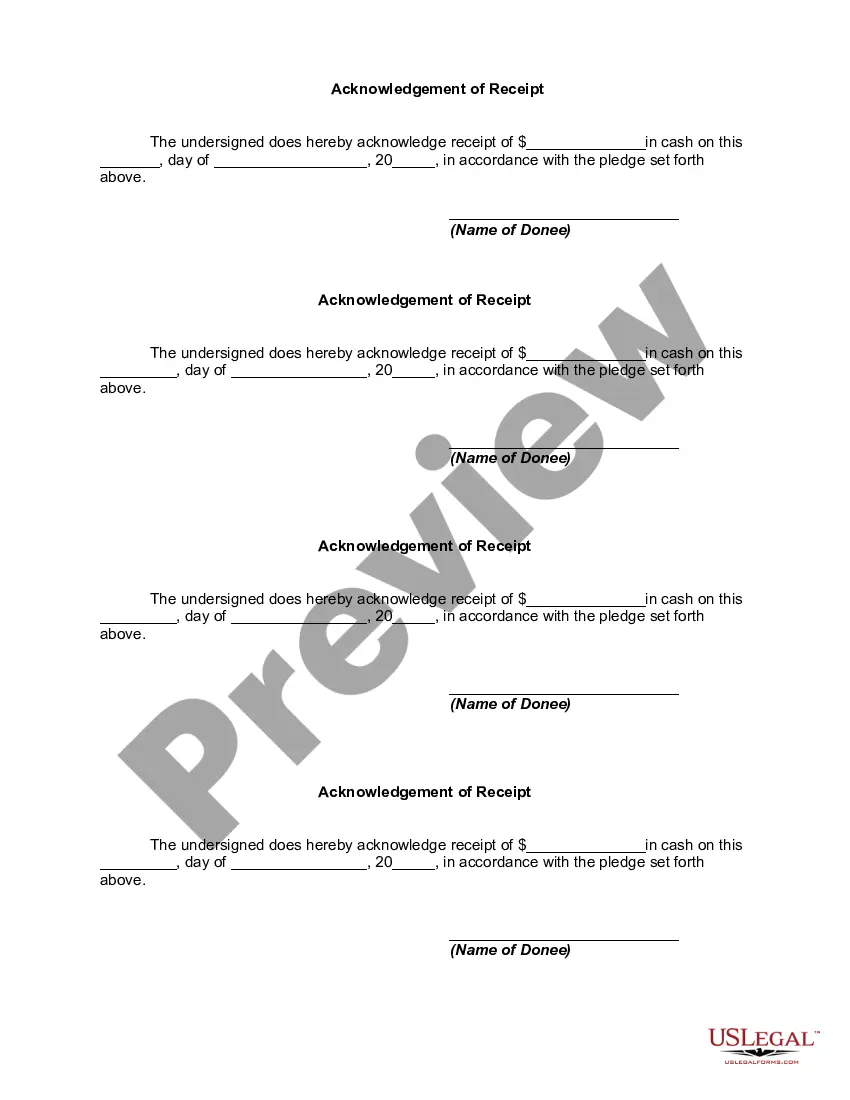

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kentucky Declaration of Gift Over Several Year Period

Description

How to fill out Declaration Of Gift Over Several Year Period?

Should you desire to acquire, download, or print licensed document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Capitalize on the site's user-friendly and convenient search feature to procure the documents you require.

A variety of templates for business and personal use are classified by categories and states or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose the payment plan you prefer and input your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to obtain the Kentucky Declaration of Gift Over Multiple Year Period with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to acquire the Kentucky Declaration of Gift Over Multiple Year Period.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to evaluate the form’s details. Always make sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

In Kentucky, the gift tax may not apply due to federal exemptions, but understanding the nuances of gift taxes is crucial. The Kentucky Declaration of Gift Over Several Year Period helps you to navigate these laws effectively. Generally, gifts below certain thresholds may be exempt, while larger gifts might require reporting. To ensure compliance and avoid unexpected surprises, using platforms like US Legal Forms can simplify the process and provide essential resources.

Yes, your parents can gift you $30,000, but it’s important to understand the implications of such a gift under Kentucky law. The Kentucky Declaration of Gift Over Several Year Period allows for substantial gifts without incurring gift tax, particularly if they fall within annual exclusions. However, if the total exceeds the annual exclusion limit, they may need to file a gift tax return. Consulting a tax professional can help clarify how this applies to your situation.

The statute of limitations related to gifts can vary depending on the context and legal implications. In the case of the Kentucky Declaration of Gift Over Several Year Period, it’s essential to be aware of the timelines as they can affect the validity of such gifts. Generally, this period might relate to any disputes or claims arising from the gift, which is typically up to five years in Kentucky. Always consult with a legal expert to understand how these timelines might affect your specific situation.

When you gift more than $15,000 in a year, you trigger a reporting requirement. You need to file a gift tax return to report the excess amount. The Kentucky Declaration of Gift Over Several Year Period can simplify this process by providing a framework for your gift documentation. This tool allows you to track your gifts and helps ensure you remain compliant with IRS regulations.

Gifting more than the annual exclusion may have tax implications. If you surpass this threshold, you must file a gift tax return, even if you do not owe any taxes. By following the Kentucky Declaration of Gift Over Several Year Period, you can efficiently track your gifts and manage your tax responsibilities. This organized approach helps you maintain compliance and reduce stress.

The IRS monitors gifts through various reporting requirements. If you exceed the annual exclusion amount, you must file a gift tax return, which provides transparency. Utilizing the Kentucky Declaration of Gift Over Several Year Period helps you document your gifts accurately, ensuring compliance with IRS regulations. This proactive measure safeguards you from potential tax issues.

In Kentucky, gift laws allow individuals to give gifts, but there are specific regulations to follow. The Kentucky Declaration of Gift Over Several Year Period can help you navigate these laws effectively. Understanding the state's rules will ensure that your gifts do not encounter legal complications. It is vital to be informed about both state and federal laws when planning your gifts.

If you exceed the gift tax exemption limits, you will need to report the excess on your gift tax return, utilizing the Kentucky Declaration of Gift Over Several Year Period. You could face a tax liability if the total gifts surpass the exemption threshold. However, the impact may vary depending on your overall financial strategy, so consulting an expert is advisable.

As of now, Form 709, the gift tax return, cannot be filed electronically. You will need to print and mail the form to the IRS, ensuring that your Kentucky Declaration of Gift Over Several Year Period is correctly documented. Always check the IRS website for any updates, as electronic filing options may evolve in the future.

You can file a gift tax return late within three years after the original due date without facing penalties. If you miss this window, you may still file, but be prepared for possible penalties and interest that may accrue. Addressing the Kentucky Declaration of Gift Over Several Year Period promptly can help mitigate these issues.