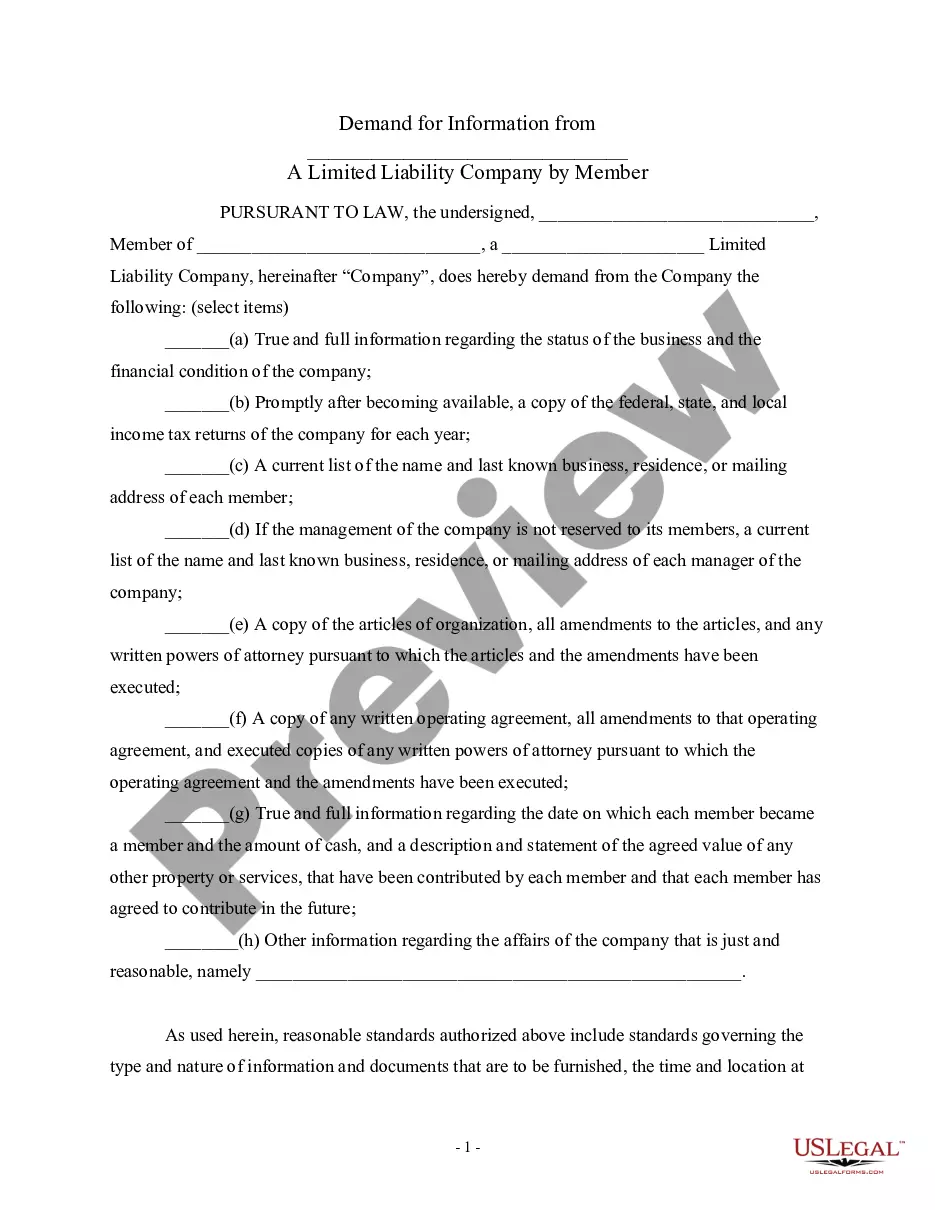

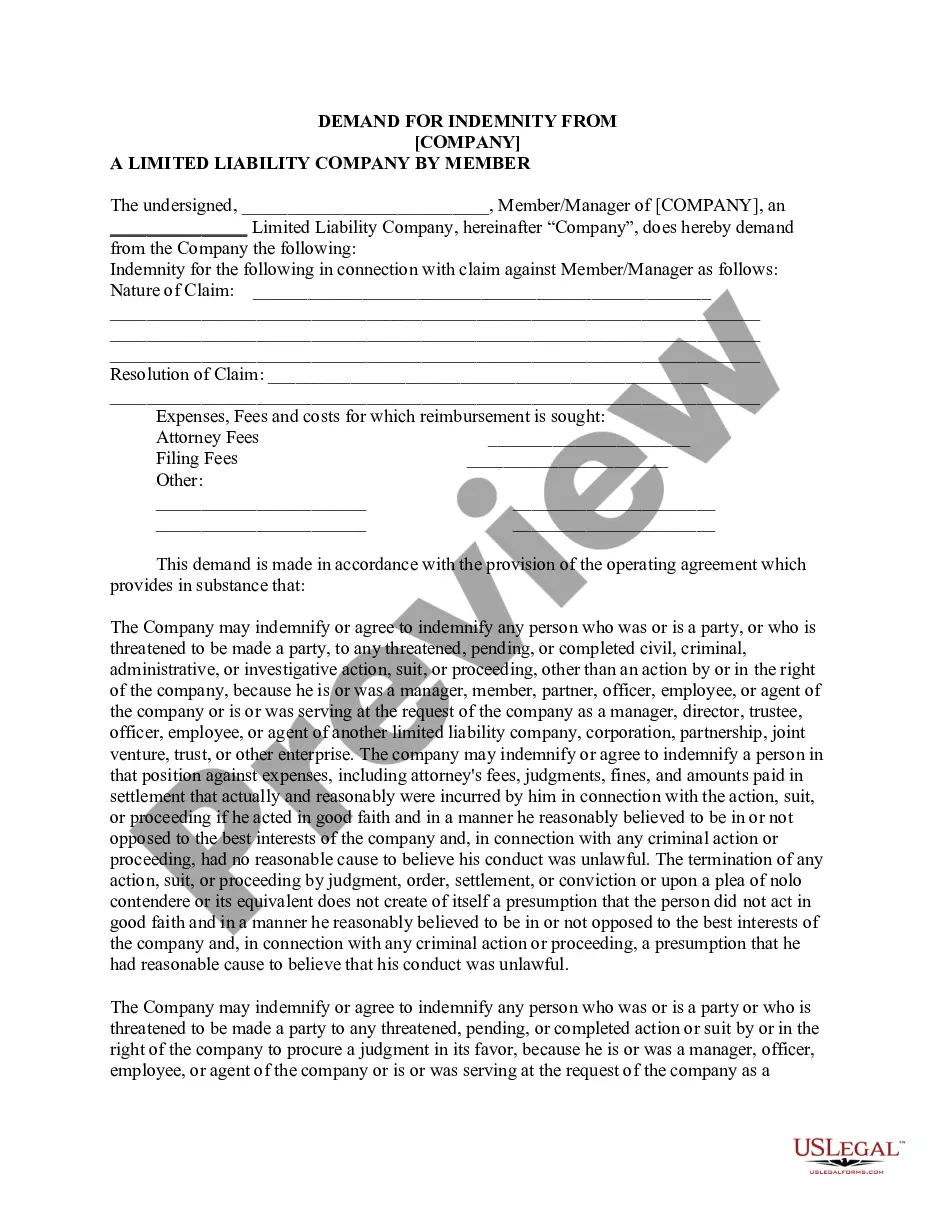

Kentucky Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc.

Description

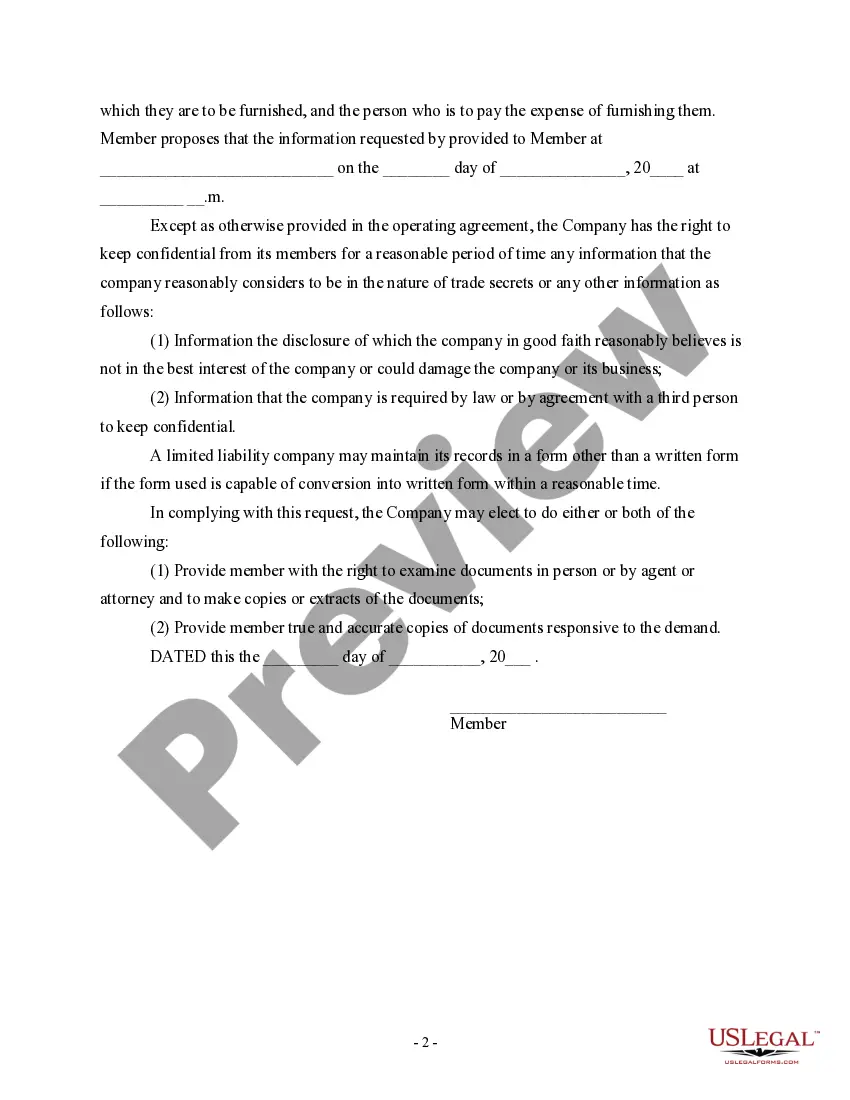

How to fill out Demand For Information From Limited Liability Company LLC By Member Regarding Financial Records, Etc.?

US Legal Forms - one of many largest libraries of legitimate types in the United States - offers a variety of legitimate record layouts it is possible to down load or produce. Utilizing the internet site, you may get a huge number of types for enterprise and individual purposes, sorted by types, states, or key phrases.You can find the most recent types of types just like the Kentucky Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc. within minutes.

If you currently have a registration, log in and down load Kentucky Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc. from the US Legal Forms catalogue. The Download button will appear on every single develop you see. You get access to all previously acquired types in the My Forms tab of your own bank account.

If you wish to use US Legal Forms for the first time, here are easy recommendations to get you started:

- Be sure to have picked the right develop for your personal town/region. Go through the Preview button to review the form`s articles. Look at the develop description to actually have selected the proper develop.

- When the develop does not suit your specifications, take advantage of the Search discipline near the top of the display screen to discover the one that does.

- In case you are happy with the shape, verify your selection by clicking the Get now button. Then, select the costs program you prefer and offer your credentials to sign up for the bank account.

- Process the financial transaction. Utilize your bank card or PayPal bank account to perform the financial transaction.

- Find the formatting and down load the shape on your system.

- Make adjustments. Fill up, change and produce and signal the acquired Kentucky Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc..

Each and every design you included in your account does not have an expiry time and is also your own forever. So, if you want to down load or produce an additional duplicate, just proceed to the My Forms area and click on on the develop you will need.

Get access to the Kentucky Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc. with US Legal Forms, the most extensive catalogue of legitimate record layouts. Use a huge number of specialist and express-particular layouts that fulfill your small business or individual requirements and specifications.

Form popularity

FAQ

A Kentucky Corporation and/or Limited Liability Company that is no longer operating is required to file a ?final? corporate and/or limited liability entity tax return in order for those tax accounts to be closed; other business tax accounts may be cancelled by utilizing the 10A104 Update to Business Information or ...

LLCs taxed as C-corp Corporations and LLCs with C-corp status are, in a way, taxed twice. Your LLC won't pay the self-employment tax, but you will need to pay the 21% federal corporate tax rate and the Kentucky corporate tax rate of 5%.

To start an LLC in Kentucky, you'll need to choose a Kentucky registered agent, file business formation paperwork with the Kentucky Division of Business Filings, and pay a $40 state filing fee.

??Individual Income Tax is due on all income earned by Kentucky residents and all income earned by nonresidents from Kentucky sources.

Kentucky Tax Registration (10A100) - Basic Kentucky tax registration can be completed online or via the Kentucky Tax Registration Application (10A100). Additional tax registrations may be required based on your industry, for more information visit the Kentucky Department of Revenue.

??????Register or Reinstate a Business Step 1: Legally Establish Your Business. ... Step 2: Obtain Your Federal Employer Identification Number (FEIN) from the IRS. ... Step 3: Register for Tax Accounts and the Commonwealth Business Identifier (CBI). ... Step 4: If necessary, complete the specialty applications below:

In addition to professional licensing, an occupational license may be required to do business at the local level. Businesses may also have to register with the Kentucky Secretary of State and the Kentucky Department of Revenue. Contact CT Corporation for a free consultation.

Kentucky law lowers personal income tax rates for 2023 and 2024 and removes triggers for future rate cuts. On February 17, 2023, Kentucky Governor Andy Beshear signed into law H.B.1, which lowers the state personal income tax rate to 4.5% retroactive to January 1, 2023, and to 4.0% effective January 1, 2024.