Kentucky Notice of Violation of Fair Debt Act - Improper Document Appearance

Description

How to fill out Notice Of Violation Of Fair Debt Act - Improper Document Appearance?

Are you presently in the place that you need paperwork for both organization or person purposes just about every day time? There are a variety of lawful file templates available online, but finding types you can depend on isn`t effortless. US Legal Forms offers 1000s of develop templates, just like the Kentucky Notice of Violation of Fair Debt Act - Improper Document Appearance, which can be published to fulfill state and federal specifications.

In case you are currently knowledgeable about US Legal Forms website and also have your account, basically log in. After that, you may obtain the Kentucky Notice of Violation of Fair Debt Act - Improper Document Appearance format.

If you do not provide an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Discover the develop you need and ensure it is for that proper town/region.

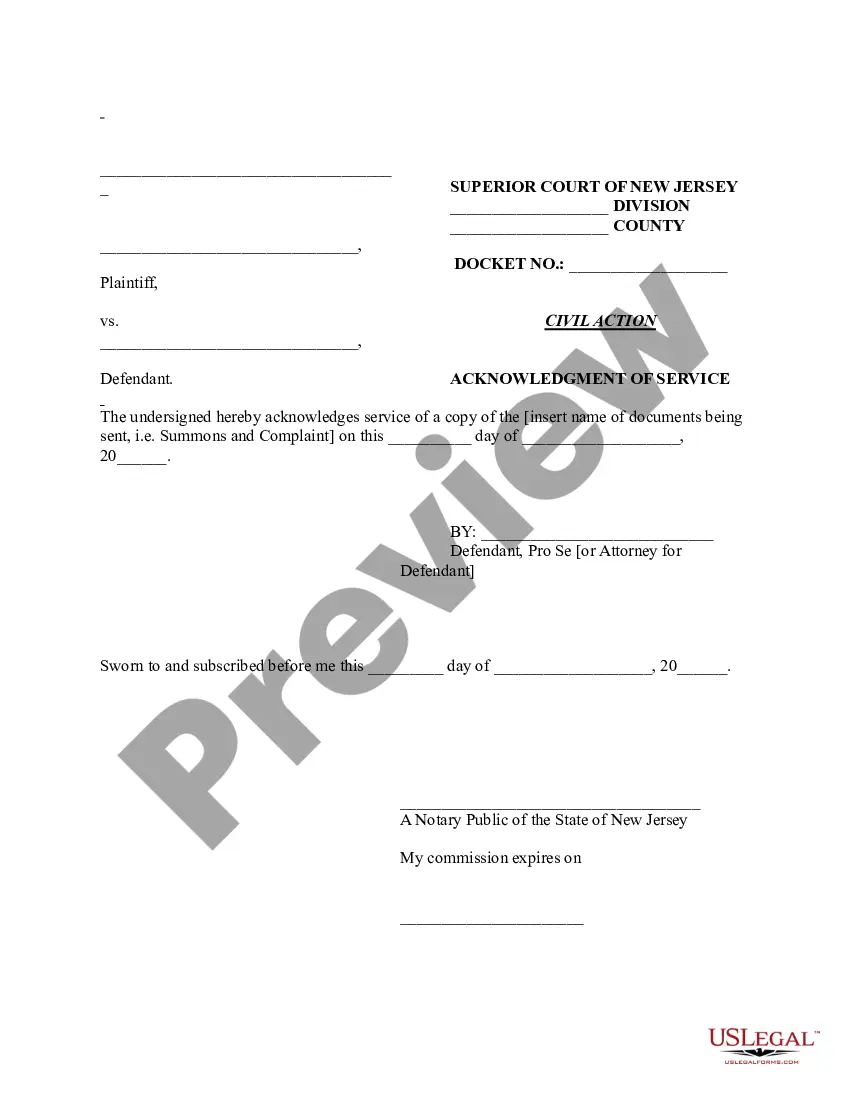

- Take advantage of the Preview switch to check the shape.

- Read the information to actually have selected the appropriate develop.

- In case the develop isn`t what you are searching for, utilize the Search discipline to discover the develop that meets your requirements and specifications.

- Once you find the proper develop, click Buy now.

- Select the pricing plan you need, complete the necessary info to make your account, and pay money for an order making use of your PayPal or charge card.

- Choose a convenient data file file format and obtain your duplicate.

Locate all the file templates you may have purchased in the My Forms menu. You may get a further duplicate of Kentucky Notice of Violation of Fair Debt Act - Improper Document Appearance at any time, if necessary. Just go through the necessary develop to obtain or print the file format.

Use US Legal Forms, by far the most substantial collection of lawful varieties, to save lots of time as well as avoid faults. The assistance offers skillfully manufactured lawful file templates that you can use for a selection of purposes. Make your account on US Legal Forms and start creating your lifestyle easier.

Form popularity

FAQ

I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies.

To further establish as evidence the date and fact that you sent the debt collector a DV letter, it's a good idea to have someone else mail your DV letter along with an "Affidavit of Mailing". This signed and notarized affidavit by a third party will firmly establish your evidence of mailing the DV letter.

A debt validation letter should include the name of your creditor and how much you owe, The letter will include information about when you need to pay the debt and how to dispute it.

If a debt collector doesn't send a debt validation letter, you should request one ? especially if you plan to dispute the debt and avoid the collections process. Collectors who don't send these letters could get in trouble with the Federal Trade Commission (FTC) if you file a complaint against them.

Failing to respond to a Debt Validation Letter while continuing to collect on the debt is a direct violation of the FDCPA. You can report a debt collector's failure to respond to your state's attorney general, the Consumer Financial Protection Bureau (CFPB), or the FTC.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

Your Right to a Validation of the Debt After receiving your request, the debt collector must provide you with information about the debt, including the amount owed and to whom it was owed. Collection activities must stop until they provide this information.

§ 807. (1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.