A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kentucky Receipt by Trustor for Trust Property Upon Revocation of Trust

Description

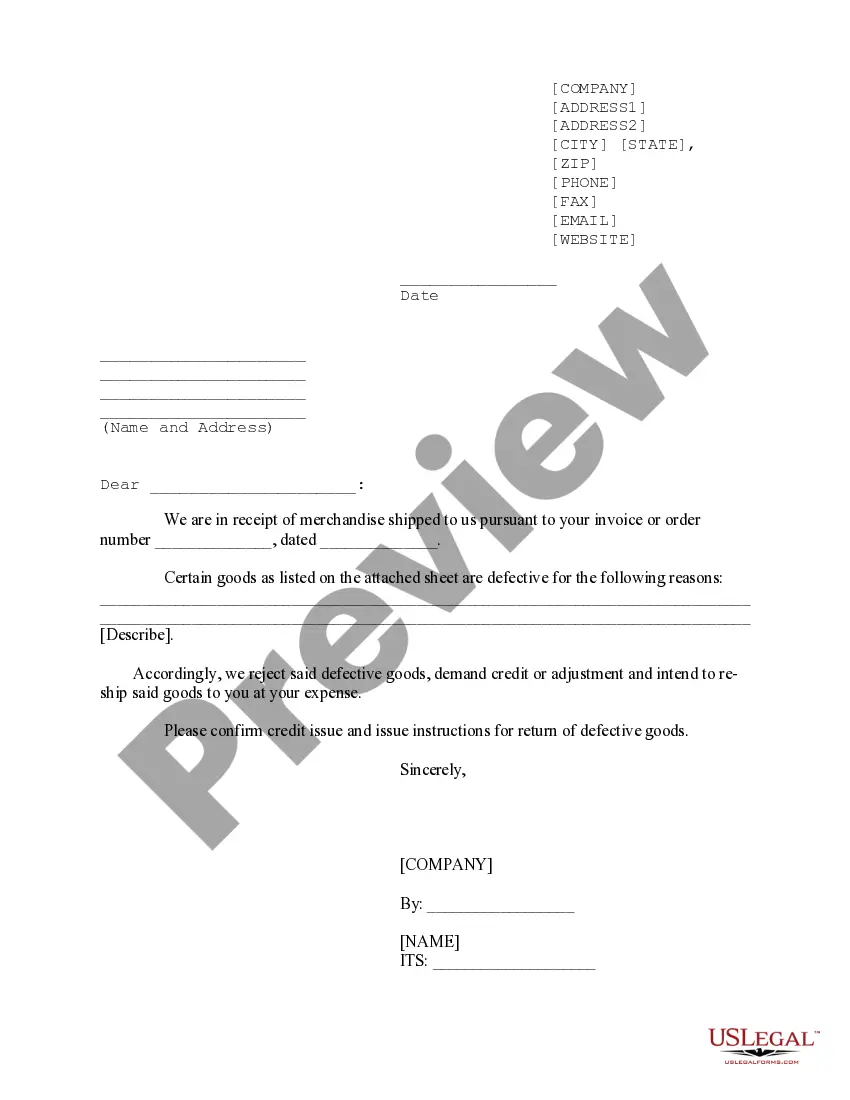

How to fill out Receipt By Trustor For Trust Property Upon Revocation Of Trust?

If you need to finalize, obtain, or print approved document templates, utilize US Legal Forms, the largest assortment of legal forms, which are accessible online.

Take advantage of the site's straightforward and convenient search to find the documents you need. Various templates for business and personal applications are categorized by types, states, or keywords.

Use US Legal Forms to acquire the Kentucky Receipt by Trustor for Trust Property Upon Revocation of Trust in just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Kentucky Receipt by Trustor for Trust Property Upon Revocation of Trust.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Kentucky Receipt by Trustor for Trust Property Upon Revocation of Trust.

- You can also find forms you previously saved under the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions outlined below.

- Step 1. Verify that you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Don't forget to read the information carefully.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. After you locate the form you need, click the Get Now button. Choose your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

Yes, you can take things out of a trust, but the process must be approached carefully. This usually involves formal paperwork to document the withdrawal, aligning with your state's regulations. The Kentucky Receipt by Trustor for Trust Property Upon Revocation of Trust serves as a key document in this process, making it clear that the assets are no longer part of the trust.

To remove assets from a trust, you often need to execute a formal amendment or revocation, depending on the type of trust. Documenting the removal is crucial, as this prevents disputes or confusion later. Consider creating the Kentucky Receipt by Trustor for Trust Property Upon Revocation of Trust as a record, ensuring that all parties involved are aware of the asset's status.

Yes, you can remove an asset from a trust. The trustor has the authority to revoke the trust or amend its terms to facilitate the removal of specific assets. However, this process must be handled carefully, following state laws and regulations. Utilizing the Kentucky Receipt by Trustor for Trust Property Upon Revocation of Trust can provide legal proof of your intent during this process.

When a trust is revoked, the assets that were previously held in the trust return to the trustor. This change effectively dissolves the legal arrangement and transfers control back to the original owner. It’s important to document this revocation properly, including the Kentucky Receipt by Trustor for Trust Property Upon Revocation of Trust to ensure that all parties understand the change in asset ownership.

One of the biggest mistakes parents make when setting up a trust fund is not clearly defining their intentions regarding the distribution of assets. Without a clear plan, children may face confusion or conflicts later on. It's essential to communicate your wishes and make sure the trust document reflects them accurately. Using the Kentucky Receipt by Trustor for Trust Property Upon Revocation of Trust can help clarify these intentions.

When a trust is revoked, all assets revert back to the trustor. This transition is documented through a Kentucky Receipt by Trustor for Trust Property Upon Revocation of Trust, which ensures a clear record of the assets' return. Upon revocation, the trustor can freely decide how to handle the assets, whether to sell, distribute, or reassign them. Utilizing platforms like US Legal Forms can streamline this process, keeping everything organized and legally sound.

In a trust, the trustor retains ownership of the property while alive. The trustee manages the property on behalf of the beneficiaries, as outlined in the trust document. During the trustor's lifetime, they can modify or revoke the trust, maintaining ultimate control over the assets. A Kentucky Receipt by Trustor for Trust Property Upon Revocation of Trust reinforces this ownership transfer process and protects the trustor’s interests.

While revocable trusts offer flexibility, certain assets should typically be avoided. For example, you should not place your retirement accounts or life insurance policies in a revocable trust, as this can complicate beneficiary designations. Additionally, placing assets that you need frequent access to can introduce unnecessary complexities. Always seek advice to ensure your Kentucky Receipt by Trustor for Trust Property Upon Revocation of Trust is well-structured.

When a trust is dissolved, the assets held within the trust are returned to the trustor. This process involves creating a Kentucky Receipt by Trustor for Trust Property Upon Revocation of Trust, which documents the transfer of ownership. The trustor then has full control over the assets again, allowing for reallocation or distribution according to their wishes. It's essential to consult legal resources or platforms like US Legal Forms for guidance in managing these processes.

The 5 year rule for trusts refers to a tax provision related to the treatment of gifted assets. Essentially, it states that any transfers made to a trust within five years of the owner's death may be included in the gross estate for tax purposes. Understanding this rule is crucial if you are planning a trust and want to manage your estate efficiently. The Kentucky Receipt by Trustor for Trust Property Upon Revocation of Trust is a key document that can assist in this process, ensuring that all assets are properly accounted for.