Kentucky Purchase Order for Non Inventory Items

Description

How to fill out Purchase Order For Non Inventory Items?

Are you currently in a situation where you need documents for both professional or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a wide array of form templates, such as the Kentucky Purchase Order for Non Inventory Items, which are designed to meet state and federal regulations.

Once you locate the suitable form, click Acquire now.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the Kentucky Purchase Order for Non Inventory Items template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct area/region.

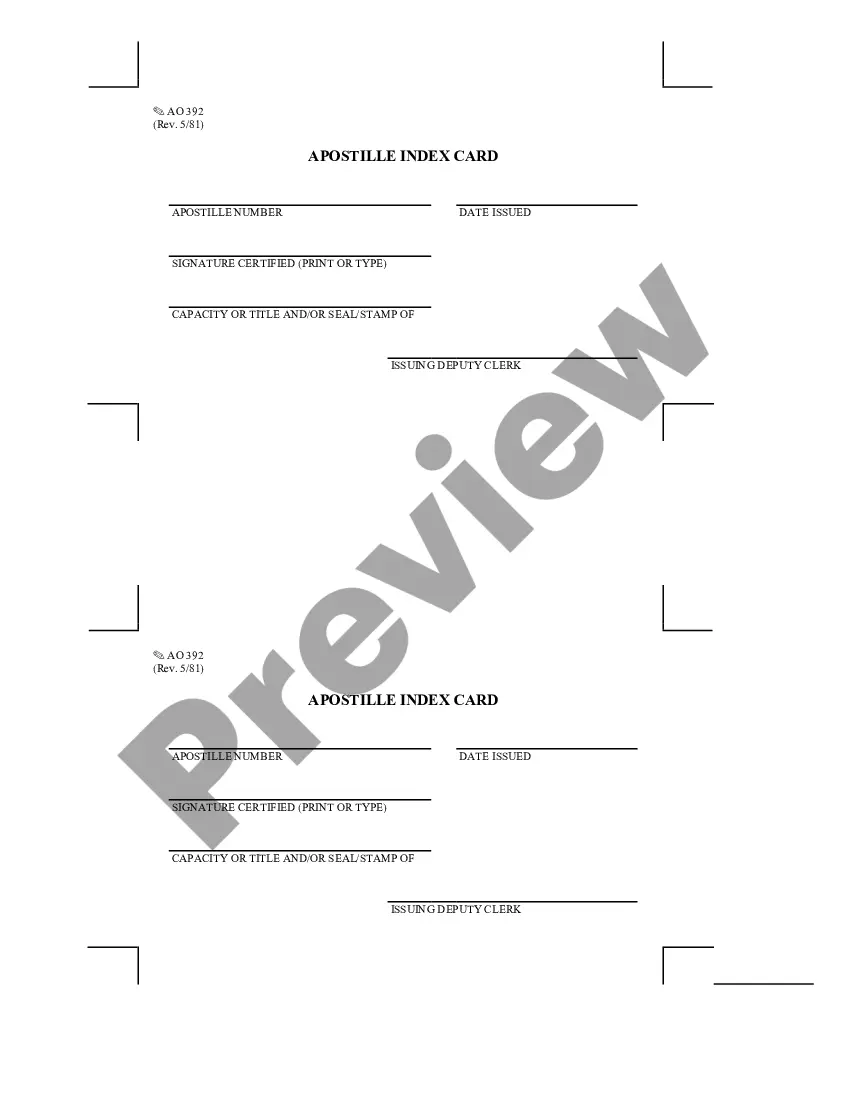

- Use the Review button to inspect the document.

- Check the summary to confirm you have selected the correct form.

- If the form does not meet your requirements, utilize the Lookup area to find the form that suits your needs and specifications.

Form popularity

FAQ

The four main types of purchasing include direct purchasing, indirect purchasing, service purchasing, and capital purchasing. For instance, direct purchasing involves acquiring raw materials necessary for production, while indirect purchasing focuses on items like office supplies. Service purchasing covers things such as legal consultations, and capital purchasing includes significant investments, like machinery. Knowing these categories helps you to effectively manage a Kentucky Purchase Order for Non Inventory Items, ensuring that your purchasing strategies align with your business goals.

A Purchase Order (PO) is a document issued by a buyer to a seller, detailing the items requested for purchase. In contrast, a Local Purchase Order (LPO) is typically used within an organization for local purchases, often for non-inventory items. Understanding the distinction is vital for using a Kentucky Purchase Order for Non Inventory Items effectively. By utilizing the correct type of order, you can streamline your purchasing process and maintain accurate financial records.

The Kentucky State Master agreement is a binding contract that outlines the terms and conditions for purchasing goods and services on behalf of the state. This framework helps facilitate efficient procurement processes and ensures compliance with state regulations. When engaging with a Kentucky Purchase Order for Non Inventory Items, utilizing this agreement can simplify transactions and provide better value for your organization. It establishes a clear guideline for procuring essential resources.

An example of a non-inventory item could be office supplies such as paper or ink, which are consumed regularly rather than stored for long periods. Another example includes contracted services like janitorial work or IT support, which do not fall under traditional inventory categories. When managing these purchases through a Kentucky Purchase Order for Non Inventory Items, you can ensure that expenses are tracked and documented efficiently, improving your business’s financial oversight.

inventory purchase order is a document used to request services or items that do not require stock tracking. These orders are crucial for procuring office supplies, consulting services, or other operational needs without inventory implications. In the context of a Kentucky Purchase Order for Non Inventory Items, this process streamlines procurement and ensures that businesses maintain accurate records of expenditures. It enhances financial management and accountability.

Inventory items are tangible goods that a business keeps on hand for sale or production. Non-inventory items, however, include services or materials that do not have a physical form but are necessary for operations. When using a Kentucky Purchase Order for Non Inventory Items, you capture expenses related to these non-physical resources. This distinction helps businesses manage their assets effectively.

If you don't inventory an item it expenses the item when it is purchased and records income when it is sold. Debits the assigned Expense account.

Examples of non-inventory items include:items purchased for a specific job and then quickly sold or invoiced to a customer.items that your organisation sells but does not purchase, including Bill of Material (BOM) items.items that your organisation purchases but does not resell, including office supplies.More items...

Non-Inventory Items are tracked as a current cost (Cost of Goods Sold) and they are recorded on your Profit & Loss statement when they are purchased. You will only see the cost of your Non-Inventory items on your Profit & Loss statement after the items associated with them have been sold.

Introduction. A non-inventory product is a type of product that is procured, sold, consumed in production but we do not keep inventories for it. its current quantity does not matter to us. Usually, these are low-value goods whose accurate monitoring would not significantly affect business results.