Kentucky Checklist - Action to Improve Collection of Accounts

Description

How to fill out Checklist - Action To Improve Collection Of Accounts?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

By using the website, you can obtain thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can swiftly access the latest versions of forms such as the Kentucky Checklist - Action to Enhance Collection of Accounts.

Check the description of the form to ensure it is the correct one you need.

If the form does not meet your criteria, use the Search box at the top of the screen to find one that does.

- If you have a monthly subscription, Log In to acquire the Kentucky Checklist - Action to Enhance Collection of Accounts from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents tab of your account.

- If you are new to US Legal Forms, here are simple steps to get started.

- Make sure you select the appropriate form for your city/state.

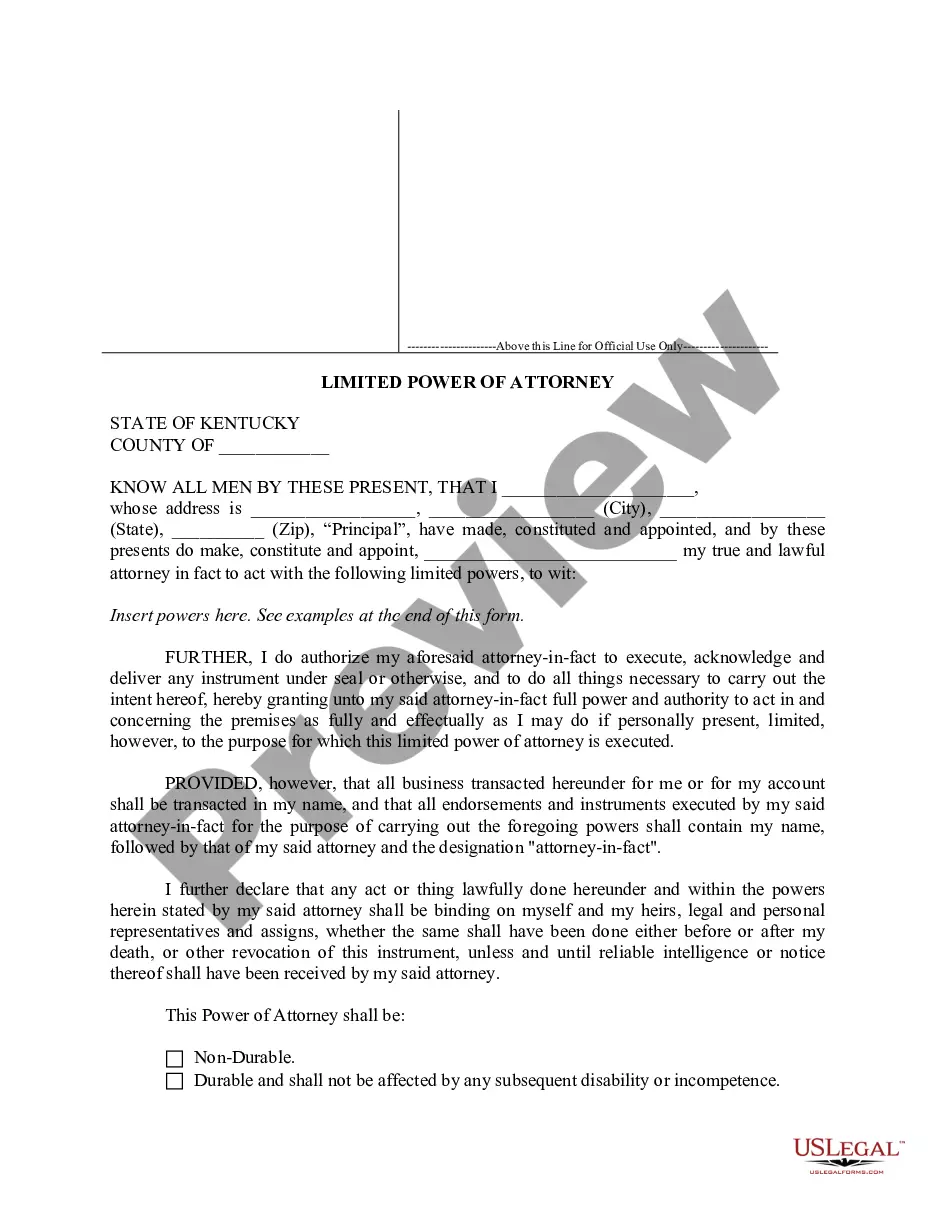

- Preview the form by clicking the Preview button to review its content.

Form popularity

FAQ

If you owe Kentucky state taxes, you may face penalties, interest on the unpaid amount, and potential legal action. It’s essential to address any tax debts proactively. Using the Kentucky Checklist - Action to Improve Collection of Accounts can provide steps to help you understand your liabilities and options for payment.

You can contact Kentucky revenue by visiting their official website for relevant contact details or calling their customer service directly. They provide assistance regarding questions about taxes and compliance. Additionally, using the Kentucky Checklist - Action to Improve Collection of Accounts can ensure all your inquiries are effectively addressed.

Receiving a letter from the Kentucky Department of Revenue may be due to various reasons, such as outstanding taxes, requests for additional information, or changes to your tax status. It is important to read the letter carefully and respond promptly. Following the Kentucky Checklist - Action to Improve Collection of Accounts can help you better understand your tax situation.

As of now, there are no official plans to eliminate Kentucky's state income tax. Legislative changes can occur, so it is advisable to stay updated through state news or official communications. For those managing income and taxes, consider the Kentucky Checklist - Action to Improve Collection of Accounts for insights on compliance.

To check the status of your Kentucky refund, visit the Kentucky Department of Revenue's official website. There, you will find tools to track your refund and receive updates on processing times. Following the Kentucky Checklist - Action to Improve Collection of Accounts can also ensure you correctly submit your information.

You can contact your Kentucky state representative through the Kentucky General Assembly's website. This site provides all the necessary contact information, including phone numbers and email addresses. Engaging with your representative using the Kentucky Checklist - Action to Improve Collection of Accounts can help you address specific tax concerns.

To contact the Kentucky Department of Revenue, you can visit their official website for contact information or call their customer service hotline. You will find dedicated resources to assist you with inquiries about tax collection and revenue services. Utilizing the Kentucky Checklist - Action to Improve Collection of Accounts may also guide you in understanding your tax obligations.

Improving receivables collection requires a strategic approach to both communication and process management. By following the Kentucky Checklist - Action to Improve Collection of Accounts, you can set clear terms and conditions to ensure transparency with your customers. Regular follow-ups and payment plans can also encourage timely payments. This comprehensive approach helps build trust while also recovering outstanding amounts.

The collection process typically involves several key steps, including invoicing, follow-up reminders, and negotiations. Utilizing the Kentucky Checklist - Action to Improve Collection of Accounts allows you to systemically approach each phase for better results. Start by sending clear invoices, then follow up regularly, and engage in constructive discussions with debtors. Each step contributes to effective collections.

To improve debtor collection, focus on clear communication and personalized outreach. The Kentucky Checklist - Action to Improve Collection of Accounts emphasizes understanding your debtors' circumstances and offering mutually agreeable solutions. Additionally, maintaining accurate records aids in tracking payments and managing relationships. This proactive approach can lead to increased collection success.