Kentucky Assignment of Accounts Receivable

Description

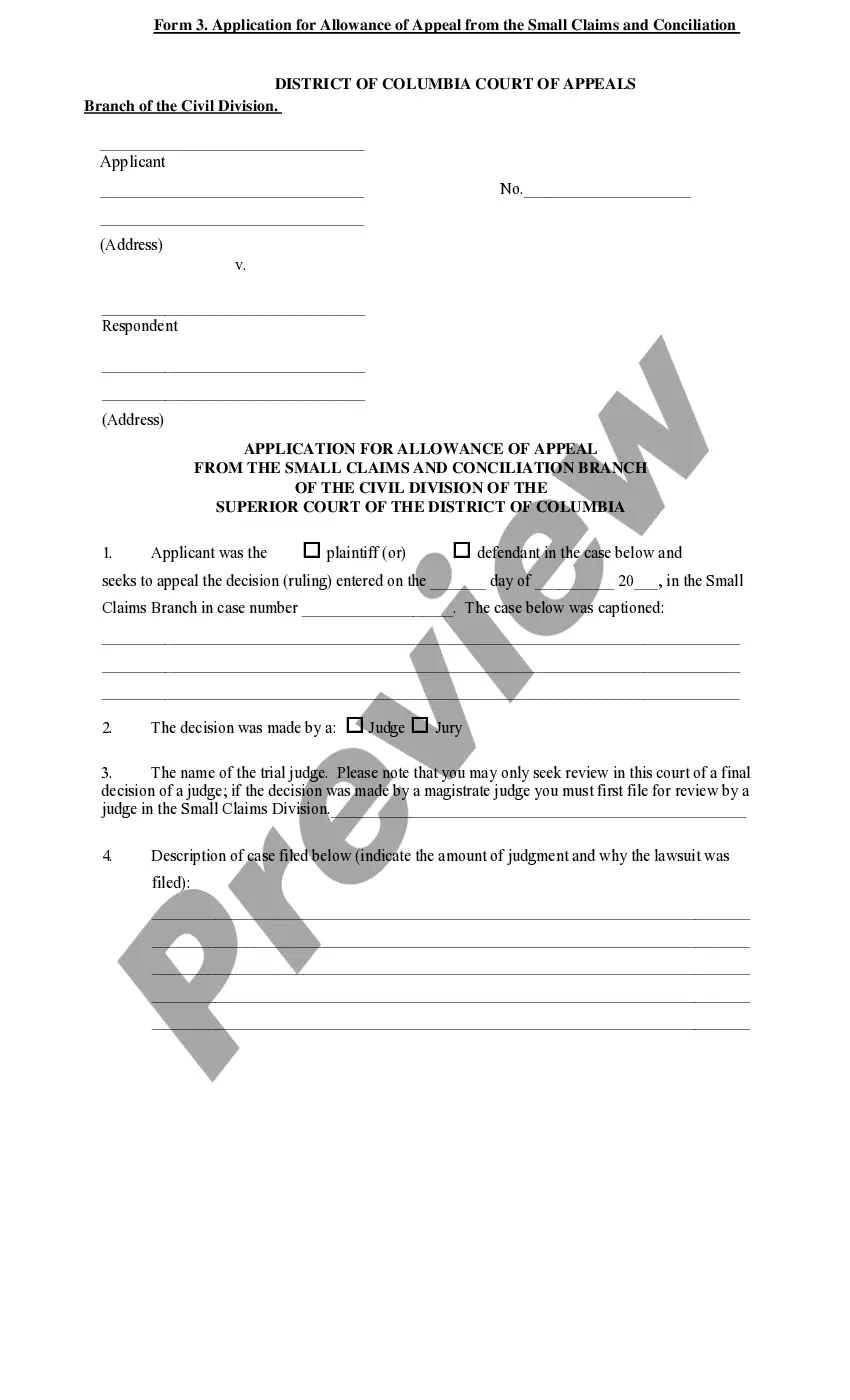

How to fill out Assignment Of Accounts Receivable?

Selecting the correct valid document template can be quite a challenge. Naturally, there are numerous templates available online, but how do you find the authentic form you need? Utilize the US Legal Forms website. This service provides a vast array of templates, including the Kentucky Assignment of Accounts Receivable, which can be utilized for both business and personal purposes. All documents are reviewed by specialists and comply with federal and state regulations.

If you are currently registered, Log In to your account and click the Download button to obtain the Kentucky Assignment of Accounts Receivable. Use your account to access the legal documents you have previously purchased. Go to the My documents section of your account and retrieve another copy of the document you need.

If you are a first-time user of US Legal Forms, here are straightforward steps for you to follow: First, ensure you have selected the appropriate form for your city/state. You can view the document by clicking the Review button and examine the form summary to confirm it is right for you. If the form does not meet your requirements, utilize the Search field to find the correct form. Once you are sure the document is suitable, click the Purchase now button to acquire it. Choose the payment plan you prefer and enter the necessary details. Create your account and complete the purchase using your PayPal account or credit card. Select the format and download the legal document template for your needs. Complete, revise, print, and sign the downloaded Kentucky Assignment of Accounts Receivable.

US Legal Forms is the largest repository of legal documents where you can find various document templates. Use the service to obtain properly crafted documents that meet state requirements.

- Selecting the right document template can be challenging.

- There are many templates available online.

- How do you find the authentic form you need.

- Utilize the US Legal Forms website.

- This service offers a wide variety of templates.

- All documents comply with regulations.

Form popularity

FAQ

Collection efforts for accounts receivable involve steps businesses take to recover funds owed to them. This process may include sending reminders, making calls, and negotiating payment plans. Understanding the Kentucky Assignment of Accounts Receivable can enhance your strategies in collecting debts. By leveraging the right tools, such as those provided by uslegalforms, you can streamline your collection process efficiently.

A notice of assignment of receivables is a formal document that informs all parties involved that accounts receivable have been assigned to another entity. This notice protects both the assignor and assignee by clarifying who has the right to collect payments. Utilizing the proper documentation, including a notice of assignment, is vital in the process of Kentucky Assignment of Accounts Receivable.

When you assign accounts receivable, you typically record a debit to the accounts receivable account and a credit to the assignment receivable account. This reflects the transfer of the receivable. The Kentucky Assignment of Accounts Receivable process ensures accurate documentation of these transactions, helping businesses maintain clear financial records.

When filing your Kentucky state tax return online, you do not need to mail anything as submissions are processed electronically. However, if you choose to file a paper return, you should refer to the specific mailing address provided on the Kentucky Department of Revenue's website. Ensure you follow the guidelines to avoid any issues. This is important for maintaining accurate records related to your Kentucky Assignment of Accounts Receivable.

An LLC in Kentucky is generally subject to a flat income tax rate on its revenues. The tax treatment may vary based on whether the LLC is classified as a sole proprietorship, partnership, or corporation. Understanding these distinctions helps you manage tax obligations effectively. For complete guidance on your Kentucky Assignment of Accounts Receivable, consider using services that can clarify these tax responsibilities.

Yes, Kentucky Form 725 can be filed electronically, which simplifies the process significantly. Many tax preparation software options support e-filing for this form. It's advisable to use official resources or trusted platforms to ensure that your submission is accurate and timely. This flexibility is particularly useful for your Kentucky Assignment of Accounts Receivable.

Filing Kentucky Form K-5 involves gathering your income details and filling out the required information accurately. You can either file it manually by mailing it to the Kentucky Department of Revenue or use an online filing service. This form is crucial for claiming various tax credits, so ensure you complete it with diligence. For assistance, US Legal Forms offers resources to simplify your Kentucky Assignment of Accounts Receivable process.

To mail Form 725 in Kentucky, you should send it to the Kentucky Department of Revenue. Ensure you use the address specific to your filing situation, as it can vary depending on whether you are sending in a payment. Properly label your envelope to avoid processing delays. This ensures that your Kentucky Assignment of Accounts Receivable is filed correctly.