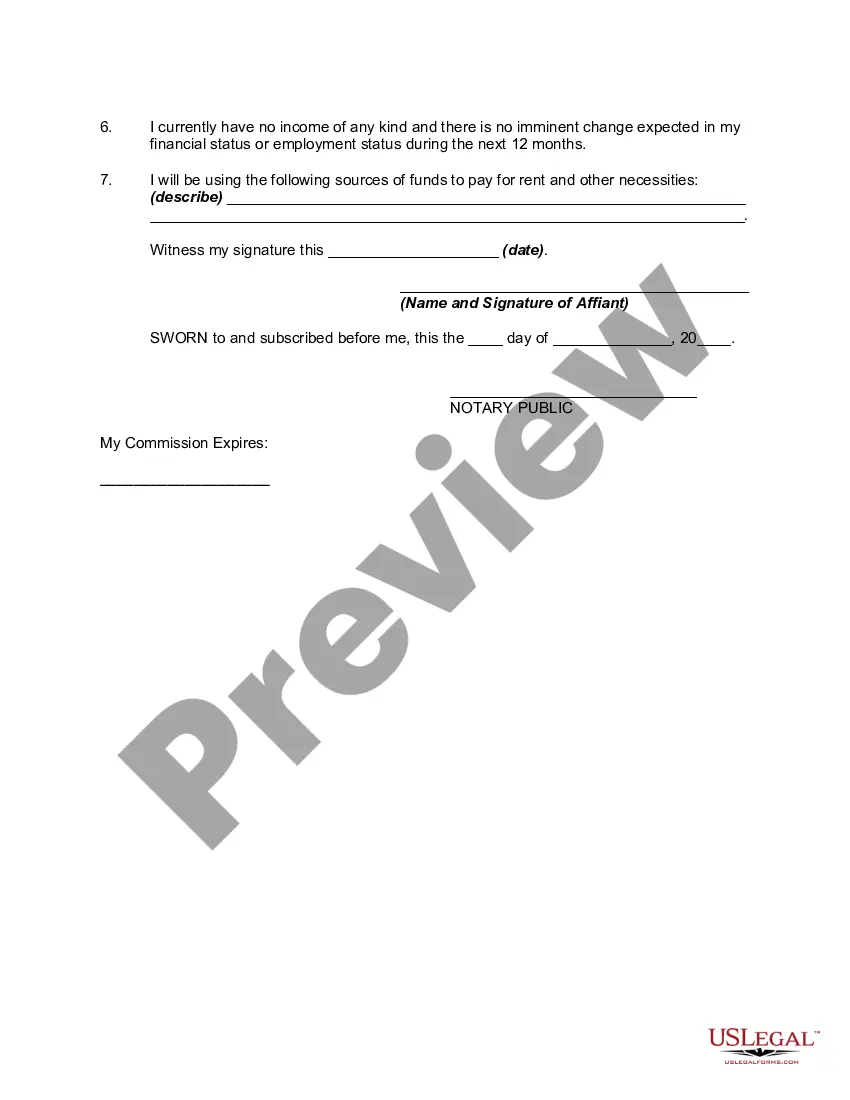

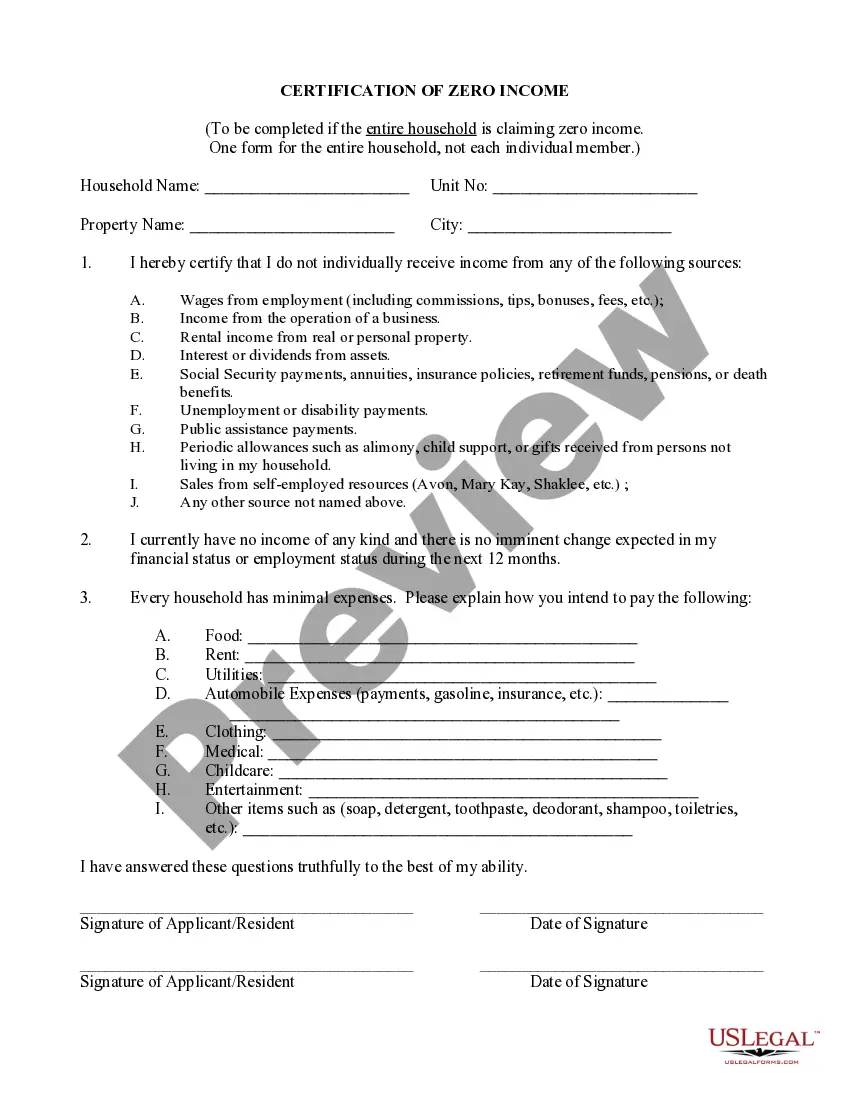

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kentucky Affidavit or Proof of No Income - Unemployed - Assets and Liabilities

Description

Form popularity

FAQ

The income limit to qualify for Medicaid in Kentucky depends on various factors, including household size. Unemployed individuals may find that the parameters allow them to apply, especially when they present a Kentucky Affidavit or Proof of No Income - Unemployed - Assets and Liabilities to substantiate their financial situation. Knowing these details can empower you to access vital healthcare services.

Eligibility for EBT in Kentucky generally includes individuals and families who meet certain income and resource guidelines. Unemployed residents may qualify, especially if they can provide a Kentucky Affidavit or Proof of No Income - Unemployed - Assets and Liabilities. It’s important to review specific criteria to determine if you can access these essential benefits.

The cut-off for food stamps in Kentucky varies based on family size and income level. For individuals seeking assistance, understanding these limits is critical for qualifying for food benefits. Individuals who are unemployed and need help may find themselves needing to submit a Kentucky Affidavit or Proof of No Income - Unemployed - Assets and Liabilities to validate their situation.

A PAFS 76 is a form used in Kentucky to assess an individual’s eligibility for financial assistance programs. It collects important information about income, resources, and living expenses, which is crucial for people who may need to submit a Kentucky Affidavit or Proof of No Income - Unemployed - Assets and Liabilities. Ensuring that this form is accurately completed can significantly affect your access to necessary support.

A community support associate in Kentucky plays a vital role in connecting individuals with various resources and services. They assist people who may be unemployed or require proof of their assets and liabilities to qualify for support programs. This position is essential in helping individuals navigate their options, especially when dealing with a Kentucky Affidavit or Proof of No Income - Unemployed - Assets and Liabilities.

If you receive income from Kentucky while residing in another state, filing a nonresident Kentucky tax return becomes necessary. This applies to various income types, including wages and rental income. To simplify this process, a Kentucky Affidavit or Proof of No Income - Unemployed - Assets and Liabilities could assist in clarifying your income status during your filing.

Exemptions from Kentucky income tax may apply to individuals under specific income levels or those receiving particular government benefits. Furthermore, those who can demonstrate their financial hardship through a Kentucky Affidavit or Proof of No Income - Unemployed - Assets and Liabilities could find themselves exempt from certain obligations, making it important to seek clarity on your personal circumstances.

In Kentucky, some income types, such as certain social security benefits and child support payments, are not subject to tax. If you're unemployed, utilizing a Kentucky Affidavit or Proof of No Income - Unemployed - Assets and Liabilities might help in documenting your financial situation for various processes, including potential income assessments.

Certain groups may hold tax-exempt status in Kentucky, including non-profit organizations, specific government entities, and sometimes individuals meeting income criteria. Understanding the stipulations around these exemptions is crucial for maintaining compliance. For further guidance, a Kentucky Affidavit or Proof of No Income - Unemployed - Assets and Liabilities could provide clarity on your rights.

If you earn income from Kentucky sources but are not a resident, you will likely need to file a non-resident tax return. This requirement can arise from various activities, such as working or owning rental property in the state. Utilizing a Kentucky Affidavit or Proof of No Income - Unemployed - Assets and Liabilities can clarify your situation and help in the filing process.