Kentucky Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

It is possible to devote time on the Internet trying to find the legal file web template that suits the federal and state specifications you will need. US Legal Forms supplies a large number of legal varieties which are examined by professionals. You can easily acquire or print the Kentucky Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust from our service.

If you currently have a US Legal Forms account, it is possible to log in and click on the Down load option. Following that, it is possible to total, change, print, or indicator the Kentucky Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust. Each legal file web template you purchase is your own property eternally. To get yet another backup of any bought type, proceed to the My Forms tab and click on the related option.

If you use the US Legal Forms website for the first time, keep to the straightforward instructions under:

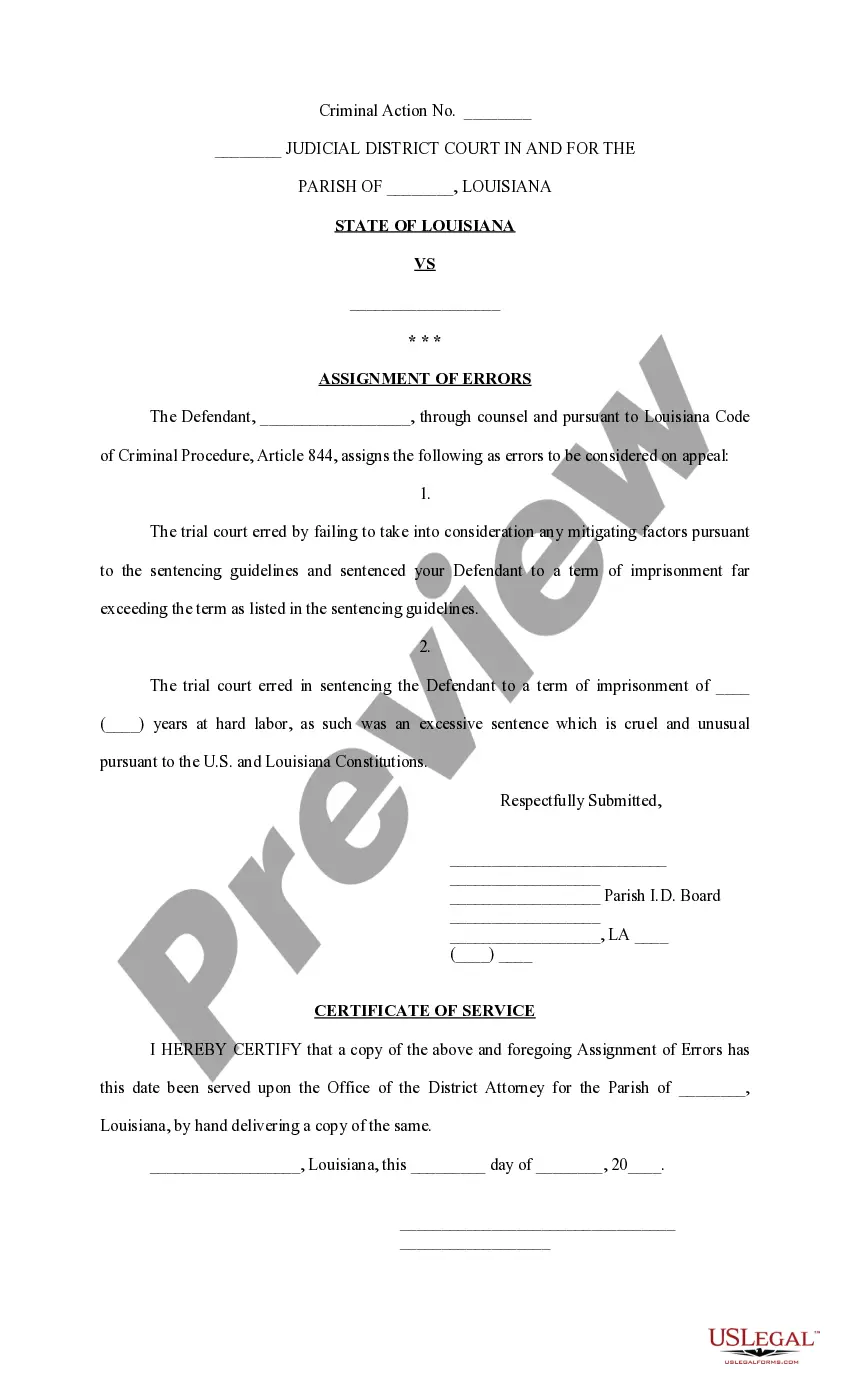

- Initially, make certain you have chosen the correct file web template for the state/town of your liking. Read the type explanation to ensure you have chosen the appropriate type. If available, make use of the Review option to look with the file web template at the same time.

- If you wish to discover yet another variation in the type, make use of the Look for discipline to discover the web template that meets your needs and specifications.

- Once you have located the web template you desire, click on Get now to carry on.

- Find the rates strategy you desire, key in your references, and sign up for a free account on US Legal Forms.

- Comprehensive the purchase. You can utilize your bank card or PayPal account to cover the legal type.

- Find the file format in the file and acquire it to your product.

- Make alterations to your file if required. It is possible to total, change and indicator and print Kentucky Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust.

Down load and print a large number of file web templates utilizing the US Legal Forms Internet site, that provides the largest variety of legal varieties. Use skilled and express-specific web templates to take on your organization or specific demands.

Form popularity

FAQ

In addition to reducing federal estate and income taxes, there are a few more reasons why a beneficiary may want to disclaim inherited assets: To avoid receiving undesirable real property, such as an eroding beachfront property or property with high real estate taxes that may take a long time to sell.

It is important to note that when an individual decides to disclaim an inheritance, they do not get to re-direct those assets to a person or entity of their choosing. The assets will pass on to the next beneficiary in line, as determined by the deceased person's will, trust, or by intestate law.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

When a person files a disclaimer he can disclaim all or any portion of the inheritance. It is not an ?all or nothing? proposition. For example, if the estate was $500,000, the beneficiary could disclaim $100,000 so that amount would pass to his children. The beneficiary would retain the remaining $400,000.

When you disclaim an inheritance, you will not receive the inheritance and it will instead pass onto the next Beneficiary. It is important to note that when you disclaim an inheritance, you do not get to choose who the Beneficiary will be in your place.

Declining An Inheritance When this occurs, the executor and the beneficiary can sign a legal document that disclaims their interest in the deceased estate. The executor can then give the gift to the next eligible beneficiary. The executor should consider the following legal points; 1.

If a decedent is survived solely by children, those children are afforded the entirety of the intestate estate, ing to Kentucky inheritance laws. Other than that, the children are given half of the estate if their deceased parent was married at the time of his or her death, ing to dower and curtesy laws.

When you disclaim an inheritance, you will not receive the inheritance and it will instead pass onto the next Beneficiary. It is important to note that when you disclaim an inheritance, you do not get to choose who the Beneficiary will be in your place.