Kentucky Purchase Order

Description

How to fill out Purchase Order?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse selection of legal template documents that you can download or print.

By using the website, you can access thousands of forms for business and personal use, categorized by type, state, or keywords. You can find the latest forms such as the Kentucky Purchase Order instantly.

If you already have a membership, Log In to obtain the Kentucky Purchase Order from the US Legal Forms library. The Get button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

Then, select your preferred pricing plan and provide your details to register for an account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

- If you want to utilize US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your area/state.

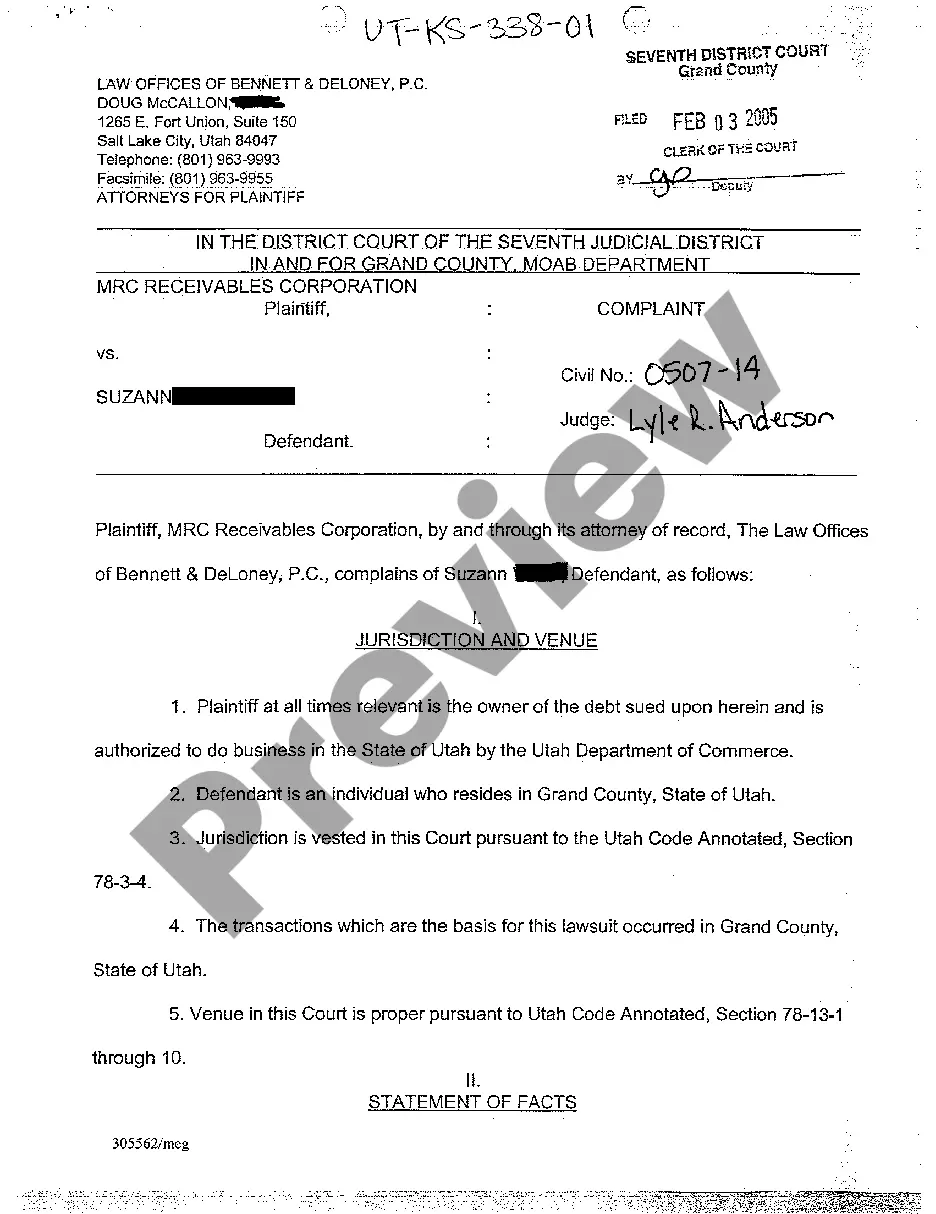

- Click the Preview button to review the form's details.

- Examine the form summary to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Search box at the top of the screen to locate a suitable one.

- If you are satisfied with the form, confirm your selection by clicking on the Buy now button.

Form popularity

FAQ

Kentucky has reciprocal agreements regarding sales tax with several states, meaning that sales made to vendors in those states may not incur Kentucky sales tax. It’s essential to know which states participate in these agreements to manage your tax responsibilities accurately.

Certain items such as groceries, prescription medications, and some services are exempt from Kentucky sales tax. Understanding what is exempt can help you reduce your tax burden and manage your finances more effectively. Always consult the latest guidelines to ensure compliance.

Purchases made outside Kentucky for use within the state may be subject to Kentucky use tax if they are not taxed by the seller. This includes items such as equipment, appliances, and supplies used in your business. Understanding your use tax obligations helps you avoid unexpected fines.

In Kentucky, sales tax typically applies to sales made within the state. However, if you sell goods to customers in other states, you need to be aware of the tax laws in those states as well. Be informed about your obligations to ensure compliance on both fronts.

Yes, a license is generally required to wholesale goods in Kentucky. Depending on the products you sell, you may also need a seller’s permit. Make sure to check with local authorities and consider using services offered by USLegalForms for assistance with licensing requirements.

Becoming a certified vendor in Kentucky typically requires you to register with the Secretary of State's office and meet certain qualifications for your products or services. Additional documentation may be necessary, such as proof of liability insurance. Resources like USLegalForms can help you navigate this certification process smoothly.

Yes, Kentucky does collect state taxes. The state imposes a variety of taxes including income tax and sales tax. Understanding your tax obligations is crucial for operating your business successfully in Kentucky.

To file a DBA in Kentucky, you need to complete an application and submit it to the county clerk's office where your business operates. This process involves providing your business name, address, and the nature of your business. Legal forms may be available through the USLegalForms platform, simplifying your filing process.