Kentucky Owner Financing Contract for Land

Description

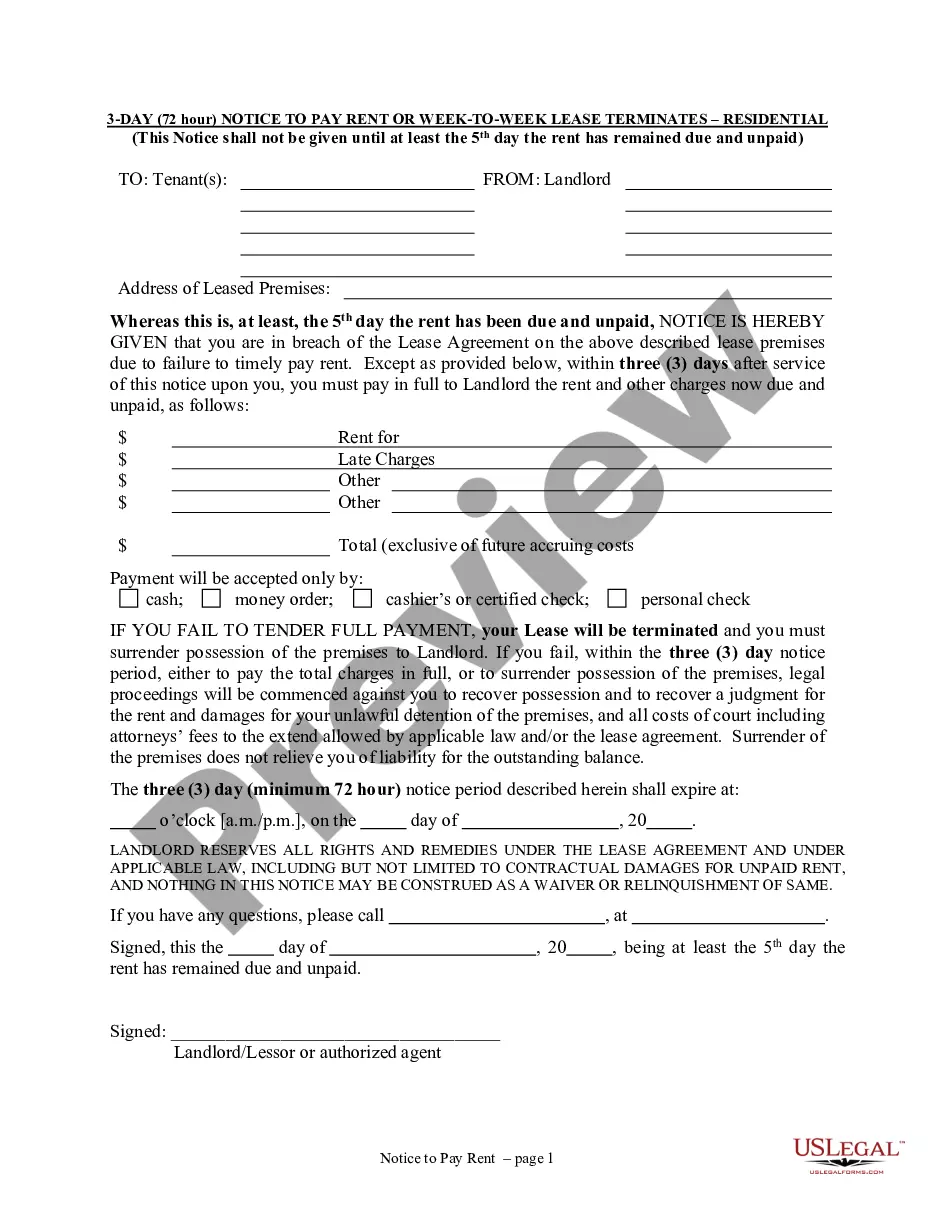

How to fill out Owner Financing Contract For Land?

You can dedicate several hours online trying to locate the legal document template that satisfies the federal and state requirements you seek.

US Legal Forms provides numerous legal documents that are reviewed by specialists.

It is easy to acquire or print the Kentucky Owner Financing Contract for Land from our platform.

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Obtain button.

- Afterward, you can fill out, modify, print, or sign the Kentucky Owner Financing Contract for Land.

- Each legal document template you receive is your own forever.

- To acquire another copy of any form you’ve obtained, visit the My documents section and click the appropriate button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you’ve selected the correct document template for the state/city of your choice.

- Read the form description to confirm you’ve chosen the right one.

Form popularity

FAQ

Owner financing can be a beneficial option for purchasing land in Kentucky, particularly for buyers with limited financing options. It allows for more flexible terms and potentially quicker transactions. However, both sellers and buyers should carefully evaluate the terms, risks, and their financial situations before proceeding.

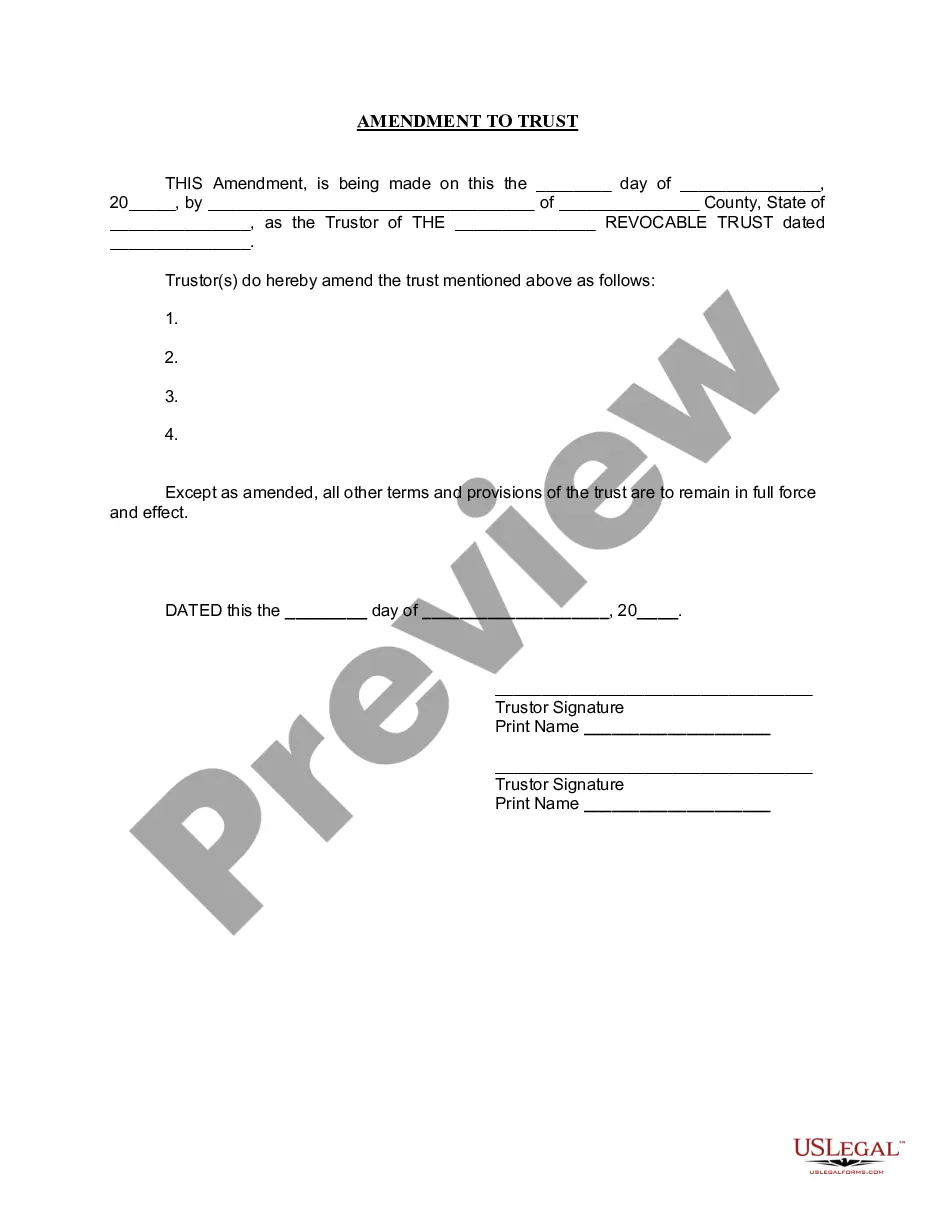

In Kentucky, a land contract must clearly outline the terms of sale, including payment amounts, interest rates, and the time period for repayment. Both parties should agree on maintenance responsibilities and property taxes during the contract term. It's important to have these terms documented to avoid misunderstandings.

To write up an owner finance contract, start by drafting a clear and concise agreement that includes all fundamental elements such as buyer and seller information, property details, and payment terms. Be sure to incorporate a provision for default consequences, including late fees or repossession rights. Consider leveraging resources from US Legal Forms to access professionally designed templates for a Kentucky Owner Financing Contract for Land, ensuring compliance and clarity.

Yes, financing land in Kentucky is certainly possible through various means. Traditional banks, credit unions, and private lenders all provide financing options. Furthermore, owner financing is increasingly popular, allowing buyers to work directly with sellers to create mutually beneficial agreements. Using a Kentucky Owner Financing Contract for Land can help finalize this arrangement effectively.

To obtain owner financing on land, start by identifying properties for sale that offer this financing option. Once you find a suitable property, engage with the seller to discuss terms and negotiate the payment structure. Drafting a Kentucky Owner Financing Contract for Land is essential to ensure both parties agree on the conditions and responsibilities involved in the transaction.

While obtaining 100% financing for land can be challenging, some options may be available. Certain programs or private lenders might offer higher financing ratios based on individual circumstances. Alternatively, owner financing may allow for low or no down payment terms, making it an appealing choice for some buyers in Kentucky. A comprehensive Kentucky Owner Financing Contract for Land can facilitate this process.

To secure financing for land in Kentucky, start by researching available lenders who specialize in land loans. Gather necessary documentation such as income verification and credit history. Consider exploring owner financing options, as they often require less stringent qualifications. A Kentucky Owner Financing Contract for Land can outline the terms that suit both you and the seller.

Yes, you can finance land in Kentucky. Various lenders offer loans specifically tailored for land purchases. Additionally, owner financing is a popular alternative, providing flexibility in payment terms and allowing buyers to negotiate directly with sellers. This is where a Kentucky Owner Financing Contract for Land can be beneficial.

Yes, in Kentucky, it is necessary to record a deed to protect your rights and interests in the property. Recording a deed provides public notice and establishes a clear chain of title. The same concept applies to a Kentucky Owner Financing Contract for Land; both instruments ensure that your ownership is recognized legally. Consulting with a knowledgeable service can assist you in navigating the recording process smoothly.

While it is not required to record a land contract in Kentucky, doing so offers several benefits. Recording provides public notice of your ownership and can prevent legal disputes regarding property rights. For a Kentucky Owner Financing Contract for Land, this action helps solidify your legal standing. Consequently, consider recording to safeguard your investment.