Kentucky Payroll Deduction Authorization Form for Optional Matters - Employee

Description

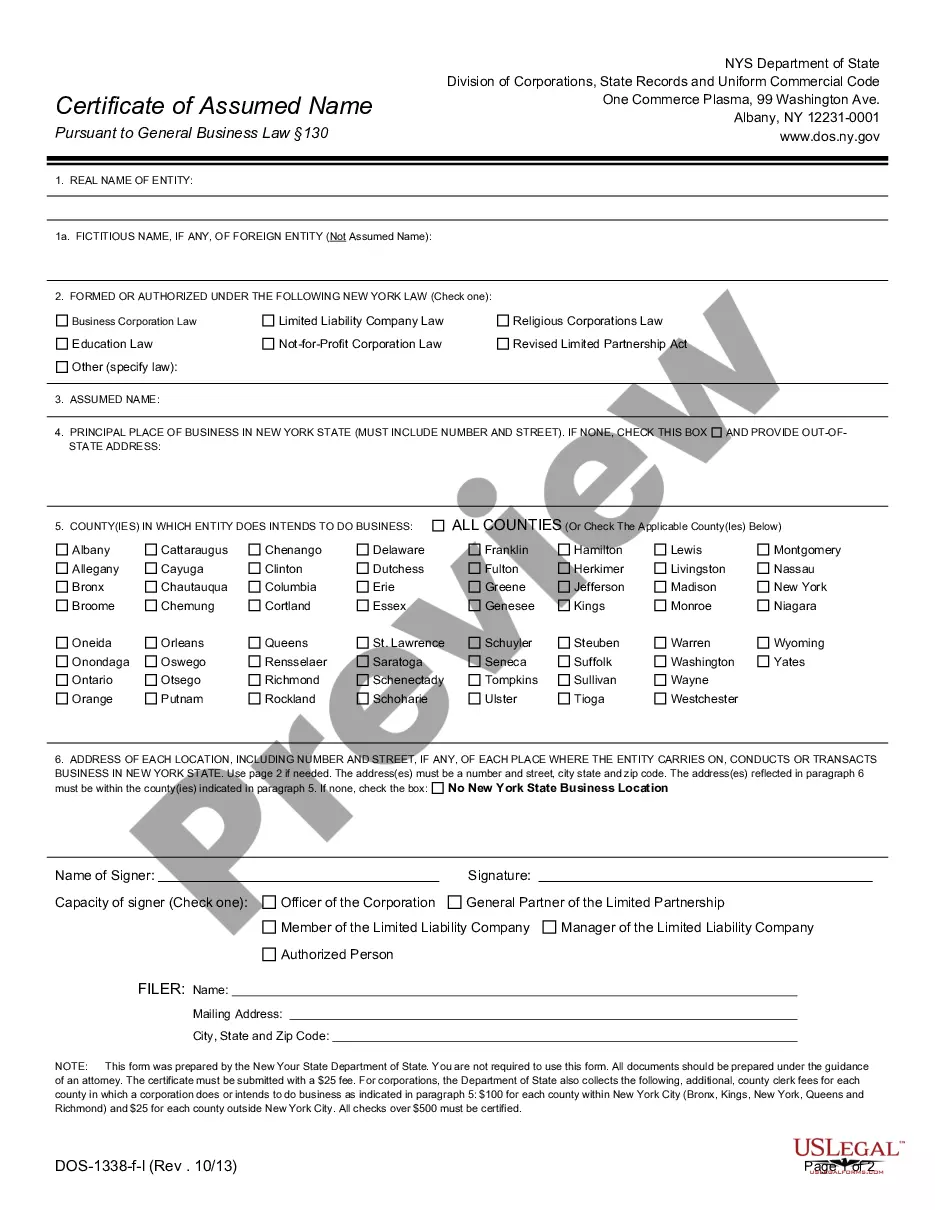

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a broad assortment of legal template documents that you can download or print.

By utilizing the website, you can find countless forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest editions of forms such as the Kentucky Payroll Deduction Authorization Form for Optional Matters - Employee within moments.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Order now button. Next, choose your preferred pricing plan and provide your credentials to register for an account.

- If you already have a subscription, Log In and download the Kentucky Payroll Deduction Authorization Form for Optional Matters - Employee from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Verify you have chosen the correct form for your city/region.

- Click the Review button to examine the content of the form. Check the form summary to ensure you have selected the right form.

Form popularity

FAQ

Payroll deduction is the process of automatically subtracting specific amounts from an employee's paycheck for various purposes. This can include items such as taxes, health insurance premiums, or retirement contributions. The Kentucky Payroll Deduction Authorization Form for Optional Matters - Employee facilitates this process by ensuring that all deductions are authorized and properly recorded. It allows employees to streamline their financial commitments, making it easier to manage budgeting and saving.

Payroll deduction authorization means an employee has formally agreed to have specific amounts deducted from their paycheck. This process is documented through the Kentucky Payroll Deduction Authorization Form for Optional Matters - Employee, which outlines the terms and conditions of the deductions. This authorization empowers employees by allowing them to choose which expenses to manage directly from their wages. It simplifies the deduction process and helps maintain clear communication between employers and employees.

An authorized deduction refers to amounts withheld from an employee's paycheck that have received explicit consent from the employee. This concept is critical when using the Kentucky Payroll Deduction Authorization Form for Optional Matters - Employee, as it ensures that employees understand and agree to the deductions. These deductions can cover a variety of options, such as retirement contributions or insurance premiums. By authorizing these deductions, employees can manage their financial contributions more effectively.

Yes, you can opt out of payroll deductions by submitting a request according to your employer's policies. It is essential to understand the implications of opting out, particularly if you are enrolled in optional benefits linked to the Kentucky Payroll Deduction Authorization Form for Optional Matters - Employee. Ensure you review the specific guidelines set forth by your employer or payroll department. If you need assistance or further information, the uslegalforms platform can provide valuable resources and templates to help you navigate this process.

Optional deductions on a paystub typically include contributions to retirement plans, health savings accounts, or other benefits that you can choose to enroll in. These deductions require your authorization and are not mandatory like taxes or social security contributions. To manage these optional deductions, the Kentucky Payroll Deduction Authorization Form for Optional Matters - Employee is your key tool.

A payroll deduction agreement is a written contract between an employee and employer regarding deductions that can be made from the employee's paycheck. It outlines the types of deductions agreed upon, such as health insurance or retirement contributions. When using the Kentucky Payroll Deduction Authorization Form for Optional Matters - Employee, you formalize your participation in optional payroll deductions under this agreement.

The form for payroll deduction permission is an official document that authorizes your employer to deduct specific amounts from your paycheck. This is essential when you want to set up deductions for benefits or other optional payments. The Kentucky Payroll Deduction Authorization Form for Optional Matters - Employee is typically the form you would need to complete to grant these permissions.

An example of an optional deduction is a subscription to a gym or fitness program. Employees may select this deduction to promote their health and wellness while reducing their taxable income. The Kentucky Payroll Deduction Authorization Form for Optional Matters - Employee assists in keeping track of such deductions, ensuring that both employer and employee are on the same page.

An optional deduction includes items such as charitable contributions or employee wellness program fees, allowing employees to contribute as they choose. These voluntary deductions enhance employee benefits and foster engagement. The Kentucky Payroll Deduction Authorization Form for Optional Matters - Employee is a tool that makes managing such options straightforward and efficient.

An optional payroll deduction is a deduction that employees can choose to opt into or out of, rather than being mandated by their employer. Examples include contributions to health savings accounts or voluntary life insurance plans. The Kentucky Payroll Deduction Authorization Form for Optional Matters - Employee provides a convenient way for employees to communicate their preferences regarding these optional deductions.