Kentucky Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.

Description

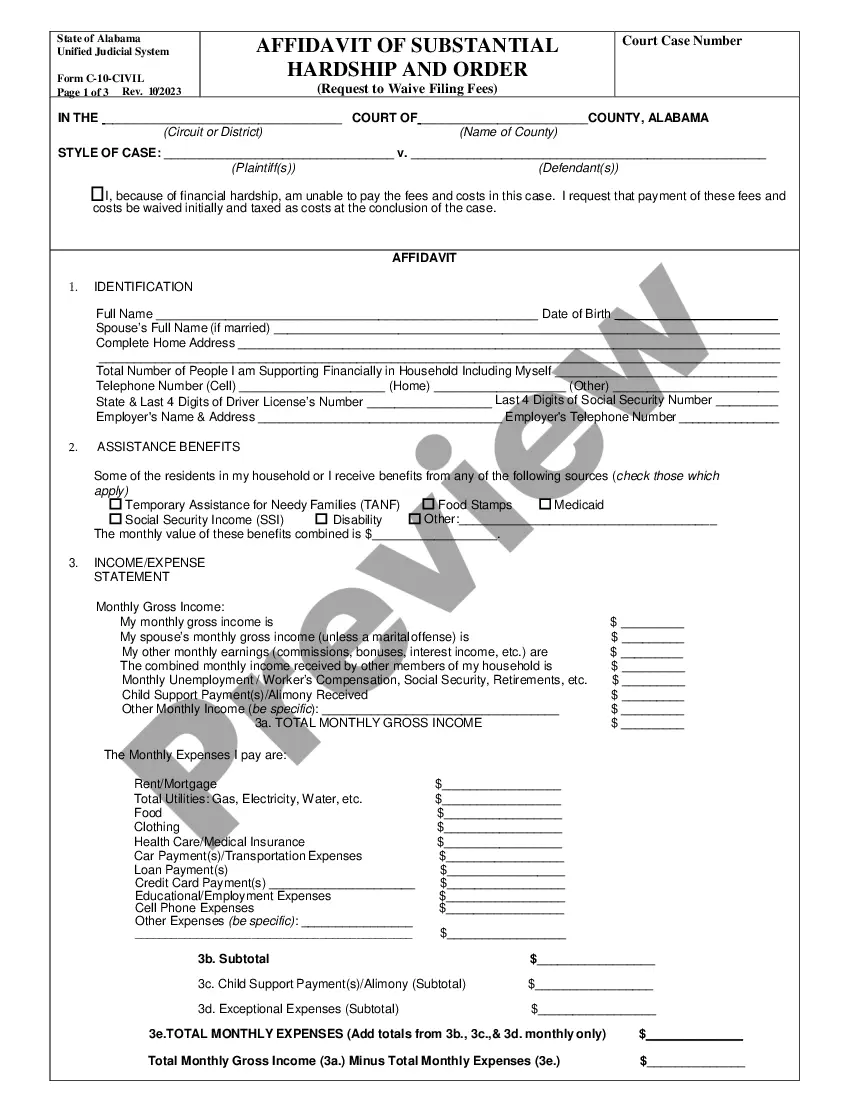

How to fill out Management Agreement Between Advisers Managers Trust And Neuberger And Berman Management Inc.?

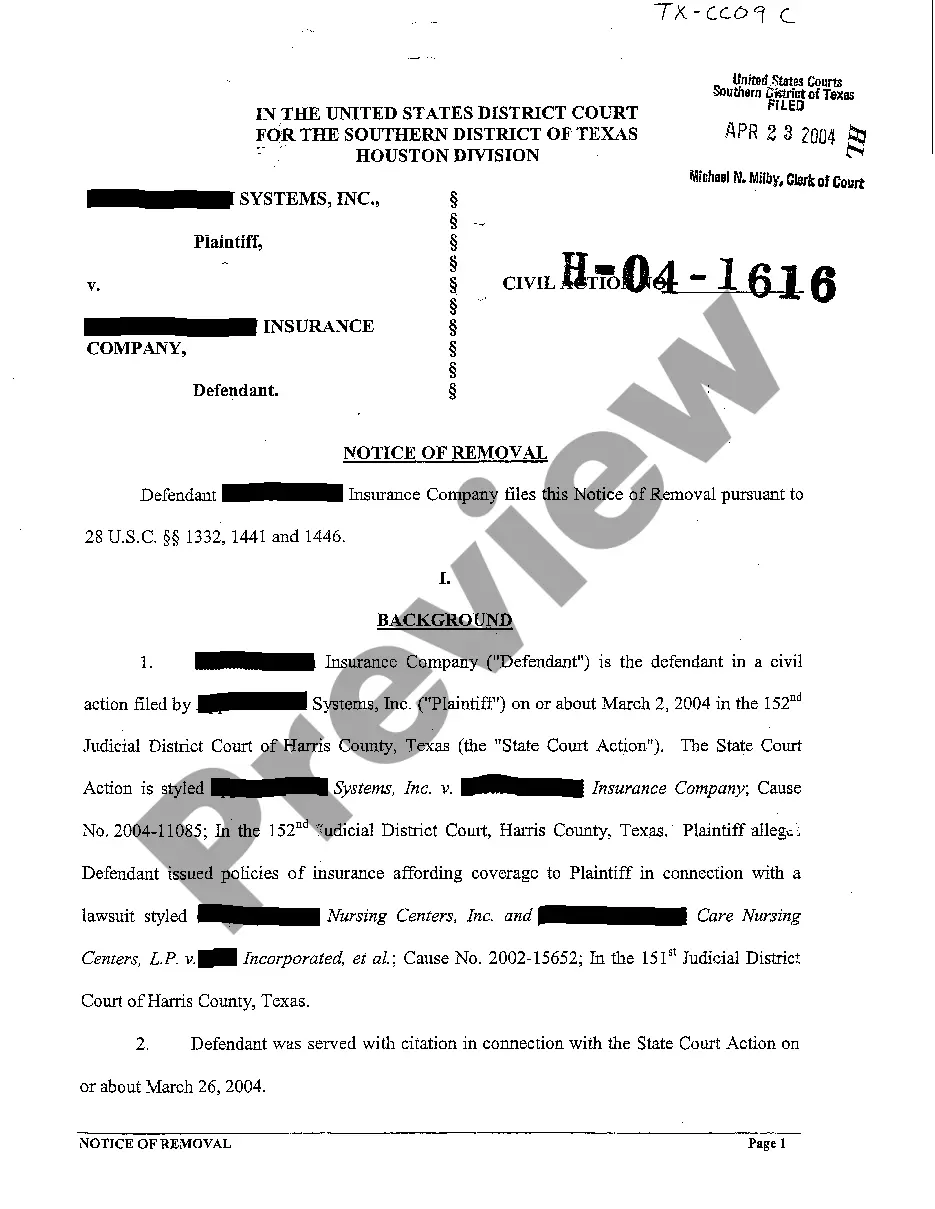

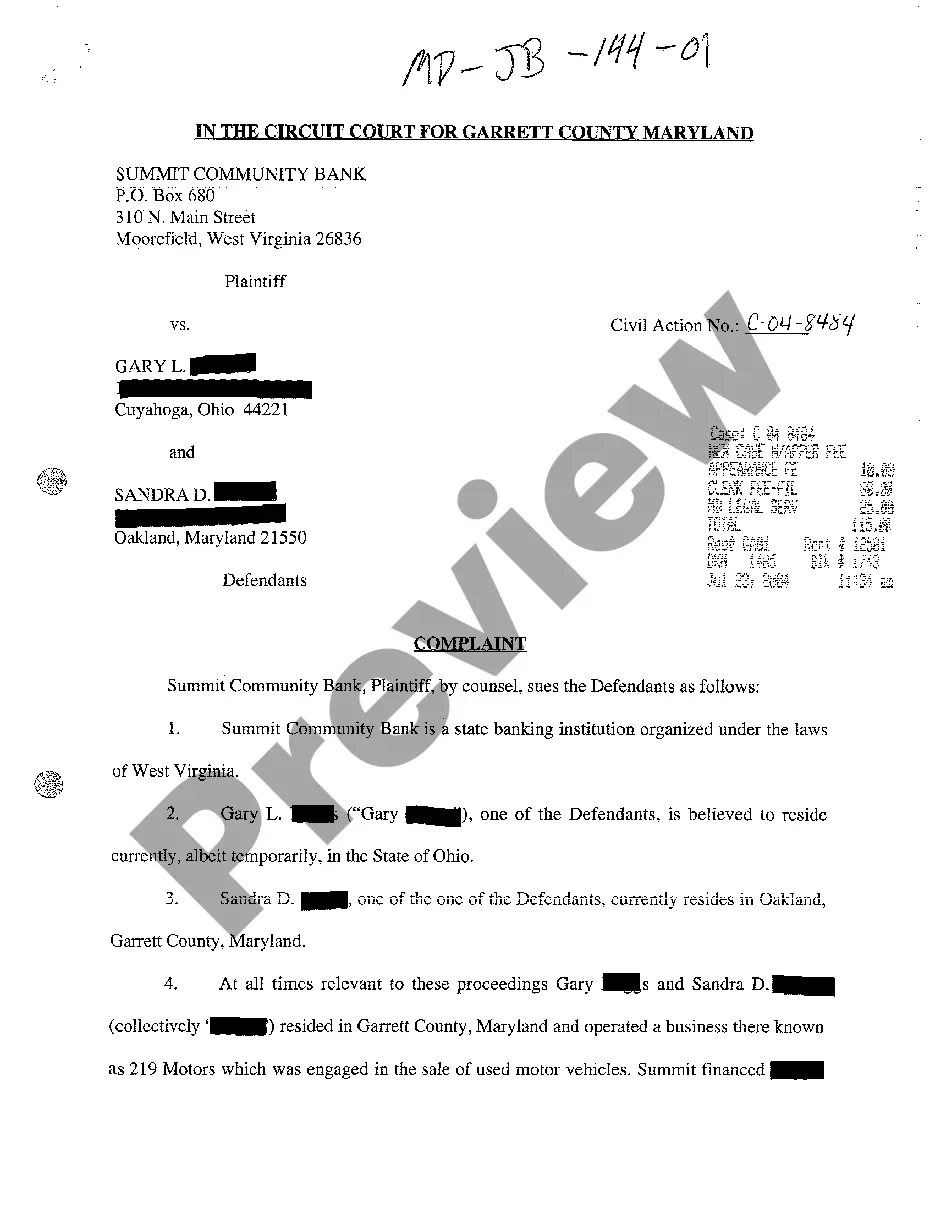

If you have to full, down load, or print out authorized papers layouts, use US Legal Forms, the biggest assortment of authorized varieties, which can be found on the Internet. Utilize the site`s simple and easy practical research to get the papers you need. Numerous layouts for organization and person uses are categorized by categories and states, or keywords and phrases. Use US Legal Forms to get the Kentucky Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc. with a number of click throughs.

If you are presently a US Legal Forms customer, log in in your accounts and click the Down load button to obtain the Kentucky Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.. Also you can accessibility varieties you formerly downloaded within the My Forms tab of your own accounts.

If you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the form for that proper metropolis/land.

- Step 2. Take advantage of the Preview option to check out the form`s content. Do not overlook to read the information.

- Step 3. If you are not happy with the kind, utilize the Research industry near the top of the monitor to get other types of your authorized kind template.

- Step 4. Upon having located the form you need, click on the Purchase now button. Pick the rates strategy you favor and put your accreditations to sign up for the accounts.

- Step 5. Method the deal. You can use your bank card or PayPal accounts to complete the deal.

- Step 6. Choose the file format of your authorized kind and down load it on your system.

- Step 7. Total, modify and print out or indication the Kentucky Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc..

Every authorized papers template you purchase is the one you have eternally. You may have acces to each kind you downloaded with your acccount. Click on the My Forms portion and pick a kind to print out or down load yet again.

Compete and down load, and print out the Kentucky Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc. with US Legal Forms. There are thousands of specialist and state-certain varieties you may use for your personal organization or person requirements.

Form popularity

FAQ

Neuberger Berman Trust Company N.A. offers comprehensive fiduciary and investment services for individuals and institutions.

With 749 investment professionals and 2,799 employees in total, Neuberger Berman has built a diverse team of individuals united in their commitment to client outcomes and investment excellence.

As a mutual fund registered under the Investment Company Act of 1940 (the "1940 Act"), the Fund is subject to certain restrictions under the 1940 Act and the Internal Revenue Code (the "Code") to which the Predecessors were not subject.

We believe this approach is the reason more than 600 employees are owners of the firm and we have a 96% retention rate for our senior investment professionals1.

For nine consecutive years, Neuberger Berman has been named first or second in Pensions & Investment's Best Places to Work in Money Management survey (among those with 1,000 employees or more). The firm manages $436 billion in client assets as of March 31, 2023.

With 749 investment professionals and 2,799 employees in total, Neuberger Berman has built a diverse team of individuals united in their commitment to client outcomes and investment excellence.

Neuberger Berman peak revenue was $2.8B in 2022. Neuberger Berman annual revenue for 2021 was 2.4B, 17.17% growth from 2020. Neuberger Berman annual revenue for 2022 was 2.8B, 17.35% growth from 2021.

Neuberger Berman Group LLC is a private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals.