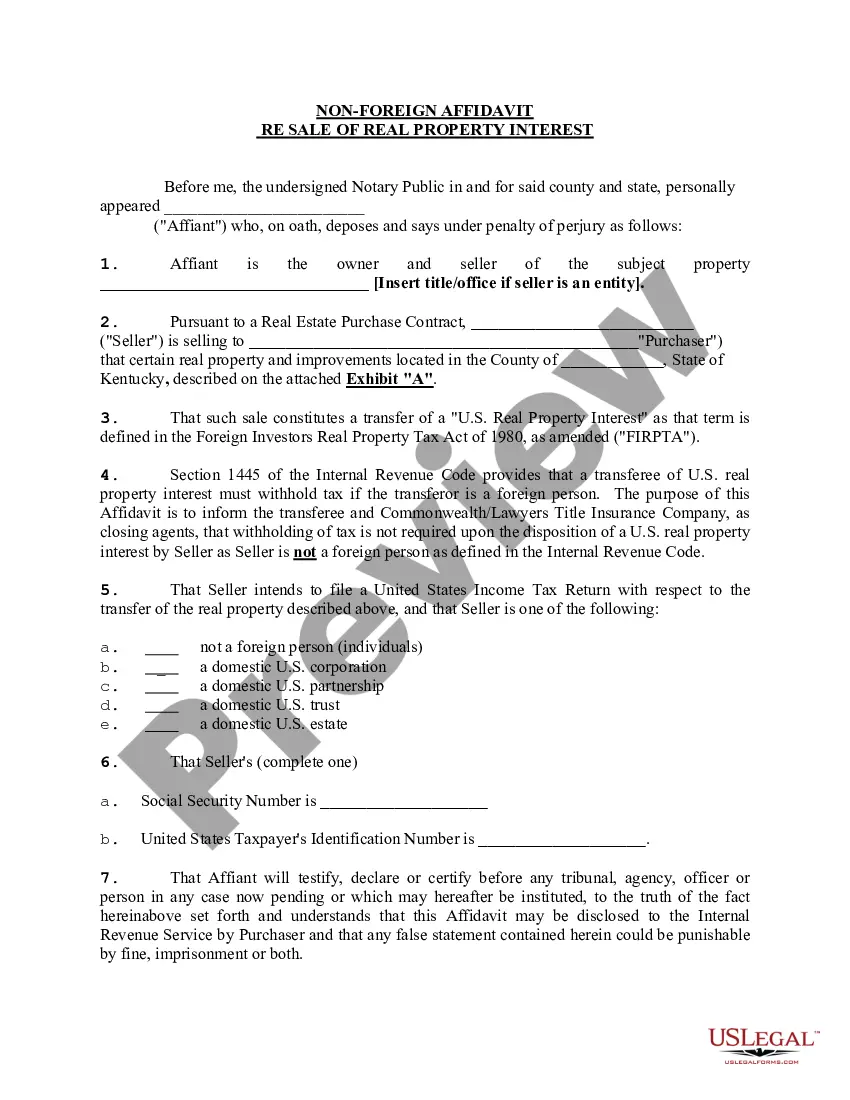

The Kentucky Non-Foreign Affidavit Resale of Real Property Interest is a legal document used to certify that real estate located in Kentucky has been sold within the state, and not outside it. This affidavit is used to protect the buyer from potential liability for any taxes the seller may owe to the state or federal government. The Kentucky Non-Foreign Affidavit Resale of Real Property Interest is also known as the Kentucky Form 76A500. There are two types of Kentucky Non-Foreign Affidavit Resale of Real Property Interest: 1. Kentucky Form 76A500: This form is used to certify that real estate located in Kentucky has been sold within the state, and not outside it. 2. Kentucky Form 76A500-I: This form is used to certify that the real estate located in Kentucky has been sold to a foreign individual or company.

Kentucky Non-Foreign Affidavit Resale of Real Property Interest

Description

How to fill out Kentucky Non-Foreign Affidavit Resale Of Real Property Interest?

How much effort and resources do you frequently allocate to crafting formal documentation.

There exists a superior alternative to obtaining such forms rather than employing legal experts or investing hours scouring the internet for an appropriate template. US Legal Forms is the premier online repository that offers expertly prepared and validated state-specific legal documents for any need, such as the Kentucky Non-Foreign Affidavit Resale of Real Property Interest.

Another benefit of our service is that you have access to previously purchased documents that you safely store in your profile in the My documents section. Retrieve them at any time and re-complete your paperwork as often as required.

Conserve time and energy finalizing official documents with US Legal Forms, one of the most dependable online services. Join us now!

- Review the form content to ensure it aligns with your state stipulations. To verify, check the form description or use the Preview option.

- If your legal template fails to meet your criteria, locate another one via the search bar located at the top of the page.

- If you are already a registered user of our service, Log In and download the Kentucky Non-Foreign Affidavit Resale of Real Property Interest. Otherwise, move on to the following steps.

- Click Buy now once you discover the appropriate document. Choose the subscription plan that best suits your needs to access our library’s complete offerings.

- Create an account and remit payment for your subscription. You can conduct a transaction using your credit card or through PayPal - our service guarantees complete security for that.

- Download your Kentucky Non-Foreign Affidavit Resale of Real Property Interest to your device and fill it out on a printed hard copy or electronically.

Form popularity

FAQ

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445). The buyer (transferee) of the U.S. real property interest is the withholding agent. The transferee must determine if the transferor is a foreign person.

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are ?not a non-resident alien for purposes of United States income taxation.? A Seller unable to complete this affidavit may be subject to withholding up to 15%.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

The transferor gives the transferee a certification stating, under penalties of perjury, that the transferor is not a foreign person. The certification should contain the transferor's name, U.S. taxpayer identification number, and home address (or office address, in the case of an entity).

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

Section 1445(e)(1) requires withholding on certain dispositions of U.S. real property interests by a domestic partnership, domestic trust, or domestic estate. Section 1445(e)(2) requires withholding on certain distributions by foreign corporations.