Kentucky General and Continuing Guaranty and Indemnification Agreement

Description

How to fill out General And Continuing Guaranty And Indemnification Agreement?

If you wish to finalize, acquire, or create sanctioned document templates, utilize US Legal Forms, the most extensive assortment of legal documents available online.

Employ the site's straightforward and convenient search feature to find the documents you require. Numerous templates for commercial and personal purposes are categorized by types and titles, or keywords.

Utilize US Legal Forms to locate the Kentucky General and Continuing Guaranty and Indemnification Agreement with just a few clicks.

Every legal document template you purchase belongs to you indefinitely. You can access all the forms you have saved in your account. Select the My documents section and choose a document to print or download again.

Complete, download, and print the Kentucky General and Continuing Guaranty and Indemnification Agreement with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to obtain the Kentucky General and Continuing Guaranty and Indemnification Agreement.

- You can also access documents you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

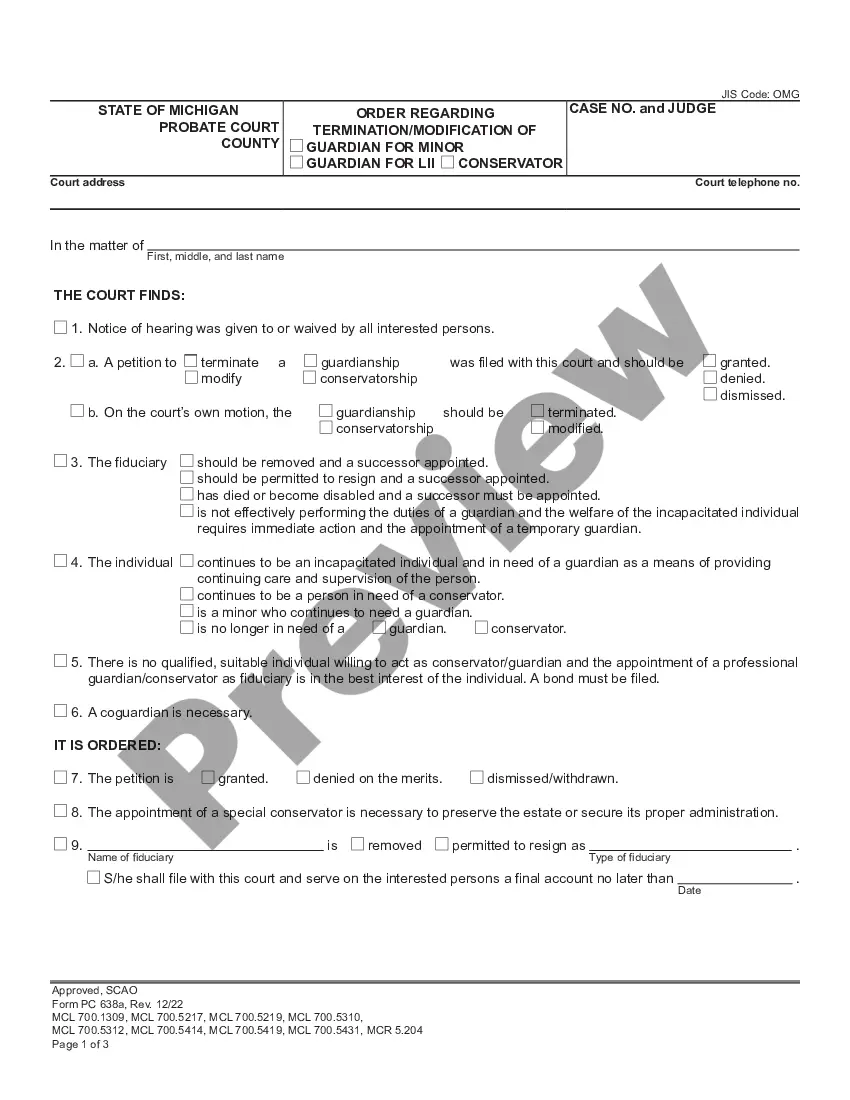

- Step 2. Utilize the Preview feature to review the document's content. Don't forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the form you need, click the Get now button. Choose your pricing plan and enter your information to create an account.

- Step 5. Complete the payment. You can use your credit card or PayPal account for the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Kentucky General and Continuing Guaranty and Indemnification Agreement.

Form popularity

FAQ

The Kentucky General and Continuing Guaranty and Indemnification Agreement outlines specific financial obligations between parties. A guaranty typically binds one party to fulfill another's contractual obligations if they default, while a guarantee can serve more broadly to assure performance. When drafting these agreements, clarity is essential to delineate responsibilities. Using a reliable platform like US Legal Forms can help you create a solid agreement that meets legal standards and protects your interests.

A continuing agreement refers to a contract that remains valid and enforceable over a longer duration, often covering multiple transactions. In the context of a Kentucky General and Continuing Guaranty and Indemnification Agreement, it means that the obligations outlined do not expire after a single transaction but extend to various debts incurred later on. This long-term commitment is beneficial for fostering trust between borrowers and lenders.

A continuing guarantee is an agreement that grants ongoing support for multiple transactions over a specified period. When you enter into a Kentucky General and Continuing Guaranty and Indemnification Agreement, you are establishing a structure that allows a creditor to call upon the guarantor for debts incurred at different times. This arrangement provides peace of mind for both parties, ensuring that obligations are met consistently.

A guarantee and indemnity form is a legal document that combines elements of both guaranteeing obligations and indemnifying against losses. It protects a party by ensuring another’s obligations are met while also covering potential financial damages. Utilizing the Kentucky General and Continuing Guaranty and Indemnification Agreement provides a robust framework that emphasizes the responsibilities of each party. If you need assistance drafting this form, platforms like uslegalforms can guide you through the necessary steps and requirements.

Yes, a guarantee is indeed a contract. In essence, it creates a legal obligation for the guarantor to assume responsibility for another party’s debts or obligations if they default. The Kentucky General and Continuing Guaranty and Indemnification Agreement exemplifies this type of contract, offering clarity and security in financial dealings. For anyone looking to establish such an agreement, using resources like uslegalforms can simplify the process and ensure compliance with state laws.

A continuing guaranty agreement is a legal arrangement where one party agrees to back the obligations of another party, ensuring they will fulfill their financial responsibilities. This type of agreement remains in force until explicitly terminated or until the obligations are met. The Kentucky General and Continuing Guaranty and Indemnification Agreement offers a clear structure for protecting creditors' interests while providing peace of mind to guarantors. It's a powerful tool in financial transactions, facilitating trust between involved parties.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

When the term indemnity is used in the legal sense, it may also refer to an exemption from liability for damages. Indemnity is a contractual agreement between two parties. In this arrangement, one party agrees to pay for potential losses or damages caused by another party.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.