Mississippi Term Mineral Deed of Undivided Interest

Description

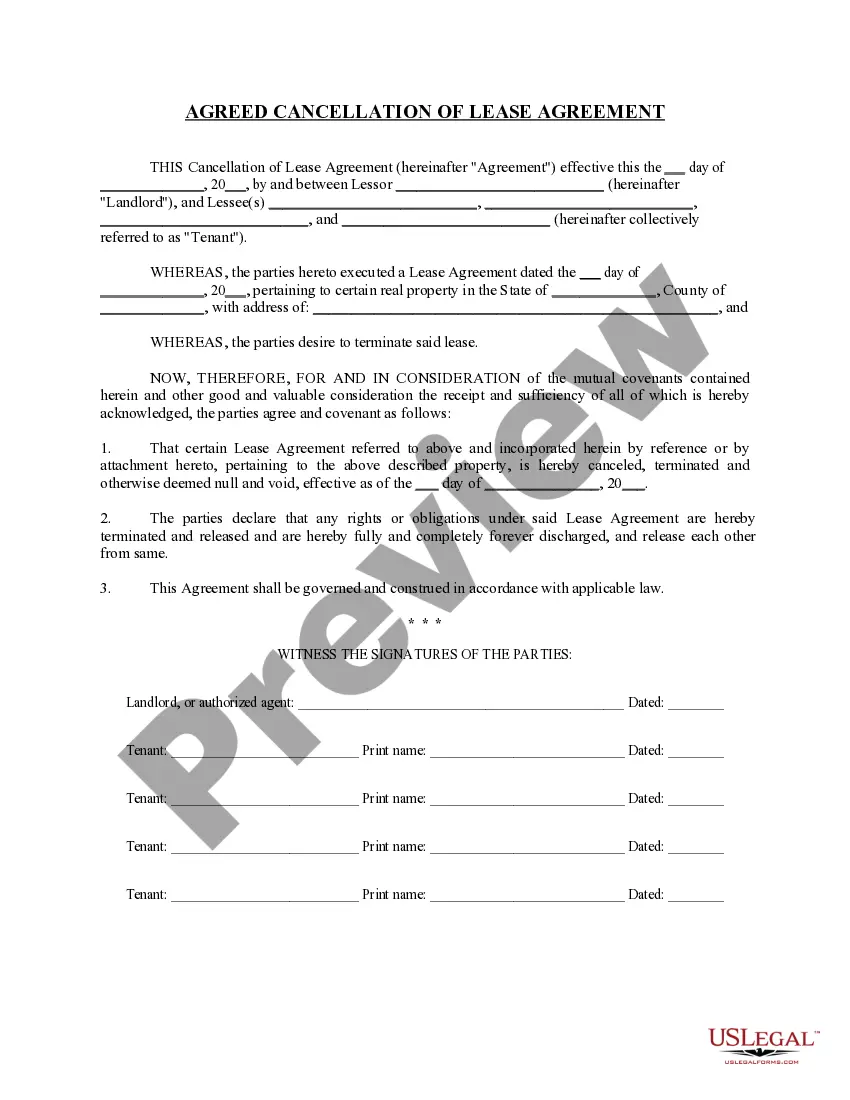

How to fill out Term Mineral Deed Of Undivided Interest?

Choosing the best legal papers web template could be a have difficulties. Needless to say, there are a lot of web templates available online, but how can you obtain the legal kind you will need? Use the US Legal Forms site. The service provides 1000s of web templates, like the Mississippi Term Mineral Deed of Undivided Interest, which you can use for company and personal requirements. All the types are checked by pros and satisfy state and federal needs.

When you are previously listed, log in in your account and then click the Acquire button to get the Mississippi Term Mineral Deed of Undivided Interest. Make use of your account to look throughout the legal types you have acquired earlier. Visit the My Forms tab of your respective account and obtain another copy from the papers you will need.

When you are a new consumer of US Legal Forms, allow me to share easy recommendations that you should stick to:

- Initially, ensure you have selected the appropriate kind for your area/county. You can examine the shape while using Preview button and browse the shape explanation to guarantee it is the best for you.

- If the kind does not satisfy your needs, make use of the Seach industry to discover the right kind.

- When you are certain that the shape would work, select the Purchase now button to get the kind.

- Opt for the prices program you need and enter the necessary information and facts. Build your account and pay for the transaction using your PayPal account or bank card.

- Choose the submit formatting and obtain the legal papers web template in your device.

- Comprehensive, revise and print out and sign the received Mississippi Term Mineral Deed of Undivided Interest.

US Legal Forms is the most significant collection of legal types where you can discover various papers web templates. Use the service to obtain professionally-made documents that stick to condition needs.

Form popularity

FAQ

Mineral rights are a form of real property, and they are governed by the same principles of marital property law as other real estate. If the mineral rights were owned before marriage, they are separate property.

Mineral Interest (MI) When the mineral rights are conveyed to another person or entity, they are ?severed? from the land, and a separate chain of title begins. When a person owns less than 100% of the minerals, they are said to own a fractional or undivided mineral interest.

Finding Who Owns Mineral Rights To Your Property The legal description of your party can make the search easier. If you don't have that, you can take your property deed to the tax office, and they can help you find the legal description. The information should be held in the deed records room.

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.

An attorney can create a deed or assignment that conveys the mineral rights to the new owners. The original deed will need to be recorded in the county where the minerals are located. If there are producing wells on the property, each operator will need to be notified of the change in ownership.

By statute and case law, mineral properties are taxable as real property and are subject to the same laws and appraisal methodology as all real property in the state.

However, since mineral rights are a severed portion of the land rights themselves (they're separated from the land's "surface rights" and sold separately by deed, just like the land itself), they are usually considered real property.

What Are Mineral Rights? Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.