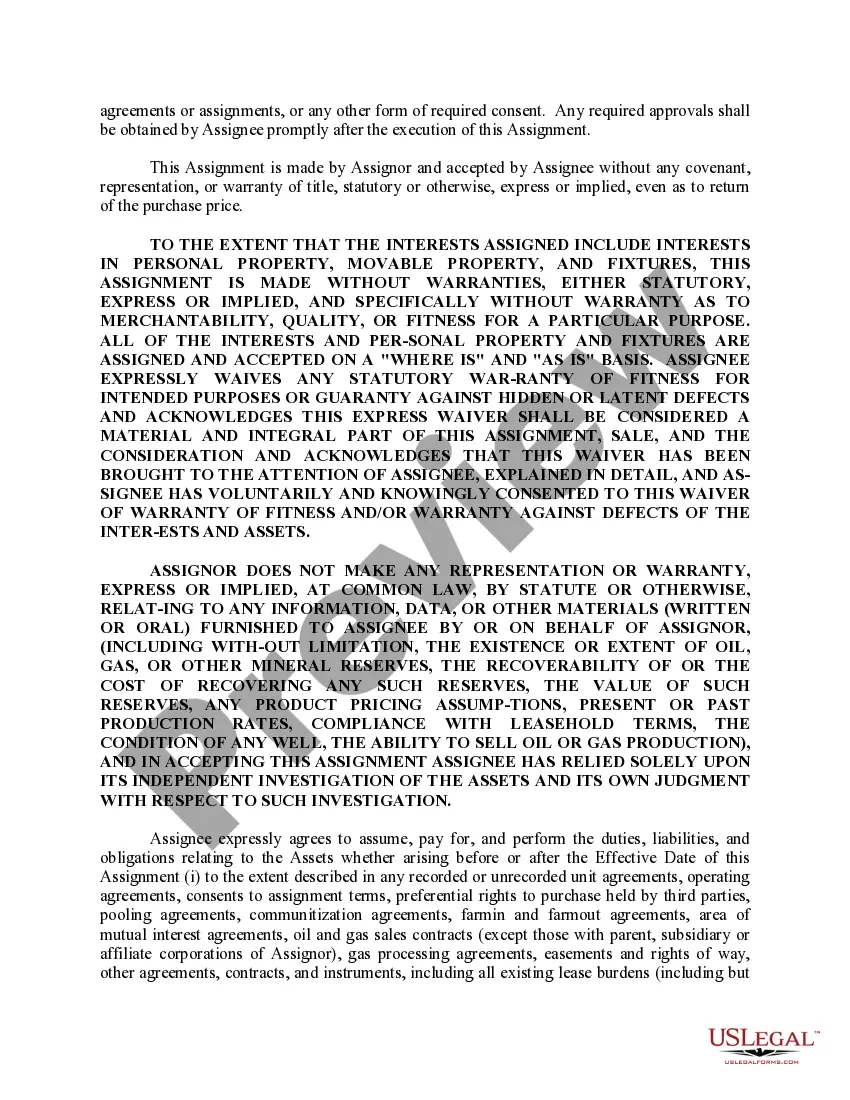

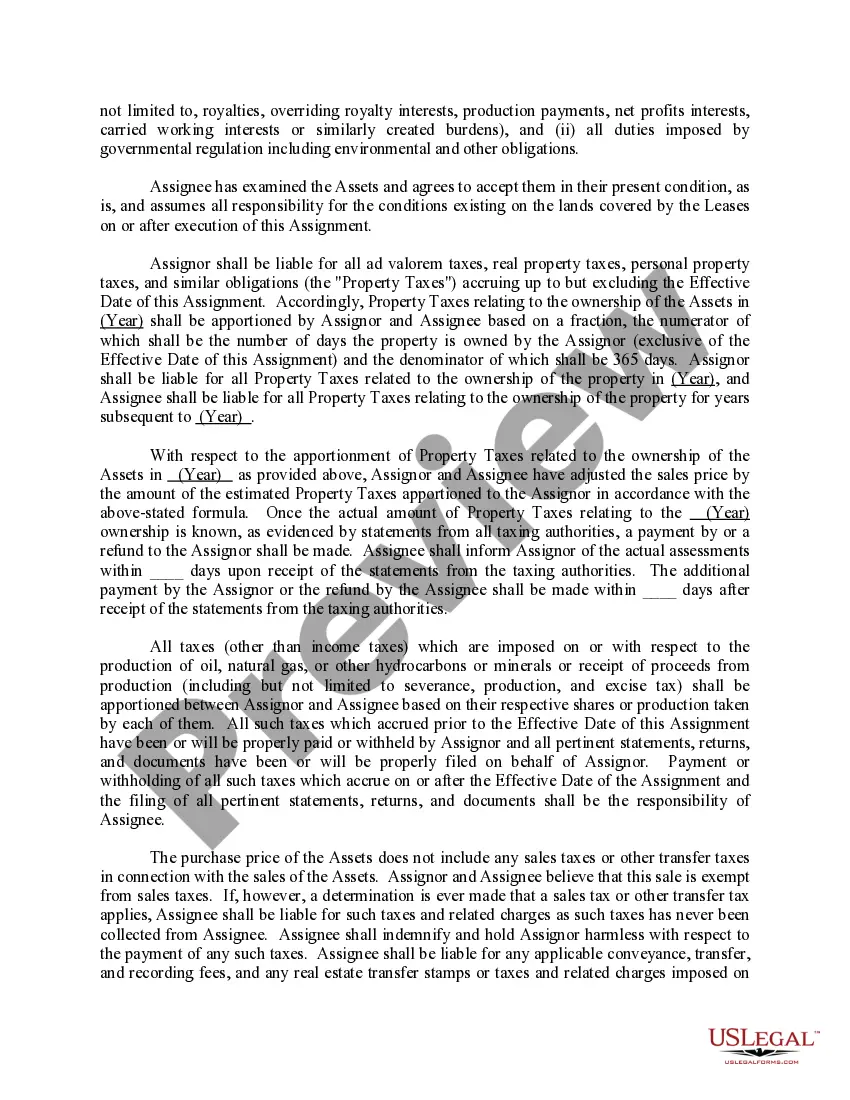

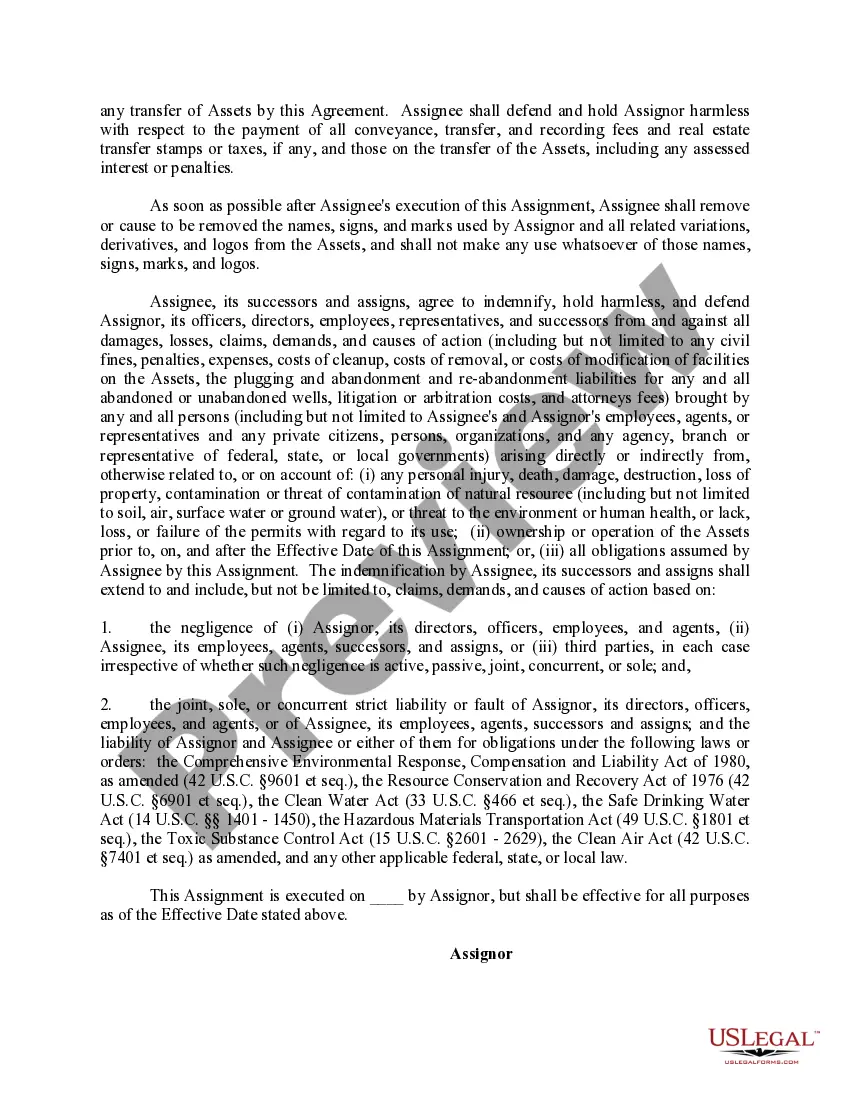

This form is used when Assignor, pursuant to the terms and conditions of a Purchase and Sale Agreement, sells, assigns, transfers, conveys, and delivers to Assignee all of Assignor's rights, title, and interests in and to the within described property and interests (collectively, the Assets )

Kentucky Assignment, Conveyance, and Bill of Sale of All Interest in Described Assets Long Form

Description

How to fill out Assignment, Conveyance, And Bill Of Sale Of All Interest In Described Assets Long Form?

You can commit hrs online looking for the lawful document template which fits the state and federal needs you need. US Legal Forms provides thousands of lawful kinds which are analyzed by pros. It is possible to obtain or print the Kentucky Assignment, Conveyance, and Bill of Sale of All Interest in Described Assets Long Form from the support.

If you have a US Legal Forms accounts, it is possible to log in and click on the Download switch. Following that, it is possible to total, modify, print, or indicator the Kentucky Assignment, Conveyance, and Bill of Sale of All Interest in Described Assets Long Form. Each and every lawful document template you buy is yours permanently. To have an additional backup for any bought type, go to the My Forms tab and click on the related switch.

If you work with the US Legal Forms site initially, stick to the simple directions below:

- Initially, make certain you have selected the proper document template for that area/city of your choice. Read the type description to ensure you have selected the right type. If available, utilize the Preview switch to search with the document template also.

- In order to find an additional version of the type, utilize the Lookup discipline to discover the template that meets your requirements and needs.

- Once you have found the template you desire, just click Acquire now to carry on.

- Pick the rates strategy you desire, type your qualifications, and register for an account on US Legal Forms.

- Complete the financial transaction. You can use your credit card or PayPal accounts to pay for the lawful type.

- Pick the file format of the document and obtain it for your product.

- Make alterations for your document if necessary. You can total, modify and indicator and print Kentucky Assignment, Conveyance, and Bill of Sale of All Interest in Described Assets Long Form.

Download and print thousands of document themes using the US Legal Forms site, that provides the largest assortment of lawful kinds. Use professional and state-distinct themes to handle your organization or personal needs.

Form popularity

FAQ

Copies of tax liens can be obtained from the county court clerk in the county where the lien is filed.

One year following the date of delinquency, a purchaser can initiate a suit to foreclose on the lien. Kentucky real property taxes are due on or before December 31 each year and are considered delinquent on January 1st.

Buying List of Certificates of Delinquency for Current Year Property Tax Bills. Current year certificates are offered for sale by the clerk in mid-July of each year. Please contact the Clerk's Office at (859) 392-1650 after April 15 to purchase a current list of certificates for sale.

If delinquent property taxes go unpaid, a lien attaches to the property and continues from the time the taxes become delinquent until the taxes are paid, up to 11 years from the date the taxes become delinquent.

¶20-754, Tax as Lien ( Sec. 134.420, KRS ) The lien that attaches to property on which taxes have become delinquent under Sec. 134.420, KRS continues from the time the taxes become delinquent until the taxes are paid or the 11-year period expires, regardless of who owns the property.

If you have delinquent property taxes in Kentucky, you might lose your home to tax foreclosure. In other parts of the state, the tax lien itself is sold, and the purchaser gets a tax lien certificate. After some time passes, the certificate purchaser can foreclose. The home is then sold at a foreclosure sale.