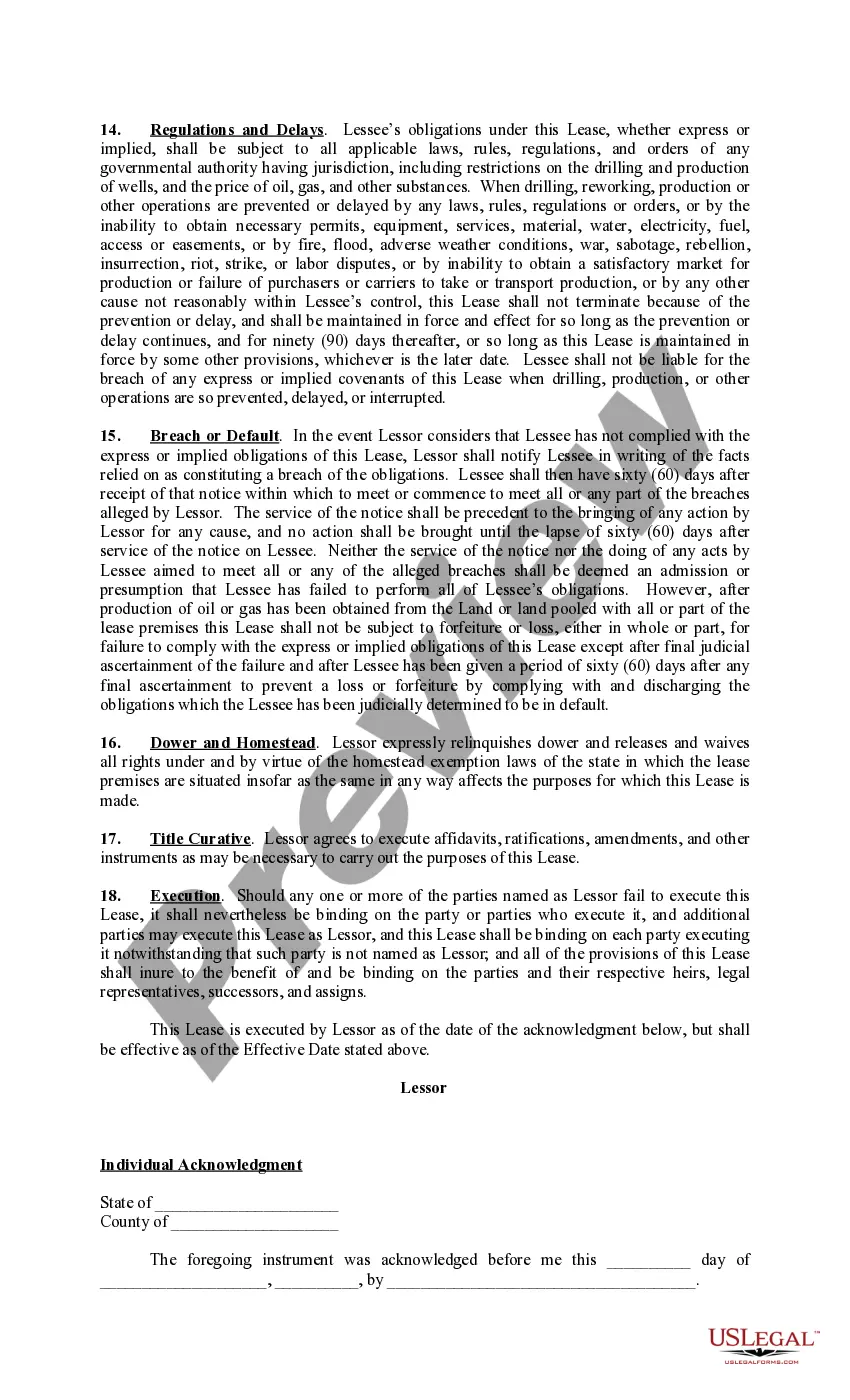

This form is a Kentucky Lease agreement wherein Lessor grants, leases, and lets exclusively to Lessee the lands described within for the purposes of conducting seismic and geophysical operations, exploring, drilling, mining, and operating for, producing and owning oil, gas, sulfur, and all other minerals whether or not similar to those mentioned (collectively the "oil or gas"), and the right to make surveys, lay pipelines, establish and utilize facilities for surface or subsurface disposal of salt water, construct roads and bridges, dig canals, build tanks, power stations, power lines, telephone lines, and other structures on the Lands, necessary or useful in Lessee's operations on the Lands or any other land adjacent to the Lands. This lease is a paid up lease and provides for pooling.

Kentucky Paid Up Lease Pooling Provision

Description

How to fill out Kentucky Paid Up Lease Pooling Provision?

Searching for Kentucky Paid Up Lease Pooling Provision templates and completing them could be challenging.

To conserve time, expenses, and effort, utilize US Legal Forms to quickly locate the appropriate template tailored for your state in just a few clicks.

Our legal professionals prepare every document, so you only need to fill them out.

Select your plan on the pricing page and create an account. Choose your payment method, either by credit card or PayPal. Save the document in your preferred format. Now you can print the Kentucky Paid Up Lease Pooling Provision template or complete it using any online editor. Don’t worry about mistakes, as your sample can be utilized, submitted, and published as often as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and revisit the form's page to save the example.

- All your downloaded examples are stored in My documents and are accessible at any time for future use.

- If you haven’t subscribed yet, you’ll need to sign up.

- Review our comprehensive instructions on how to obtain your Kentucky Paid Up Lease Pooling Provision form in mere minutes.

- To obtain a valid form, verify its relevance for your state.

- Examine the example using the Preview feature (if it’s available).

- If there's a description, read it to grasp the key elements.

- Click on the Buy Now button if you discover what you’re looking for.

Form popularity

FAQ

Pooling combines mineral interests for collective resource extraction, while separating refers to the division of those interests among individual owners. The Kentucky Paid Up Lease Pooling Provision emphasizes pooling for efficiency in production, ensuring that all parties reap the benefits of collaboration. Understanding these terms helps stakeholders navigate their rights and opportunities effectively.

Pooling combines mineral rights from multiple owners into a single unit for oil and gas extraction, while unitization not only consolidates production but also involves shared management of the resource. Understanding the Kentucky Paid Up Lease Pooling Provision is essential as it often facilitates both processes, allowing for a cohesive approach to mineral extraction and profit-sharing.

Pooling groups mineral rights for efficient resource extraction, while the allowance system determines how much each landowner receives based on their contribution to the pool. Pooling under the Kentucky Paid Up Lease Pooling Provision aims to streamline production and benefit multiple parties. This aggregation can lead to more efficient resource management and revenue sharing.

A unitizing agreement consolidates mineral interests for the purpose of resource management, often leading to joint operations among stakeholders. Meanwhile, a pooling agreement primarily focuses on sharing production from pooled mineral rights. Both are vital tools, and understanding the Kentucky Paid Up Lease Pooling Provision can clarify how these agreements function together.

A pooling order is a legal document issued by a regulatory authority that allows the pooling of mineral interests in a designated area. It consolidates rights for the extraction of resources, often benefiting multiple stakeholders. The Kentucky Paid Up Lease Pooling Provision plays a significant role in defining the scope and terms of such orders.

Mineral rights in Kentucky grant the owner the right to extract minerals, such as oil and gas, from the land. These rights can be distinct from the surface rights, allowing landowners to lease these rights to companies. Understanding the Kentucky Paid Up Lease Pooling Provision is crucial for landowners and mineral rights holders to maximize their benefits.

Pooling refers to the combination of mineral rights from several owners into a single unit for oil or gas production. In contrast, purchasing involves acquiring ownership of those mineral rights outright. The Kentucky Paid Up Lease Pooling Provision facilitates pooling arrangements, enabling multiple parties to benefit from resource extraction without transferring ownership.