Kentucky Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children

Description

How to fill out Revocable Trust For Lifetime Benefit Of Trustor, Lifetime Benefit Of Surviving Spouse After Trustor's Death With Trusts For Children?

Are you in a situation where you require documents for either your business or certain tasks on almost a daily basis.

There are numerous authorized document templates accessible online, but finding reliable forms can be challenging.

US Legal Forms offers thousands of form templates, such as the Kentucky Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children, designed to meet federal and state regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Kentucky Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children whenever necessary. Simply click on the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid errors. The service offers professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you can download the Kentucky Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/state.

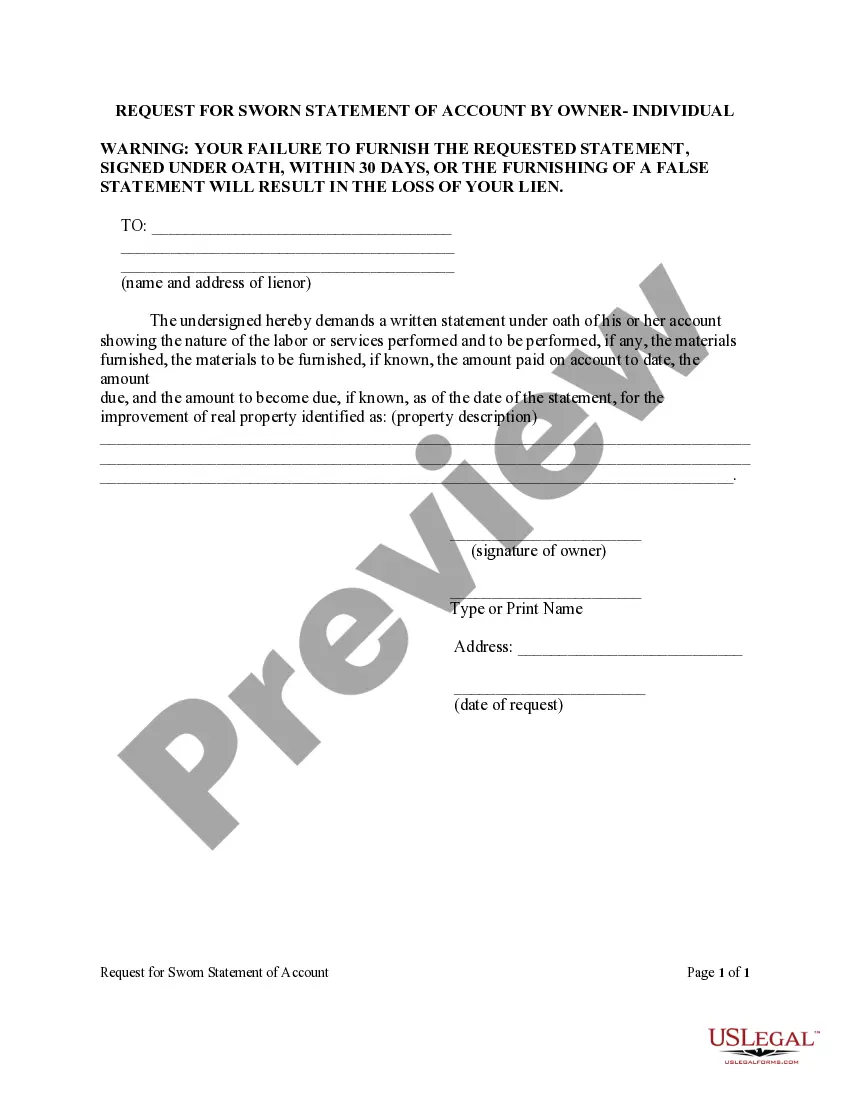

- Utilize the Review button to examine the document.

- Read the description to confirm you have selected the correct form.

- If the form is not what you're looking for, use the Search section to find the document that matches your needs and requirements.

- Once you find the right form, click Buy now.

- Select the pricing plan you desire, provide the needed information to create your account, and complete the transaction using your PayPal or credit card.

Form popularity

FAQ

Living trusts allow you to enjoy the benefits of your assets while you're alive and pass them automatically to your chosen beneficiaries once you're gone.

A revocable trust is a trust whereby provisions can be altered or canceled dependent on the grantor or the originator of the trust. During the life of the trust, income earned is distributed to the grantor, and only after death does property transfer to the beneficiaries of the trust.

No Asset Protection A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

200dThe bottom line is that if you are using revocable living trusts as an estate tax planning vehicle, the trust should be listed as the primary beneficiary of your life insurance policy as opposed to your spouse.

What Happens When One Spouse Dies. While both spouses are alive, they typically act as co-trustees and manage the trust together. Upon the death of the first spousealso known as the decedent spousethe surviving spouse generally becomes the sole grantor/trustee and continues to manage the trust based on its terms.

Under typical circumstances, the surviving spouse would become the sole trustee after the death of one spouse. The surviving spouse would control the shared property, and the personal property of the deceased spouse would be distributed to the beneficiaries.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

But when the Trustee of a Revocable Trust dies, it is up to their Successor to settle their loved one's affairs and close the Trust. The Successor Trustee follows what the Trust lays out for all assets, property, and heirlooms, as well as any special instructions.

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

A living trust is a legal document that's similar to a last will and testament and is usually made alongside a will. It lets you name the people (or organizations) who you want to receive your property after your death.