Kentucky Loan Agreement - Short Form

Description

How to fill out Loan Agreement - Short Form?

Locating the appropriate legal document template can be a challenge. Of course, there are numerous templates accessible online, but how do you find the legal form you require? Utilize the US Legal Forms website. The service offers a wide array of templates, including the Kentucky Loan Agreement - Short Form, suitable for both business and personal purposes. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Obtain button to access the Kentucky Loan Agreement - Short Form. Use your account to view the legal forms you have previously obtained. Visit the My documents section of your account to download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, ensure you have chosen the correct form for your city/state. You can browse the form using the Preview feature and read the form description to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click the Get now button to obtain the form. Select the pricing plan you want and enter the required information. Create your account and complete the payment using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Complete, modify, print, and sign the acquired Kentucky Loan Agreement - Short Form. US Legal Forms is the largest collection of legal forms where you can find numerous document templates. Use the service to download professionally crafted documents that adhere to state regulations.

Form popularity

FAQ

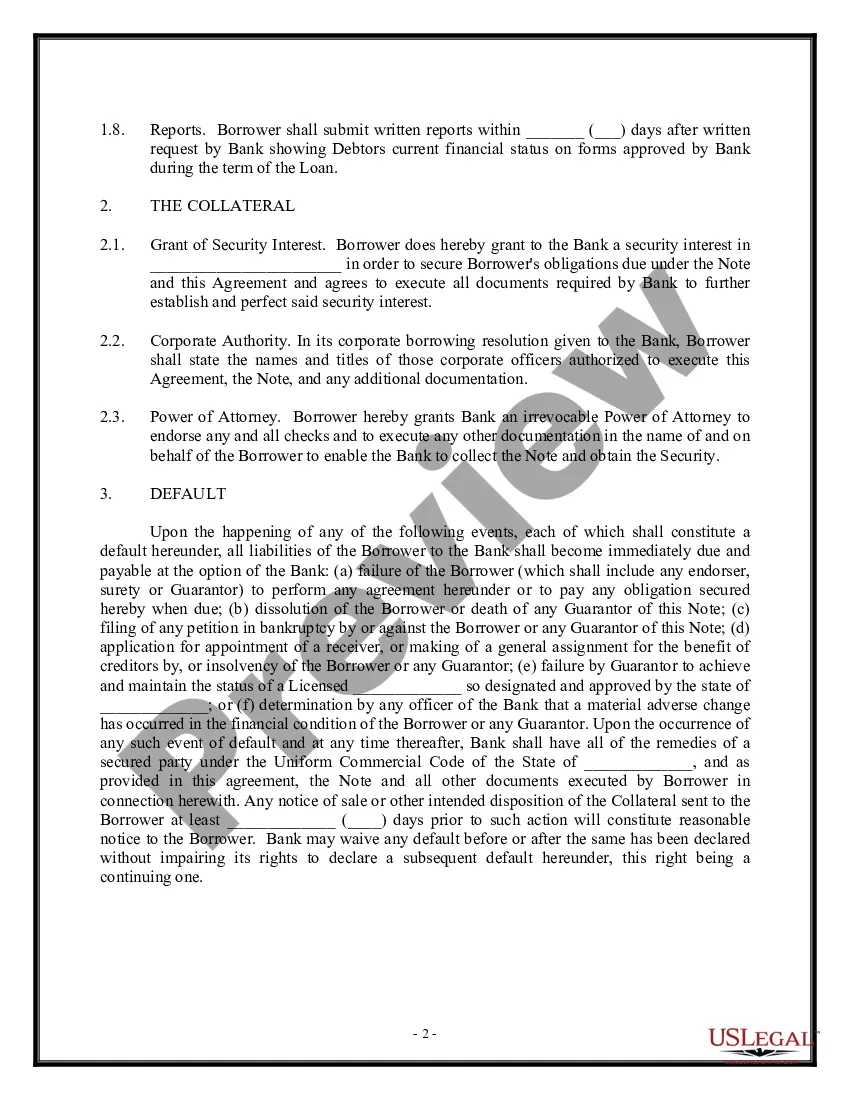

How to Draft a Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

A family loan agreement shares the same basic elements with other lending contracts. It should specify a repayment term and payment schedule, an interest rate, and other contingencies, such as how late payments or a default will be handled. Notarizing your agreement is also recommended.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

Read our editorial guidelines here . A personal loan agreement is a written contract between two parties, generally a borrower and a lender. It outlines how much money is being borrowed, the repayment schedule and what should be done if there's a dispute over paying it back.

Here's a step-by-step on writing a simple Loan Agreement with a free Loan Agreement template. Step 1 ? Name the Parties. ... Step 2 ? Write Down the Loan Amount. ... Step 3 ? Specify Repayment Details. ... Step 4 ? Choose How the Loan Will Be Secured (Optional) ... Step 5 ? Provide a Guarantor (Optional) ... Step 6 ? Specify an Interest Rate.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.

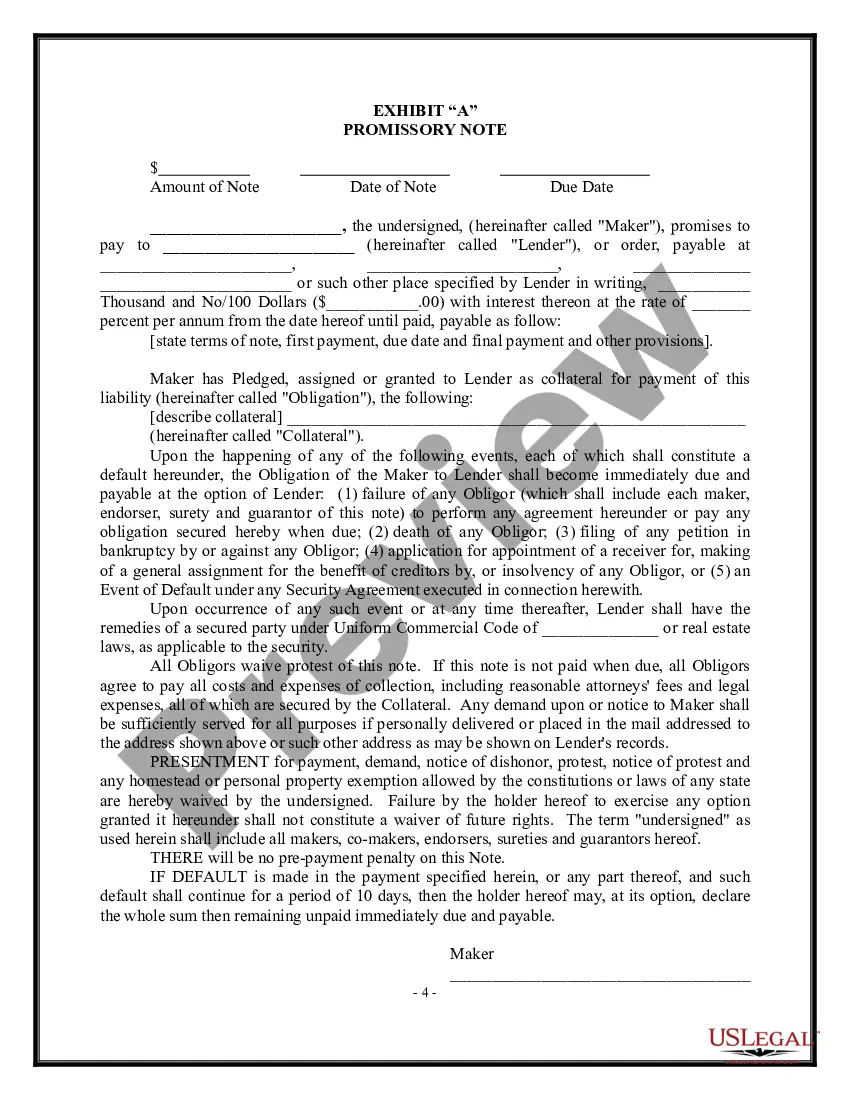

What should be included in a Secured Promissory Note? The amount of the loan and how that money may be transferred. All parties involved and their contact information. ... Repayment schedule. ... Any interest on the loan. ... The details of the collateral.