Kentucky Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check)

Description

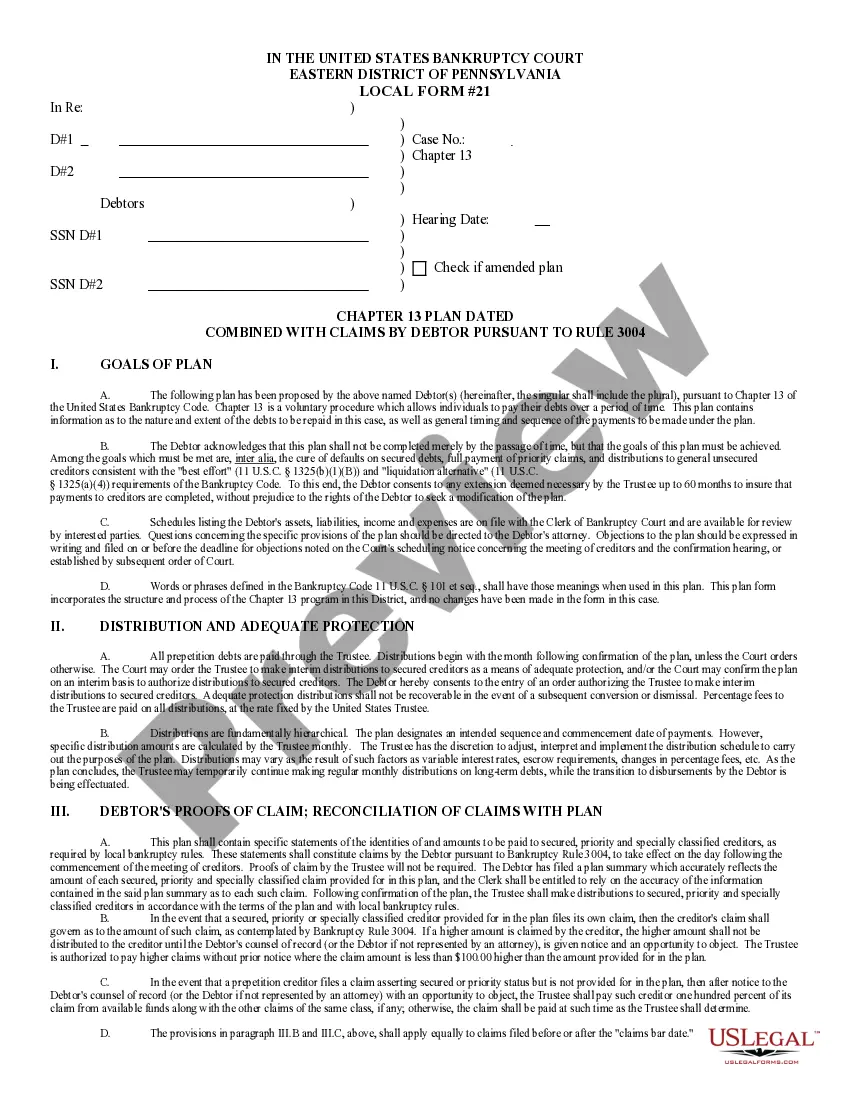

How to fill out Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

Are you currently inside a place that you require documents for sometimes organization or individual uses nearly every day time? There are a lot of authorized document themes accessible on the Internet, but finding types you can trust is not straightforward. US Legal Forms gives a huge number of develop themes, like the Kentucky Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check), that are created to meet federal and state specifications.

In case you are previously familiar with US Legal Forms internet site and have your account, basically log in. After that, it is possible to down load the Kentucky Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) template.

Unless you come with an bank account and wish to begin using US Legal Forms, adopt these measures:

- Obtain the develop you want and ensure it is to the right town/county.

- Use the Preview button to analyze the shape.

- Browse the information to actually have chosen the proper develop.

- In the event the develop is not what you are searching for, make use of the Lookup area to obtain the develop that meets your needs and specifications.

- When you get the right develop, click on Purchase now.

- Pick the costs strategy you want, complete the desired information to create your money, and buy an order using your PayPal or bank card.

- Pick a handy data file file format and down load your backup.

Discover all of the document themes you may have bought in the My Forms menus. You may get a additional backup of Kentucky Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) anytime, if required. Just go through the essential develop to down load or produce the document template.

Use US Legal Forms, one of the most substantial variety of authorized kinds, to conserve time as well as stay away from faults. The services gives skillfully produced authorized document themes which can be used for a range of uses. Produce your account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

It is also a crime to forge a check or write a check. If you believe you are a victim of a crime, report this to your police department, sheriff's office, or district attorney's office. You may also sue someone who writes you a bad check without having a valid reason for doing so.

It is also a crime to forge a check or write a check. If you believe you are a victim of a crime, report this to your police department, sheriff's office, or district attorney's office. You may also sue someone who writes you a bad check without having a valid reason for doing so.

If someone writes you a check that bounces after you deposit it, your bank can reverse the deposit and charge you an NSF fee or ?returned item? fee. If you want to retrieve the money from the writer of the check, it's up to you to take care of it.

Prosecution of check writers should begin as soon as possible after the check was issued. The statute of limitations is one year for checks under $1,000 and is considered a misdemeanor. Checks over $1,000 are felonies and do not fall within a statute of limitations.

When a check bounces, it will be returned unpaid to your bank, and you'll likely face fees. If a check bounces, it means that there was not enough money in your bank account to fund the check. The person attempting to cash the check won't receive their funds and may even have to deal with additional fees.

Generally, if your bank credited your account, it can later reverse the funds if the check is found to be fraudulent. You should check your deposit account agreement for information on the bank's policies regarding fraudulent checks. Fraudulent checks may be part of an overpayment/money order scam.

A bad check crime refers to the act of issuing a check knowing that there are insufficient funds in the account to cover the amount of the check. This is also known as check fraud or bouncing a check.

However, if you intentionally bounce bad checks, you could face criminal prosecution and jail time. In other words, PC 476a makes it a theft crime to present a check to a business when you know there are insufficient funds in the account ? and you had the intent to commit fraud.