Kentucky Loan Agreement - Long Form

Description

How to fill out Loan Agreement - Long Form?

If you need to finalize, obtain, or create sanctioned document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Take advantage of the website's straightforward and convenient search function to locate the documents you require.

Various templates for corporate and personal purposes are categorized by types and jurisdictions, or keywords. Use US Legal Forms to find the Kentucky Loan Agreement - Long Form in just a few clicks.

Every legal document format you acquire is yours forever. You have access to every form you downloaded within your account. Navigate to the My documents section and choose a form to print or download again.

Stay competitive and obtain, and print the Kentucky Loan Agreement - Long Form with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and then click the Obtain button to access the Kentucky Loan Agreement - Long Form.

- You can also retrieve forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm you have selected the form for the correct city/state.

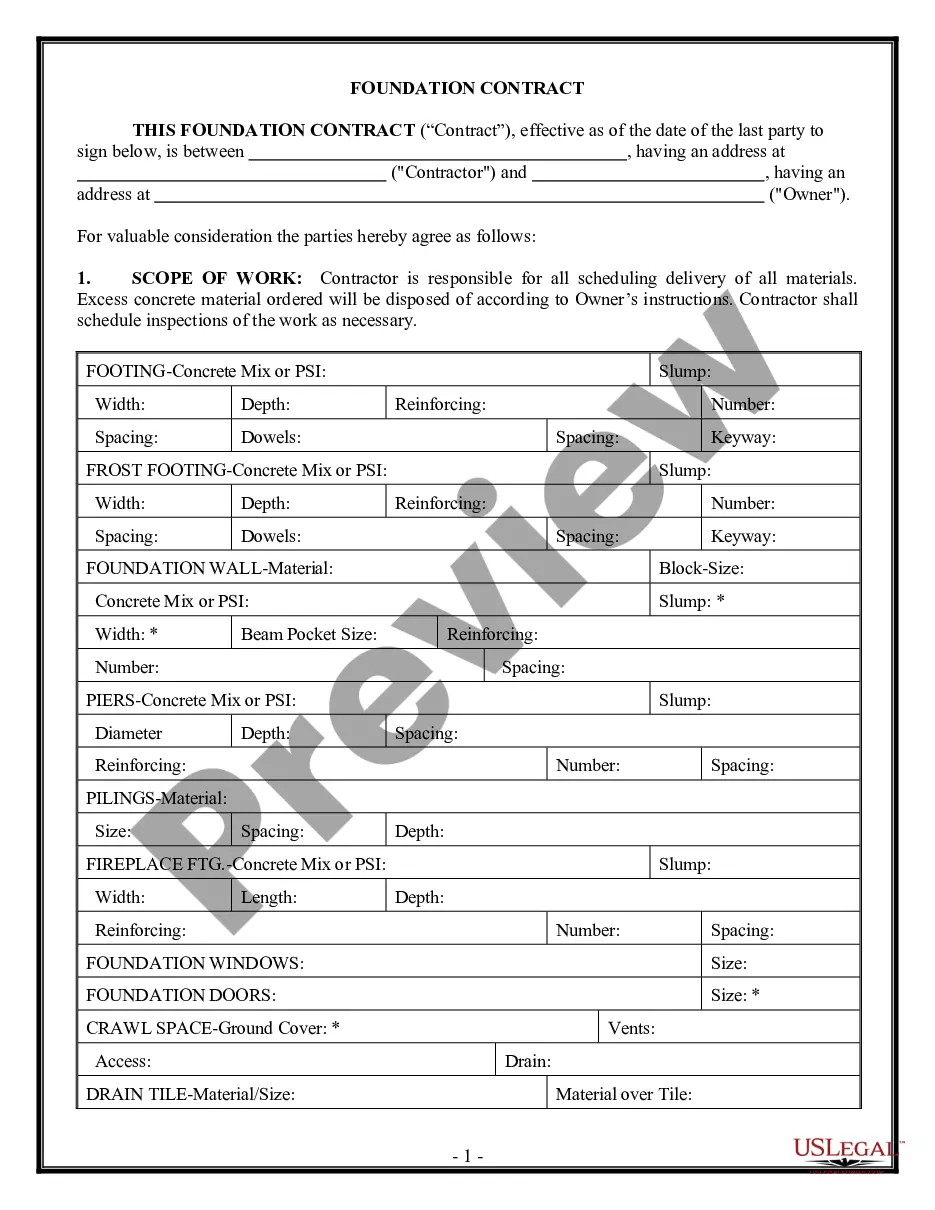

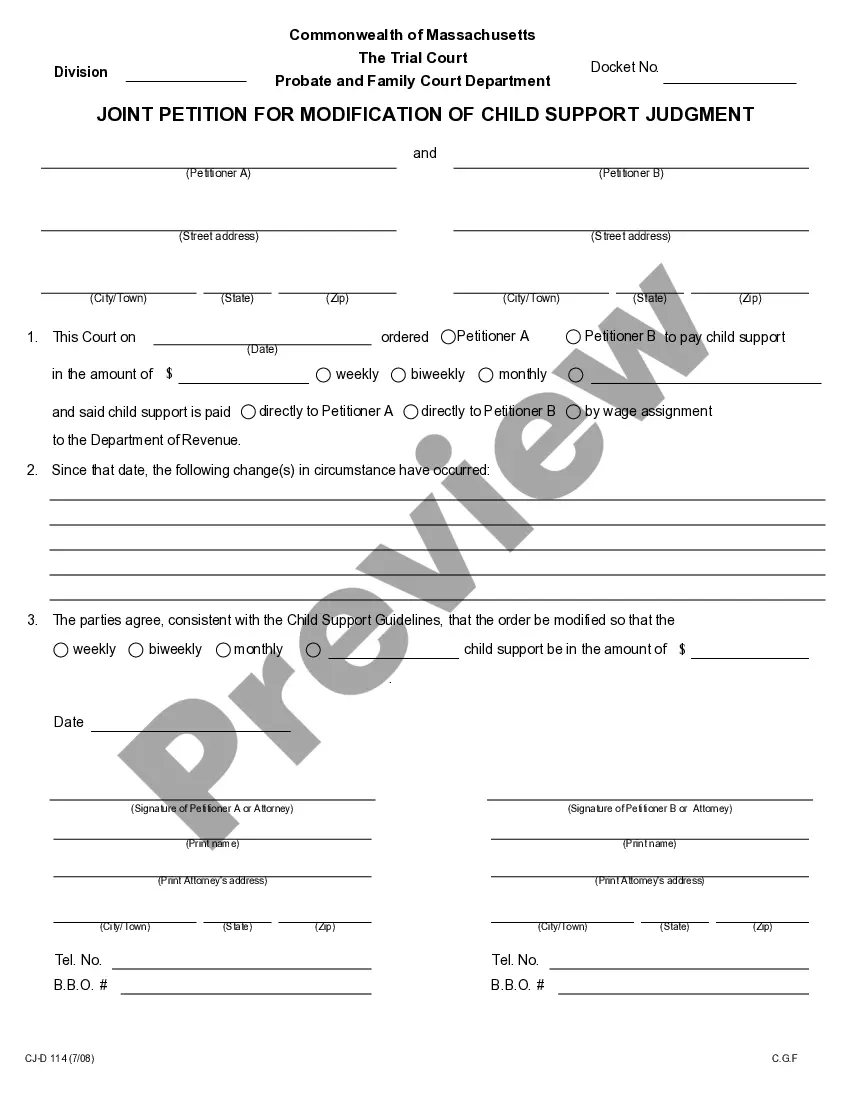

- Step 2. Use the Preview feature to review the form’s contents. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Kentucky Loan Agreement - Long Form.

Form popularity

FAQ

A personal loan agreement is a written contract between two parties, generally a borrower and a lender. It outlines how much money is being borrowed, the repayment schedule and what should be done if there's a dispute over paying it back.

If you're going to create a personal loan agreement from the ground up, it should include the following information: Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided.

A loan agreement is a document, signed by both the lender and the borrower, that spells out the terms of the loan. These agreements are binding and can be simple or complex. The loan agreement lays out the repayment schedule, the costs to the borrower, and other rules or requirements.

No, entering into a valid loan agreement does not necessarily mean that you are approved for the loan. This is a scenario that borrowers will face when applying for a loan through a financial institution like a bank. Typically, the loan approval process begins with the borrower requesting a loan from a lender.

Common items in personal loan agreements. The name, address, and contact information of the borrower. The name, address, and contact information of the lender. A plan for loan payment, such as a monthly payment plan with start dates and due dates. The maturity date or the date that the final payment is due on the loan.

Loan terms refer to the terms and conditions involved when borrowing money. This can include the loan's repayment period, the interest rate and fees associated with the loan, penalty fees borrowers might be charged, and any other special conditions that may apply.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

A lending agreement (loan agreement) is a formal contract between a lender and a borrower. Lending agreements spell out all the details of the loan, such as the principal amount, interest rate, amortization period, term, fees, payment terms and any covenants.