used for retail properties (especially malls). In a percentage lease, tenants pay a base rent plus a portion of the gross sales they make from conducting business in the building.

Gross Lease Gross leases are most common for commercial properties such as offices and retail space. The tenant pays a single, flat amount that includes rent, taxes, utilities, and insurance.

tenant net lease can be a single, double, or triple net lease in which the property is 100% leased to one tenant. Typically these are singletenant triple net leases, and the tenant is responsible for all propertyrelated expenses. Expect to use this type of commercial lease for retailers and restaurants.

A net lease is perhaps the most common form of commercial lease agreement. With a net lease, the tenant is responsible for a base rent payment, plus additional expenses associated with the property. That might include one or multiple additional expenses, including: Utilities.