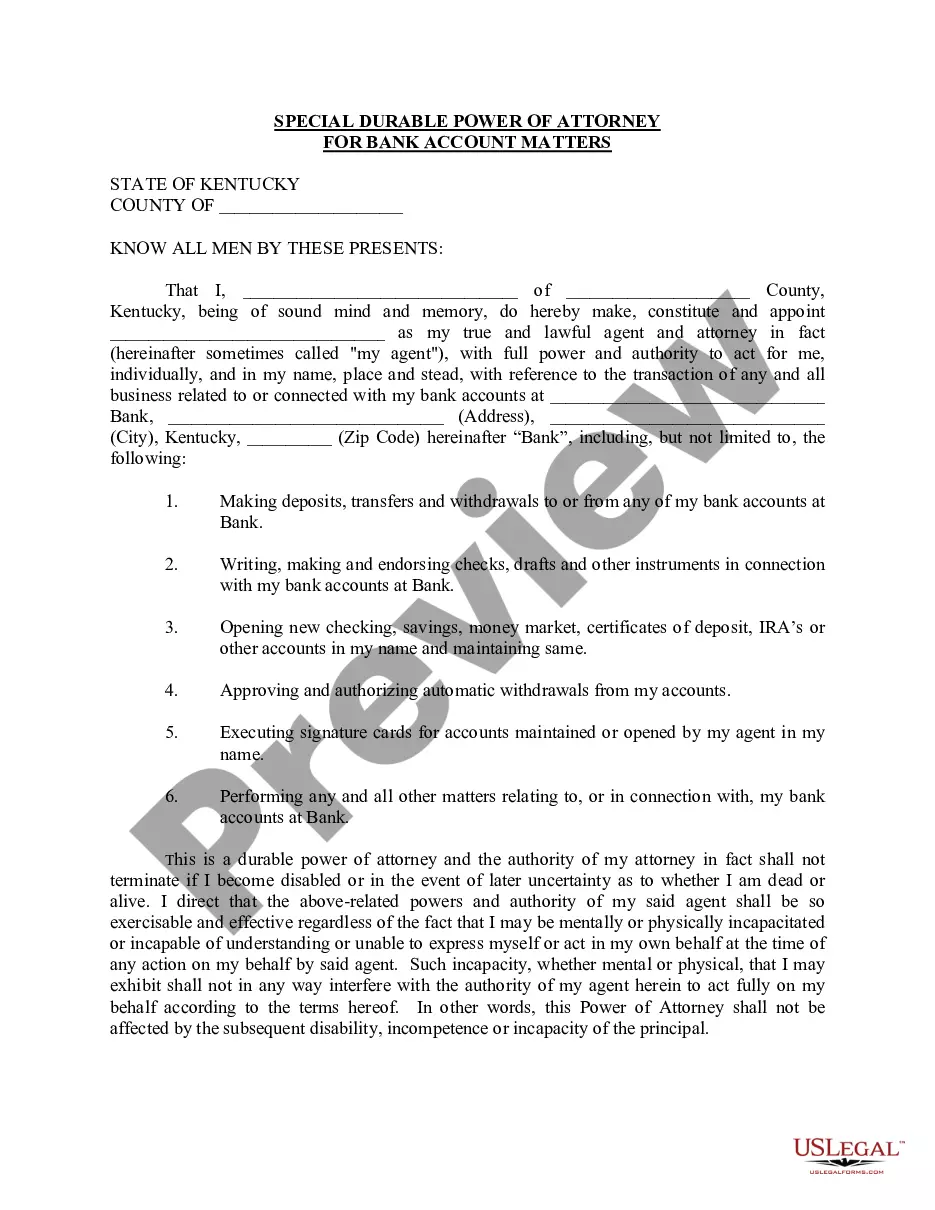

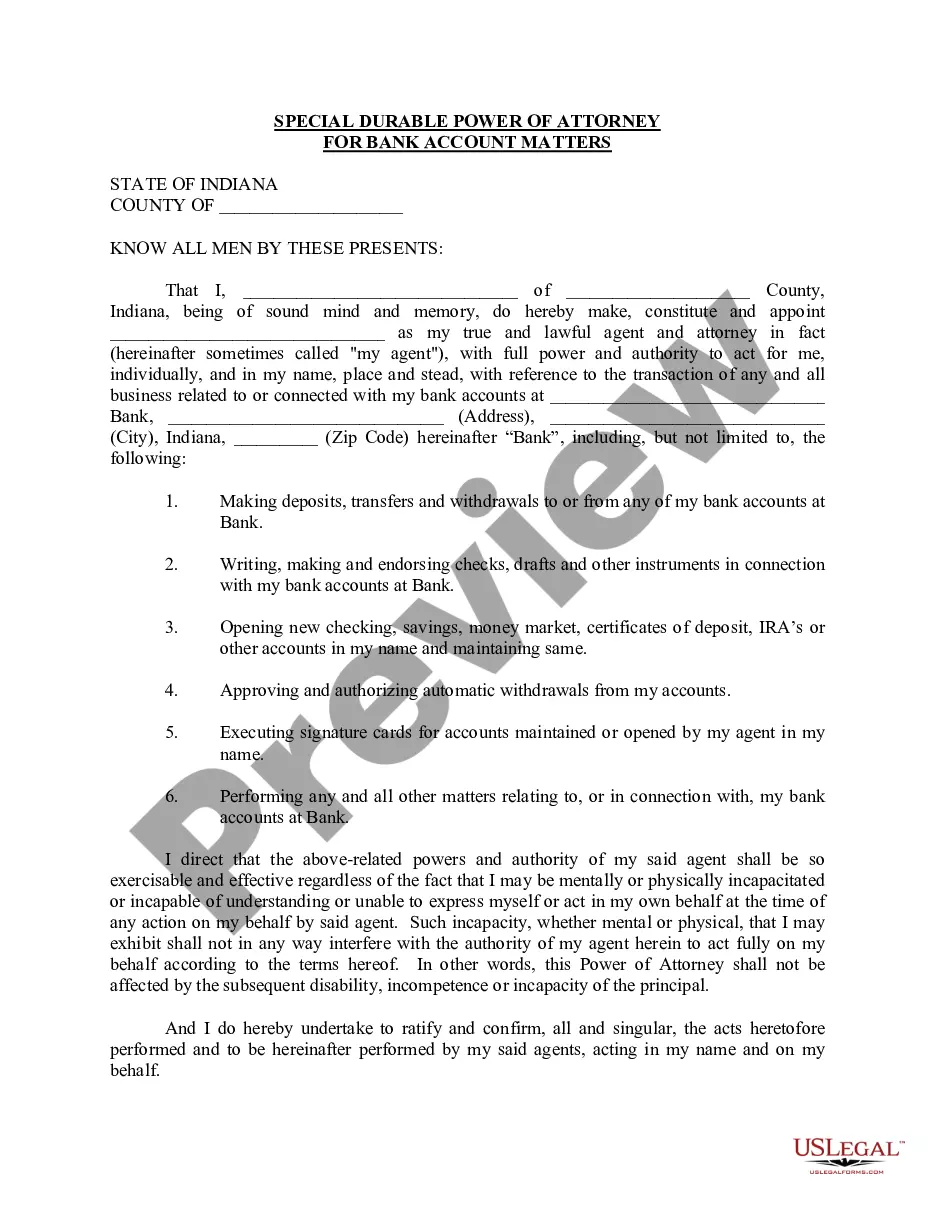

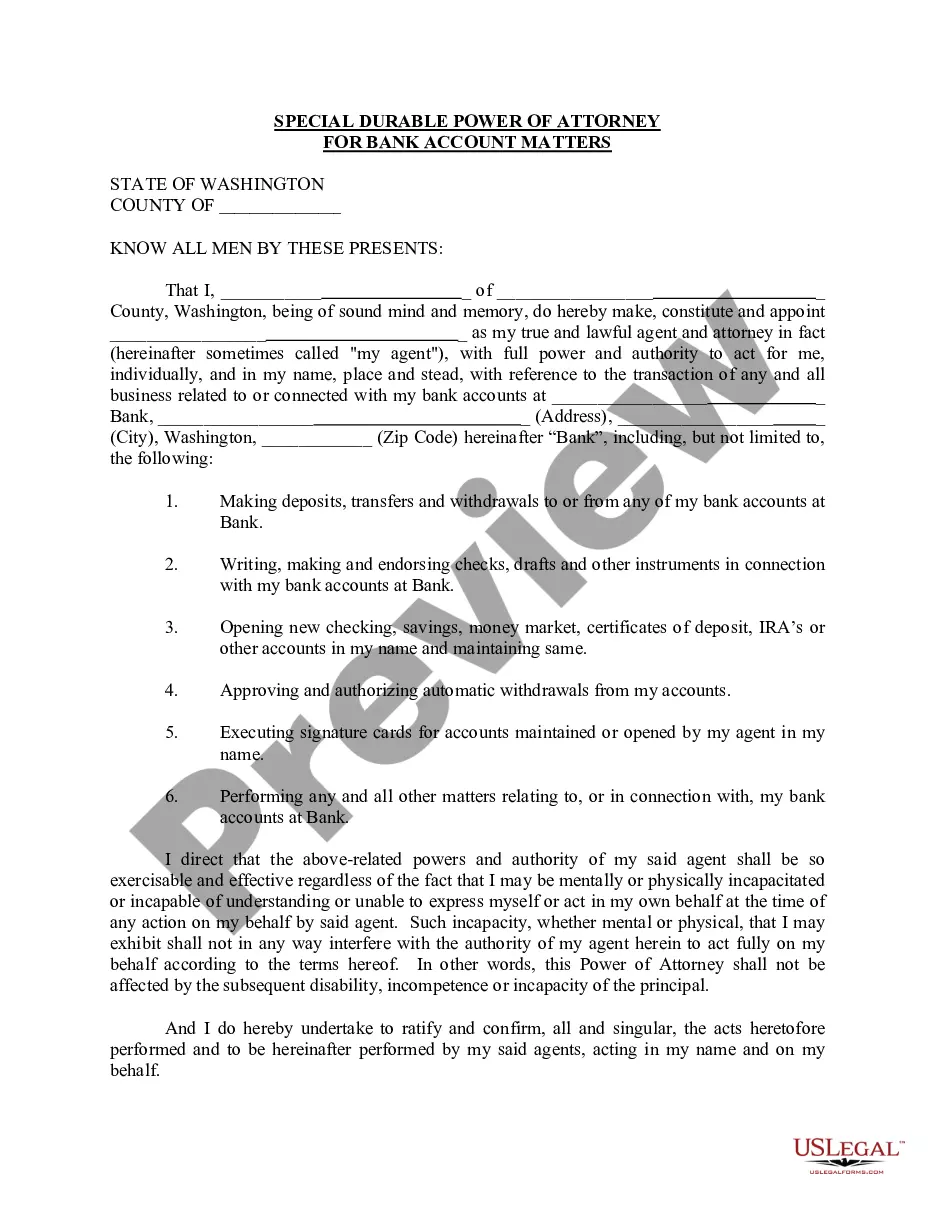

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Kentucky Special Durable Power of Attorney for Bank Account Matters

Description

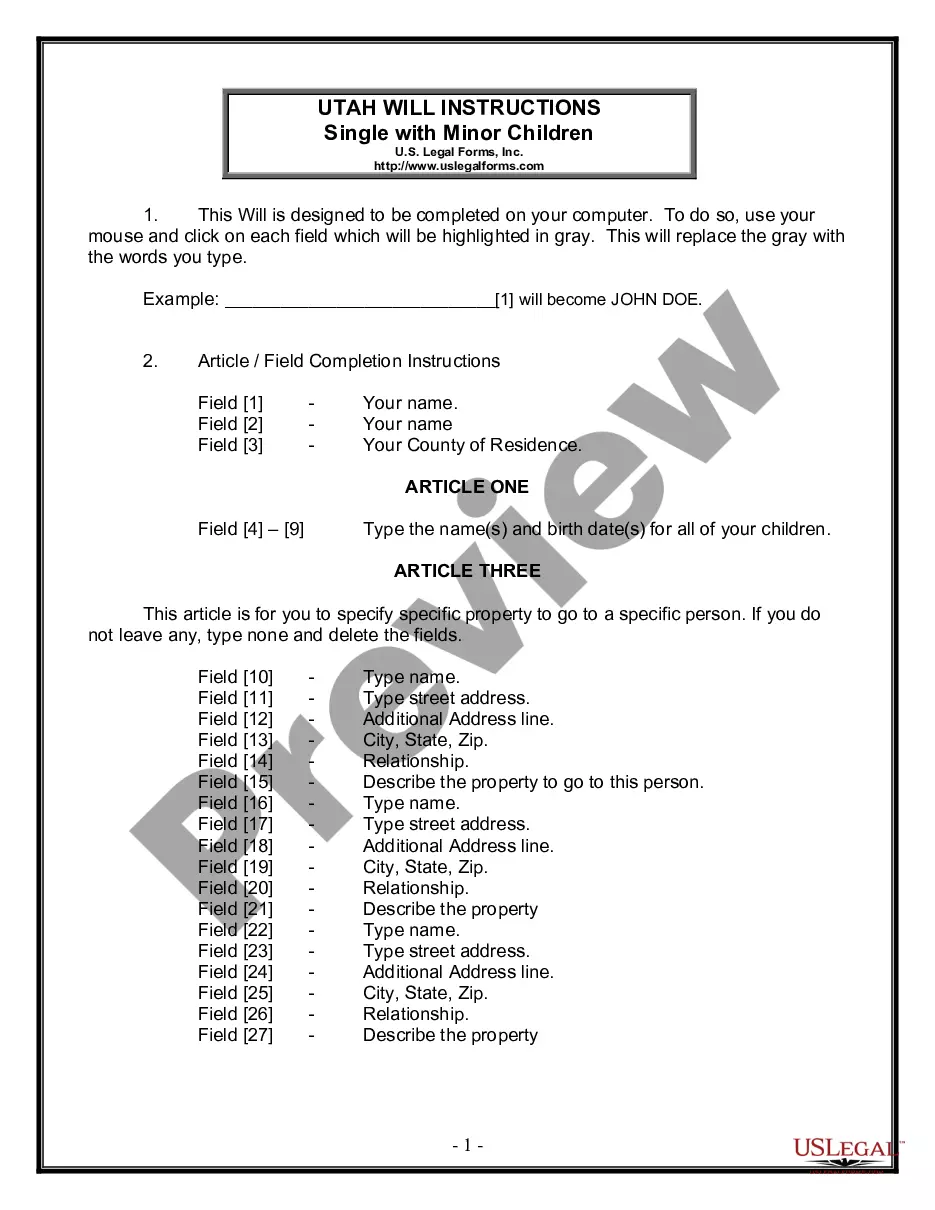

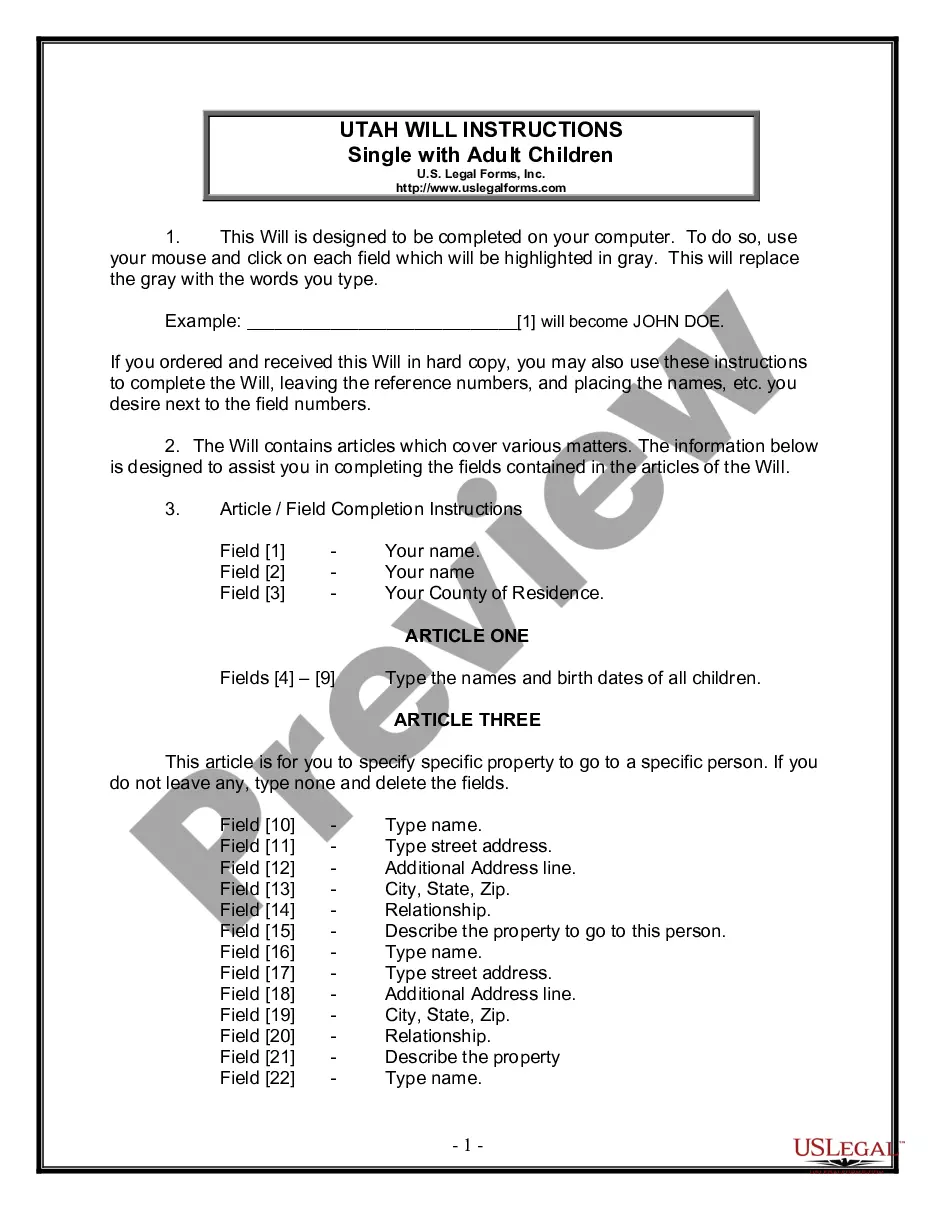

How to fill out Kentucky Special Durable Power Of Attorney For Bank Account Matters?

Locating Kentucky Special Durable Power of Attorney for Bank Account Matters forms and completing them could pose a challenge.

To save time, expenses, and effort, utilize US Legal Forms and discover the appropriate template specifically for your state within a few clicks.

Our legal experts prepare each document, so all you need to do is fill them in. It’s really that easy.

Select your plan on the pricing page and create an account. Decide your payment method, either by card or PayPal. Save the template in your preferred format. You can print the Kentucky Special Durable Power of Attorney for Bank Account Matters form or complete it using any online editor. Don’t worry about typos since your template can be utilized and submitted as many times as you wish. Visit US Legal Forms to gain access to over 85,000 state-specific legal and tax documents.

- Log into your account and return to the form's webpage to download the sample.

- Your saved templates are stored in My documents and accessible at any time for future use.

- If you haven’t registered yet, you must create an account.

- Follow our detailed instructions on how to obtain the Kentucky Special Durable Power of Attorney for Bank Account Matters form in just a few minutes.

- Check the form's applicability for your state to ensure eligibility.

- Review the form using the Preview option (if available).

- If there’s a description, read it to comprehend the key details.

- Click the Buy Now button if you’ve found what you’re looking for.

Form popularity

FAQ

Choose an agent. Before you begin to fill out the form, you have some decisions to make. Decide on the type of authority. You can choose whether you want your POA to be broad or narrow. Identify the length of time the POA will be in effect. Fill out the form. Execute the document.

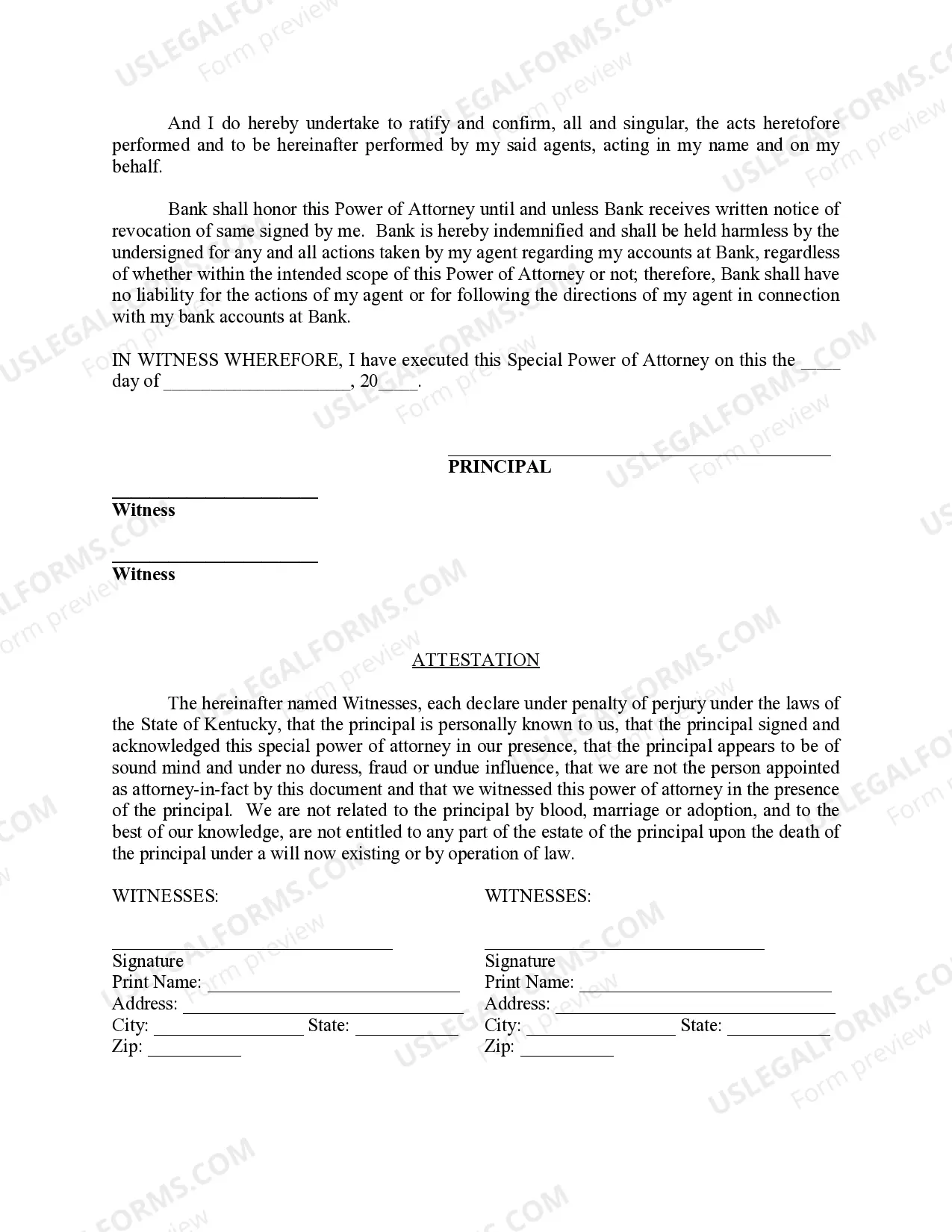

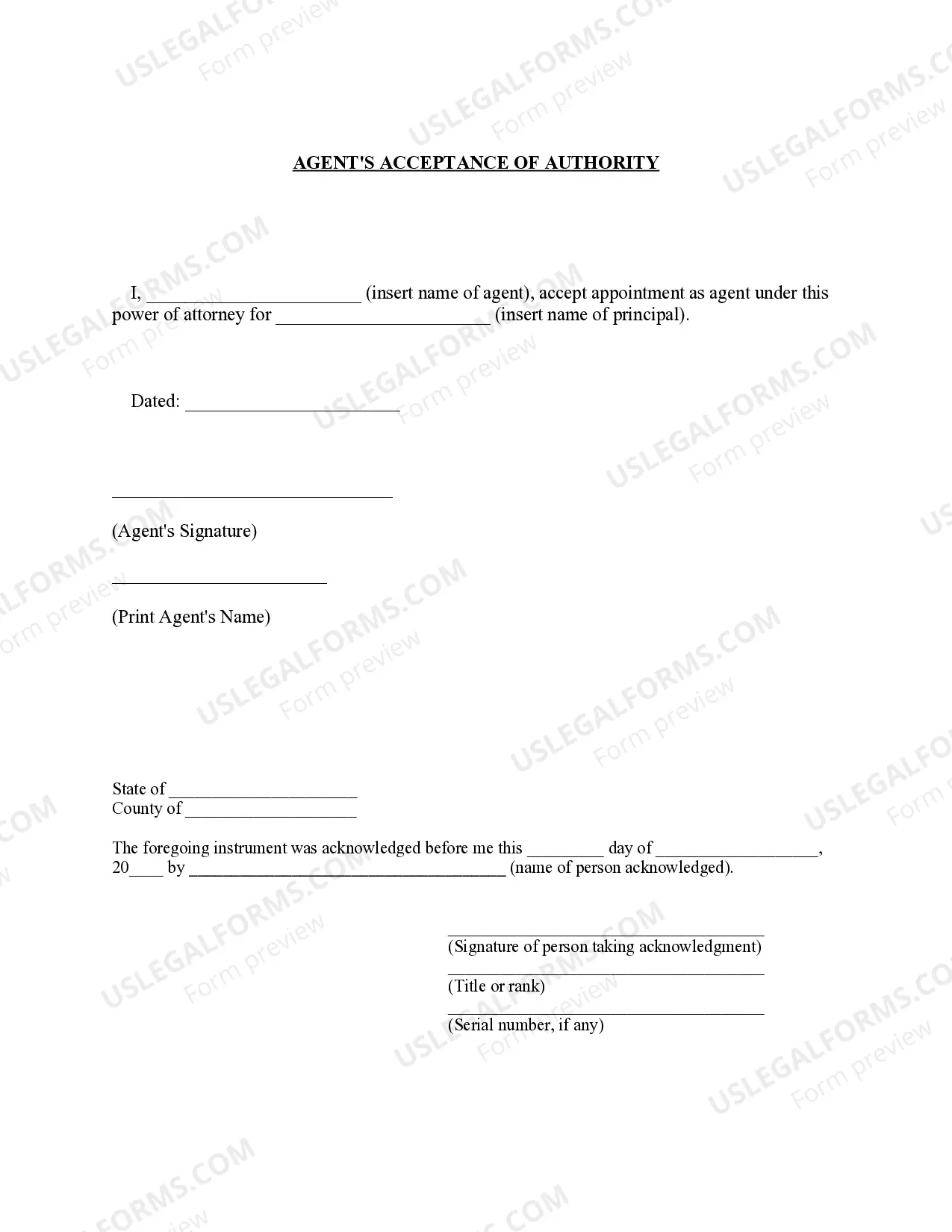

Most states offer simple forms to help you create a power of attorney for finances. Generally, the document must be signed, witnessed and notarized by an adult. If your agent will have to deal with real estate assets, some states require you to put the document on file in the local land records office.

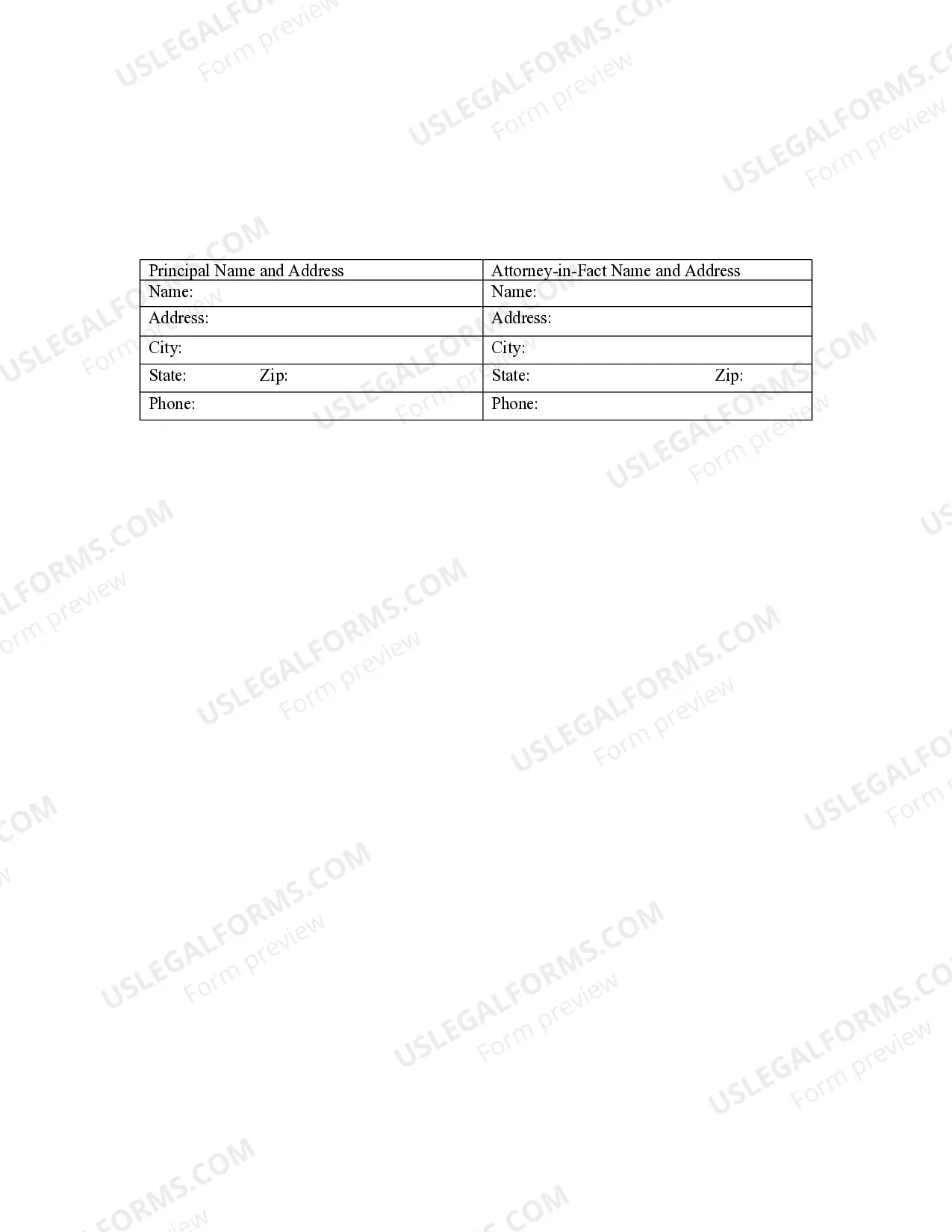

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

Perhaps the most important duty you have as an attorney is the duty to act in the best interests of the donor. Therefore, any gifts or payments you make on the donor's behalf must be in line with their best interests.Attorneys can even make payments to themselves.

While laws vary between states, a POA can't typically add or remove signers from your bank account unless you include this responsibility in the POA document.If you don't include a clause giving the POA this authority, then financial institutions won't allow your POA to make ownership changes to your accounts.

Depending on the language of the power of attorney, your agent may be able to change the ownership of your bank accounts or change your beneficiary designations.

A power of attorney, or POA, is one of the most commonly used legal documents because of the numerous purposes a POA can serve.Banks, for example, are notorious for refusing to honor, or at least questioning, the authority of an Agent when presented with a power of attorney.

Through the use of a valid Power of Attorney, an Agent can sign checks for the Principal, withdraw and deposit funds from the Principal's financial accounts, change or create beneficiary designations for financial assets, and perform many other financial transactions.