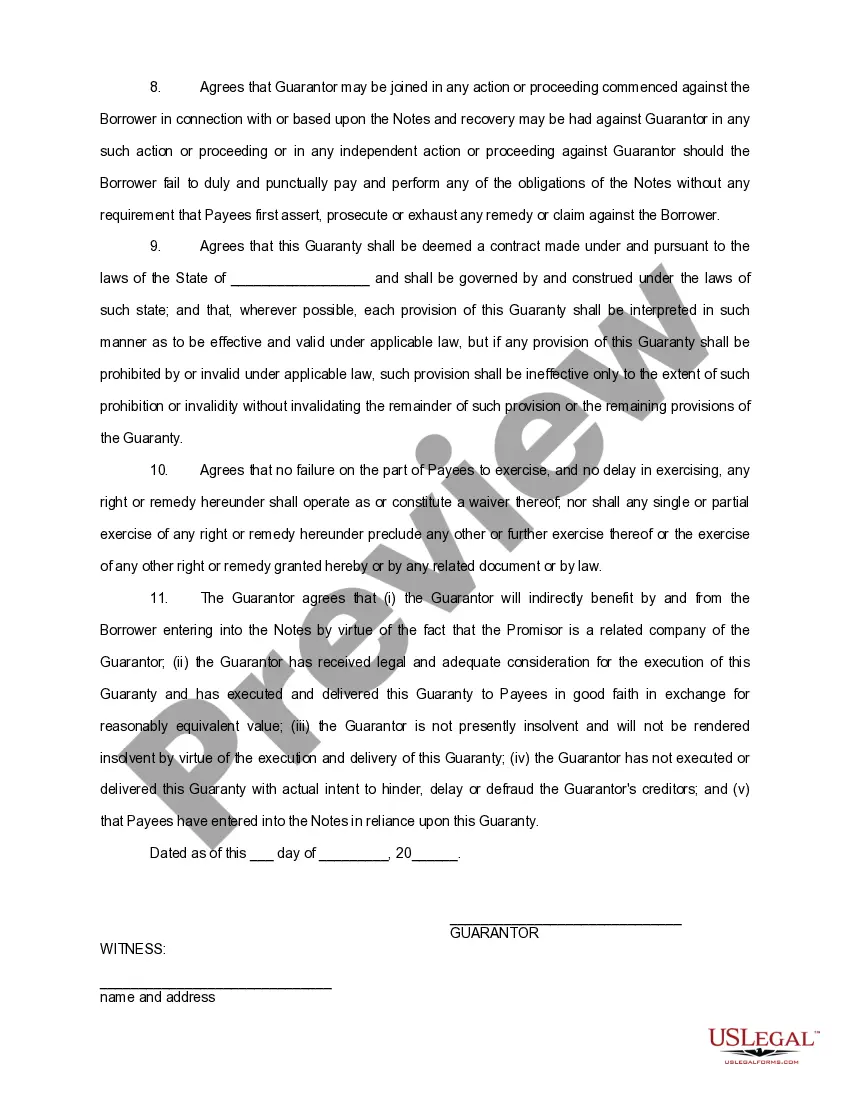

Kentucky Guaranty of Promissory Note by Individual - Corporate Borrower

Description

How to fill out Guaranty Of Promissory Note By Individual - Corporate Borrower?

You can spend hours online looking for the valid document template that fulfills the state and federal standards you require.

US Legal Forms offers a vast array of valid forms that are reviewed by experts.

It's easy to obtain or create the Kentucky Guaranty of Promissory Note by Individual - Corporate Borrower through the service.

- If you already possess a US Legal Forms account, you may Log In and click the Download button.

- Then, you can complete, edit, print, or sign the Kentucky Guaranty of Promissory Note by Individual - Corporate Borrower.

- Every valid document template you buy is yours permanently.

- To request an additional copy of any purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

Form popularity

FAQ

It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements. The note must clearly mention only the promise of making the repayment and no other conditions.

A promissory note is a legal document in which one party promises to pay money owed to another. Typically, the party that executes the note is the party that is borrowing the money. He is also referred to as the "maker" of the note. The lending entity is known as the payee.

A promissory note is a contract that spells out the terms of a loan. It reduces misunderstandings and provides a legal remedy if the borrower doesn't pay or the lender oversteps its rights. If you're borrowing or lending money, you should consider having oneyou can write one either as the borrower or the lender.

The promissory note is commonly only signed by the maker since the holder is not making any commitment under the note. Even in the case of a loan, the transfer of funds is separate from the note itself. It's important to note that a promissory note is not a substitute for a formal contract.

A promissory note is a legal document signed by a debtor who promises to pay a debt in a form and manner as described in the document. A personal guaranty, as defined at businessdictionary.com, is an agreement that makes one liable for one's own or a third party's debts or obligations.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

In order for the promissory note to be valid, the borrower needs to sign it. The lender may require the borrower to sign this document in front of a notary to guarantee the signature.

4(2) Notwithstanding anything contained in the Negotiable Instruments Act, 1881, (26 of 1881) no person in 2India other than the Bank or, as expressly authorised by this Act, the Central Government shall make or issue any promissory note expressed to be payable to the bearer of the instrument.

A bank can issue a promissory note, but so can an individual or a company or business. Anyone who lends money can do so. A promissory note isn't a contract, but you'll likely have to sign one before you take out a mortgage.