Kentucky Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

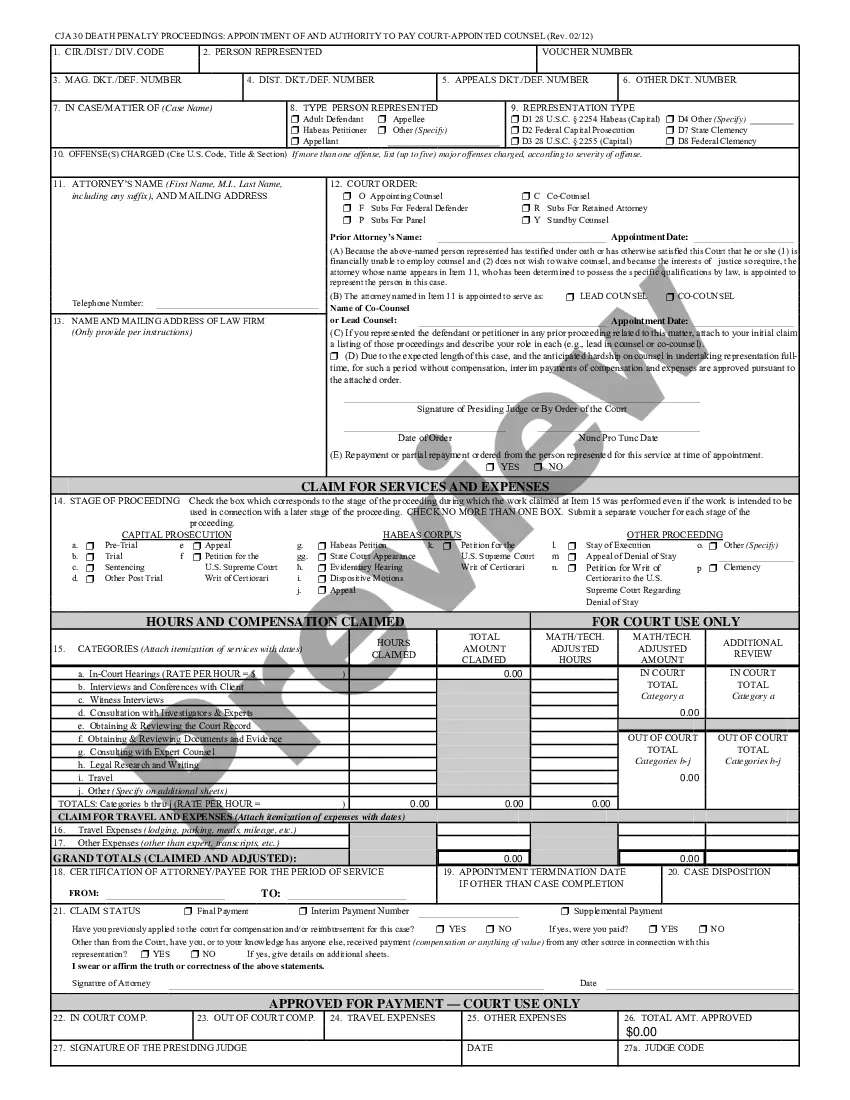

How to fill out Agreement For Sale Of Retail Store By Sole Proprietorship With Goods And Fixtures At Invoice Cost Plus Percentage?

You can allocate time on the web attempting to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers numerous legal documents that have been reviewed by experts.

You can download or print the Kentucky Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage from their services.

If available, use the Preview option to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can fill out, amend, print, or sign the Kentucky Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage.

- Every legal document template you purchase is yours indefinitely.

- To get another copy of any purchased form, navigate to the My documents section and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow these simple steps.

- First, ensure you have selected the correct document template for your preferred area/city.

- Check the form description to confirm you have picked the right document.

Form popularity

FAQ

Certain goods are exempt from sales and use tax including coal and other energy-producing fuels, certain medical items, locomotives or rolling stock, certain farm machinery and livestock, certain seeds and farm chemicals, machinery for new and expanded industry, tombstones, textbooks, property certified as an alcohol

Ice and Bottled Water: The sale of ice and unflavored bottled water are not subject to sales and use tax per the definition of food and food ingredients. Pursuant to KRS 139.485(2), food includes substances, whether in liquid, concentrated, solid, frozen, dried, or dehydrated form, that are sold for ingestion or

California sales tax overviewSales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. California first adopted a general state sales tax in 1933, and since that time, the rate has risen to 7.25 percent.

Retail sales of tangible items in California are generally subject to sales tax. Examples include furniture, giftware, toys, antiques and clothing. Some labor service and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new personal property.

The GST is imposed on the supply of taxable property and services in the remaining provinces and territories, with the addition of a provincial sales tax or a retail tax depending on the jurisdiction. There is no provincial sales tax in Alberta or in Canada's three territories.

Traditional Goods or Services Goods that are subject to sales tax in Kentucky include physical property, like furniture, home appliances, and motor vehicles. Groceries, prescription medicine, and gasoline are all tax-exempt. Some services in Kentucky are subject to sales tax.

The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer. Alimony payments (for divorce decrees finalized after 2018)

Goods that are subject to sales tax in Kentucky include physical property, like furniture, home appliances, and motor vehicles. Groceries, prescription medicine, and gasoline are all tax-exempt. Some services in Kentucky are subject to sales tax.

Traditional Goods or Services Goods that are subject to sales tax in Kentucky include physical property, like furniture, home appliances, and motor vehicles. Groceries, prescription medicine, and gasoline are all tax-exempt.

Sales Tax Exemptions in Kentucky Also exempt are security lighting products, wrapping and packaging materials, certain containers, and any property which is used in the publication of newspapers.