Kentucky Direct Deposit Form for Stimulus Check

Description

How to fill out Direct Deposit Form For Stimulus Check?

Have you ever been in a situation where you need paperwork for either business or personal purposes almost daily.

There are numerous legal document templates available online, but finding ones you can rely on is not straightforward.

US Legal Forms offers thousands of template documents, such as the Kentucky Direct Deposit Form for Stimulus Check, which can be tailored to meet federal and state regulations.

Once you find the right document, click Purchase now.

Choose the payment plan you wish, fill in the necessary details to process your payment, and complete the transaction using your PayPal or Visa/Mastercard.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After logging in, you can download the Kentucky Direct Deposit Form for Stimulus Check template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Locate the document you need and ensure it is suited for your specific city/region.

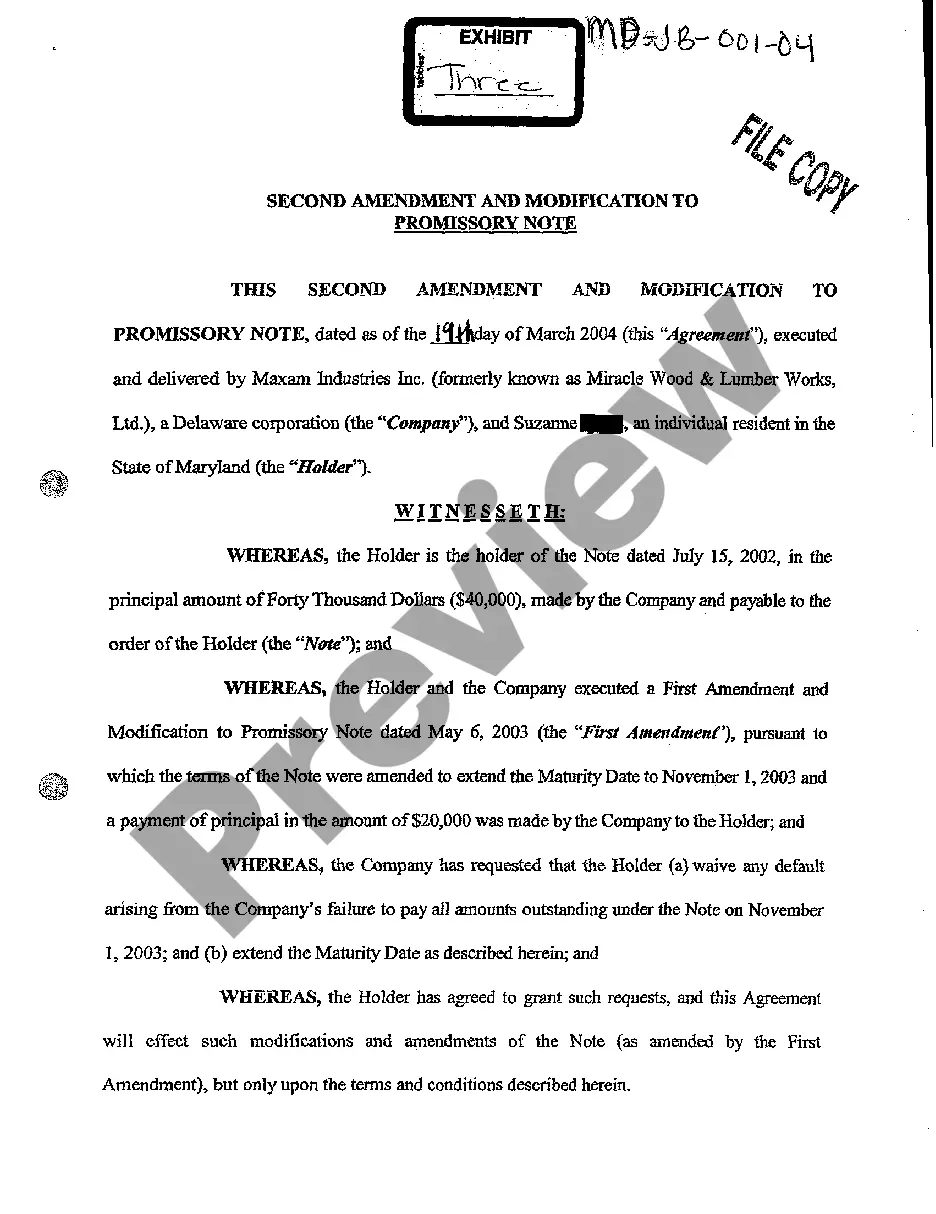

- Utilize the Review option to examine the form.

- Check the description to ensure you have selected the correct document.

- If the form is not what you are looking for, utilize the Search field to find the document that fits your requirements.

Form popularity

FAQ

Once you have signed up for a bank account, you can use it to get your payment faster when you file taxes. Have your new account number and routing number before you start the process. This will allow you to receive your stimulus check as a direct deposit.

IRS Website Now Has Tools to Add or Change Direct Deposit Information, Track Coronavirus Stimulus Payments. Taxpayers who did not have direct deposit information on record with the IRS can now enter or change that info on the IRS website Get My Payment tool.

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper.

If they want to switch to receiving their payments by direct deposit, they can use the tool to add their bank account information. They do that by entering their bank routing number and account number and indicating whether it is a savings or checking account.

At this point, you can enter a routing and account number for your bank account, prepaid debit card or alternative financial product that has a routing and account number associated with it, the IRS said. That is the only time you are able to change your banking information.

If you want to change your bank account or routing number for a tax refund, call the IRS at 800-829-1040....If you haven't yet filed your return, or if the IRS rejected your return:Go to the File section of the H&R Block Online product.Choose how you want to file.Choose Direct Deposit.

The Commonwealth of Kentucky utilizes direct deposit to deliver payroll. It is a convenient, reliable, cost and time saving alternative to issuing paper checks. It eliminates the need to pick-up and cash a check on pay day and instead provides access to funds immediately upon deposit.

Right now, this includes updating their bank account information with the IRS or unenrolling from monthly payments. Soon, it will allow people to check on the status of their payments. Later this year, the tool will also enable them to make other status updates and be available in Spanish.

If you have already filed your return you cannot change your information. You would have to wait until your return gets accepted or rejected (January 31st is when the IRS opens their efile system). If your return gets accepted, you will not be able to make any changes.