Kentucky Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

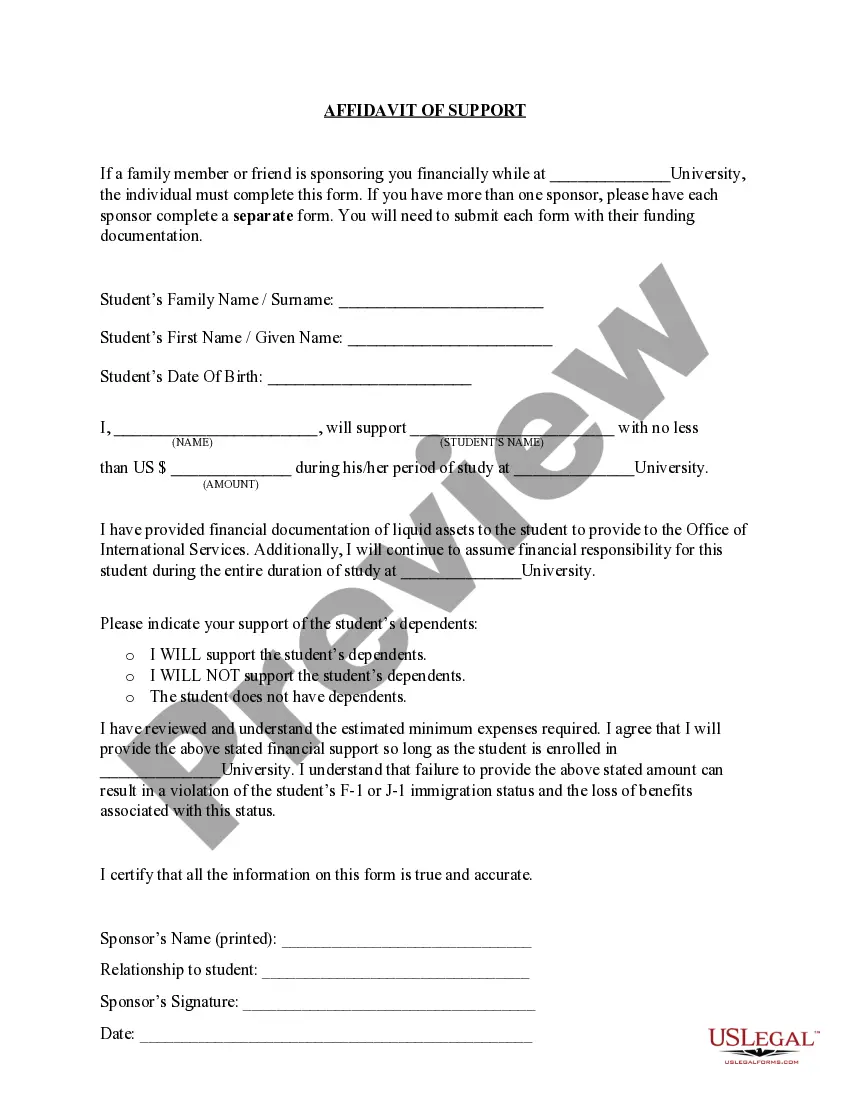

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

It is possible to spend time on-line trying to find the legitimate record design that fits the federal and state needs you will need. US Legal Forms offers a huge number of legitimate forms which are reviewed by professionals. It is simple to download or print out the Kentucky Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 from the support.

If you currently have a US Legal Forms account, you can log in and click the Download switch. After that, you can total, change, print out, or sign the Kentucky Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005. Each legitimate record design you buy is your own property for a long time. To obtain an additional copy of any acquired form, visit the My Forms tab and click the related switch.

If you use the US Legal Forms internet site for the first time, adhere to the easy guidelines beneath:

- Very first, make sure that you have chosen the right record design for your state/metropolis of your choosing. Look at the form information to ensure you have selected the right form. If available, utilize the Review switch to search throughout the record design also.

- In order to get an additional model of the form, utilize the Search discipline to find the design that meets your requirements and needs.

- After you have discovered the design you would like, just click Purchase now to carry on.

- Find the rates program you would like, type your credentials, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You may use your bank card or PayPal account to cover the legitimate form.

- Find the structure of the record and download it for your device.

- Make alterations for your record if possible. It is possible to total, change and sign and print out Kentucky Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

Download and print out a huge number of record layouts utilizing the US Legal Forms Internet site, that offers the largest variety of legitimate forms. Use expert and condition-particular layouts to handle your business or person needs.

Form popularity

FAQ

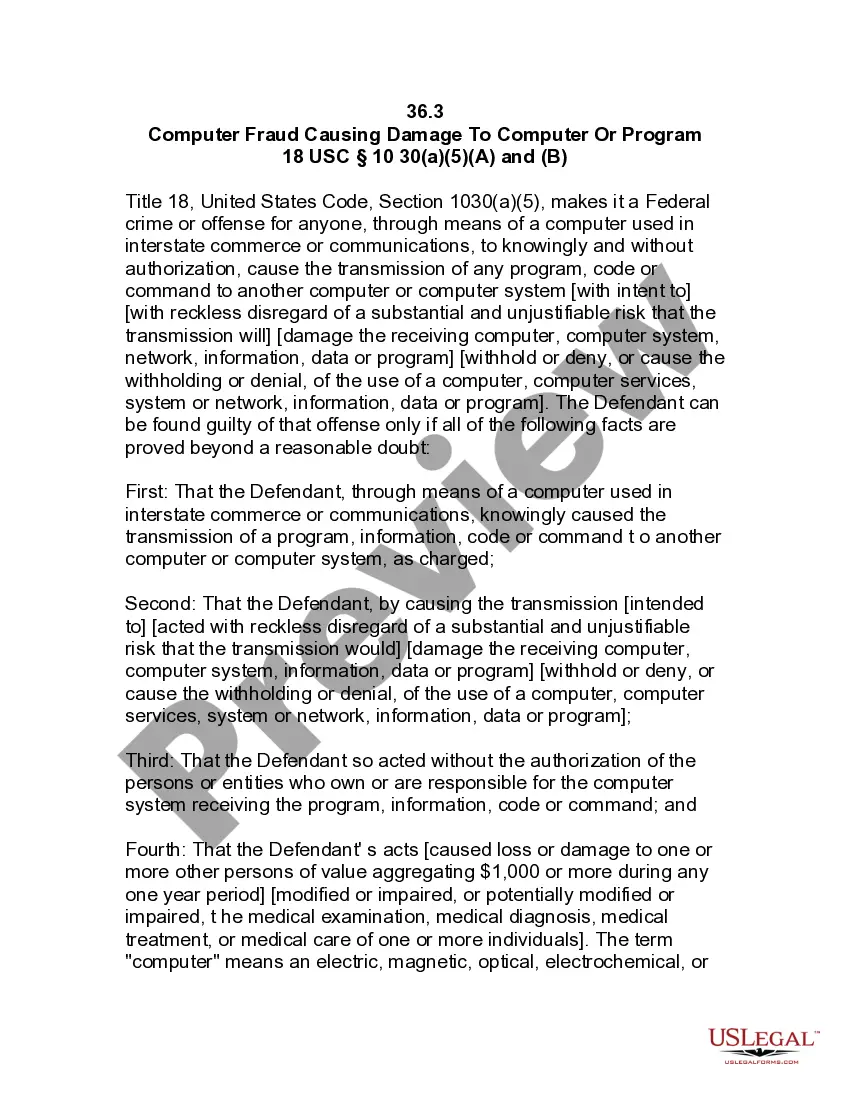

The Minimum Percentage of Debt Repayments In A Chapter 13 Bankruptcy Is 8 To 10 Percent.

To calculate the total average monthly payment, add all amounts that are contractually due to each secured creditor in the 60 months after you file for bankruptcy. Then divide by 60.

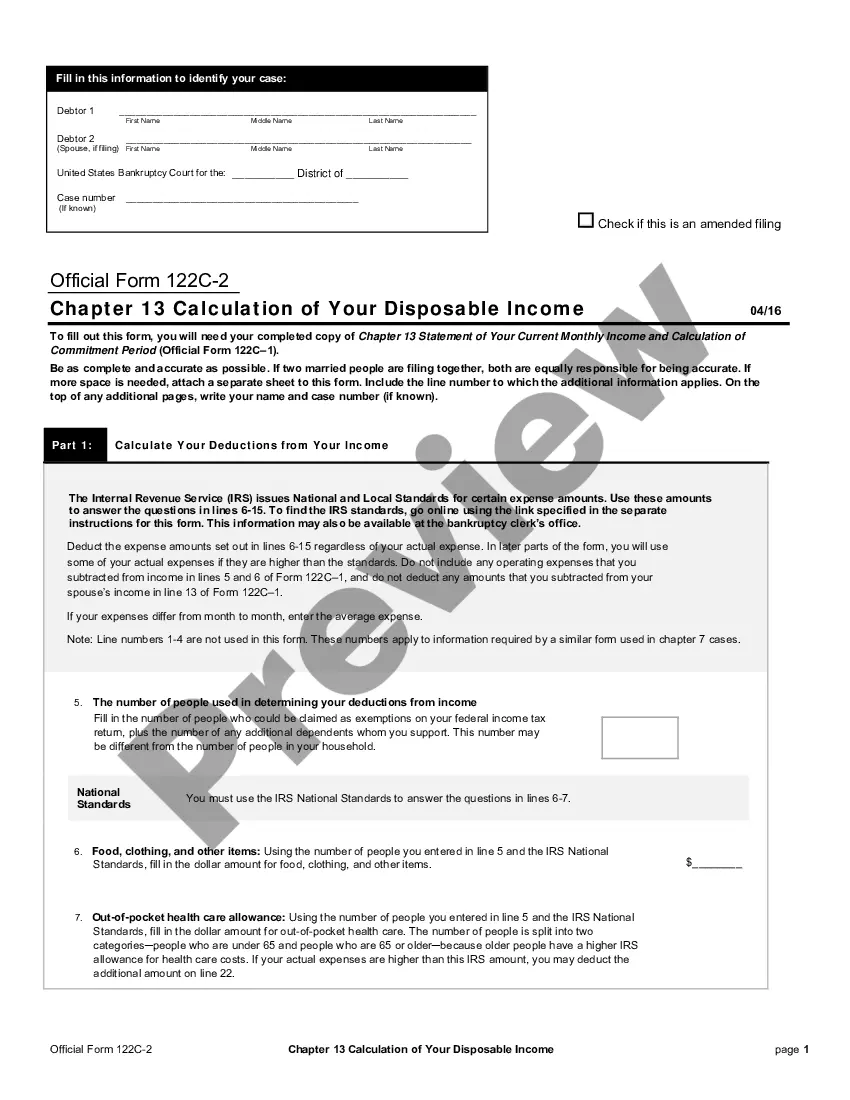

Take your monthly income and deduct living expenses, priority debt payments, and secured payments. The remaining amount is your disposable income. You'd are responsible to pay this amount to creditors each month.

Trustees do not monitor your income during the course of your repayment. However, a trustee possesses what Ginter terms ?broad powers? and responsibilities. They include: Determining if you qualify for Chapter 13 bankruptcy.

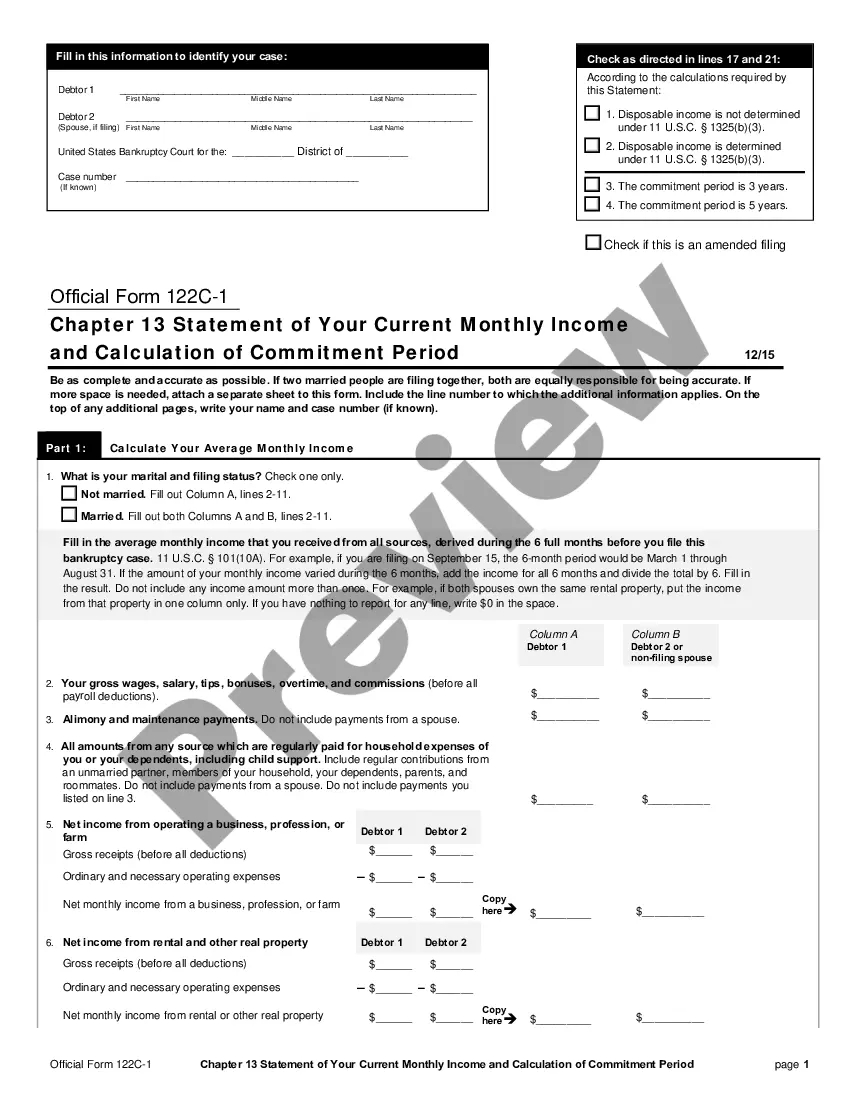

For a Chapter 13, the ?Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period? (Form 122C-1) tells the court your average monthly income. Your income is compared to the median income for your state, which will assist in calculating your disposable income.

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.