Kentucky Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees

Description

How to fill out Deferred Compensation Agreement By First Florida Bank, Inc. For Key Employees?

Are you presently within a position where you require files for sometimes enterprise or individual reasons virtually every time? There are a variety of lawful record web templates accessible on the Internet, but getting types you can rely on isn`t straightforward. US Legal Forms gives 1000s of develop web templates, like the Kentucky Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees, that are published to fulfill state and federal needs.

In case you are already informed about US Legal Forms web site and have a free account, simply log in. Following that, it is possible to obtain the Kentucky Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees design.

If you do not provide an bank account and need to begin to use US Legal Forms, abide by these steps:

- Find the develop you will need and ensure it is for that correct area/state.

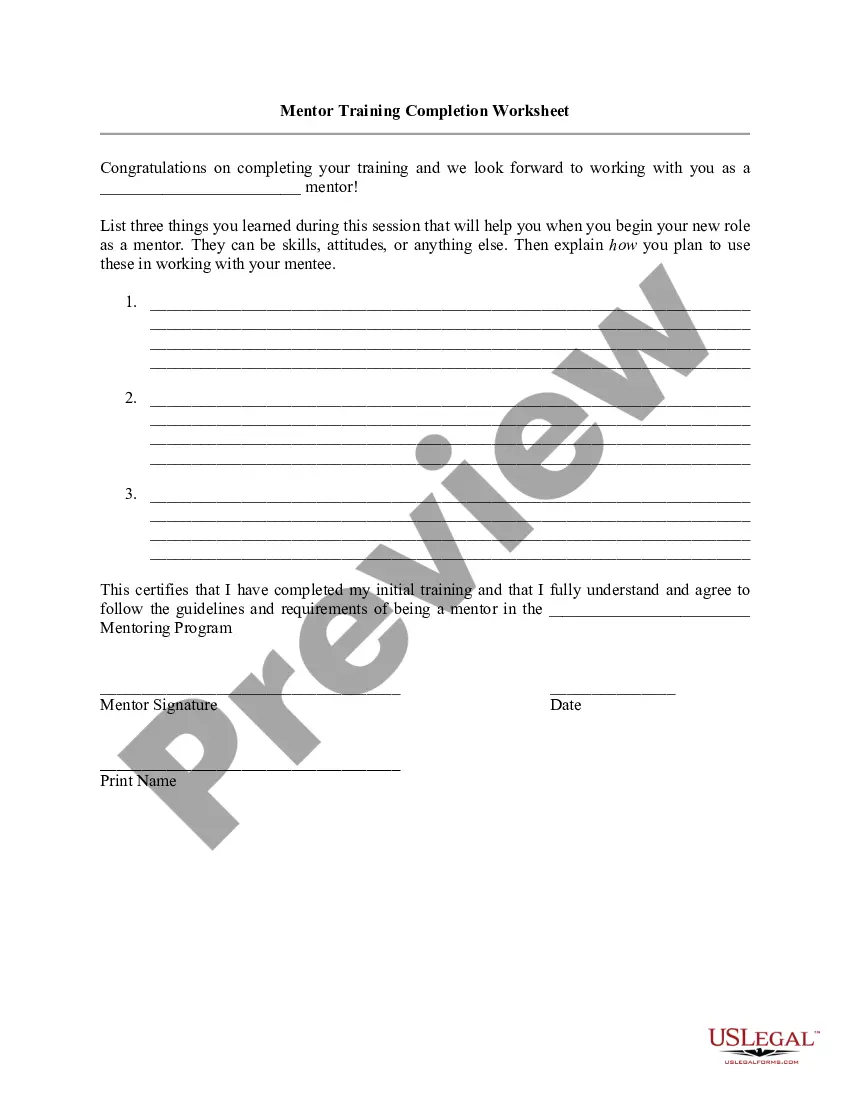

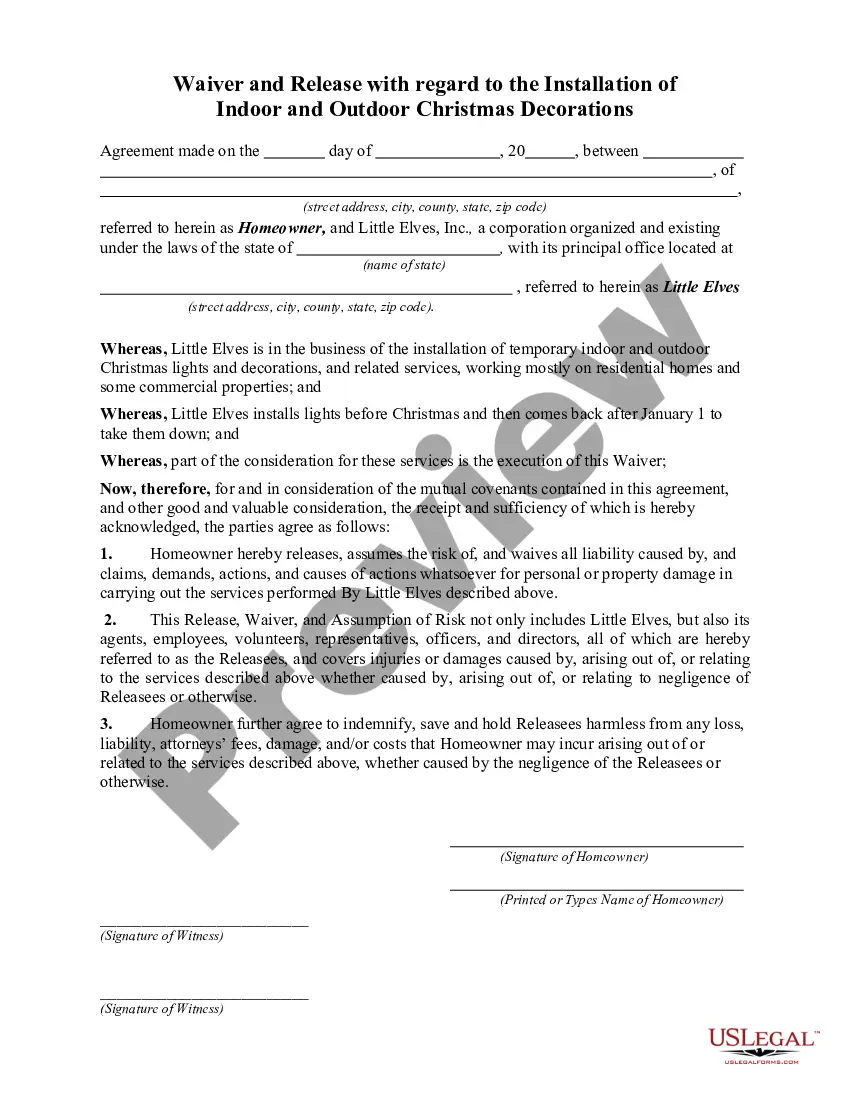

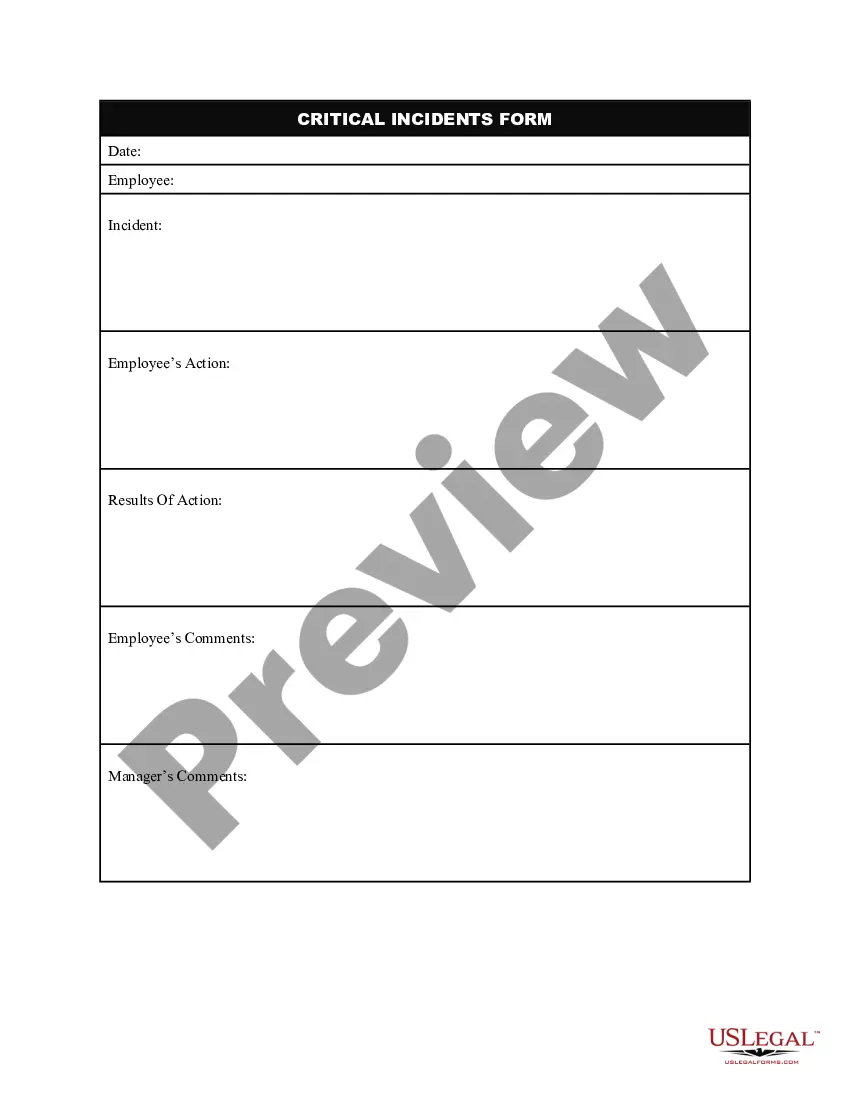

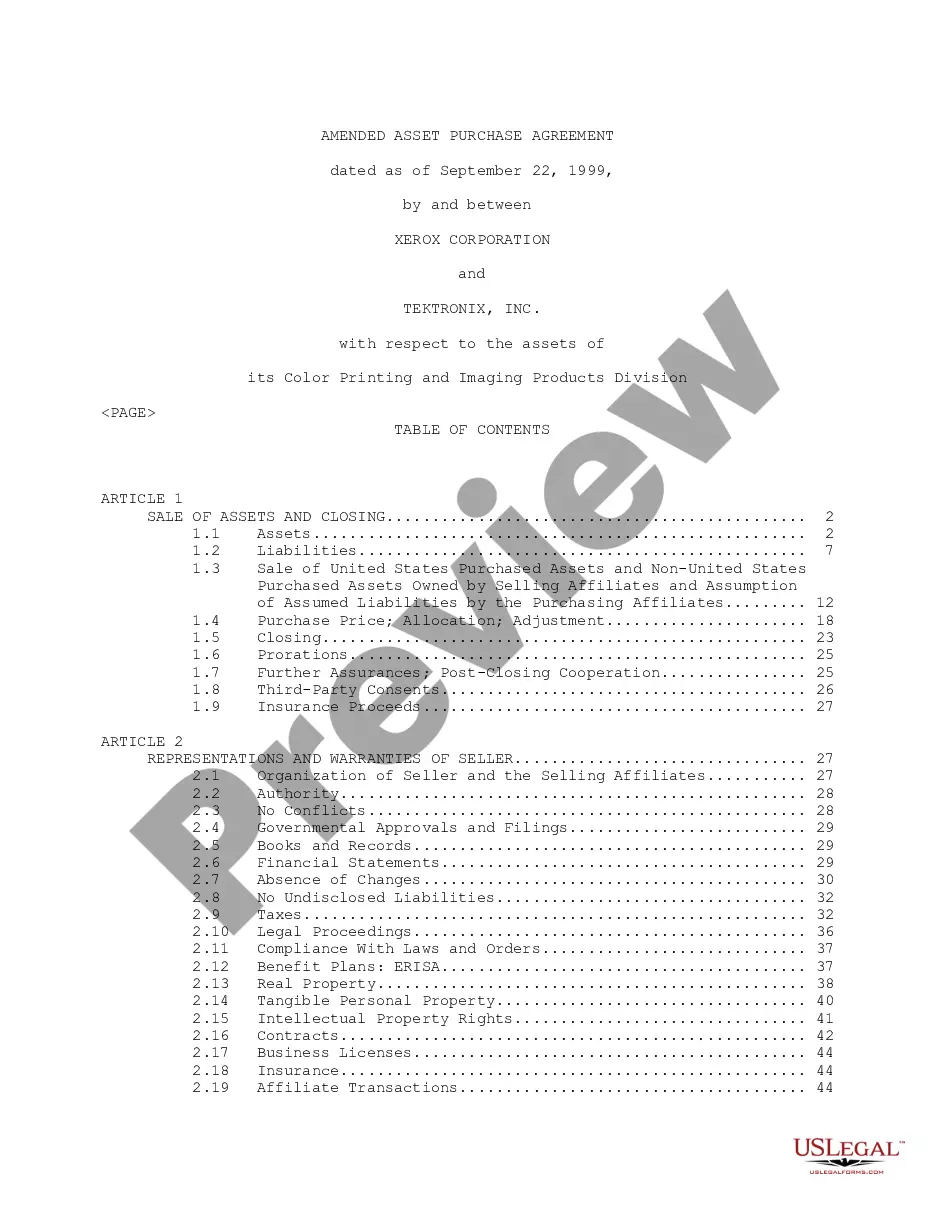

- Take advantage of the Preview button to review the shape.

- Read the information to actually have chosen the proper develop.

- In the event the develop isn`t what you`re seeking, use the Look for area to find the develop that meets your requirements and needs.

- When you get the correct develop, click on Purchase now.

- Opt for the prices prepare you would like, fill out the necessary information and facts to create your money, and pay for the transaction with your PayPal or charge card.

- Decide on a handy document format and obtain your duplicate.

Find all the record web templates you have purchased in the My Forms menus. You can aquire a further duplicate of Kentucky Deferred Compensation Agreement by First Florida Bank, Inc. for Key Employees at any time, if required. Just go through the essential develop to obtain or produce the record design.

Use US Legal Forms, by far the most considerable variety of lawful forms, in order to save some time and steer clear of mistakes. The assistance gives skillfully produced lawful record web templates that can be used for a selection of reasons. Generate a free account on US Legal Forms and initiate producing your way of life a little easier.

Form popularity

FAQ

Plan costs The maximum annual fee that any participant can be charged is $237! This accounts for the $12 administrative fee and $225 maximum for mutual fund asset costs.

Deferred compensation plans don't have required minimum distributions, either. Based upon your plan options, generally, you may choose 1 of 2 ways to receive your deferred compensation: as a lump-sum payment or in installments.

Plan costs The maximum annual fee that any participant can be charged is $237! This accounts for the $12 administrative fee and $225 maximum for mutual fund asset costs.

The Florida Deferred Compensation Plan is a supplemental retirement plan for employees of the State of Florida, including OPS employees and employees of the State University System, State Board of Administration, Division of Rehab and Liquidation, Special Districts*, and Water Management Districts* [established under ...

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.

The Pros And Cons Of Using A Deferred Compensation Plan Deferred compensation plans can save a high earner a lot of money in the long run. These plans grow tax-deferred and the contributions can be deducted from taxable income. ... There are risks to these plans, such as the company declaring bankruptcy.

Deferring income to retirement might help avoid high state income taxes (ex: California, New York, etc) if you're planning to move to a low-tax state. The biggest risk of deferred compensation plans is they're not guaranteed; if your company goes bankrupt, you might receive none of the income you deferred.

Consider these benefits: KDC lets you supplement your retirement with your own voluntary savings and investment plan. IRA programs). of your income you contribute to the traditional pre-tax 457 and 401(k) plans, or on any of your investment earnings, until the money is paid out to you.