Kentucky Charitable Contribution Payroll Deduction Form

Description

How to fill out Charitable Contribution Payroll Deduction Form?

Have you found yourself in a scenario where you need documents for potential business or personal reasons almost every single day.

There are numerous legal document templates available online, but finding reliable ones is not straightforward.

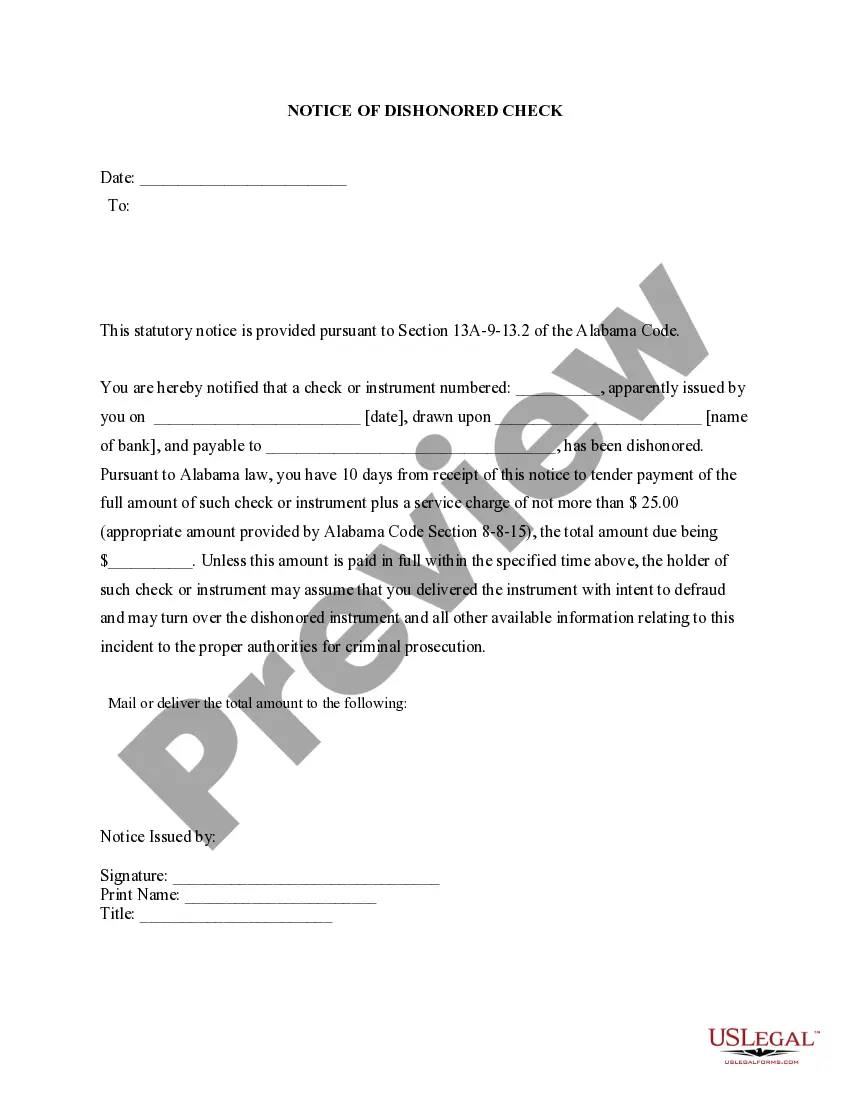

US Legal Forms provides thousands of form templates, such as the Kentucky Charitable Contribution Payroll Deduction Form, which are designed to comply with federal and state regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents list. You can retrieve another version of the Kentucky Charitable Contribution Payroll Deduction Form anytime, if necessary. Just select the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- After that, you can download the Kentucky Charitable Contribution Payroll Deduction Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it corresponds to the correct city/state.

- Utilize the Review button to evaluate the form.

- Examine the details to ensure you have selected the appropriate form.

- If the form is not what you seek, use the Search field to find the form that meets your needs and requirements.

- Once you find the right form, click on Buy now.

- Select the payment plan you prefer, fill in the necessary details to create your account, and complete your purchase using PayPal or credit card.

Form popularity

FAQ

For 2020, the charitable limit was $300 per tax unit meaning that those who are married and filing jointly can only get a $300 deduction. For the 2021 tax year, however, those who are married and filing jointly can each take a $300 deduction, for a total of $600.

How to score a tax write-off for 2021 donations to charity if you don't itemize deductions. Single taxpayers can claim a tax write-off for cash charitable gifts up to $300 and married couples filing together may get up to $600 for 2021.

When you don't itemize your tax deductions, you typically won't get any additional tax savings from donating to charity. However, in 2021, U.S. taxpayers can deduct up to $300 in charitable donations made this year, even if they choose to take the standard deduction.

Charitable contributions to qualified organizations may be deductible if you itemize deductions on Form 1040, Schedule A, Itemized Deductions PDF. To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions, use Tax Exempt Organization Search.

2022 standard tax deductionsKeep track of your charitable contributions throughout the year, and consider any additional applicable deductions. Generally taxpayers use the larger deduction, standard or itemized, when it's time to file taxes.

If you itemize deductions, you will be able to use the amount in Box 14 as a charitable deduction. Depending on the code you enter, the program may enter it automatically. Enter the Box 14 description/code from your Form W-2 in the first field in the row for Box 14 (e.g. NONTX PK).

However, in 2021, U.S. taxpayers can deduct up to $300 in charitable donations made this year, even if they choose to take the standard deduction. One donation of $300 may not move the needle much but multiplied across millions of donations; the impact for charities can be huge.

Generally, you can only deduct charitable contributions if you itemize deductions on Schedule A (Form 1040), Itemized Deductions.

In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50% depending on the type of contribution and the organization (contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations come

Just like last year, individuals, including married individuals filing separate returns, who take the standard deduction can claim a deduction of up to $300 on their 2021 federal income tax for their charitable cash contributions made to certain qualifying charitable organizations.