Kentucky Aging of Accounts Payable

Description

How to fill out Aging Of Accounts Payable?

If you intend to finalize, acquire, or generate sanctioned document templates, utilize US Legal Forms, the premier collection of legal forms, which can be accessed online.

Employ the website's straightforward and user-friendly search feature to find the documents you need.

A wide array of templates for business and personal purposes are categorized by types and regions, or keywords.

Step 4. Upon finding the form you need, click on the Get now option. Select your preferred pricing plan and provide your information to register for an account.

Step 5. Complete the payment process. You can use a credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Kentucky Aging of Accounts Payable with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to retrieve the Kentucky Aging of Accounts Payable.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have chosen the form for the correct city/state.

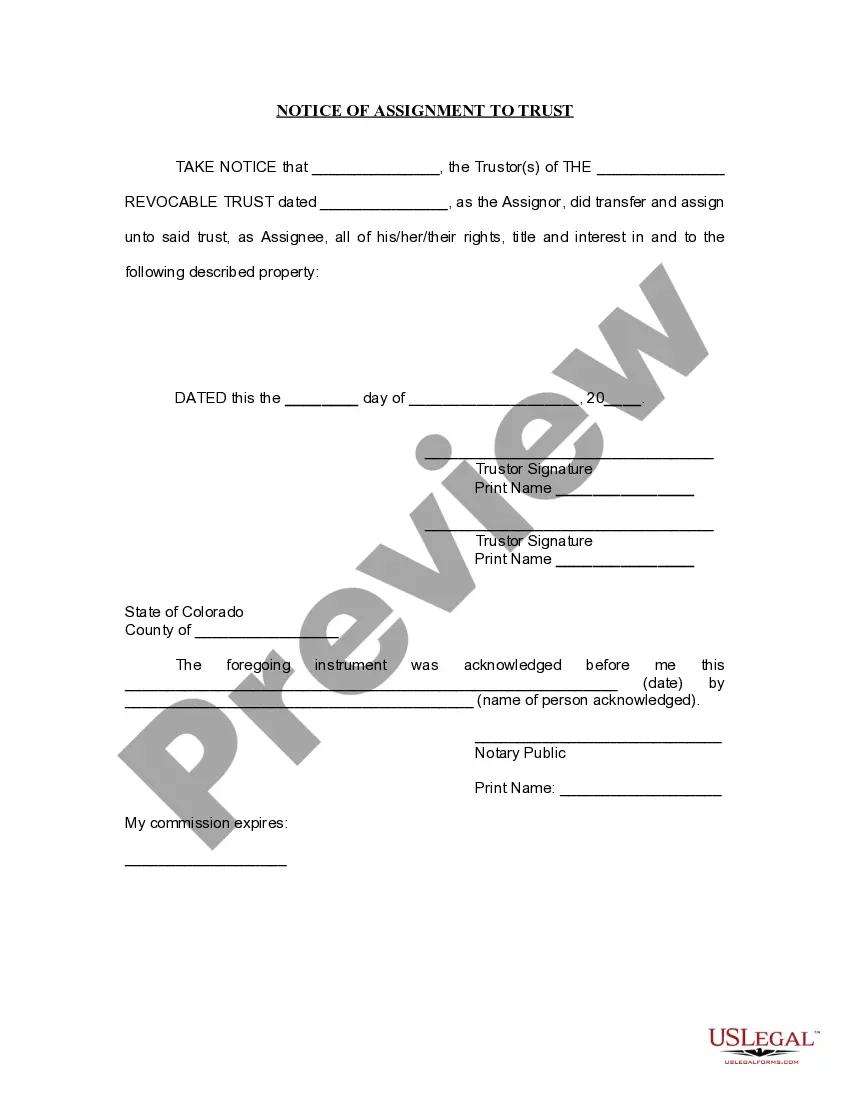

- Step 2. Utilize the Preview option to review the form's details. Remember to read through the summary.

- Step 3. If you are dissatisfied with the document, employ the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

An aging of accounts report highlights all unpaid invoices, grouped by time periods like 30, 60, or 90 days. This report aids in tracking overdue payments and managing liabilities effectively. Utilizing the aging of accounts report is crucial for understanding the Kentucky Aging of Accounts Payable and optimizing your payment strategies.

The aging schedule of accounts payable lists your unpaid invoices, grouped by the length of time they have been outstanding. This schedule offers a clear view of which payments are due soon and which are overdue, allowing you to take appropriate action. Managing the Kentucky Aging of Accounts Payable effectively can enhance your financial planning and operations.

To find the average age of accounts payable, first, gather your total accounts payable amount for a specific period. Next, divide this amount by your total purchases on credit during the same time frame. This calculation helps you understand the average time it takes to settle payments, a crucial aspect of the Kentucky Aging of Accounts Payable.

Claiming exemption from Kentucky withholding means your business is not required to withhold state income taxes from certain payments. This typically applies to specific organizations or situations as outlined by Kentucky tax guidelines. Understanding how this exemption interacts with your Kentucky Aging of Accounts Payable can help streamline your financial processes.

If your business operates in Kentucky and you owe taxes, it is likely that you need to file Form 720. To verify your filing requirements, assess your business structure and revenue. Keeping accurate Kentucky Aging of Accounts Payable records can also help determine whether you must submit this form.

The KY 740 form is the state's individual income tax return form for residents. If you earn income in Kentucky, filing this form is essential for ensuring compliance with state tax laws. It plays a role in managing your overall financial picture, which relates to your Kentucky Aging of Accounts Payable.

Form 720 in Kentucky serves as a tax reporting form used primarily by corporations and limited liability companies. It requires detailed information about your business's financial obligations, including those related to Kentucky Aging of Accounts Payable. Understanding this form can help you manage your tax liabilities better.

Any business entity operating in Kentucky must file Kentucky LLC tax returns, known as llet, according to its business structure. This includes sole proprietorships, partnerships, corporations, and limited liability companies. Properly filing the llet form is an important aspect of managing your Kentucky Aging of Accounts Payable effectively.

The purpose of Form 720 is to report and remit taxes such as the Corporate Limited Liability Entity Tax in the state of Kentucky. This form plays a crucial role in accurately managing your Kentucky Aging of Accounts Payable. Filing it on time contributes to good standing with the state and helps avoid any issues with your business finances.

KY Form 725 is an extension application related to the filing of Kentucky business taxes. It allows businesses to request an additional time to file their tax forms while ensuring that they meet their Kentucky Aging of Accounts Payable obligations. Using this form can provide needed flexibility for those managing high volumes of transactions.