Kentucky Depreciation Schedule

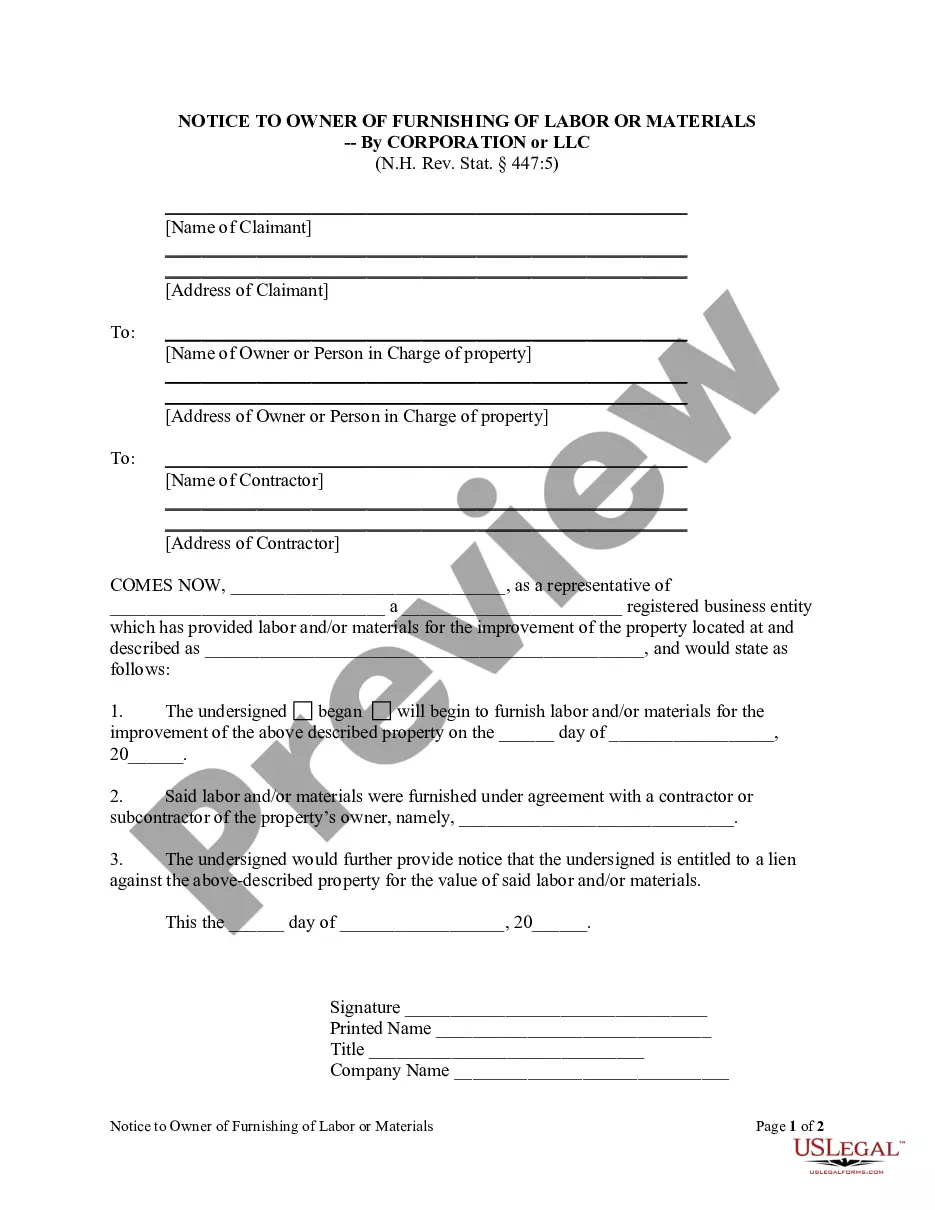

Description

How to fill out Depreciation Schedule?

Locating the appropriate sanctioned document template can be a challenge.

Indeed, there exists a multitude of templates accessible online, but how do you find the official form you require.

Utilize the US Legal Forms website. This platform provides thousands of templates, including the Kentucky Depreciation Schedule, that you can utilize for business and personal purposes.

You can preview the form using the Preview button and check the form description to confirm it is the right fit for you.

- All of the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already a member, Log In to your account and click on the Download button to obtain the Kentucky Depreciation Schedule.

- Use your account to review the legal forms you have previously acquired.

- Navigate to the My documents section of your account to retrieve an additional copy of the document you require.

- If you are a first-time user of US Legal Forms, here are simple steps to follow.

- First, make sure you have selected the correct form for your city/state.

Form popularity

FAQ

Yes, Kentucky requires an addback for federal bonus depreciation deductions under IRC Sec. 168(k). Resident taxpayers report the addition adjustment on Schedule M.

Kentucky is a static conformity state and adopts the IRC as of December 31, 2019. Consequently, Kentucky will not conform to the suspension of the 80 percent NOL limitation, the expanded interest deduction temporarily available under IRC section 163(j) and other federal changes in the CARES Act.

The state of Kentucky finally expanded its Section 179 Deduction to $100,000. For 2020, Bonus Depreciation of 100% is still available.

The taxable situs of tangible personal property in Kentucky are the Counties where the property is physically located. Another way to define tangible personal property is that it is every physical item subject to ownership except real and intangible property.

State Conformity with Federal Section 179Forty-six states allow Section 179 deductions. Of the remaining four, three do not levy corporate income taxes and the fourth (Ohio) does not make allowances for federal expense deductions against its gross receipts tax.

All property in Kentucky, unless exempted by the Kentucky Constitution or statute, is subject to taxation. Tangible personal property is not exempted.

Tangible personal property is every physical item subject to ownership, except real and intangible property. Lessors and Lessees of Tangible Personal PropertyLeased property must be listed by the owner on Revenue Form 62A500, regardless of the lease agreement's terms regarding tax liability.

Kentucky taxpayers may deduct up $100,000 of cost of section 179 property placed in service on or after January 1, 2020, regardless of the total cost of section 179 property placed in service during the taxable year.

Over the years, the State real property tax rate has declined from 31.5 cents per $100 of assessed valuation to 12.2 cents due to this statutory provision. This rate is set annually by July 1, and it applies to all real property tax bills throughout Kentucky.