Kentucky Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

Description

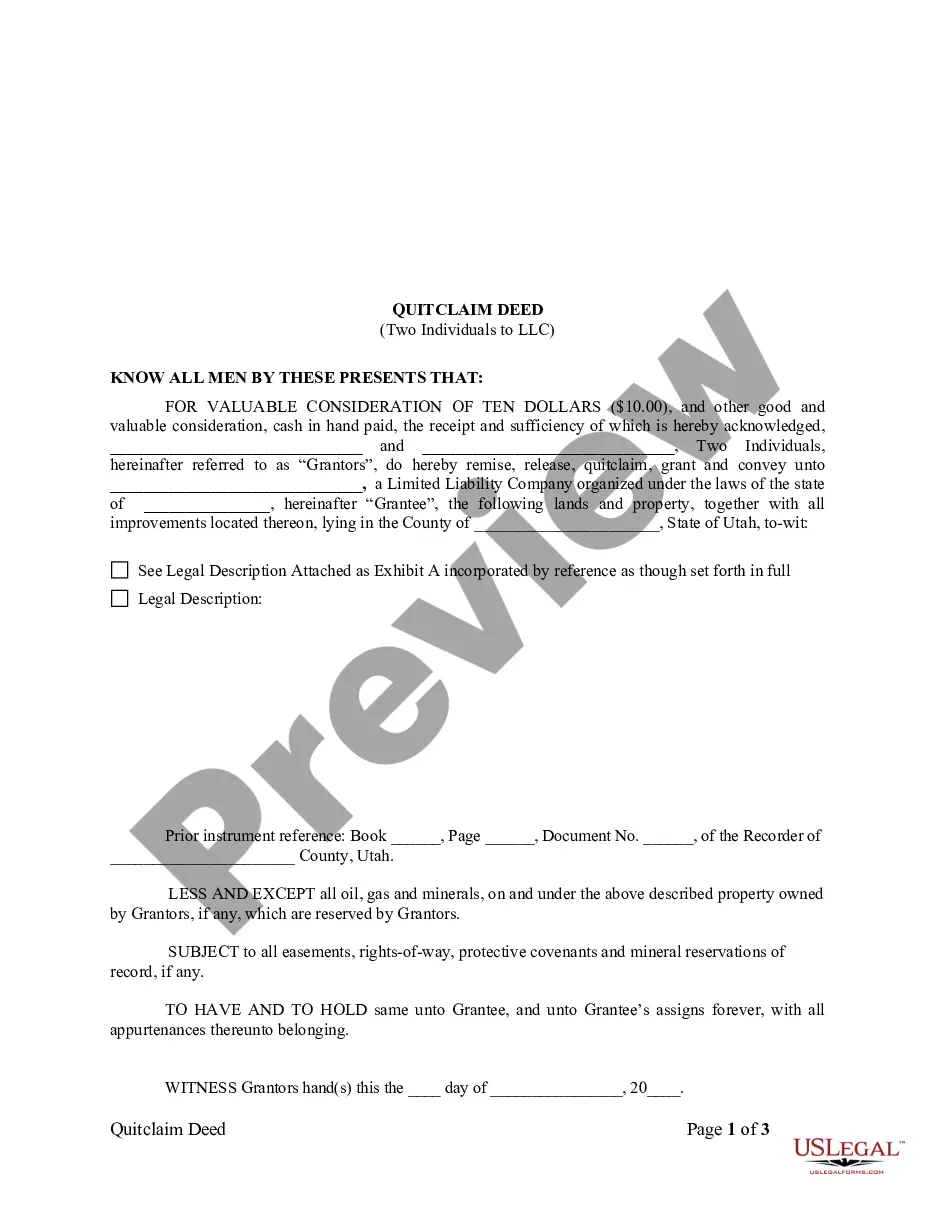

How to fill out Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

US Legal Forms - among the greatest libraries of lawful varieties in America - delivers an array of lawful papers layouts it is possible to download or printing. Using the website, you can get 1000s of varieties for enterprise and specific functions, sorted by groups, suggests, or keywords.You can get the latest types of varieties such as the Kentucky Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan in seconds.

If you have a monthly subscription, log in and download Kentucky Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan from the US Legal Forms library. The Obtain option can look on each type you perspective. You get access to all previously delivered electronically varieties from the My Forms tab of your respective accounts.

If you want to use US Legal Forms the first time, listed here are simple directions to help you get started:

- Make sure you have picked the right type for the metropolis/state. Click the Preview option to analyze the form`s content material. Read the type explanation to ensure that you have selected the right type.

- When the type does not suit your needs, take advantage of the Research area at the top of the display screen to obtain the one that does.

- If you are satisfied with the shape, confirm your decision by visiting the Buy now option. Then, opt for the pricing program you prefer and provide your qualifications to register for the accounts.

- Approach the deal. Make use of your charge card or PayPal accounts to finish the deal.

- Pick the structure and download the shape in your device.

- Make adjustments. Fill up, edit and printing and indication the delivered electronically Kentucky Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan.

Each and every format you included with your bank account lacks an expiration day and is also the one you have eternally. So, in order to download or printing another version, just proceed to the My Forms segment and click about the type you need.

Obtain access to the Kentucky Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan with US Legal Forms, the most considerable library of lawful papers layouts. Use 1000s of professional and state-particular layouts that satisfy your organization or specific demands and needs.

Form popularity

FAQ

The law governing security interests in personal property is Article 9 of the UCC, which defines a security interest as an interest in personal property or fixtures which secures payment or performance of an obligation.

A fixture filing is a UCC-1 financing statement authorized and made in ance with the UCC adopted in the state in which the related real property is located. It covers property that is, or will be, affixed to improvements to such real property.

Creating a security agreement Some key provisions in a security agreement include: Describing the collateral as accurately and as detailed as possible, so both the borrower and the lender agree upon the secured property. How to determine whether and when the borrower is in default under the loan.

An interest in certain assets which secures payment or performance of an obligation. In a secured financing transaction, the borrower grants a security interest over its assets in favor of the lender to secure its payment and performance obligations to the lender.

Collateral. The property in which a security interest is taken. Security Interest. Lenders are reluctant to lend large sums of money simply on the borrower's promise to repay , so they take a security interest in either the item purchased or some other personal property of the debtor.

Security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Secured party is a lender, seller, or other person in whose favor a security interest exists.

Commercial Security Agreement means the security agreements from Borrower to Lender pledging security interests in all of the Collateral and such security agreements as the Borrower shall execute in the future with respect to any future Advance from the Revolving Line of Credit Loan securing interests in certificates ...

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.