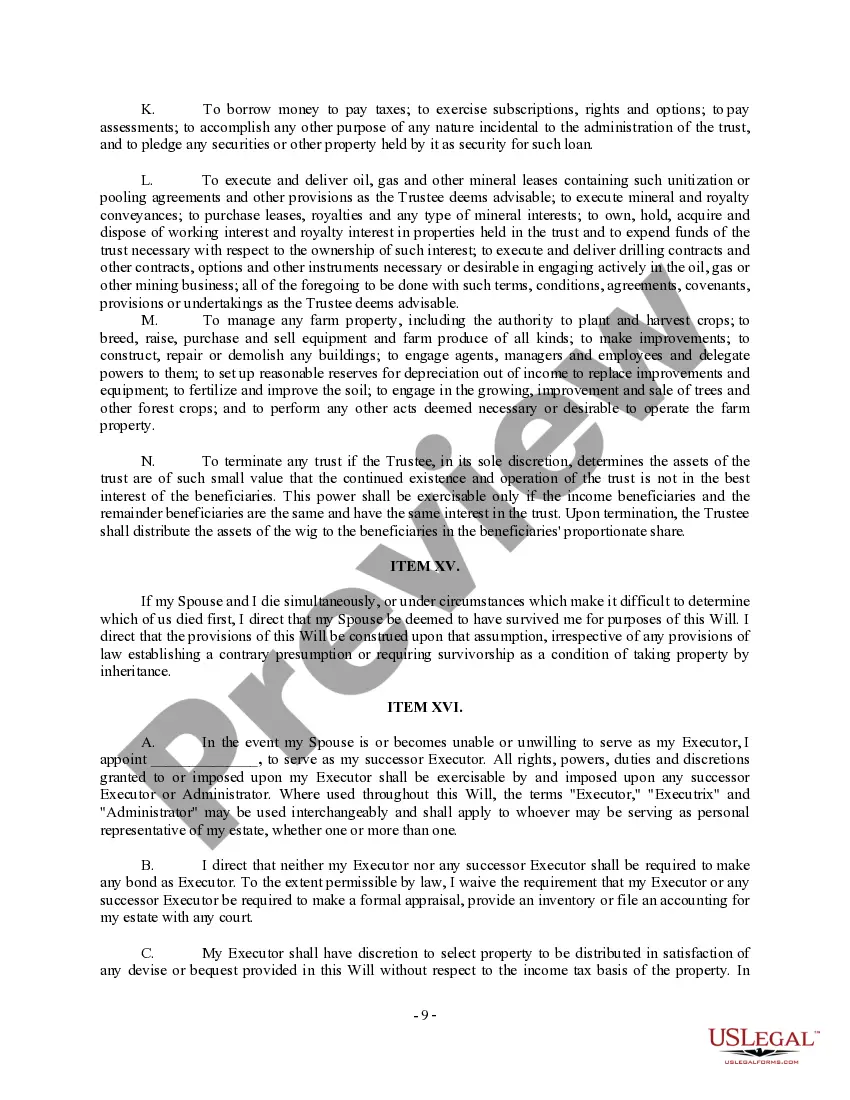

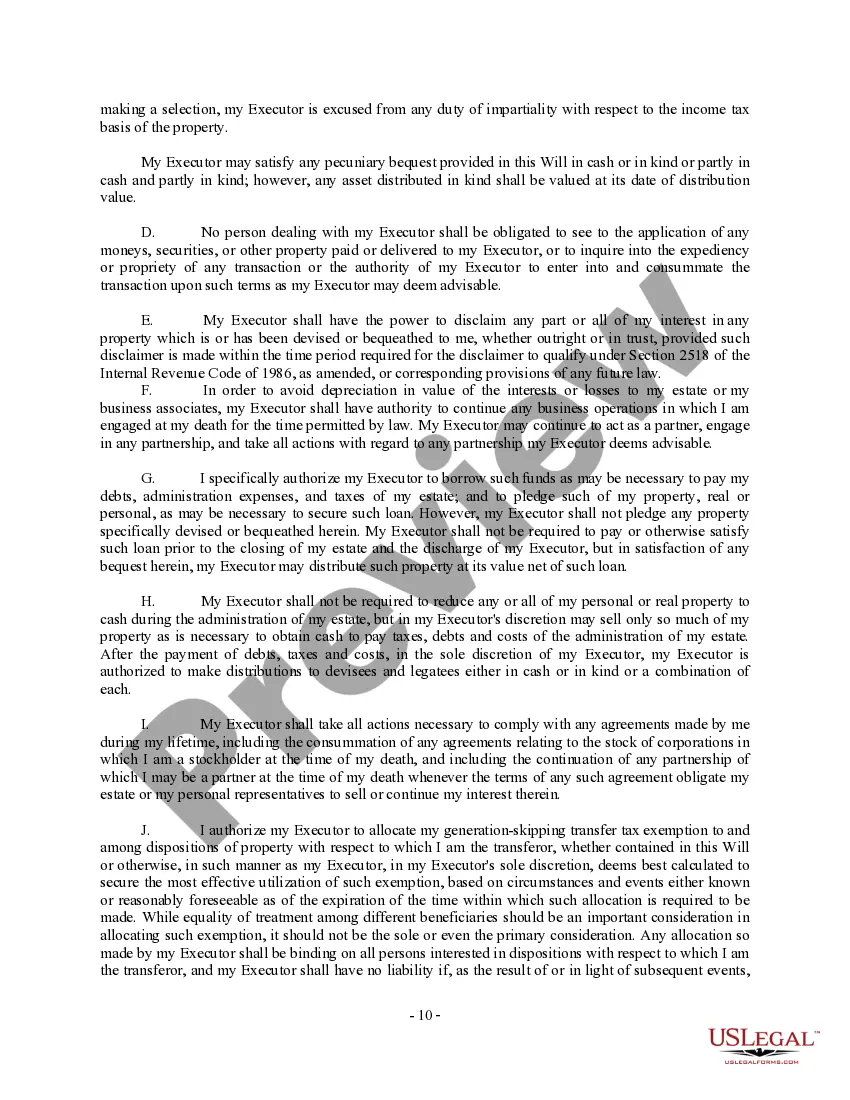

This Complex Will with Credit Shelter Trust for Large Estates form is a complex Will designed to enable a couple to maximize the amount of property that can pass free of estate taxes. The Will leaves the maximum tax free amount allowed (i.e. 1,000,000.00 as of 2001) to a trust and the remainder of property to the surviving spouse. All of the property passing to the Spouse is estate tax free. Therefore, no estate taxes are due at the death of the first Spouse. Since the trust has 1 million dollars that can pass to the children tax free, the surviving spouse can also leave 1 million to a similar trust or children and thereby enable 2 million dollars instead of 1 to pass to the children estate tax free. Income from the trust can be disbursed to the surviving spouse and children.

Kentucky Complex Will with Credit Shelter Marital Trust for Large Estates

Description

How to fill out Kentucky Complex Will With Credit Shelter Marital Trust For Large Estates?

Looking for Kentucky Complex Will with Credit Shelter Marital Trust for Large Estates forms and completing them can be a challenge.

To conserve time, money, and effort, utilize US Legal Forms to discover the suitable template specifically for your state in just a few clicks.

Our legal experts prepare all documents, leaving you only to complete them. It's that straightforward.

You can print the Kentucky Complex Will with Credit Shelter Marital Trust for Large Estates form or fill it out using any online editor. There's no worry about making errors since your template can be used, sent, and printed as often as needed. Visit US Legal Forms for over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the document.

- Your downloaded templates are stored in My documents and are always accessible for future use.

- If you haven't registered yet, you'll need to create an account.

- Check the sample's eligibility for your state before acquiring a form.

- Use the Preview feature (if available) to view the sample.

- Read through any description to understand the details.

- Click Buy Now if you've found what you're looking for.

- Choose your payment method on the pricing page and set up an account.

Form popularity

FAQ

Yes, the surviving spouse may serve as trustee of the credit shelter trust.All of the assets in the credit shelter trust, including any appreciation in value during the surviving spouse's lifetime, pass free of estate tax to the beneficiaries.

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

Assets That May Not Be Eligible for a Step-Up in Basis 401(k) accounts. Pensions. Tax deferred annuities. Certificates of deposit.

It applies to investment assets passed on in death. When someone inherits capital assets such as stocks, mutual funds, bonds, real estate and other investment property, the IRS steps up the cost basis of those properties.

A QTIP trust (officially a qualified terminable interest property trust) is a type of trust that allows someone to provide income for their surviving spouse and bequeath property and assets to a different set of beneficiaries.

Assets that have been conveyed into a revocable living trust do get a step-up in basis when they are distributed to the beneficiaries after the passing of the grantor. We should point out the fact that the beneficiaries would be responsible for any future appreciation from a capital gains perspective.

Unlike with a QTIP trust, the surviving spouse typically has complete control over a marital trust, including use of the trust assets and final say on designating who the final beneficiaries are. A QTIP trust offers more control to the grantor but less control to the surviving spouse compared to marital trust.

First, in a standard credit shelter trust, there is no step-up in basis at the death of the surviving spouse.Second, the credit shelter trust is a separate taxpayer and requires its own tax return, Form 1041.

QTIP trusts are put to use in estate planning and are especially useful when beneficiaries exist from a previous marriage but the grantor dies before a subsequent spouse does. With a QTIP, estate tax is not assessed at the point of the first spouse's death, but is instead determined after the second spouse has passed.