Kentucky Subscription Agreement between Ichargeit.Com, Inc. and prospective investor for the purchase of units consisting of common stock and common stock warrant

Description

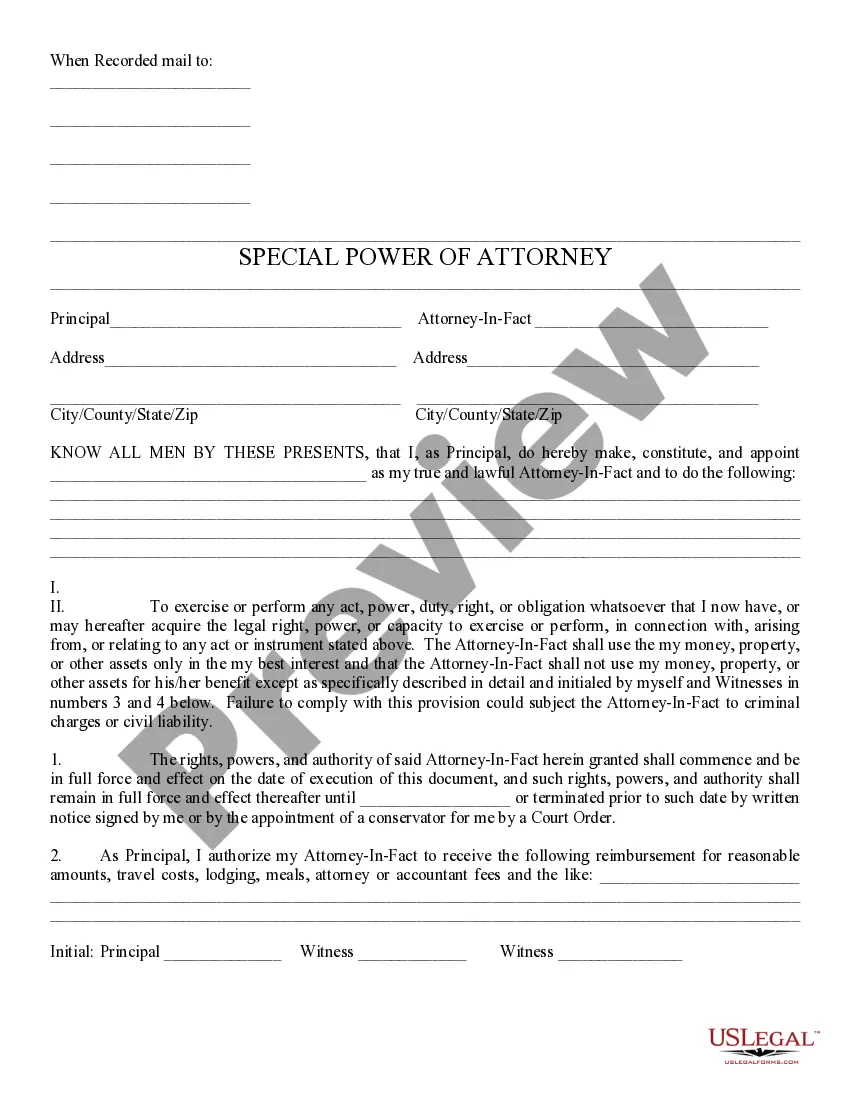

How to fill out Subscription Agreement Between Ichargeit.Com, Inc. And Prospective Investor For The Purchase Of Units Consisting Of Common Stock And Common Stock Warrant?

You can commit hours on-line searching for the lawful record design that suits the federal and state specifications you will need. US Legal Forms offers 1000s of lawful varieties which are reviewed by professionals. It is simple to acquire or produce the Kentucky Subscription Agreement between Ichargeit.Com, Inc. and prospective investor for the purchase of units consisting of common stock and common stock warrant from your service.

If you currently have a US Legal Forms account, you are able to log in and click on the Download option. Afterward, you are able to complete, modify, produce, or indicator the Kentucky Subscription Agreement between Ichargeit.Com, Inc. and prospective investor for the purchase of units consisting of common stock and common stock warrant. Every single lawful record design you acquire is yours permanently. To get an additional backup of the acquired type, check out the My Forms tab and click on the related option.

If you use the US Legal Forms internet site initially, follow the straightforward instructions beneath:

- Very first, be sure that you have chosen the best record design to the county/area of your liking. Browse the type information to make sure you have selected the right type. If accessible, use the Preview option to search throughout the record design too.

- If you want to discover an additional version in the type, use the Look for field to discover the design that fits your needs and specifications.

- After you have found the design you want, simply click Purchase now to carry on.

- Choose the prices prepare you want, enter your accreditations, and register for a merchant account on US Legal Forms.

- Full the purchase. You can use your Visa or Mastercard or PayPal account to cover the lawful type.

- Choose the formatting in the record and acquire it to your product.

- Make changes to your record if possible. You can complete, modify and indicator and produce Kentucky Subscription Agreement between Ichargeit.Com, Inc. and prospective investor for the purchase of units consisting of common stock and common stock warrant.

Download and produce 1000s of record web templates while using US Legal Forms Internet site, that offers the greatest selection of lawful varieties. Use expert and condition-specific web templates to handle your small business or specific requirements.

Form popularity

FAQ

There are advantages as well as disadvantages of each agreement. A share purchase agreement differs from a share subscription agreement because a share purchase agreement has a seller that is not the business itself. In a subscription agreement, the business agrees to sell shares to a subscriber.

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.

The subscription agreement refers to the shareholders' agreement and typically they are signed at the same time. Sometimes, these documents are merged to one big document (often called investment agreement) but for clarity they are usually separated.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

Issued share capital is the value of shares actually held by investors. Subscribed share capital is the value of shares investors have promised to buy when they are released.

A company executes a Share subscription agreement (SSA) in case of a fresh issue of shares. A shareholders' agreement (SHA) is a contract that contains the rights and obligations of the shareholders in a company.

A well organized and well-structured subscription agreement will include the details about the transaction, the number of shares being sold and the price per share, and any legally binding confidentiality agreements and clauses.

A share subscription agreement is essentially an agreement for the purchase of shares from a company. In contrast, a shareholders agreement contains terms that govern the ongoing relationship between shareholders.