Kentucky Exclusive Supply Agreement

Description

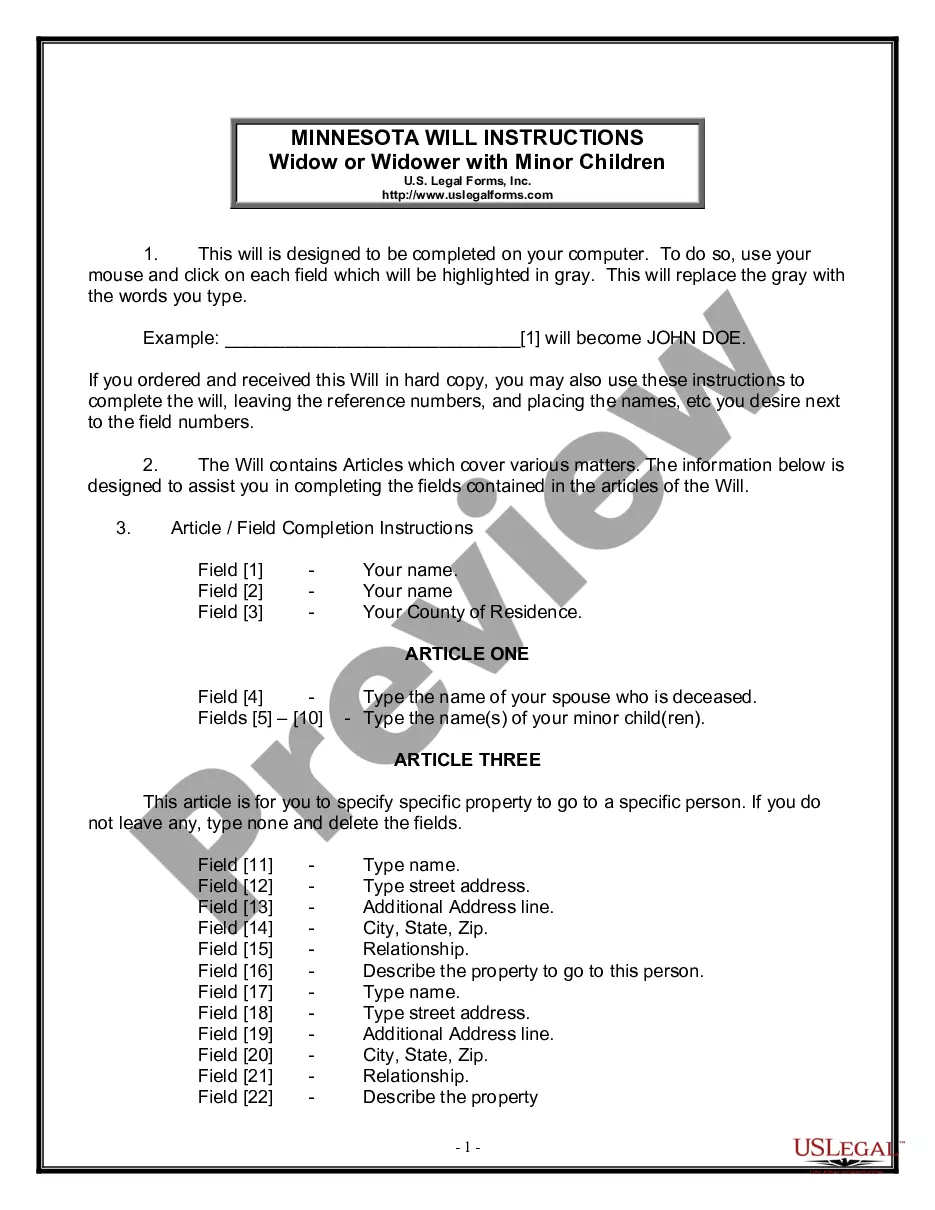

How to fill out Exclusive Supply Agreement?

If you aim to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms, which can be accessed online.

Make use of the site’s straightforward and user-friendly search to locate the documents you require.

A range of templates for business and personal applications are sorted by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the payment process. You can use your Visa or MasterCard or PayPal account to finalize the transaction.Step 6. Choose the format of the legal form and download it to your system.Step 7. Fill out, modify, and print or sign the Kentucky Exclusive Supply Agreement.

- Use US Legal Forms to obtain the Kentucky Exclusive Supply Agreement with just a couple of clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to download the Kentucky Exclusive Supply Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Review option to examine the form's content. Don’t forget to read the description.

- Step 3. If you are unhappy with the form, use the Lookup section at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

To make your own agreement, first, understand what you want to achieve from this contract. Write down the essential terms, including obligations, rights, and timelines. Make sure to use clear and unambiguous language to avoid misunderstandings. Using a template for a Kentucky Exclusive Supply Agreement can help you create a solid foundation and ensure compliance with relevant laws.

To become a vendor for the state of Kentucky, you must register with the state's procurement portal and complete the necessary application requirements. It helps to familiarize yourself with state bidding opportunities and regulations. By building relationships and demonstrating reliability, you can enhance your chances of being awarded contracts. Being proactive about understanding the Kentucky Exclusive Supply Agreement can also benefit your vendor application.

The current Secretary of Finance and Administration in Kentucky oversees financial management for the state. This position is crucial for maintaining budgetary integrity and fiscal responsibility. While this role does not directly relate to a Kentucky Exclusive Supply Agreement, understanding the state's financial leadership can provide insight into legislative resources and support available for businesses.

To obtain a Kentucky resale certificate, you must complete the appropriate registration form with the Kentucky Department of Revenue. This certificate enables you to make tax-exempt purchases for resale purposes. If you are planning to engage in multiple sales as part of your Kentucky Exclusive Supply Agreement, acquiring this certificate is a smart move to reduce upfront costs.

Nexus in Kentucky is created through various actions, including physical presence, employees, and having sales exceeding a certain threshold. Engaging in activities such as advertising or conducting business meetings within the state can also contribute to establishing Nexus. Understanding what creates Nexus is essential when forming a Kentucky Exclusive Supply Agreement, as it can affect tax responsibilities.

If you earn income in Kentucky and you are a nonresident, you are likely required to file a nonresident Kentucky tax return. This requirement ensures that any taxes owed on income generated within the state are properly accounted for. By addressing these obligations, you can protect yourself when entering into agreements, including a Kentucky Exclusive Supply Agreement.

In Kentucky, the tax rate can vary based on several factors. After federal and state taxes are considered, the amount you take home from a $100,000 salary may be significantly less. It is wise to factor this into any financial agreements, including a Kentucky Exclusive Supply Agreement, to ensure you maintain profitability.

Yes, having an employee in Kentucky typically creates Nexus for your business. This means your business must comply with Kentucky tax laws, including sales tax collection. It’s important to reflect this consideration in any Kentucky Exclusive Supply Agreement you enter to ensure compliance with local regulations.

Nexus refers to the level of connection your business has with Kentucky that requires it to collect sales tax. Generally, Nexus is established through physical presence, such as having an office, warehouse, or employees in the state. Understanding Nexus is crucial when drafting your Kentucky Exclusive Supply Agreement, as it will impact your tax obligations.

To become a vendor in Kentucky, start by registering your business with the Kentucky Secretary of State. You'll need to gather necessary documents, including any licenses that pertain to your area of operations. Once registered, consider entering into a Kentucky Exclusive Supply Agreement with established businesses to broaden your opportunities and enhance your visibility.